Global HSV Testing Market Size, Share, and COVID-19 Impact Analysis, By Type (HSV-1/HSV-2 Combines, HSV-1, and HSV-2), By Test Type (Serological tests, Direct detection tests, and Point-of-care tests), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal HSV Testing Market Insights Forecasts To 2035

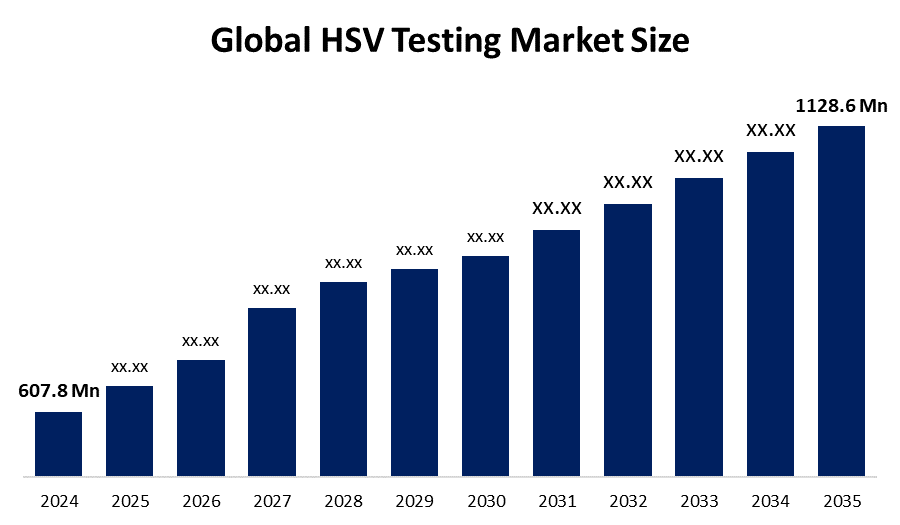

- The Global HSV Testing Market Size Was Estimated at USD 607.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.79% from 2025 to 2035

- The Worldwide HSV Testing Market Size is Expected to Reach USD 1128.6 Million by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Global HSV Testing Market Size was worth around USD 607.8 Million in 2024 and is predicted to Grow to around USD 1128.6 Million by 2035 with a compound annual Growth rate (CAGR) of 5.79% from 2025 and 2035. The rising prevalence of herpes, growing demand for rapid diagnoses, advancements in molecular testing methods, increased public awareness, and improved access to healthcare are all factors driving the market for herpes diagnostic solutions

Market Overview

The HSV testing market offers goods and services for detecting herpes simplex virus types 1 and 2 in patients. The market for HSV testing is developing as a result of rising herpes prevalence, greater public awareness, and a growing focus on sexual health screening. The World Health Organization (WHO) estimates that by 2025, 3.8 billion individuals under 50 (64%) will have HSV-1, the primary cause of oral herpes, and 520 million consumers between the ages of 15 and 49 (13%) will have HSV-2, the primary cause of genital herpes. These figures underscore the pressing need for sophisticated, scalable, and readily available HSV diagnostic instruments, which are being adopted by healthcare facilities, diagnostic laboratories, and home care agencies worldwide. Traditional serology and sophisticated molecular assays, such as multiplex PCR systems that can identify HSV in addition to other STIs, are examples of testing platforms. To prevent neonatal herpes, there is a growing need for type-specific testing, particularly during prenatal care. Access is improved in urgent care and low-resource settings by the move towards decentralised and point-of-care testing. Telehealth consultations, outcome tracking, and remote diagnostics are all supported by integration with digital health solutions. Government programs aimed at STI prevention and regulatory approvals for user-friendly kits also contribute to market expansion. The availability of tests is being increased by public health initiatives and partnerships between organizations and diagnostic companies. In general, the market is driven by the demand for prompt and precise HSV detection in a variety of healthcare settings, changing clinical standards, and technical improvements.

Report Coverage

This research report categorizes the HSV testing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the HSV testing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the HSV testing market.

Global HSV Testing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 607.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.79% |

| 2035 Value Projection: | USD 1128.6 Million by 2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 260 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Test Type, By Region |

| Companies covered:: | F. Hoffmann-La Roche Ltd., Abbott, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., bioMérieux SA, Hologic, Inc., Cepheid, QuidelOrtho Corporation, AdvaCare Pharma, CTK Biotech, McKesson Medical-Surgical, Quest Diagnostics, ZEUS Scientific, and Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Expanding STI prevalence, heightened public consciousness, and greater emphasis on earlier detection, mostly obstetrically, directly propel the HSV testing industry. Rising innovation, with examples being rapid molecular assays, multiplex PCRs, and at-home test kits, expands accessibility and improves accuracy. Integration with digital health solutions enables explicit delivery of real-time results and remote diagnostics. Wider industry demand is bolstered by institutional regulatory imperatives, public health initiatives, and regional healthcare spending, especially in densely populated emerging regions, for cost-effective and convenience-based HSV testing.

