Global Hybrid Endoscopy Market Size, Share, And COVID-19 Impact Analysis, By Product Type (Hybrid Video Endoscopy Platforms, Single-Use / Disposable Hybrid Scopes, Imaging Modes & AI Modules, EUS/ERCP Hybrid Suites & Equipment, And Accessories & Consumables), By Application (GI Endoscopy, Pulmonology/Bronchoscopy, Urology, ENT, And Gynecology & Other MIS), And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, And Africa), Analysis And Forecast 2025 - 2035

Industry: HealthcareGlobal Hybrid Endoscopy Market Insights Forecasts to 2035

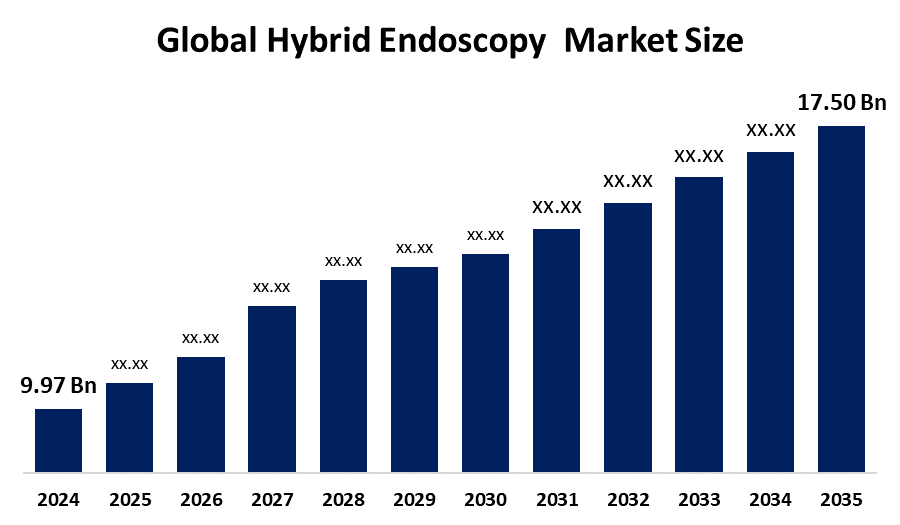

- The Global Hybrid Endoscopy Market Size Was Estimated at USD 9.97 billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.25% from 2025 to 2035

- The Worldwide Hybrid Endoscopy Market Size is Expected to Reach USD 17.50 billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global hybrid endoscopy market size was worth around USD 9.97 billion in 2024 and is predicted to grow to around USD 17.50 billion by 2035 with a compound annual growth rate (CAGR) of 5.25% from 2025 to 2035. Technological developments, increased clinical applications, growing demand for minimally invasive procedures, improved diagnostic precision, and higher healthcare investments supporting integrated imaging-endoscopic solutions across international medical systems all present opportunities in the hybrid endoscopy market.

Market Overview

The advanced field of medical devices and systems that combine endoscopic imaging with complementary technologies like fluoroscopy, ultrasound, and AI-driven navigation to enable real-time, multimodal visualization in hybrid operating rooms for minimally invasive diagnostics and surgeries is known as the hybrid endoscopy market. Government programs support expansion, such as the UK's NHS improvements and China's "Healthy China 2030" plan, which modernizes GI endoscopy, and India's National Health Mission, which encourages surgical training. Growth in the hybrid endoscopy market is mostly driven by the factors such as increasing demand for less invasive diagnostic and surgical procedures, digital imaging systems integration, and more GI endoscopy and specialized surgical centers in the world adopting hybrid operating room infrastructure. Furthermore, government health care modernization programs, increasing funds in surgical infrastructure, and more attention paid to patient safety and clinical outcomes are the main things that speed up the growth process.

Report Coverage

This research report categorizes the hybrid endoscopy market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hybrid endoscopy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the hybrid endoscopy market.

Driving Factors

The rising need for sophisticated vision and precision instruments in minimally invasive and image-guided surgical procedures, the hybrid endoscopy market is expanding globally. The market for hybrid endoscopy is expanding significantly due to a number of reasons that improve the uptake of cutting-edge endoscopic technology in healthcare settings. Technological advancements in robotic-assisted endoscopy, 3D visualization, and sophisticated imaging are increasing the clinical applications of hybrid systems and streamlining workflows. Technological developments in imaging modalities, such as fluorescence imaging, high-definition visualization, and AI-assisted diagnostics, are driving the hybrid endoscopy market.

Restraining Factors

The hybrid endoscopy market is constrained by factors such as expensive equipment, restricted reimbursement policies, complicated system integration, and the requirement for specialized training, especially in developing nations with limited healthcare infrastructure and financial resources.

Market Segmentation

The hybrid endoscopy market share is classified into product type and application.

- The hybrid video endoscopy platforms segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the hybrid endoscopy market is divided into hybrid video endoscopy platforms, single-use / disposable hybrid scopes, imaging modes & AI modules, EUS/ERCP hybrid suites & equipment, and accessories & consumables. Among these, the hybrid video endoscopy platforms segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Advanced systems that combine video processors and scopes to provide high-definition and 4K imaging, digital signal processing, and real-time visualization for precision-guided treatments are included in the hybrid video endoscopic platforms section. The sophisticated integration of viewing, diagnostic, and therapeutic capabilities into a single system is the reason for the hybrid video endoscopy systems market.

