Global Hydrobromic Acid Market Size, Share, and COVID-19 Impact Analysis, By Type (Organic Bromides and Inorganic Bromides), By Product (HBr 48% and HBr 62%), By Application (Food & Beverages, Pharmaceutical, Agricultural, Chemical, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Hydrobromic Acid Market Size Insights Forecasts to 2035

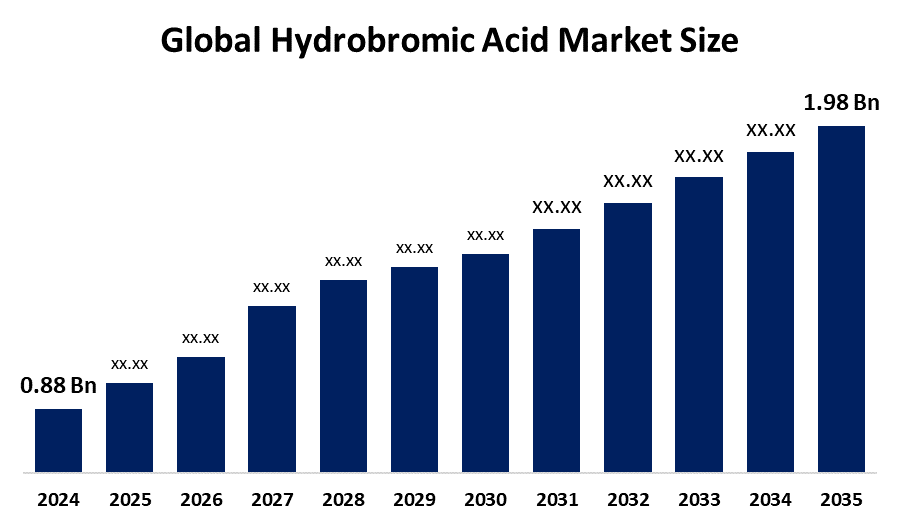

- The Global Hydrobromic Acid Market Size Was Estimated at USD 0.88 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.65% from 2025 to 2035

- The Worldwide Hydrobromic Acid Market Size is Expected to Reach USD 1.98 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Hydrobromic Acid Market Size was worth around USD 0.88 Billion in 2024 and is predicted to Grow to around USD 1.98 Billion by 2035 with a compound annual growth rate (CAGR) of 7.65% from 2025 to 2035. The global hydrobromic acid market expands because pharmaceutical companies need hydrobromic acid to create drugs, while food production requires more agrochemicals, and electronics manufacturers and oilfield companies need to use hydrobromic acid.

Market Overview

Hydrobromic acid (HBr) exists as a strong corrosive solution that contains hydrogen bromide in water at concentrations of 48% to 62% and produces a strong odor while serving as a vital chemical building block. The chemical serves multiple purposes in pharmaceuticals to create active pharmaceutical ingredients, which include sedatives anesthetics and antihistamines, and it also functions as clear brine fluids for well completion in the oil and gas industry and in agrochemicals, dyes, perfumes and electronic devices for etching and cleaning purposes. The pharmaceutical sector drives market demand while oil exploration work increases, and global food security needs push more people to adopt agrochemicals.

The U.S. Food and Drug Administration revoked its approval of brominated vegetable oil (BVO) for food and beverage use on May 16 2025, because safety issues arose with this ingredient. The ban also extends to FD&C Red No. 3, which is used in food and drugs that people consume. Manufacturers must obtain new formula approvals before compliance deadlines. The company can develop new business opportunities through the industrial growth of emerging economies, the creation of new bromine-based compounds and the development of sustainable energy solutions, which improve electrical efficiency in industrial operations.

Report Coverage

This research report categorizes the hydrobromic acid market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hydrobromic acid market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hydrobromic acid market.

