Global Hydraulic Fluids Market Size, Share, and COVID-19 Impact Analysis, By Base Oil (Mineral Oil, Synthetic Oil, Bio-Based Oil), By End Use (Construction, Oil & Gas, Agriculture, Metal & Mining), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Industry: Chemicals & MaterialsGlobal Hydraulic Fluids Market Insights Forecasts to 2033.

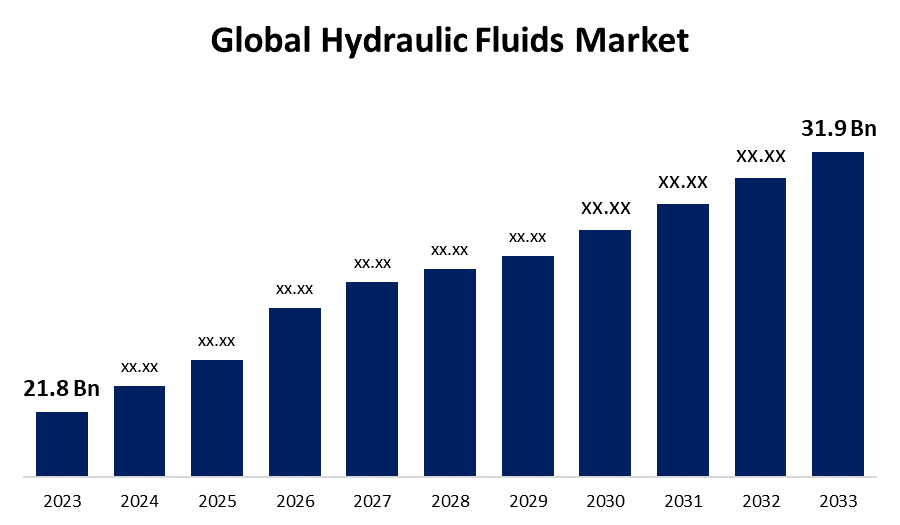

- The Global Hydraulic Fluids Market Size was Valued at USD 21.8 Billion in 2023.

- The Market Size is Growing at a CAGR of 3.88% from 2023 to 2033.

- The Worldwide Hydraulic Fluids Market Size is Expected to Reach USD 31.9 Billion by 2033.

- Europe is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Hydraulic Fluids Market Size is Anticipated to Exceed USD 31.9 Billion by 2033, Growing at a CAGR of 3.88% from 2023 to 2033.

Market Overview

Specialized liquids known as hydraulic fluids are utilized to transfer power in hydraulic systems. They act as a conduit for the passage of energy between various parts of machinery, including car braking systems, airplane landing gear, and excavators. These fluids usually have excellent lubricating qualities that reduce wear and friction in the system, guaranteeing long-term component life and seamless operation. They also have excellent thermal stability, which allows them to endure the high temperatures produced by hydraulic operation. Additionally, hydraulic fluids stop rust and corrosion from developing, preserving the system's integrity over time. A hydraulic fluid's compatibility with system components and environmental conditions are important considerations for choosing the right hydraulic fluid for safety and maximum performance. The worldwide spike in infrastructure and construction activity is responsible for the market's grow. Infrastructure development is a top priority for governments in developing countries. The expansion of infrastructure operations is being aided by elements including the accessibility of funding, emphasis on operational resilience, introduction of new technology, and the affordability of infrastructure.

Report Coverage

This research report categorizes the market for the global hydraulic fluids market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global hydraulic fluids market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global hydraulic fluids market.

Global Hydraulic Fluids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 21.8 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.88% |

| 2033 Value Projection: | USD 31.9 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Base Oil, By End Use, By Region. |

| Companies covered:: | Shell plc, Exxon Mobil Corporation, Chevron Corporation, BP p.l.c., TotalEnergies, PetroChina Company Limited, China Petrochemical Corporation (SINOPEC), FUCHS, Valvoline, NYCO, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global hydraulic fluids market is driven by various factors, including the focus of the automakers has turned to creating long-lasting automotive parts, like engines that fit into passenger cars, light trucks, and large trucks. Superior viscosity-temperature behavior, compatibility with a wide variety of hardware, good oxidation stability, and—above all—lower evaporation rates set synthetic lubricants apart from conventional lubricants. Incorporating these characteristics into modern car designs enhances the potential lifespan of the vehicle, which is a desirable outcome. Ultimately, the growth of this industry is driven by consumer acceptance of synthetic lubricants, which raises their acceptability among consumers. In addition, the international automotive sector witnessed enormous growth as a result of the market for passenger and commercial cars reaching an all-time high. The automotive industry is expanding quickly in developing nations such as China, India, Brazil, and others. Furthermore, the majority of the global demand for automotive manufacture and sales is accounted for by industrialized regions such as North America and Europe. The important national market with the greatest production and sales figures has been China.

Restraining Factors

Extraction of crude oil is the initial step in the manufacturing of hydraulic fluids. A major contributing element to the overall increase in lubricant prices is the rise in the price of crude oil. This factor is hampering the global hydraulic fluids market.

