Global Hospital EMR Systems Market Size, Share, and COVID-19 Impact Analysis, By Component Type (Software, Services, and Hardware), By Type (Specialty EMR Solutions and General EMR Solutions), By Hospital Size (Small & Medium-sized Hospitals and Large Hospitals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Hospital EMR Systems Market Insights Forecasts to 2035

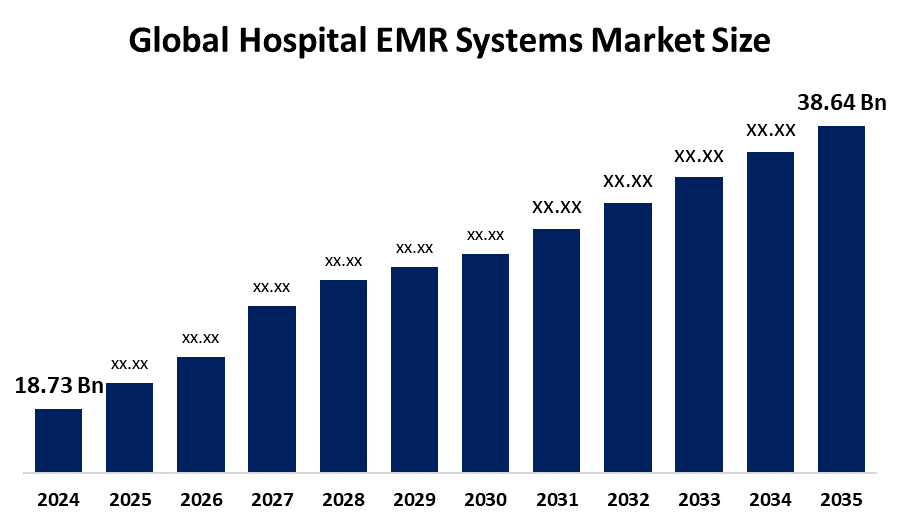

- The Global Hospital EMR Systems Market Size Was Estimated at USD 18.73 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.8% from 2025 to 2035

- The Worldwide Hospital EMR Systems Market Size is Expected to Reach USD 38.64 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Hospital EMR Systems Market Size was worth around USD 18.73 Billion in 2024 and is predicted to grow to around USD 38.64 Billion by 2035 with a compound annual growth rate (CAGR) of 6.8% from 2025 to 2035. The market for hospital EMR systems is expanding with growing adoption of digital health solutions, government efforts in healthcare IT, growing need for effective patient data management, better care coordination, and the need to optimize operational performance and minimize medical errors.

Market Overview

The global hospital EMR (electronic medical records) systems market refers to the market that deals with offering electronic platforms that store, manage, and exchange patient health data electronically. EMR systems are intended to substitute paper-based records, allowing healthcare professionals to access patient information efficiently and update it promptly, simplify administrative tasks, and improve in quality of care. These solutions find extensive usage in all types of hospitals, clinics, and specialty care facilities for managing patient records, tracking treatment, clinical decision-making support, and billing. The demand is majorly fueled by growing necessity for healthcare solutions in electronic form, expanding usage of health IT infrastructure, and government policy support for electronic record-keeping to improve patient safety and operational efficiencies. Increasing incidence of chronic diseases, aging populations, and the requirement for integrated care also increase EMR adoption.

Market innovation covers cloud-based EMR solutions, AI-driven analytics for predictive medicine, interoperability solutions, and mobile accessible systems, enabling real-time data access and enhanced patient monitoring. Emerging economies with growing healthcare infrastructure, along with telemedicine integration and remote patient monitoring, provide opportunities. Major industry players fueling growth are Cerner Corporation, Epic Systems Corporation, Allscripts Healthcare Solutions, MEDITECH, McKesson Corporation, and GE Healthcare, underpinned by strategic alliances, mergers, acquisitions, and ongoing product development. With hospitals increasingly looking for effective, secure, and scalable EMR solutions, the market is well positioned for continuous growth across the world, with continuous technological innovations dictating the future of e-health. The NABH initiated a certification program for Hospital Information Systems (HIS) and EMR systems, based on new standards unveiled during the September 17, 2024, National Patient Safety Conference. With Basic and Advanced certifications that last two years, the program fits into Ayushman Bharat Digital Mission, with the goal to enhance system interoperability, quality, and overall healthcare services in India.

Report Coverage

This research report categorizes the hospital EMR systems market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hospital EMR systems market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hospital EMR systems market.

Global Hospital EMR Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.73 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.8% |

| 2035 Value Projection: | USD 38.64 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Component Type, By Type, By Hospital Size and By Region |

| Companies covered:: | Epic Systems, athenahealth, Oracle Health, Meditech, GE HealthCare, Allscripts Veradigm, NextGen Healthcare, InterSystem, CPSI, Greenway Health, Infor Healthcare, McKesson, Philips Healthcare, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The hospital EMR (electronic medical records) system market is largely fueled by the growing demand for digitalization of the healthcare industry for better patient care and operational performance. Government policies and laws that support healthcare IT adoption motivate hospitals to adopt EMR systems. An increased understanding of advantages in the form of efficient management of patient data, improved clinical decision-making, and decreased medical errors drives demand. Also, an increase in chronic diseases, an aging population, and the necessity for integrated care among various providers drive market growth. Technological progress, such as cloud-based EMRs, interoperability, and mobile access, hastens adoption in healthcare centers.