Global Hydrobromic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.88 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.65% |

| 2035 Value Projection: | USD 1.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Type, By Product and COVID-19 Impact Analysis |

| Companies covered:: | ICL Industrial Products, LANXESS AG, Albemarle Corporation, Tosoh Corporation, Jordan Bromine Company, Haiwang Chemical, Tata Chemicals Limited, Merck KGaA, Honeywell International Inc., Gulf Resources, Inc., Shandong Tianyi Chemicals, Air Liquide S.A., Apollo Scientific Ltd., Tokyo Chemical Industry Co., Ltd., and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The global hydrobromic acid market is primarily driven by surging demand for brominated flame retardants to meet stringent fire safety standards. The pharmaceutical industry experiences substantial growth, which drives increased demand for API synthesis and high-purity applications. The oil & gas industry relies more on high-density clear brine fluids, containing calcium and zinc bromides for deep-well drilling. The growing electronics industry needs high-purity HBr to use in semiconductor etching processes. This application is essential for manufacturing advanced 3nm and 2nm architecture chips, as ultra-high purity 5N (99.999%) grade HBr prevents metallic contamination during plasma etching of 3D NAND and finFET devices. The semiconductor industry's 19.1% sales growth to $627.6 billion in 2024 directly correlates with increased high-purity HBr demand. Bromine-based compounds see increased demand throughout the Asia-Pacific region, which is developing its industrial and agricultural sectors.

Restraining Factors

The global hydrobromic acid market faces major restrictions because production expenses become excessive, bromine raw material prices fluctuate, and environmental and safety regulations control its hazardous corrosive properties. The market expansion gets restricted by the costly specialized logistics system, which handles toxic materials and the potential explosion and fire hazards that occur during material handling.

Market Segmentation

The hydrobromic acid market share is classified into type, product, and application.

- The organic bromides segment dominated the market in 2024, approximately 35% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the hydrobromic acid market is divided into organic bromides and inorganic bromides. Among these, the organic bromides segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The HBr 48% segment led the market because it provides both cost-effectiveness and versatile capabilities to produce inorganic bromides required for flame retardants and chemical synthesis processes. The industry considers this concentration to be the safest option for handling operations. The EU's decaBDE restriction under REACH, which it proposed will continue to influence the need for bromine precursors that support the development of new products.

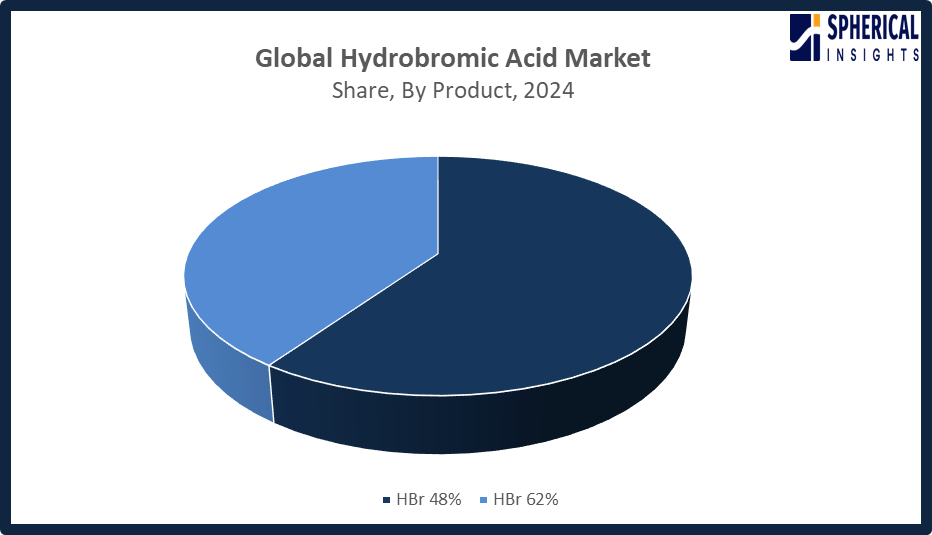

- The HBr 48% segment accounted for the largest share in 2024, approximately 60% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the hydrobromic acid market is divided into HBr 48% and HBr 62%. Among these, the HBr 48% segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The organic bromides segment dominated the hydrobromic acid market because of increasing demand for brominated flame retardants, which serve as vital fire safety components in construction and electronics. The development of pharmaceutical applications as drug intermediates, together with manufacturing improvements, resulted in industry expansion despite the implementation of an expanded restricted substances list in AFIRM 2025 RSL v10 for apparel supply chains.

Get more details on this report -

- The chemical segment accounted for the highest market revenue in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the hydrobromic acid market is divided into food & beverages, pharmaceutical, agricultural, chemical, and others. Among these, the chemical segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The chemical segment achieved its most substantial market growth through increasing demand for brominated intermediates, which serve pharmaceutical, agrochemical, flame retardant, and specialty chemical needs. The segment continued to grow because industrial production expanded while chemical synthesis activities increased, and multiple end-use industries started to use more chemical products.

