Global High-Purity Sulfuric Acid Market Size, Share, and COVID-19 Impact Analysis, By Application (Cleaning and Etching), By End User (Semiconductor & Electronics, and Pharmaceuticals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal High-Purity Sulfuric Acid Market Size Forecasts to 2033

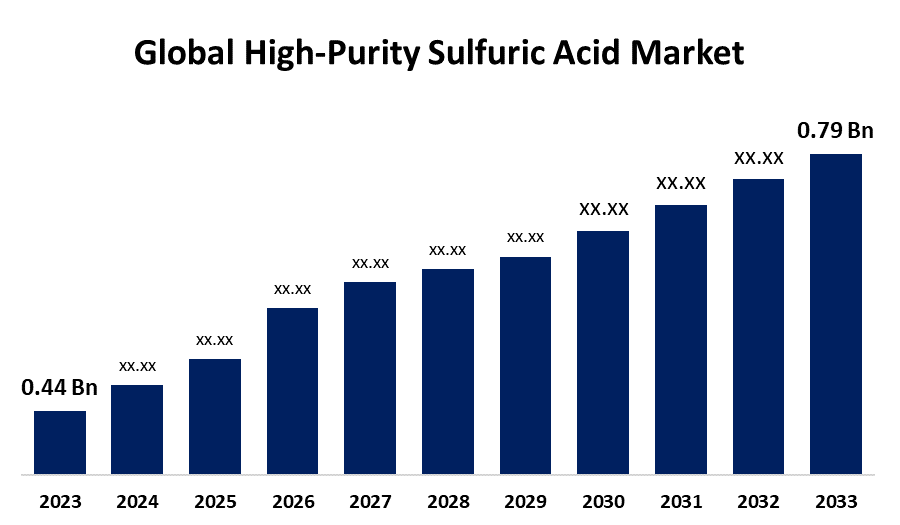

- The Global High-Purity Sulfuric Acid Market Size was estimated at USD 0.44 Billion in 2023

- The Global High-Purity Sulfuric Acid Market Size is Expected to Grow at a CAGR of around 6.03% from 2023 to 2033

- The Worldwide High-Purity Sulfuric Acid Market Size is Expected to Reach USD 0.79 Billion by 2033

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global High-Purity Sulfuric Acid Market Size is Expected to cross USD 0.79 Billion by 2033, Growing at a CAGR of 6.03% from 2023 to 2033. The growing demand from a variety of end-user sectors, the market for high purity sulfuric acid offers a plethora of potential opportunities.

Market Overview

The global industry devoted to the manufacture, distribution, and usage of ultra-pure sulfuric acid, which is mostly utilised in the electronics, pharmaceutical, and semiconductor manufacturing sectors, is known as the high purity sulfuric acid market. Strict contamination control, high demand from sophisticated chip production, and growing use in solar applications are its defining characteristics. Environmental laws, growing industrial uses, and technical improvements are the main drivers of high purity sulfuric acid market growth.

It's a large market opportunity for the ultra-clean materials that are becoming more and more important in the semiconductor and electronics industries. For instance, in December 2022, A USD 50 million expansion project was launched by Chemtrade Logistics to increase manufacturing capacity at its site in Cairo. The goal of this investment is to increase the production of ultrapure sulfuric acid, a crucial chemical used in the manufacturing process to clean semiconductor chips.

The growing use of cutting-edge chip manufacturing methods and growing production capacity in semiconductor hubs are driving the global market for high-purity sulfuric acid. The market for high-purity sulfuric acids is driven by demand in the semiconductor and electronics

sectors. Since high-purity sulfuric acid is used in medication production and laboratory settings, the pharmaceutical industry's strict contamination control regulations also contribute to the market's worth.

Report Coverage

This research report categorizes the high purity sulfuric acid market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the high purity sulfuric acid market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the high purity sulfuric acid market.

High-Purity Sulfuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 0.44 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.03% |

| 2033 Value Projection: | USD 0.79 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Application, By End Use, By Region and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, PVS Chemicals, Inc., OCI Company Ltd., Arkema Group, KMG Chemicals, Inc., Linde plc, Avantor, Inc., Reagent Chemicals, Solvay S.A., Huntsman Corporation, Honeywell International Inc., Kanto Chemical Co., Inc., The Chemours Company, Moses Lake Industries, Inc. and others key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The explosive expansion of the semiconductor industry and its reliance on high-purity process chemicals like sulfuric acid are demonstrated by the spike in demand for various semiconductor device types. Innovation in manufacturing processes increases the productivity, efficiency, and cost-effectiveness of acid manufacture, offering new market growth opportunities due to the growing and potentially robust worldwide demand. The market for high-purity sulfuric acid is anticipated to be driven by the expansion of the semiconductor and electronics sectors, as this chemical is used in the production of microchips, integrated circuits, and other sophisticated electronic components.

