Global Hydrogen Bromide Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial Grade, Pharmaceutical Grade, and Others), By Application (Chemical Intermediate, Pharmaceuticals, Dyes and Pigments, and Others), By End-Use (Chemical, Pharmaceutical, Textile, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Hydrogen Bromide Market Insights Forecasts to 2035

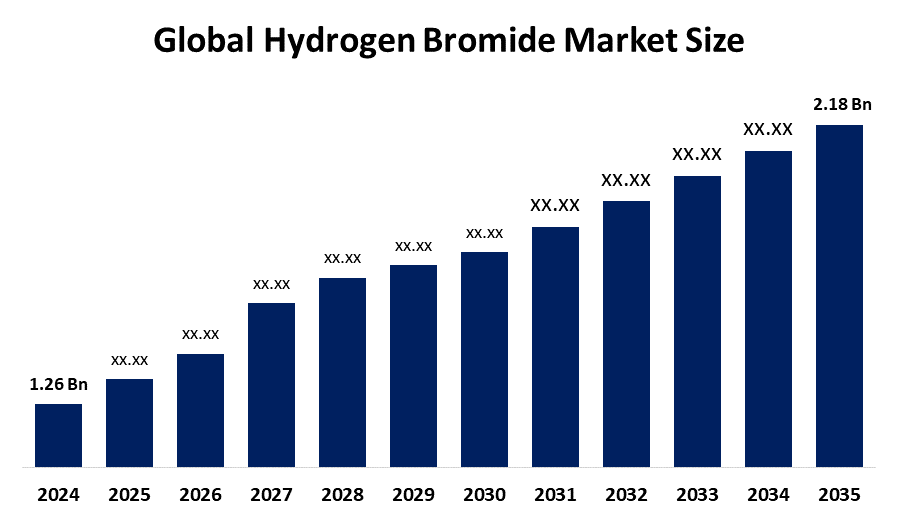

- The Global Hydrogen Bromide Market Size Was Valued at USD 1.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.11% from 2025 to 2035

- The Worldwide Hydrogen Bromide Market Size is Expected to Reach USD 2.18 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global hydrogen bromide market size was worth around USD 1.26 Billion in 2024 and is predicted to Grow to around USD 2.18 Billion by 2035 with a compound annual growth rate (CAGR) of 5.11% from 2025 to 2035. The market for hydrogen bromide is expanding owing to its rising applications in crucial sectors such as the electronic industry (for Semiconductor Etching), production of flame-resistant materials and drugs, and newer energy storage technologies in flow batteries.

Market Overview

The worldwide market for hydrogen bromide refers to the production and use of hydrogen bromide, a toxic chemical that is widely utilized as a chemical reagent in the synthesis of various compounds, pharmaceuticals, flame retardants, and semiconductor devices. Hydrogen bromide is very important for the synthesis of active pharmaceuticals, brominated compounds, and etching in semiconductor devices. The chemical is also utilized in other sectors, including water treatments, agrochemicals, and advanced batteries. The market for hydrogen bromide is driven by growing demand from the pharmaceuticals and chemical sectors, the increased use of semiconductor devices in both developed and developing countries, and the use of brominated flame retardants in various applications, including construction and transportation, especially in the APAC market.

Opportunities lie in the development of high-purity hydrogen bromide for advanced semiconductor and battery applications, sustainable production methods, and expanding industrialization in emerging economies. Key market competitors in the hydrogen bromide (HBr) market include Albemarle Corporation, Air Liquide S.A., Linde plc, Showa Denko K.K., LANXESS AG, Bhavika Chemicals Corporation, Tosoh Corporation, Gulf Resources, Inc., and Matheson Tri-Gas Inc. In July 2025, the National Institute for Occupational Safety and Health (NIOSH) updated the Immediately Dangerous to Life or Health (IDLH) values for hydrogen bromide, hydrogen chloride, and hydrogen fluoride, setting the IDLH value for HBr at 3 ppm in alignment with occupational safety standards. The update emphasizes respiratory exposure risks, particularly in semiconductor etching processes, and supports strengthened chemical safety practices across semiconductor manufacturing and other high-technology industries globally.

Report Coverage

This research report categorizes the hydrogen bromide market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hydrogen bromide market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hydrogen bromide market.

Global Hydrogen Bromide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.26 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.11% |

| 2035 Value Projection: | USD 2.18 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Air Liquide S.A., Lanxess AG, Albemarle Corporation, Linde PLC, Showa Denko K.K., Gulf Resources, Inc., Tosoh Corporation, Matheson Tri-Gas Inc., Tata Chemicals Limited, Bhavika Chemicals Corporation, ICL Group Ltd., Neogen Chemicals Ltd., TETRA Technologies, Inc., Honeywell International Inc., Others, and Key Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The chief driving factor for the global market of hydrogen bromide is the substantial rise in the demand for hydrogen bromide, driven by various end-use industries such as the pharmaceutical, chemical, and electronic industries, where hydrogen bromide is required for the preparation of active pharmaceutical intermediates, specialty chemicals, and semiconductor etching. The rising demand for hydrogen bromide is driven by the growing usage in Flame Retardants on account of the rising need for enhanced fire safety, the growing demand for hydrogen bromide in Advanced Batteries and Water Treatment, and the rising industrial production in the Asia Pacific region.