Market Segmentation

The global hydraulic fluids market share is classified into base oil and end use.

- The mineral oil segment is expected to hold the largest share of the global hydraulic fluids market during the forecast period.

Based on the base oil, the global hydraulic fluids market is divided into mineral oil, synthetic oil, bio-based oil. Among these, the mineral oil segment is expected to hold the largest share of the global hydraulic fluids market during the forecast period. Group I, Group II, and Group III comprise mineral oil, which is the most commonly utilized base oil in the manufacturing of hydraulic fluid. Group I is where the solvent-refined mineral oil is classified. For modern hydraulic fluids, the most common base stock is Group I base mineral oil. For some uses, additional base stocks such propylene glycol or silicone oils necessary. Additives are used to give hydraulic fluids unique properties. Common additives include anti-foaming compounds, corrosion inhibitors, friction reducers, and anti-erosion additives.

- The construction segment is expected to hold the largest share of the global hydraulic fluids market during the forecast period.

Based on the end use, the global hydraulic fluids market is divided into construction, oil and gas, agriculture, metal and mining. Among these, the construction segment is expected to hold the largest share of the global hydraulic fluids market during the forecast period. The Society of Tribologists and Lubrication Engineers (STLE) estimates that 76% of the market for hydraulic equipment is made up of hydraulic construction equipment. Excavators, backhoes, bulldozers, trenchers, loaders, dump trucks, graders, and other common construction hydraulic equipment are some examples of the equipment that employs hydraulic fluids. It is challenging to maintain operational flow and end-activity in frequently unpredictable construction environments.

Regional Segment Analysis of the Global Hydraulic Fluids Market

- North America (U.S., Canada, Mexico)

- Europe (Global, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

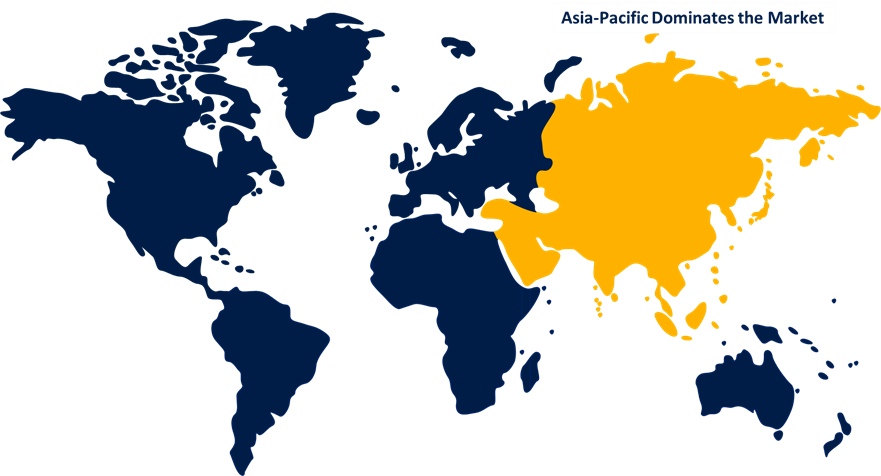

Asia-Pacific is anticipated to hold the largest share of the global hydraulic fluids market over the predicted timeframe.

Get more details on this report -

Asia-Pacific is anticipated to hold the largest share of the global hydraulic fluids market over the predicted timeframe. China, Japan, India, and Australia are the main markets in the Asia-Pacific region. The demand for industrial lubricants in the region is being driven by a number of reasons, including growing investments in the manufacturing and construction industries, the expansion of the SME sector, and the entry of new domestic and foreign companies. Additionally, the market is expanding due to rising passenger and commercial vehicle sales in the area as well as a rise in the demand for synthetic lubricants.

Europe is expected to grow the fastest during the forecast period. One of the main drivers of market expansion in this region is the expanding demand from the automotive and marine industries. It is also possible to attribute the significantly large expenditures in infrastructure projects to the increasing demand in Europe. The U.K. market had the largest revenue share since it was home to important hydraulic companies like General Oceanics Inc., OSSO, and others.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global hydraulic fluids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shell plc

- Exxon Mobil Corporation

- Chevron Corporation

- BP p.l.c.

- TotalEnergies

- PetroChina Company Limited

- China Petrochemical Corporation (SINOPEC)

- FUCHS

- Valvoline

- NYCO

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2022, ExxonMobil and Pertamina of Indonesia has expanded their collaboration on carbon capture and storage.

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the Global Hydraulic Fluids Market based on the below-mentioned segments:

Global Hydraulic Fluids Market, By Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

Global Hydraulic Fluids Market, By End Use

- Construction

- Oil and Gas

- Agriculture

- Metal and Mining

Global Hydraulic Fluids Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What are the hydraulic fluids?Specialized liquids known as hydraulic fluids are utilized to transfer power in hydraulic systems.

-

2. What are the segments of the hydraulics fluids market?Base oil and end use are two main segments of the hydraulics fluids market.

-

3. Which has the largest share in the global hydraulic fluids market?Asia pacific region has the largest share in the global hydraulic fluids market.

Need help to buy this report?