Global High-Purity Quartz Market Size, Share, and COVID-19 Impact Analysis, By Product Type (HPQ Powder, Grade I, Grade II, and Grade III), By Application (Semiconductor, Solar, Lighting, Telecom & Optics, Microelectronics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal High-Purity Quartz Market Size Insights Forecasts to 2035

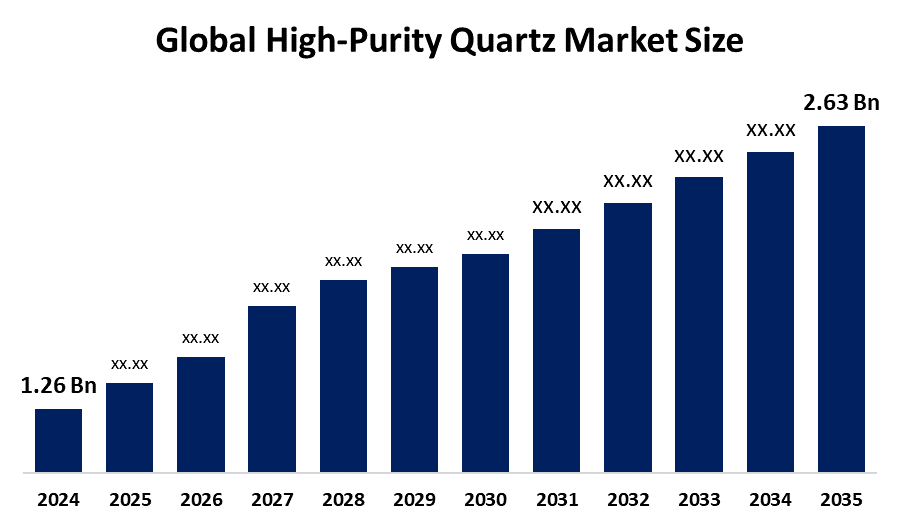

- The Global High-Purity Quartz Market Size Was Estimated at USD 1.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.92% from 2025 to 2035

- The Worldwide High-Purity Quartz Market Size is Expected to Reach USD 2.63 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global High-Purity Quartz Market Size was worth around USD 1.26 Billion in 2024 and is predicted to Grow to around USD 2.63 Billion by 2035 with a compound annual growth rate (CAGR) of 6.92% from 2025 to 2035. Increased solar power, faster fiber-optic connections, and chip manufacturing advancements are expected to propel the high-purity quartz market towards consistent growth. Because high-purity quartz is increasingly being used in the electrical industry, there is a steady growth in demand for it. Superb physicochemical properties, including strong optical transmission and great temperature tolerance.

Market Overview

The global high-purity quartz market refers to the production and distribution of ultra-pure quartz materials for use in semiconductors, solar panels, optics, and electronics, which require high chemical and physical purity criteria. The market for high-purity quartz is driven by its essential use in cutting-edge technologies that demand exceptional insulation, thermal stability, and optical clarity. The manufacturing of semiconductors, solar panels, fibre-optic cables, and AI-related products all depend on HPQ. The need for solar-grade polysilicon and ultra-pure quartz in wafer manufacturing has grown as a result of 5G, AI, edge computing, and renewable energy. Additionally, it is essential for VLSI circuits, aerospace ceramics, quantum computing, and UV-C lamps. The need for HPQ is still rising due to increased data centre and broadband connectivity, particularly for high-performance optical and electrical applications that demand extraordinary purity.

The semiconductor and solar industries depend on high-purity quartz because of its exceptional purity and resilience to heat. Crucibles, windows, glass tubes, and rods that are essential to the manufacturing of silicon and wafers are made with it. Global photovoltaic (PV) installations and semiconductor fabrication growth are driving up demand for HPQ. Market expansion is fuelled by new manufacturing facilities in nations including the U.S., South Korea, Germany, and Japan. In order to increase the installed capacity of high-purity quartz (HPQ) at its Spruce Pine facility in North Carolina, Sibelco stated in 2023 that it will invest an estimated $200 million USD. The demand for HPQ is gradually expanding due to increased investments in solar and clean energy projects under international accords like the Paris Accord.

