Global Humira Market Size, Share, and COVID-19 Impact Analysis, By Product (Branded and Biosimilar), By Application (Rheumatoid Arthritis (RA), Psoriatic Arthritis (PsA), Crohn’s Disease (CD), Ulcerative Colitis (UC), Ankylosing Spondylitis and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Humira Market Insights Forecasts to 2035

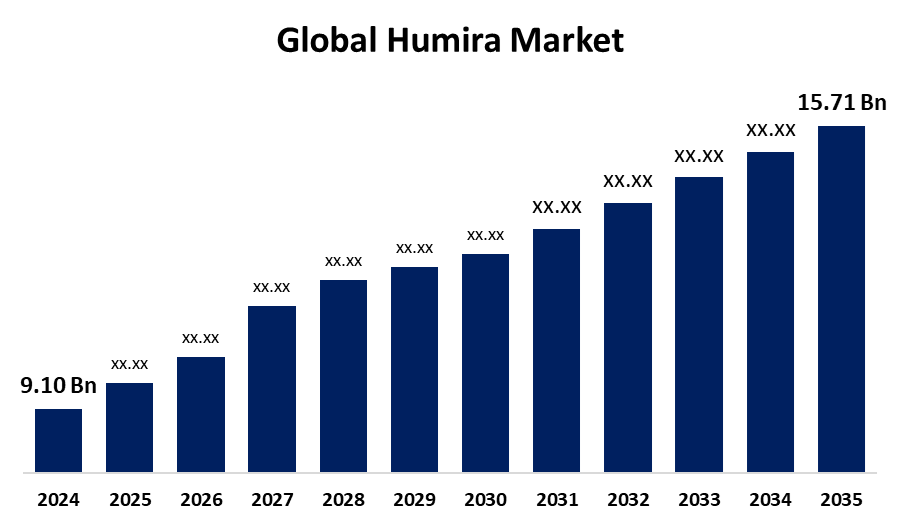

- The Global Humira Market Size Was Estimated at USD 9.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.09% from 2025 to 2035

- The Worldwide Humira Market Size is Expected to Reach USD 15.71 Billion By 2035

- Asia Pacific is Expected to Grow the fastest during the Forecast Period.

Get more details on this report -

The Global Humira Market Size was Worth Around USD 9.10 Billion in 2024 and is Predicted to Grow to Around USD 15.71 Billion By 2035 with a Compound Annual Growth Rate (CAGR) of 5.09% from 2025 and 2035. The Humira Market is driven by its proven efficacy across multiple autoimmune conditions, established brand recognition, expanding global availability, growing prevalence of autoimmune diseases, established healthcare systems, robust reimbursement coverage, and continuous clinical research in new indications.

Market Overview

The humira market is the worldwide market for humira (adalimumab), a biologic medication created by AbbVie used to treat most autoimmune diseases. They include rheumatoid arthritis, psoriasis, Crohn's disease, ulcerative colitis, ankylosing spondylitis, and other inflammatory diseases. Humira inhibits tumor necrosis factor-alpha (TNF-α), a central protein that plays a significant role in inflammation. Healthcare professionals and payers are increasingly adopting biosimilars, and that trend is driving greater adoption of adalimumab for the treatment of autoimmune conditions. This trend is making cost-effective treatments more widely available and affordable, enabling more patients to control their diseases with biologics. In April 2024, the FDA approved multiple biosimilars for Humira, such as Amjevita, Hyrimoz, and Yuflyma. These approvals have caused tremendous price competition in the marketplace, reducing the cost of treatments and enhancing patient access to therapy. Now that lower-cost options are available, patients can access effective therapies without the expense of the branded Humira, increasing the uptake of biologic therapies.

Report Coverage

This research report categorizes the humira market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the humira market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the humira market.

Global Humira Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.09% |

| 2035 Value Projection: | USD 15.71 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By Region. |

| Companies covered:: | Alvotech, Amgen Inc., Boehringer Ingelheim Pharmaceuticals, Inc., CELLTRION INC., Coherus BioSciences, Inc., Fresenius Kabi AG, FUJIFILM KYOWA KIRIN BIOLOGICS Co., Ltd., Pfizer Inc., Samsung Bioepis, Sandoz Inc., and Other Key Venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Humira's efficacy in the treatment of numerous autoimmune conditions such as rheumatoid arthritis, Crohn's disease, psoriasis, and ulcerative colitis has established it as a first-line treatment. Its symptom control and slowing of disease progression fuel sustained demand across various patient populations. Additionally, humira continues to receive approvals for new indications and combinations, further increasing its clinical utility. Regular clinical trials and investigations into other indications for Humira in other inflammatory diseases contribute towards maintaining its momentum and prolonging its market life.

