Global Hydrogen Generation Market Size, Share, and COVID-19 Impact Analysis By Source (Blue hydrogen, Green hydrogen, and Grey Hydrogen), By Technology (Steam Methane Reforming (SMR), Coal Gasification, and Others), By Applications (Oil Refining, Chemical Processing, Iron & Steel Production, and Ammonia Production), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030.

Industry: Energy & PowerGlobal Hydrogen Generation Market Insights Forecasts to 2030

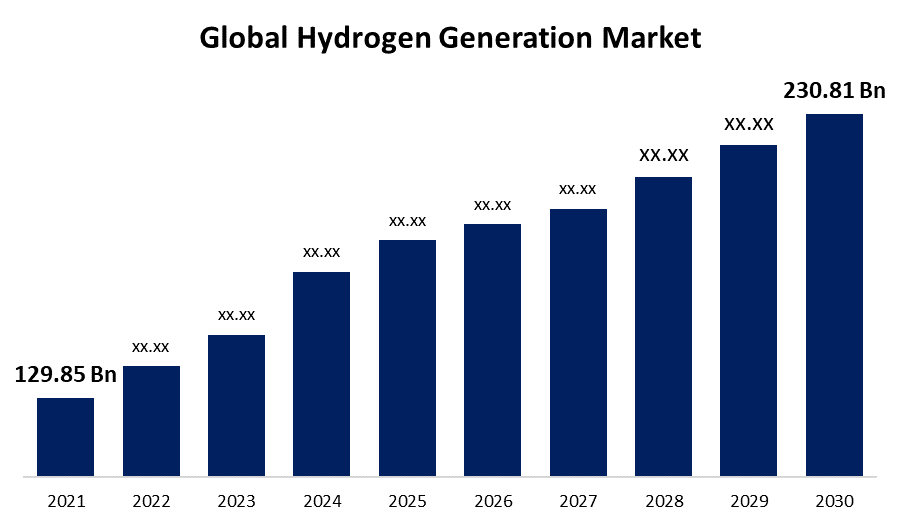

- The global hydrogen generation market was valued at USD 129.85 billion in 2021.

- The market is growing at a CAGR of 6.6% from 2021 to 2030

- The global hydrogen generation market is expected to reach USD 230.81 billion by 2030

- The Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The global hydrogen generation market is expected to reach USD 230.81 billion by 2030, at a CAGR of 6.6% during the forecast period 2021 to 2030. The need for cleaner fuel, in conjunction with growing government restrictions for the desulfurization of petroleum products, is projected to be the primary factor driving growth in the global market for hydrogen generation.

Market Overview:

The United States is one of the world's early adopters of clean energy solutions for industries such as power production, manufacturing, and transportation, making it one of the early adopters in the world. In December 2006, the Department of Energy (DOE) and the Department of Transportation (DOT) of the United States of America unveiled their Hydrogen Posture Plan. The purpose of this strategy was to strengthen research and development efforts and validate technologies that may be used in establishing an infrastructure for hydrogen. In addition, this plan included deliverables that the federal government had established to assist the development of hydrogen infrastructure throughout the country. The strategy was established in compliance with the National Hydrogen Energy Vision and Roadmap. One of the primary goals anticipated by the government agency is the development and installation of hydrogen stations around the country that are both cost-effective and energy-saving. It is anticipated that the demand for the hydrogen-generating market in the United States will be driven upward by all of these causes.

Report Coverage

This research report categorizes the market for global-based hydrogen generation based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global hydrogen generation market. Recent market developments and competitive strategies such as expansion, product launch and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each global hydrogen generation market sub-segments.

Global Hydrogen Generation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 129.85 Billion |

| Forecast Period: | 2021 - 2030 |

| Forecast Period CAGR 2021 - 2030 : | 6.6% |

| 2030 Value Projection: | USD 230.81 Billion |

| Historical Data for: | 2017 - 2020 |

| No. of Pages: | 222 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Source, By Technology, By Applications, By Region |

| Companies covered:: | Air Liquide International S.A, Air Products and Chemicals, Inc, Hydrogenics Corporation, INOX Air Products Ltd., Iwatani Corporation, Linde Plc, Matheson Tri-Gas, Inc., Messer, SOL Group, Tokyo Gas Chemicals Co., Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Segmentation Analysis

- In 2021, the blue hydrogen segment dominated the market with the largest market share of 41% and market revenue of 53.12 billion.

Based on the source, the hydrogen generation market is categorized into Blue hydrogen, Green hydrogen, and Grey Hydrogen. In 2021, the blue hydrogen segment dominated the market with the largest market share of 41% and market revenue of 53.12 billion. It is anticipated that the increased usage of hydrogen in fuel cell-powered cars will be the primary factor driving the blue hydrogen industry. Fuel cells are a means of transportation that are better for the environment and have the potential to replace fossil fuels. In addition, governments in every region of the world have come out in favor of using fuel-cell cars to reduce greenhouse gas emissions. The infrastructure development required to support fuel-cell cars is receiving more funding, subsidies, and tax benefits. Because of this, it is anticipated that there will be a rise in demand for blue hydrogen during the forecast period due to the rising usage of hydrogen in the automotive industry.

- In 2021, the steam methane reforming ( SMR) segment accounted for the largest share of the market, with 45% and market revenue of 58.31 billion.