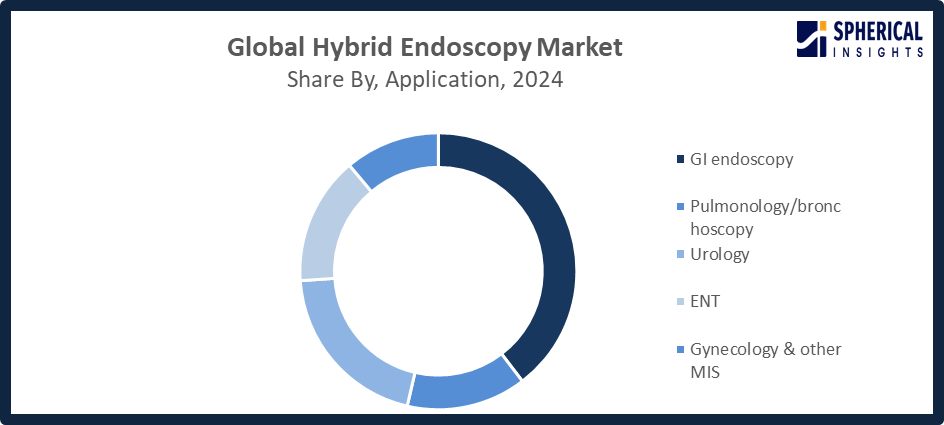

- The GI endoscopy segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the hybrid endoscopy market is divided into GI endoscopy, pulmonology/bronchoscopy, urology, ENT, and gynecology & other MIS. Among these, the GI endoscopy segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. High procedure volume and growing clinical acceptance of sophisticated hybrid visualization systems in gastroenterology are reflected in GI endoscopy applications. The adoption of minimally invasive diagnostic and treatments, including polypectomy, mucosal resection, and biliary interventions, as well as the increasing prevalence of gastrointestinal illnesses and cancer screening programs, are the driving forces behind leadership.

Get more details on this report -

Regional Segment Analysis of the Hybrid Endoscopy Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the hybrid endoscopy market over the predicted timeframe.

North America is anticipated to hold the largest share of the hybrid endoscopy market over the predicted timeframe. The adoption of hybrid endoscopic systems is made easier in North America by the region's highly developed healthcare infrastructure, state-of-the-art medical facilities, and extensive access to cutting-edge technologies. Due to sophisticated healthcare infrastructure, well-established hospital networks, and strong procedural demand among top medical institutions, the hybrid endoscopy market in the United States exhibits mature adoption. This dominance is reinforced by recent launches: Fujifilm introduced the AI-integrated ELUXEO 8000 for precision endoscopy in July; Olympus unveiled its VISERA S OTV-S500 hybrid platform for ENT in October 2025, improving 4K visualization; and Outlook Surgical obtained FDA approval for the Inova 1 towerless endoscope in September, with an early 2026 deployment.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the hybrid endoscopy market during the forecast period. The demand for sophisticated endoscopic solutions is being driven by an increase in the prevalence of chronic illnesses, such as urological and gastrointestinal disorders, as well as an increase in patient knowledge of minimally invasive procedures. In nations like China, India, Japan, and South Korea, technological developments like AI-assisted imaging and portable hybrid endoscopic equipment are also quickening market penetration. Notable 2025 debuts include PENTAX Medical's LED-integrated platforms in Q4, aimed at South Korea and Japan; Ovesco's AWC twin clip in November for advanced flexible endoscopy; and Fujifilm's Asia-Pacific deployment of the ELUXEO 8000 hybrid system in July for GI applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hybrid endoscopy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ambu A/S

- B. Braun Melsungen AG

- Boston Scientific Corporation

- CONMED Corporation

- Cook Medical

- FUJIFILM Holdings Corporation

- Johnson & Johnson

- Karl Storz SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Pentax Medical

- Richard Wolf GmbH

- Smith & Nephew plc

- Stryker Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2025, Olympus Corporation lunched the VISERA™ S OTV-S500 hybrid endoscopy imaging platform in the U.S., providing state-of-the-art diagnostic features for ENT and urology, and elevating the level of flexibility and accuracy in office and outpatient practices.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hybrid endoscopy market based on the below-mentioned segments:

Global Hybrid Endoscopy Market, By Product Type

- Hybrid video endoscopy platforms

- Single-use / disposable hybrid scopes

- Imaging modes & AI modules

- EUS/ERCP hybrid suites & equipment

- Accessories & consumables

Global Hybrid Endoscopy Market, By Application

- GI endoscopy

- Pulmonology/bronchoscopy

- Urology

- ENT

- Gynecology & other MIS

Global Hybrid Endoscopy Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the hybrid endoscopy market over the forecast period?The global hybrid endoscopy market is projected to expand at a CAGR of 5.25% during the forecast period.

-

2. What is the market size of the hybrid endoscopy market?The global hybrid endoscopy market size is expected to grow from USD 9.97 billion in 2024 to USD 17.50 billion by 2035, at a CAGR of 5.25% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the hybrid endoscopy market?North America is anticipated to hold the largest share of the hybrid endoscopy market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global hybrid endoscopy market?Ambu A/S, B. Braun Melsungen AG, Boston Scientific Corporation, CONMED Corporation, Cook Medical, FUJIFILM Holdings Corporation, Johnson & Johnson, Karl Storz SE & Co. KG, Medtronic plc, Olympus Corporation, Pentax Medical, Richard Wolf GmbH, Smith & Nephew plc, Stryker Corporation, and Others.

-

5. What are the market trends in the hybrid endoscopy market?The hybrid endoscopy market is driven by advancements in minimally invasive procedures, AI-assisted imaging, integration with complementary technologies, rising outpatient procedures, and increasing demand for precision diagnostics globally

-

6. What are the main challenges restricting the wider adoption of the hybrid endoscopy market?High equipment costs, limited reimbursement policies, complex integration, requirement for specialized training, and infrastructure constraints in developing regions restrict the broader adoption of hybrid endoscopy systems

Need help to buy this report?