Global Hydrogen Storage Market Size, Share, and COVID-19 Impact Analysis, By Storage Form (Physical and Material-Based), By Storage Type (Cylinder, Merchant, On-Site, and On-board), By Application (Chemicals, Oil Refineries, Industrial, Automotive & Transportation, and Metalworking), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Hydrogen Storage Market Insights Forecasts to 2035

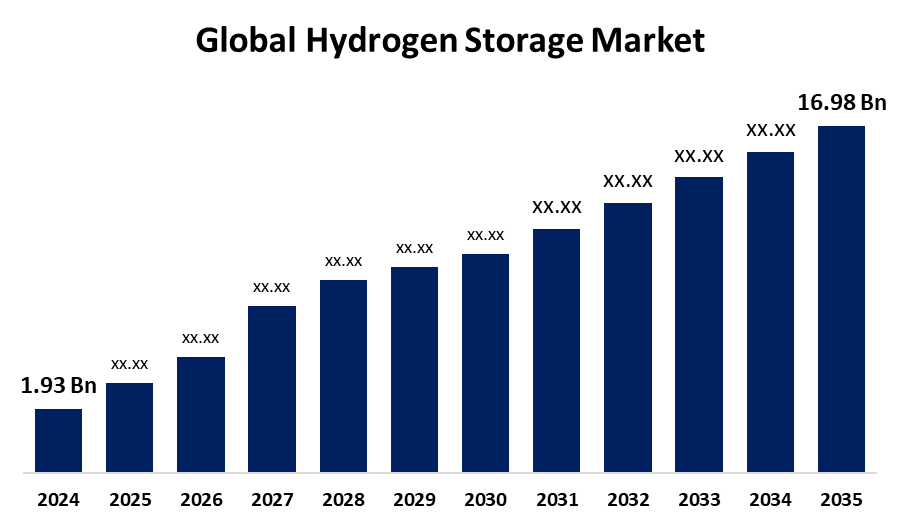

- The Global Hydrogen Storage Market Size Was Estimated at USD 1.93 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 21.86% from 2025 to 2035

- The Worldwide Hydrogen Storage Market Size is Expected to Reach USD 16.98 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Hydrogen Storage Market Size was worth around USD 1.93 Billion in 2024 and is predicted to Grow to around USD 16.98 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 21.86% from 2025 to 2035. The increasing adoption of hydrogen in transportation and industry highlights its critical role in decarbonization and energy storage. Consequently, hydrogen storage technologies are poised for sustained growth across diverse sectors through 2035.

Market Overview

The Hydrogen Storage Market Size refers to the techniques and tools for containing hydrogen for a variety of uses, especially in fuel cell systems for portable electronics, stationary power, and transportation. Effective storage is a major technical difficulty because, although having the maximum energy per mass of any fuel, hydrogen has a low energy per unit volume due to its low ambient temperature density.

To fully realize hydrogen's potential as a clean, effective energy carrier in industries including manufacturing, power generation, and transportation, hydrogen storage systems are essential. Because of its high energy-per-mass and adaptability, hydrogen requires sophisticated storage solutions to overcome its low volumetric density. The need for dependable hydrogen storage solutions is being driven by the growing trend toward decarbonization. The main forces behind this expansion are hard-to-electrify sectors, including energy-intensive industry and heavy transportation. Adoption is speeding up due to advancements in infrastructure and hydrogen fuel cell technology. In general, storing hydrogen is essential to a sustainable, emission-free energy future.

Report Coverage

This research report categorizes the hydrogen storage market size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hydrogen storage market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hydrogen storage market.

Global Hydrogen Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.93 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 21.86% |

| 2035 Value Projection: | USD 16.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 248 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Storage Form, By Storage Type, By Application, By Region |

| Companies covered:: | Air Liquide, Croyolor, Worthington Industries, Inc., Pragma Industries, Linde plc, HBank Technologies Inc., Luxfer Holdings PLC, INOXCVA, Hexagon Composites ASA, Chart Industries, Engie, Cummins Inc., Air Products Inc., Iwatani Corp., ITM Power, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The strong demand for hydrogen storage solutions is being driven by the rise in hydrogen-powered vehicles and industrial decarbonization initiatives. For vehicles that need high-pressure hydrogen for a longer range, compression storage is still essential. Because hydrogen is widely used in the chemicals, refining, and growing green energy sectors, the industrial segment is expected to dominate the market through 2035. The use of hydrogen to decarbonize steel manufacturing and store renewable energy is growing. A larger movement toward sustainable practices and lower emissions is reflected in these trends. As a result, methods for storing hydrogen are expected to continue growing in a number of industries.