Restraining Factors

The hospital EMR systems market is hindered by high implementation and maintenance costs, particularly for mid-sized and small hospitals. Concerns regarding data privacy and security, the absence of standardization, and resistance to change among healthcare professionals also slow adoption. Moreover, integration issues with legacy hospital systems hamper smooth EMR implementation and effectiveness.

Market Segmentation

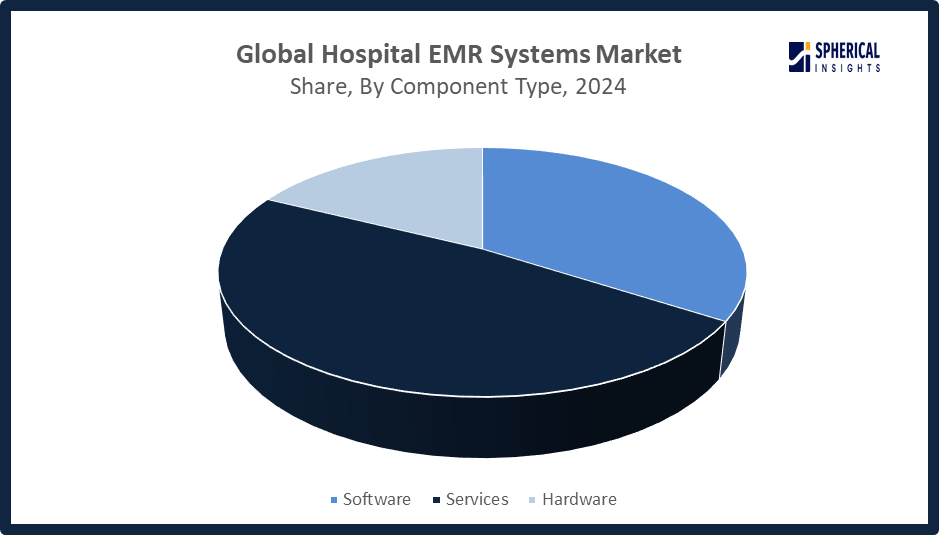

The hospital EMR systems market share is classified into component type, type, and hospital size.

- The services segment dominated the market in 2024, approximately 48% and is projected to grow at a substantial CAGR during the forecast period.

Based on the component type, the hospital EMR systems market is divided into software, services, and hardware. Among these, the services segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This segment is dominating due to its pivotal position in EMR implementation, upkeep, training, and maintenance. Hospitals depend on consulting, integration, and deployment services to adopt it without glitches. Managed services take care of software updates, security, compliance, and workflow optimization, particularly for providers with limited in-house IT capabilities, for whom third-party assistance is needed for data migration, cloud hosting, and interoperability.

Get more details on this report -

- The general EMR solutions segment accounted for the largest share in 2024, approximately 60% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the hospital EMR systems market is divided into specialty EMR solutions and general EMR solutions. Among these, the general EMR solutions segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. General EMR solutions dominate the market due to they have wide applicability, are cost-effective, and can be easily integrated into various hospital departments such as internal medicine, cardiology, and emergency treatment. General EMR solutions provide scalable workflows, integrate with laboratories, pharmacies, and billing, and are supported by government incentives and mandates, including the HITECH Act, that accelerate the adoption of interoperable, regulation-compliant systems.

- The large hospitals segment accounted for the highest market revenue in 2024, approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the hospital size, the hospital EMR systems market is divided into small & medium-sized hospitals and large hospitals. Among these, the large hospitals segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The large hospitals segment is driving the market owing to increased patient volumes, intricate multi-specialty services, and higher adoption rates of sophisticated EMR solutions. Large hospitals need robust systems for streamlined workflow management, interoperability, and regulatory compliance. Large hospitals also tend to have segregated IT infrastructure and budgets for implementing, managing, and updating EMR systems, further fueling market growth.

Regional Segment Analysis of the Hospital EMR Systems Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the hospital EMR systems market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the hospital EMR systems market over the predicted timeframe. North America is estimated to hold an approximate 45% market share of hospital EMR systems, due to by the United States, driven by a large adoption of digital health solutions, a strong healthcare infrastructure, and initiatives such as the HITECH Act, an initiative that offers incentives for the adoption of EMRs. Further, increasing demand for effective management of patient data, interoperability, and telehealth solutions drives the market growth. The availability of top EMR vendors, sophisticated hospital networks, and growing emphasis on minimizing medical errors and enhancing operational efficiency further support North America's leadership in the hospital EMR systems market over the forecast period.