Based on technology, the hydrogen generation market is categorized into Steam Methane Reforming (SMR), Coal Gasification, and Others. In 2021, steam methane reforming (SMER) dominated the market with the largest market share of 45% and market revenue of 58.31 billion. The steam methane reforming process is an established and highly developed method for the creation of hydrogen. This is because the global demand for hydrogen generation is expanding at an alarming rate. High conversion efficiency is one of the operational benefits connected with the steam methane reforming process, which is another reason contributing to the market's expansion. During the forecast period, it is anticipated that the Steam Methane Reforming sector will maintain its position as the leader.

- In 2021, the ammonia production segment accounted for the largest share of the market, with 31% and a market revenue of 40.16 billion.

Based on application, the hydrogen generation market is categorized into Oil Refining, Chemical Processing, Iron & Steel Production, and Ammonia Production. In 2021, ammonia production dominated the market with the largest market share of 31% and market revenue of 40.16 billion. The ammonia production sector will continue to hold the top spot throughout the forecast period. Because of ammonia's ability to serve as a carbon-free fuel, hydrogen transporter, and energy storage medium, technologies that generate hydrogen from renewable sources might be implemented on a far larger scale. Ammonia facilities often have on-site hydrogen production, which uses a feedstock derived from fossil fuels. Natural gas is the feedstock that is used most frequently, and it is used to feed a steam methane reforming (SMR) unit. The production of ammonia from coal can also be accomplished by a method known as partial oxidation (POX).

Regional Segment Analysis of the hydrogen generation market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Get more details on this report -

Among all regions, North America emerged as the largest market for the global hydrogen generation market, with a market share of around 38.91% and 129.85 billion of the market revenue in 2021.

- In 2021, North America emerged as the largest market for the global hydrogen generation market, with a market share of around 38.91% and 129.85 billion of the market revenue. The development of a larger-scale hydrogen-generating industry in North America has been in the works for several years. The industry as a whole has expanded at a rapid rate because of the contributions made by each application and technological advancement. The manufacturing of methanol and ammonia is the industry that is expanding at the highest rate, and nations like the United States and Canada have witnessed tremendous growth in this sector over the past five years.

- The Asia Pacific market is expected to grow at the fastest CAGR between 2022 and 2030. Due to the increasing need for hydrogen in China and India for power generation, the Asia-Pacific area is the market that is expanding at the quickest rate. In addition, a surge in the number of steps national governments take to encourage clean and green energy in nations such as India, Japan, and Australia is driving the expansion of the industry. The robust economic development evidenced by the quick expansion of several sectors in various economies such as South Korea, China, Japan, and India helped the rise of the hydrogen-producing industry in this area. These economies include South Korea, China, Japan, and India. The region's enticing growth may mostly be attributed to the rising demand for electric vehicles fueled by fuel cells. Aside from that, the use of renewable energies to generate electricity is becoming increasingly widespread throughout the region. The market for hydrogen generation is dominated by China, which also has the highest growth rate. In recent years, this nation's oil and gas and industrial industries have both undergone remarkable increases.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global hydrogen generation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Market Players:

- Air Liquide International S.A

- Air Products and Chemicals, Inc

- Hydrogenics Corporation

- INOX Air Products Ltd.

- Iwatani Corporation

- Linde Plc

- Matheson Tri-Gas, Inc.

- Messer

- SOL Group

- Tokyo Gas Chemicals Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Third-party knowledge providers

- Value-Added Resellers (VARs)

Recent Development

- In March 2022, Air Products Inc. announced that it would develop and operate the brand new green liquid hydrogen generation plant in Casa Grande, Arizona. The plant will produce carbon-free liquid hydrogen, which is anticipated to enter the market in 2023.

- In July 2020, Air Products and ThyssenKrupp Uhde Chlorine Engineers signed a strategic collaboration agreement. The two companies have formed an exclusive partnership in strategic regions to construct green hydrogen projects. This partnership will use both companies' complementary technological, engineering, and project execution skills.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2030. Spherical Insights has segmented the global hydrogen generation market based on the below-mentioned segments:

Global Hydrogen Generation Market, By Source

- Blue hydrogen

- Green hydrogen

- Grey Hydrogen

Global Hydrogen Generation Market, By Technology

- Steam Methane Reforming (SMR)

- Coal Gasification

- Others

Global Hydrogen Generation Market, By Applications

- Oil Refining

- Chemical Processing

- Iron & Steel Production

- Ammonia Production

Global Hydrogen Generation Market, Regional Analysis

- North America

- The US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- The Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the Hydrogen Generation market?As per Spherical Insights, the size of the Hydrogen Generation market was valued at USD 129.85 billion in 2021 to USD 230.81 billion by 2030.

-

What is the market growth rate of the Hydrogen Generation market?The Hydrogen Generation market is growing at a CAGR of 6.6% from 2021 to 2030.

-

Which country dominates the Hydrogen Generation market?North America emerged as the largest market for Hydrogen Generation.

-

Who are the key players in the Hydrogen Generation market?Key players in the Hydrogen Generation market are Air Liquide International S.A, Air Products and Chemicals, Inc, Hydrogenics Corporation, INOX Air Products Ltd., Iwatani Corporation, Linde Plc, Matheson Tri-Gas, Inc., Messer, SOL Group, and Tokyo Gas Chemicals Co., Ltd.

-

Which factor drives the growth of the Hydrogen Generation market?Extensive research and development (R&D) to drive the market’s growth over the forecast period.

Need help to buy this report?