Global Hybrid Composites Market Size, Share, and COVID-19 Impact Analysis, By Fiber Type (Carbon/Glass, Carbon/Aramid), By Resin Type (Thermoplastic, Thermosetting), by End-Use Industry (Aerospace & Defense, Building & Construction, Automotive & Transportation), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Hybrid Composites Market Insights Forecasts to 2035

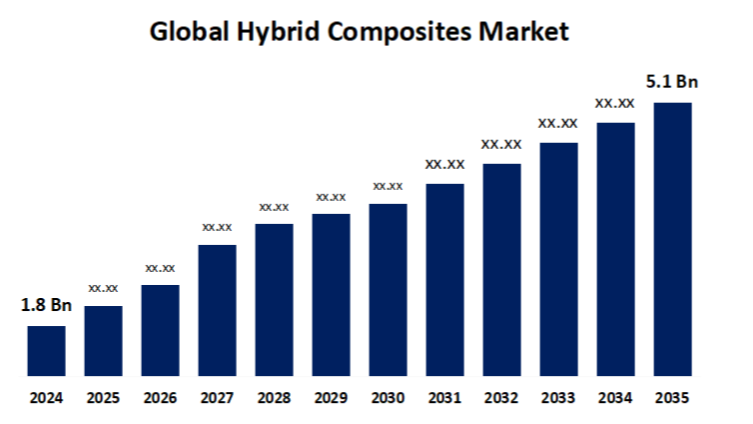

- The Global Hybrid Composites Market Size was valued at USD 1.8 Billion in 2024.

- The Market is Growing at a CAGR of 10.98% from 2025 to 2035.

- The Worldwide Hybrid Composites Market Size is Expected to reach USD 5.1 Billion by 2035.

- Asia Pacific is Expected to Grow the fastest during the forecast period.

The Global Hybrid Composites Market Size is Expected to reach USD 5.1 Billion by 2035, at a CAGR of 10.98% during the forecast period 2025 to 2035.

Get more details on this report -

The hybrid composites market is witnessing robust growth, driven by increasing demand for lightweight, high-strength materials across automotive, aerospace, wind energy, and construction sectors. Hybrid composites, which combine two or more types of fibers such as carbon, glass, or aramid offer enhanced performance characteristics, including improved mechanical strength, thermal stability, and corrosion resistance. Their ability to be tailored for specific applications makes them ideal for structural and semi-structural components. The automotive industry, in particular, is increasingly adopting hybrid composites to meet stringent fuel efficiency and emission regulations. Advancements in manufacturing technologies, such as resin transfer molding and automated fiber placement, are further accelerating market adoption. Asia-Pacific leads the market due to rising industrialisation and government support for sustainable and energy-efficient materials in key industries.

Hybrid Composites Market Value Chain Analysis

The value chain of the hybrid composites market encompasses several key stages, starting with raw material suppliers who provide fibers (carbon, glass, aramid) and resins (epoxy, polyester, etc.). These materials are processed by composite manufacturers to produce hybrid fabrics or prepregs, integrating different fibers for enhanced properties. Component fabricators and part manufacturers use techniques like compression molding, vacuum infusion, and resin transfer molding to create customized components for end-use industries. Distributors and suppliers play a vital role in ensuring timely delivery and quality control. End-users, including automotive, aerospace, wind energy, and construction sectors, drive demand based on performance needs. The value chain also involves research institutions and technology providers that support innovation and sustainability. Efficient collaboration across this chain is crucial for cost optimization and product development.

Hybrid Composites Market Opportunity Analysis

The hybrid composites market presents significant growth opportunities driven by evolving industry requirements and technological advancements. In the automotive and aerospace sectors, the push for lightweight and fuel-efficient materials is accelerating the adoption of hybrid composites. The renewable energy industry, especially wind energy, is also a key area, as hybrid composites enable the development of longer, more durable, and lighter turbine blades. The Asia-Pacific region, particularly countries like India and China, is emerging as a major growth hub due to rapid industrialisation and supportive policies. Furthermore, innovations in biopolymer hybrids, thermoplastic matrices, and automated manufacturing techniques are expanding application possibilities. As industries increasingly prioritise sustainability, performance, and cost efficiency, hybrid composites are poised to experience widespread adoption across various end-use sectors.

Global Hybrid Composites Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.98% |

| 2035 Value Projection: | USD 5.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Fiber Type, By Resin Type, By End-Use, By Region |

| Companies covered:: | Royal DSM (the Netherlands), SGL Group - The Carbon Company (Germany), Gurit (Switzerland), Hexcel Corporation (US), TEIJIN LIMITED (Japan), Exel Group World Wide (Finland), Solvay (Belgium), PlastiComp, Inc. (US), Innegra Technologies, LLC (US), and Quantum Composites (US) and other key vendors. |

| Growth Drivers: | A rising demand within the automotive sector |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Hybrid Composites Market Dynamics

A rising demand within the automotive sector

The hybrid composites market is experiencing strong growth, primarily driven by the rising demand within the automotive sector for lightweight, high-performance materials that enhance fuel efficiency and reduce emissions. Hybrid composites, which combine two or more types of reinforcing fibers, offer superior mechanical strength, durability, and design flexibility, making them ideal for automotive structural and interior components. Additionally, the aerospace and wind energy industries are adopting these materials to meet stringent performance standards while minimising weight. Growing interest in sustainable and energy-efficient solutions is further accelerating their use across sectors. Advancements in manufacturing technologies and material innovations are enabling cost-effective production and expanding application scope. The Asia-Pacific region, supported by rapid industrialisation and favourable government policies, continues to be a major contributor to market expansion.