Regional Segment Analysis of the Hydrobromic Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the hydrobromic acid market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the hydrobromic acid market over the predicted timeframe. The hydrobromic acid market in the Asia Pacific is expected to grow because China and India experience rapid industrial growth, together with their expanding chemical and pharmaceutical sectors, and their increasing electronics production activities. The region accounted for approximately 46% of the market in 2024, supported by strong demand for brominated compounds and high-purity HBr in semiconductors and flame retardants. Government policies that support manufacturing development through foreign investment and research and development activities create advantages that make the Asia Pacific the top global market for hydrobromic acid and its related products.

North America is expected to grow at a rapid CAGR in the hydrobromic acid market during the forecast period. The hydrobromic acid market in North America will experience rapid growth because advanced pharmaceutical, chemical and electronics industries in the United States drive demand for hydrobromic acid, which currently accounts for 35% global HBr consumption. Industrial research and development spending, together with regulatory support for new manufacturing technologies, create favorable conditions for business development. The upward trend in Canada’s specialty chemical applications results from market expansion tactics and innovative solutions.

European demand for hydrobromic acid products increases because chemical and environmental regulations compel businesses to obtain high-quality, compliant chemicals, which are essential for pharmaceutical, flame retardant and specialty chemical production. The EU REACH framework requires companies to follow strict safety protocols, which creates a need for trustworthy hydrobromic acid resources in controlled industries, thus driving industry growth. The chemical research and sustainability initiatives in Europe drive market expansion for chemical compounds.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hydrobromic acid market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ICL Industrial Products

- LANXESS AG

- Albemarle Corporation

- Tosoh Corporation

- Jordan Bromine Company

- Haiwang Chemical

- Tata Chemicals Limited

- Merck KGaA

- Honeywell International Inc.

- Gulf Resources, Inc.

- Shandong Tianyi Chemicals

- Air Liquide S.A.

- Apollo Scientific Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, LANXESS AG expanded its portfolio of organic flame retardants, introducing advanced polymeric and reactive solutions that reduce additive migration while maintaining fire safety. The products support applications in construction, electronics, e-mobility, cables, insulation, and electrical components, enhancing environmental protection and performance.

- In November 2024, Gulf Resources, Inc. announced the acquisition of five salt fields totaling 5.14 million square meters for RMB 280.76 million. The expansion will boost crude salt output and enable additional bromine well drilling, strengthening its production capacity in China.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hydrobromic acid market based on the below-mentioned segments:

Global Hydrobromic Acid Market, By Type

- Organic Bromides

- Inorganic Bromides

Global Hydrobromic Acid Market, By Product

- HBr 48%

- HBr 62%

Global Hydrobromic Acid Market, By Application

- Food & Beverages

- Pharmaceutical

- Agricultural

- Chemical

- Others

Global Hydrobromic Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the hydrobromic acid market?The global hydrobromic acid market size is expected to grow from USD 0.88 billion in 2024 to USD 1.98 billion by 2035, at a CAGR of 7.65% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the hydrobromic acid market?Asia Pacific is anticipated to hold the largest share of the hydrobromic acid market over the predicted timeframe.

-

3. What is the role of hydrobromic acid in the agrochemicals industry?Hydrobromic acid (HBr) is a critical reagent in the agrochemicals industry, used primarily as a brominating agent and catalyst to synthesize intermediates for pesticides, herbicides, and fungicides.

-

4. What are the market trends in the hydrobromic acid market?Current market trends include rising pharmaceutical demand for drug synthesis, expanding electronics sector requiring high-purity acid for semiconductors, and growing agrochemical adoption. Asia-Pacific leads consumption growth, while flame-retardant applications drive steady demand despite environmental regulations

-

5. What is the application of hydrobromic acid in the pharmaceuticals industry?Hydrobromic acid is crucial for synthesizing active pharmaceutical ingredients (APIs), including sedatives and anesthetics. It also serves as a catalyst and aids in purifying bromine-based compounds, ensuring high purity in final drug formulations.

-

6. What are the effects of updated food additive policies on hydrobromic acid production and usage?Updated food additive policies, like China's 2025 production rules and U.S. safety reassessments, could tighten regulations on food-grade HBr, potentially impacting its production and specific usage permissions in food processing.

Need help to buy this report?