Restraining Factors

Major restraints that are affecting the international market of hydrogen bromide include stringent environmental and safety regulations due to its toxic and corrosive properties. High costs associated with handling due to the same reasons are also hindering. Volatility of bromine prices, which are the main raw material, and high manufacturing costs are yet another restraint.

Market Segmentation

The hydrogen bromide market share is classified into grade, application, and end-use.

- The industrial grade segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the hydrogen bromide market is divided into industrial grade, pharmaceutical grade, and others. Among these, the industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market share of the industrial-grade hydrogen bromide segment is substantial, as this product is widely utilized as a flame retardant and in the treatment of water at the industrial level. The level of purity also fulfils the criteria for the said applications, where the greatest level of purity is not necessarily the priority. The demand in the manufacturing and water treatment sectors is expected to retain the leading position of the industrial-grade segment.

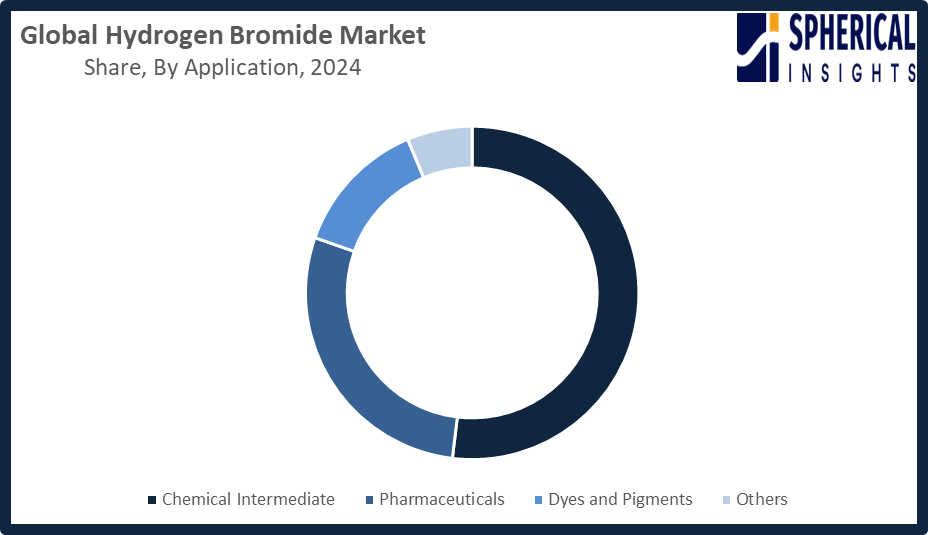

- The chemical intermediate segment accounted for the largest share in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the hydrogen bromide market is divided into chemical intermediate, pharmaceuticals, dyes and pigments, and others. Among these, the chemical intermediate segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The chemical intermediate segment had the largest share of the market due to the prominent use of HBr in the manufacturing of pharmaceuticals, agrochemicals, and speciality chemicals. Its utility value in halogenation reactions and organic reactions contributes to the rising demand in the manufacturing of various chemicals. This will increase the dominance of the segment within the HBr market.

Get more details on this report -

- The pharmaceutical segment accounted for the highest market revenue in 2024, approximately 58% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the hydrogen bromide market is divided into chemical, pharmaceutical, textile, and others. Among these, the pharmaceutical segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pharmaceuticals market experienced the strongest market growth as a result of the increased demand for the use of hydrogen bromide in the synthesis of active pharmaceutical ingredients and drug intermediates. The essential role it plays in halogenation reactions and special chemical synthesis is one of the reasons driving this segment to experience extremely rapid growth in the market for hydrogen bromide. The needs of the global healthcare industry are additional factors.

Regional Segment Analysis of the Hydrogen Bromide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the hydrogen bromide market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the hydrogen bromide market over the predicted timeframe. The Asia Pacific is expected to account for the 42% share in the hydrogen bromide market, with the region undergoing fast-paced growth in the chemical and pharmaceutical sectors and the development of the electronics and semiconductor industry. The key players here include China, with its dominant production of chemicals and electronics, the Indian pharmaceutical and speciality chemical industry growth, and the use of high-purity chemicals by the solvent industry, based mainly in Japan. The Green Hydrogen Policy 2025 announcement by the Indian government in August 2025 aims to offer subsidies as well as tax benefits to consume large-scale green hydrogen in the steel, refinery, and fertilizer sectors, with hydrogen corridors and export schemes also part of the agenda. This document aims to highlight the key features and evolution of the hydrogen bromide industry and its reaction to the current situation with the Green Hydrogen Policy 2025 announcement by the Indian government and the global climate change situation.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the hydrogen bromide market during the forecast period. The market in North America is expected to have a 30% of the hydrogen bromide market. This is mainly due to the rise in the use of hydrogen bromide in the pharmaceutical industry, specialty chemicals, and the production of semiconductors. The major driving factor in the U.S. market is the incentives available in the clean energy and chemical sectors. Additionally, the U.S. Treasury and IRS in January 2025 finalized the guidelines under the Inflation Reduction Act related to the Section 45V Clean Hydrogen Production Tax Credit.