Restraints & Challenges

One major hurdle is the high cost of raw materials, particularly carbon and aramid fibres, which significantly raises overall production expenses. Additionally, the manufacturing processes involved are complex, requiring advanced machinery, skilled labour, and standardised methods, factors that can be difficult for smaller or emerging players to manage. Variability in material properties and a lack of standardisation also pose issues for quality control and product consistency. Recycling hybrid composites remains a significant challenge due to their multi-material composition, complicating sustainability efforts. Moreover, limited awareness and slow acceptance in certain end-use industries, along with strict regulatory requirements and economic uncertainties, further restrain market growth and delay large-scale implementation.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Hybrid Composites Market from 2025 to 2035. The United States leads the regional market, supported by a well-established aerospace and defense sector that significantly contributes to the adoption of advanced composite materials. Hybrid composites such as carbon/glass and carbon/aramid fiber combinations are widely used due to their superior performance characteristics. Thermoset resins remain the most commonly used matrix type in the region. The presence of major manufacturers and OEMs, along with favorable government policies promoting lightweight materials and clean energy initiatives, further accelerates market development. Although challenges such as high raw material costs and recyclability issues persist, ongoing innovation and industrial demand continue to position North America as a key hub for hybrid composite growth.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. The automotive and aerospace industries are key contributors, as manufacturers seek advanced composites to enhance performance and meet stringent efficiency standards. Wind energy is another major growth area, with hybrid composites used in the production of durable and lightweight turbine blades. The region is also benefiting from advancements in manufacturing technologies and a shift toward sustainable, bio-based materials. Countries like China, India, Japan, and South Korea are at the forefront, supported by strong domestic production capabilities and favorable government initiatives. As industries prioritize energy efficiency and sustainability, Asia-Pacific is emerging as a leading growth hub in the hybrid composites market.

Segmentation Analysis

Insights by Fiber Type

The carbon/glass segment accounted for the largest market share over the forecast period 2025 to 2035. The carbon/glass fiber segment is a key contributor to the growth of the hybrid composites market, offering an optimal balance of strength, stiffness, and cost-efficiency. This combination delivers many of the performance advantages of carbon fiber at a more affordable price point, making it highly attractive across various industries. In the automotive sector, carbon/glass hybrids are increasingly used in lightweight, durable components such as body panels and structural parts. Aerospace, marine, and wind energy applications also benefit from these materials due to their ability to reduce weight while maintaining mechanical integrity. As industries focus on enhancing performance and reducing material costs, demand for carbon/glass fiber composites continues to rise. The segment is expected to witness sustained growth driven by expanding applications and technological advancements.

Insights by Resin Type

The thermoset segment accounted for the largest market share over the forecast period 2025 to 2035. Thermoset resins are widely used in hybrid composites due to their ability to withstand high temperatures and maintain structural integrity under stress. These properties make them ideal for demanding applications in automotive, aerospace, and wind energy sectors. In the automotive industry, thermoset-based hybrids are increasingly used in structural parts and electric vehicle battery enclosures due to their stiffness and heat resistance. Wind turbine blades also benefit from thermoset composites for their lightweight and high-performance characteristics. Ongoing innovations in resin technologies such as faster curing systems, bio-based options, and compatibility with automated processes are enhancing efficiency and sustainability. As a result, thermosets continue to play a dominant role in market growth.

Insights by End Use

The automotive & transportation segment accounted for the largest market share over the forecast period 2025 to 2035. The growth is fueled by the industry's increasing focus on lightweight, fuel-efficient, and environmentally friendly solutions. Hybrid composites particularly carbon/glass fiber combinations with thermoset resins are being widely adopted for structural components, interior parts, battery enclosures, and rail applications. The growing popularity of electric vehicles is further accelerating this trend, as reducing vehicle weight is essential for improving battery performance and overall efficiency. Beyond automobiles, the broader transportation sector, including railways, benefits from the superior durability, corrosion resistance, and cost-effectiveness of hybrid composites. As regulatory pressures for lower emissions intensify and manufacturers seek better-performing materials, the adoption of hybrid composites in this segment is expected to continue rising, supported by ongoing innovation and increased integration into modern mobility solutions.

Recent Market Developments

- In April 2022, Tenneco broadened its product range and application capabilities in the automotive industry with the launch of advanced OE hybrid friction material composites, designed to meet the sector's stringent brake performance and comfort standards.

Competitive Landscape

Major players in the market

- Royal DSM (the Netherlands)

- SGL Group – The Carbon Company (Germany)

- Gurit (Switzerland)

- Hexcel Corporation (US)

- TEIJIN LIMITED (Japan)

- Exel Group World Wide (Finland)

- Solvay (Belgium)

- PlastiComp, Inc. (US)

- Innegra Technologies, LLC (US)

- Quantum Composites (US)

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Hybrid Composites Market, Fiber Type Analysis

- Carbon/Glass

- Carbon/Aramid

Hybrid Composites Market, Resin Type Analysis

- Thermoplastic

- Thermosetting

Hybrid Composites Market, End Use Analysis

- Aerospace & Defense

- Building & Construction

- Automotive & Transportation

Hybrid Composites Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Hybrid Composites Market?The global Hybrid Composites Market is expected to grow from USD 1.8 billion in 2024 to USD 5.1 billion by 2035, at a CAGR of 10.98% during the forecast period 2025-2035.

-

2. Who are the key market players of the Hybrid Composites Market?Some of the key market players of the market are Royal DSM (the Netherlands), SGL Group – The Carbon Company (Germany), Gurit (Switzerland), Hexcel Corporation (US), TEIJIN LIMITED (Japan), Exel Group World Wide (Finland), Solvay (Belgium), PlastiComp, Inc. (US), Innegra Technologies, LLC (US), and Quantum Composites (US).

-

3. Which segment holds the largest market share?The automotive & transportation segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?