Asia Pacific is expected to grow at a rapid CAGR in the hospital EMR systems market during the forecast period. Asia Pacific is rapidly growing in the hospital EMR systems market, with approximately 20% of market share, driven by China, Japan, and India. Accelerating market growth is fueled by healthcare digitization growth, government support for EMR adoption, investments in hospital facilities, and demand for effective management of patient data. Moreover, the large population in the region, growing healthcare availability, and rising awareness of advanced healthcare technologies speed up adoption. Enhancing IT infrastructure, increasing telemedicine adoption, and favorable regulatory policies also drive the rapid expansion of EMR systems in the Asia Pacific throughout the forecast period.

Tokyo Metropolitan Government targets 100% EMR adoption in all 639 hospitals by fiscal 2027, surpassing Japan’s 2030 national goal. To support this, subsidies for installation and upgrades have increased, raising assistance for some hospitals from 50% to 75%, facilitating faster EMR implementation and improved healthcare efficiency.

Europe is experiencing consistent growth in the hospital EMR systems market, approximately 25% of market share, with Germany, the UK, and France leading the adoption. Growth is fueled by government initiatives in favor of healthcare digitization, strict patient data management regulations, and the growing need for effective hospital workflow. Moreover, investment in sophisticated healthcare IT infrastructure, emphasis on interoperability, and the move towards value-based care are driving the implementation of EMR systems in hospitals, improving operational efficiency and patient care throughout the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hospital EMR systems market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Epic Systems

- athenahealth

- Oracle Health

- Meditech

- GE HealthCare

- Allscripts Veradigm

- NextGen Healthcare

- InterSystem

- CPSI

- Greenway Health

- Infor Healthcare

- McKesson

- Philips Healthcare

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, GE HealthCare announced collaborations with The Queen’s Health Systems (Honolulu) and Duke Health (Durham) to advance its AI-driven hospital operations software. Both will provide expertise to develop GE’s cloud-based CareIntellect SaaS solution, ensuring user feedback guides innovation for improved efficiency and patient care.

- In August 2025, Nimkee Memorial Wellness Center partnered with MyMichigan Health to integrate EMRs through MyMichigan’s Epic system under the Epic Community Connect program. This collaboration enhances patient record access, streamlines care, reduces duplicate tests, lowers costs, and improves efficiency and overall healthcare services.

- In August 2025, Oracle announced major upgrades to its Clinical One Data Collection EDC solution, enabling seamless interoperability with EHR systems. The enhancements streamline data collection, integrate with Oracle Safety One Argus, simplify clinical workflows, reduce data friction, and accelerate research, safety reporting, and therapy development for faster market delivery.

- In March 2025, InterSystems, a global data technology leader managing over one billion health records, partnered with Indonesia’s EMC Healthcare to implement the next-generation InterSystems IntelliCare EHR system. This strategic collaboration aims to revolutionize patient care, enhance operational efficiency, and advance healthcare delivery across the Southeast Asian region.

- In August 2024, Meditech launched Traverse Exchange, a new health information exchange network designed to improve interoperability among U.S. healthcare providers. The platform enables Meditech customers to securely share patient data across various EHR systems and networks, fully aligning with TEFCA standards to enhance coordinated, connected healthcare delivery.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hospital EMR systems market based on the below-mentioned segments:

Global Hospital EMR Systems Market, By Component Type

- Software

- Services

- Hardware

Global Hospital EMR Systems Market, By Type

- Specialty EMR Solutions

- General EMR Solutions

Global Hospital EMR Systems Market, By Hospital Size

- Small & Medium-sized Hospitals

- Large Hospitals

Global Hospital EMR Systems Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the hospital EMR systems market over the forecast period?The global hospital EMR systems market is projected to expand at a CAGR of 6.8% during the forecast period

-

2. What is the hospital EMR systems market?The hospital EMR (electronic medical record) systems market is the sector focused on software, hardware, and services for managing digital patient health records within hospitals.

-

3. What is the market size of the hospital EMR systems market?The global hospital EMR systems market size is expected to grow from USD 18.73 billion in 2024 to USD 38.64 billion by 2035, at a CAGR of 6.8% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the hospital EMR systems market?North America is anticipated to hold the largest share of the hospital EMR systems market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global hospital EMR systems market?Epic Systems, athenahealth, Oracle Health, Meditech, GE HealthCare, Allscripts Veradigm, NextGen Healthcare, InterSystems, CPSI, Greenway Health, Infor Healthcare, McKesson, Philips Healthcare, and Others.

-

6. What factors are driving the growth of the hospital EMR systems market?Growth in the hospital EMR systems market is driven by government initiatives and regulations, the increasing digitalization of healthcare, and the need for improved patient care and operational efficiency.

-

7. What are the market trends in the hospital EMR systems market?Key trends in the hospital EMR systems market include the increasing adoption of cloud-based solutions, the integration of advanced technologies such as AI and machine learning, and a growing focus on specialized EMR systems.

-

8. What are the main challenges restricting the wider adoption of the hospital EMR systems market?The main challenges restricting wider adoption of hospital EMR systems include high costs, interoperability issues, user resistance, and technical infrastructure limitations.

Need help to buy this report?