Restraining Factors

The hydrogen storage faces several restraining factors that hinder the broad use of hydrogen fuel cell vehicles, is the scarcity of infrastructure for hydrogen refilling. Rapid expansion is hampered by high setup costs and low investor trust. Developed countries are progressively investing in refueling networks in spite of these obstacles. Accelerating the market requires ongoing cost reductions and infrastructural expansion.

Market Segmentation

The hydrogen storage market share is classified into storage form, storage type, and application.

- The physical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the storage form, the hydrogen storage market is classified into physical and material-based. Among these, the physical segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the commercial viability and technological development of physical storage techniques like liquid hydrogen and compressed gas storage. Applications such as hydrogen refueling stations, fuel cell automobiles, and industrial operations make extensive use of these techniques.

- The cylinder segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the storage type, the hydrogen storage market is segmented into cylinder, merchant, on-site, and on-board. Among these, the cylinder segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the Industries that need tiny but reliable hydrogen sources must use hydrogen cylinders. Cylinder-based storage is steadily in demand due to applications in electronics, metalworking, and food processing. The special chemical and physical characteristics of hydrogen are advantageous to these industries. As a result, the market for hydrogen cylinders, a dependable and adaptable storage option, keeps expanding.

- The automotive and transportation segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the hydrogen storage market is categorized into chemicals, oil refineries, industrial, automotive & transportation, and metalworking. Among these, the automotive and transportation segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the growing interest in cars with no emissions. The transition to hydrogen fuel cell vehicles is being accelerated by strict CO2 laws in North America and Europe. Adoption is being boosted by innovations from big automakers like Hyundai, Toyota, and Honda. The need for sophisticated hydrogen storage tanks is being driven by this increase. High-performance carbon fiber tank manufacturers play a critical role in satisfying this expanding market demand.

Regional Segment Analysis of the Hydrogen Storage Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the hydrogen storage market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the hydrogen storage market over the predicted timeframe. The region's strong government commitments to clean energy and hydrogen development, the US is a major driver of regional market growth. The need for improved storage systems is increasing as a result of ambitious DOE targets and significant projects in the production, distribution, and storage of hydrogen. The market's growth is being accelerated by both public and private expenditures in hydrogen infrastructure. A strong hydrogen economy is being fostered in the area by this cooperative effort.

Asia Pacific is expected to grow at a rapid CAGR in the hydrogen storage market during the forecast period. In this region, the robust government support for the development of hydrogen and fuel cells, Asia Pacific is becoming a major area for the adoption of green technologies. Japan, South Korea, China, India, and Malaysia are among the nations making significant investments in fuel cell projects and hydrogen policies. The goals of these pilot projects and national strategies are to speed up the switch to sustainable energy and lower GHG emissions. The hydrogen economy is expected to flourish significantly as a result of this regional commitment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hydrogen storage market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Liquide

- Croyolor

- Worthington Industries, Inc.

- Pragma Industries

- Linde plc

- HBank Technologies Inc.

- Luxfer Holdings PLC

- INOXCVA

- Hexagon Composites ASA

- Chart Industries

- Engie

- Cummins Inc.

- Air Products Inc.

- Iwatani Corp.

- ITM Power

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, Air Products Inc., a global leader in industrial gases, announced the successful construction of a new hydrogen storage facility in the United States, which aims to accelerate the adoption of clean energy solutions. This cutting-edge facility, which uses advanced cryogenic storage technology, is intended to meet the expanding need for hydrogen in a variety of industries, including transportation and power generation.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hydrogen storage market based on the below-mentioned segments:

Global Hydrogen Storage Market, By Storage Form

- Physical

- Material-Based

Global Hydrogen Storage Market, By Storage Type

- Cylinder

- Merchant

- On-Site

- On-board

Global Hydrogen Storage Market, By Application

- Chemicals

- Oil Refineries

- Industrial

- Automotive & Transportation

- Metalworking

Global Hydrogen Storage Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

-

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the hydrogen storage market over the forecast period?The global hydrogen storage market is projected to expand at a CAGR of 21.86% during the forecast period.

-

2. What is the market size of the hydrogen storage market?The global hydrogen storage market size is expected to grow from USD 1.93 Billion in 2024 to USD 16.98 Billion by 2035, at a CAGR of 21.86% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the hydrogen storage market?North America is anticipated to hold the largest share of the hydrogen storage market over the predicted timeframe.

Need help to buy this report?