The European market for hydrogen bromide is growing consistently, and this is attributed to the pharma, specialty chemical, and semiconductor industries. Germany dominates due to R&D funding for chemical companies, strict regulations for reducing emissions into the environment, and developed transportation networks. The European emphasis on eco-friendly production techniques and purified uses is in line with the Green Deal and thus pushes for green HBr production techniques. The European Union initiated the hydrogen market support scheme in July 2025 with the European Hydrogen Bank by connecting consumers and producers of hydrogen and ammonia, thereby promoting the consumption of derivative chemicals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hydrogen bromide market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Liquide S.A.

- Lanxess AG

- Albemarle Corporation

- Linde PLC

- Showa Denko K.K.

- Gulf Resources, Inc.

- Tosoh Corporation

- Matheson Tri-Gas Inc.

- Tata Chemicals Limited

- Bhavika Chemicals Corporation

- ICL Group Ltd.

- Neogen Chemicals Ltd.

- TETRA Technologies, Inc.

- Honeywell International Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Air Liquide and Hyundai Motor Group expanded their strategic partnership at the Hydrogen Council CEO Summit in Seoul. The renewed MoU aims to accelerate the global hydrogen economy by developing a comprehensive hydrogen ecosystem covering production, storage, transportation, and utilization worldwide.

- In June 2020, Tosoh Corporation announced plans to expand bromine production capacity at its Nanyo Complex in Japan. As Japan’s largest bromine producer, Tosoh aims to meet steady Asian demand and address supply tightness caused by insufficient bromine availability in China.

- In September 2019, ICL’s Industrial Products division announced plans to expand capacity for elemental bromine and bromine compounds following strategic customer agreements in Asia. The USD 50 million investment is expected to generate USD 110 million annually in additional revenues.

- In March 2018, Showa Denko (SDK) expanded its production capacity for high-purity hydrogen bromide and began operating the upgraded plant. High-purity HBr is a key specialty gas used for fine-etching polysilicon in semiconductor manufacturing, with demand rising due to digitalization trends such as IoT, big data, and autonomous driving.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hydrogen bromide market based on the below-mentioned segments:

Global Hydrogen Bromide Market, By Grade

- Industrial Grade

- Pharmaceutical Grade

- Others

Global Hydrogen Bromide Market, By Application

- Chemical Intermediate

- Pharmaceuticals

- Dyes and Pigments

- Others

Global Hydrogen Bromide Market, By End-Use

- Chemical

- Pharmaceutical

- Textile

- Others

Global Hydrogen Bromide Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the hydrogen bromide market over the forecast period?The global hydrogen bromide market is projected to expand at a CAGR of 5.11% during the forecast period.

-

2.What is the market size of the hydrogen bromide market?The global hydrogen bromide market size is expected to grow from USD 1.26 billion in 2024 to USD 2.18 billion by 2035, at a CAGR of 5.11% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the hydrogen bromide market?Asia Pacific is anticipated to hold the largest share of the hydrogen bromide market over the predicted timeframe.

-

4.What is the hydrogen bromide market?The hydrogen bromide market involves production, distribution, and consumption of hydrogen bromide used in chemicals, pharmaceuticals, dyes, electronics, and industrial applications.

-

5.Who are the top 10 companies operating in the global hydrogen bromide market?Air Liquide S.A., Lanxess AG, Albemarle Corporation, Linde PLC, Showa Denko K.K., Gulf Resources, Inc., Tosoh Corporation, Matheson Tri-Gas Inc., Tata Chemicals Limited, Bhavika Chemicals Corporation, and Others.

-

6.What factors are driving the growth of the hydrogen bromide market?The hydrogen bromide market is driven by rising pharmaceutical and chemical synthesis demand, expanding electronics and semiconductor industries, growing use in flame retardants, and increasing industrial and laboratory applications worldwide.

-

7.What are the market trends in the hydrogen bromide market?Hydrogen bromide market trends include rising demand from semiconductors and electronics, increased pharmaceutical and chemical applications, flame retardant growth, and innovation in high‑purity hydrogen bromide production.

-

8.What are the main challenges restricting wider adoption of the hydrogen bromide market?The main challenges restricting the wider adoption of the hydrogen bromide market largely stem from safety concerns, handling complexity, high costs, and a lack of specific infrastructure.

Need help to buy this report?