The widespread usage of high purity sulfuric acid in the semiconductor sector is one of the main drivers of the market's expansion. The global market for high-purity sulfuric acid is anticipated to rise steadily due to advancements in manufacturing technologies, rising regional semiconductor investments, and ongoing pharmaceutical discoveries. High purity chemicals must be used to prevent contamination due to the pharmaceutical industry's strict quality standards and regulatory regulations.

Restraining Factors

Numerous sectors, including semiconductors, photovoltaics, and medicines, need high-purity sulfuric acid. However, owing to the high manufacturing costs and the complexity of the production processes, it presents significant barriers to the high purity sulfuric acid market's expansion.

Market Segmentation

The high purity sulfuric acid market share is classified into application and end user.

- The cleaning segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the high purity sulfuric acid market is divided into cleaning and etching. Among these, the cleaning segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The most important use of high-purity sulfuric acid in semiconductor fabrication is for cleaning. In addition to semiconductors, high-purity sulfuric acid is also utilized in the solar energy industry for cleaning and etching photovoltaic cells.

- The semiconductor & electronics segment is anticipated to witness the fastest CAGR growth during the forecast period.

Based on the end user, the high purity sulfuric acid market is divided into semiconductor & electronics, and pharmaceuticals. Among these, the semiconductor & electronics segment is anticipated to witness the fastest CAGR growth during the forecast period. High-purity sulfuric acid is essential for wafer cleaning, etching, and surface preparation in the semiconductor and electronics industries. Maintaining ultra-clean surfaces is crucial for maximizing performance and yield as semiconductor devices get smaller, quicker, and more sophisticated.

Regional Segment Analysis of the High-Purity Sulfuric Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the high-purity sulfuric acid market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the high purity sulfuric acid market over the predicted timeframe. The market for high-purity sulfuric acid is dominated by Asia-Pacific, which is supported by the fast expansion of the semiconductor, electronics, and solar sectors in China, Taiwan, South Korea, and Japan. More recently, governments in nations like China, India, and Southeast Asia have made investments in renewable energy and implemented different clean energy incentives. High-purity sulfuric acid plays a significant role in the chemical markets as it is essential for the production of solar cells, namely for etching and texturing silicon wafers.

Europe is expected to grow at the fastest CAGR growth of the high purity sulfuric acid market during the forecast period. Europe is a significant market for high purity sulfuric acid because of its sophisticated production capabilities and strong emphasis on environmental sustainability. Due to the need for premium parts and goods, the region's electronics and automotive sectors are major users of high purity sulfuric acid. Furthermore, high purity reagents are necessary to guarantee product safety and efficacy in Europe's pharmaceutical business, which is renowned for its exacting quality requirements.

North America is predicted to hold a significant share of the global high purity sulfuric acid throughout the estimated period. The existence of significant pharmaceutical corporations and a thriving chemical sector propels North America regional market expansion. The usage of high purity reagents, such as sulfuric acid, is required due to the region's emphasis on technical innovation and superior industrial processes. The need for high purity sulfuric acid in North America is further supported by the expansion of the automotive sector and the shift to electric cars.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the high purity sulfuric acid market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- PVS Chemicals, Inc.

- OCI Company Ltd.

- Arkema Group

- KMG Chemicals, Inc.

- Linde plc

- Avantor, Inc.

- Reagent Chemicals

- Solvay S.A.

- Huntsman Corporation

- Honeywell International Inc.

- Kanto Chemical Co., Inc.

- The Chemours Company

- Moses Lake Industries, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, Entegris, Inc.'s electronic chemicals division was entirely acquired by FUJIFILM Corporation. A final deal was reached for FUJIFILM to purchase CMC Materials KMG Corporation (KMG), a semiconductor high-purity process chemicals (HPPC) company.

- In June 2023, the U.S. private equity firm Copperbeck Energy Partners LLC sold Saconix LLC to Sumitomo Chemical Co., Ltd. Sulfuric acid distribution and transportation throughout the Gulf and West Coast areas of the United States is Saconix's area of expertise.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the high purity sulfuric acid market based on the below-mentioned segments:

Global High-Purity Sulfuric Acid Market, By Application

- Cleaning

- Etching

Global High-Purity Sulfuric Acid Market, By End User

- Semiconductor & Electronics

- Pharmaceuticals

Global High-Purity Sulfuric Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the high purity sulfuric acid market over the forecast period?The high-purity sulfuric acid market is projected to expand at a CAGR of 6.03% during the forecast period.

-

2. What is the market size of the high purity sulfuric acid market?The Global High-Purity Sulfuric Acid Market Size is Expected to Grow from USD 0.44 Billion in 2023 to USD 0.79 Billion by 2033, at a CAGR of 6.03% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the high purity sulfuric acid market?Asia Pacific is anticipated to hold the largest share of the high purity sulfuric acid market over the predicted timeframe.

Need help to buy this report?