Restraining Factors

The market for HSV testing is hampered by strict regulations, especially for digital and home-based diagnostic tools, which can cause delays in product approvals. Concerns about data privacy, societal stigma around STI testing, and low awareness in low-income areas all impede market expansion. Furthermore, widespread usage may be limited by the high cost of sophisticated molecular diagnostics.

Market Segmentation

The HSV testing market share is classified into type and test type.

- The HSV-1/HSV-2 combines segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the HSV testing market is divided into HSV-1/HSV-2 combines, HSV-1, and HSV-2. Among these, the HSV-1/HSV-2 combines segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This is due to the growing demand for evidence-based treatment and prenatal decisions, as well as for quick and precise diagnosis, dual-target molecular tests that can identify HSV-1 and HSV-2 have the benefit of portability and point-of-care testing. These dual-target kits offer enormous potential when used in clinical or public health settings, especially for decentralised healthcare and sexual health clinics.

- The serological tests segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the test type, the HSV testing market is divided into serological tests, direct detection tests, and point-of-care tests. Among these, the serological tests segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Serological assays dominate HSV testing due to their low cost, ease of use, and suitability for routine screening and monitoring. Serological assays identify previous exposures and unsuspected infections through the identification of HSV antibodies. Molecular methodologies are emerging but are limited in their early sensitivity and differentiation from latent or active infection. Serological assays remain in widespread use due to their scalability and are part of the laboratory workflow.

Regional Segment Analysis of the HSV Testing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the HSV testing market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the HSV testing market over the predicted timeframe. The robust healthcare system, high STI awareness, and widespread availability of lab-based and point-of-care diagnostics all contribute to the North American HSV testing market. Testing volumes are driven by routine screening in emergency rooms, prenatal care facilities, and sexual health clinics. Demand is also increased by government-led programs for early identification and STI education. Blood-based diagnostics are becoming more widely used as a result of clinical guidelines from agencies such as the CDC that encourage type-specific serological testing. Technological advancement is supported by large investments in molecular testing and the existence of top diagnostic companies. North America's dominance in the global HSV testing scene is further cemented by the region's emphasis on accessible and decentralised testing solutions, which propels market expansion.

Asia Pacific is expected to grow at a rapid CAGR in the HSV testing market during the forecast period. expanding access to diagnostic services, increasing infection load, and growing awareness of sexually transmitted illnesses. Through the implementation of digital healthcare, prenatal care initiatives, and public health campaigns, nations like China, India, and Japan are strengthening screening efforts. Thanks to advancements in healthcare infrastructure, there is a growing demand for reasonably priced serological and molecular HSV diagnostics in urban and semi-urban areas. Government-led reproductive health interventions and early identification and treatment for infections are being enhanced. In addition, the region's rapid market development is being supported by the increased availability of STI testing, which was made possible through the accessibility of point-of-care platforms and their integration with mobile health.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the HSV testing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- F. Hoffmann-La Roche Ltd.

- Abbott

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Hologic, Inc.

- Cepheid

- QuidelOrtho Corporation

- AdvaCare Pharma

- CTK Biotech

- McKesson Medical-Surgical

- Quest Diagnostics

- ZEUS Scientific

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, the U.S. FDA designating as Class II medical devices as herpes simplex virus (HSV) nucleic acid-based assays for the detection of central nervous system (CNS) diseases, including encephalitis and meningitis linked to HSV. In particular, for individuals who work with cerebrospinal fluid (CSF) samples, this classification provides a distinct regulatory pathway with unique controls. The ruling is anticipated to stimulate additional advancements in PCR-based HSV testing and could enable wider integration into clinical settings using serum- and lesion-swab-based NAAT technologies.

- In October 2024, A new Quality Assessment Product (QAP) for HSV detection in formalin-fixed paraffin-embedded (FFPE) tissue was unveiled by Microbix Biosystems (Canada). The QAP, which was co-developed with Sunnybrook Research Institute and tested with QuidelOrtho, is intended to facilitate workflows for both immunohistochemistry (IHC) and quantitative PCR (qPCR). By enabling increased accuracy and uniformity in HSV test performance across clinical and reference laboratories, this quality assurance tool improves the dependability and consistency of molecular HSV diagnostics in tissue-based applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the HSV testing market based on the below-mentioned segments:

Global HSV Testing Market, By Type

- HSV-1/HSV-2 Combines

- HSV-1

- HSV-2

Global HSV Testing Market, By Test Type

- Serological tests

- Direct detection tests

- Point-of-care tests

Global HSV Testing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the HSV Testing market over the forecast period?The global HSV testing market is projected to expand at a CAGR of 5.79% during the forecast period.

-

2. What is the market size of the HSV Testing market?The global HSV testing market size is expected to grow from USD 607.8 million in 2024 to USD 1128.6 million by 2035, at a CAGR of 5.79% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the HSV Testing market?North America is anticipated to hold the largest share of the HSV testing market over the predicted timeframe.

Need help to buy this report?