Restraining Factors

Humira continues to be a very costly biologic, hence limiting access for some patients. Despite insurance, the out-of-pocket expenses being high can put a strain on finances, thereby causing discontinuation of treatment or switching to other cheaper options such as biosimilars. Additionally, competition has been brought in by entry of several Humira biosimilars on the market. Biosimilars, including Amjevita and Cyltezo, are lower-cost alternatives, resulting in a loss of market share from the original branded Humira to the cheaper biosimilars.

Market Segmentation

The humira market share is classified into product and application.

- The branded segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the humira market is divided into branded and biosimilar. Among these, the branded segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to humira's established clinical success in treating several autoimmune diseases has made it the gold standard within the biologic treatment space. The established efficacy of the drug in alleviating symptoms and inhibiting disease progression has kept the branded product highly demanded over the long term.

- The rheumatoid arthritis (RA) segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the humira market is divided into rheumatoid arthritis (RA), psoriatic arthritis (PSA), Crohn's disease (CD), ulcerative colitis (UC), ankylosing spondylitis, and others. Among these, the rheumatoid arthritis (RA) segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to rheumatoid arthritis is among the most prevalent autoimmune diseases globally, impacting millions, especially in developed countries. Its chronic character necessitates long-term treatment, resulting in steady demand for efficient treatments such as Humira. This wide patient population plays a major role in Humira's market leadership in the RA segment.

Regional Segment Analysis of the Humira Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the humira market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the humira market over the predicted timeframe. North America has an elevated incidence of autoimmune diseases such as rheumatoid arthritis, Crohn's disease, and psoriasis. With millions of patients affected, the market demand for biologics such as Humira remains high. Approval for various indications has helped secure widespread use among patient populations, sustaining steady sales and cementing its market leadership in the region.

Asia Pacific is expected to grow at a rapid CAGR in the humira market during the forecast period. Asia-Pacific nations are experiencing a consistent rise in autoimmune conditions such as rheumatoid arthritis and inflammatory bowel disease as a result of lifestyle changes, aging populations, and enhanced diagnostic rates. With increasing awareness and diagnosis, the need for effective biologics such as Humira and its biosimilars is gaining momentum, and the region is becoming a fast-growing market for treatment options.

Europe is predicted to hold a significant share of the humira market throughout the estimated period. Since the launch of Humira biosimilars in Europe, treatment has become more affordable, promoting broader use. The biosimilars are usually reimbursed on a similar basis to the reference product, ensuring Humira's strong market share despite rising competition.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the humira market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alvotech

- Amgen Inc.

- Boehringer Ingelheim Pharmaceuticals, Inc.

- CELLTRION INC.

- Coherus BioSciences, Inc.

- Fresenius Kabi AG

- FUJIFILM KYOWA KIRIN BIOLOGICS Co., Ltd.

- Pfizer Inc.

- Samsung Bioepis

- Sandoz Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, the U.S. Food and Drug Administration (FDA) approved Celltrion's YUFLYMA, a biosimilar to Humira (adalimumab), as interchangeable. Created by Celltrion, Inc., YUFLYMA is a citrate-free, high-concentration formulation that helps minimize injection discomfort and provides an improved, patient-friendly version.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the humira market based on the below-mentioned segments:

Global Humira Market, By Type

- Branded

- Biosimilar

Global Humira Market, By Application

- Rheumatoid Arthritis (RA)

- Psoriatic Arthritis (PsA)

- Crohn’s Disease (CD)

- Ulcerative Colitis (UC)

- Ankylosing Spondylitis

- Others

Global Humira Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Humira market over the forecast period?The global Humira market is projected to expand at a CAGR of 5.09% during the forecast period.

-

2. What is the market size of the Humira market?The global Humira market size is expected to grow from USD 9.10 Billion in 2024 to USD 15.71 Billion by 2035, at a CAGR of 5.09% during the forecast period 2025-2035.

-

1. Which region holds the largest share of the humira market?North America is anticipated to hold the largest share of the humira market over the predicted timeframe.

Need help to buy this report?