Report Coverage

This research report categorizes the high-purity quartz market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the high-purity quartz market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the high-purity quartz market.

Global High-Purity Quartz Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.92% |

| 2035 Value Projection: | USD 2.63 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Australian Silica Quartz Group Ltd, Jiangsu Pacific Quartz Co., Ltd, Russian Quartz LLC, Sibelco, The Quartz Corp., Hunter Quartz, Hoshine Silicon Industry Co., Ltd, Elkem ASA, Gansu Hoshine Silicon Materials Co., Ltd, Magies Quartz Pvt Ltd, Jilin Quartz Industry, Inc., Feldspar Industries, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The heightened growth of renewable energy, chiefly the solar-PV technology, is contributing to worldwide high-purity quartz market high-purity quartz is vital for producing silicon ingots and crystalline silicon solar cells. Demand for quartz is increasing with solar project development, pricing pressures, and more prominent utilization of larger wafers. Furthermore, ultra-pure quartz is required for high-speed data transmission due to the rollout of 5G and optical fiber networks. In addition, demand for HPQ continues to increase with the heightened use in defence, aerospace, medical, and optical applications. Ultimately, HPQ is paramount in advancing the clean energy and high-tech industries due to its unmatched purity and performance.

Restraining Factors

The primary issues facing the HPQ market are the erratic raw material supply and the additional expenses associated with processing them. The production of HPQ feedstock, which is mined, will eventually be constrained by political, regulatory, and weather factors. A disruption could result in abrupt price adjustments and reduce earnings for businesses with extremely tight profit margins, such as refiners and semiconductor or solar panel manufacturers. HPQ is unsuitable for use in polysilicon or photolithography due to contamination traces.

Market Segmentation

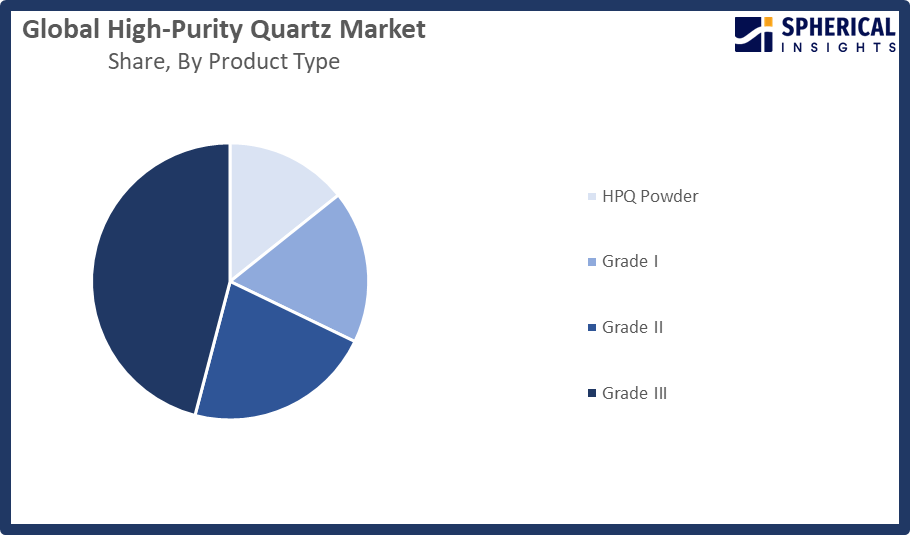

The High-Purity Quartz market share is classified into form and application.

- The grade III segment dominated the market in 2024, approximately 46.8% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the high-purity quartz market is divided into HPQ powder, grade I, grade II, and grade III. Among these, the grade III segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Its extensive use in applications requiring great optical clarity and exceptional thermal resistance at a cheaper cost than higher grades, grade III quartz has dominated the global high-purity quartz industry. It is widely used in sectors like electronics, optics, and solar, especially in the manufacturing of fiber optics, quartz glass, and crucibles. It is the go-to option due to its harmony of purity, performance, and affordability, which propels its commanding market dominance in a variety of end-use industries.

Get more details on this report -

- The semiconductor segment accounted for the largest share in 2024, approximately 56.7% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the high-purity quartz market is divided into semiconductor, solar, lighting, telecom & optics, microelectronics, and others. Among these, the semiconductor segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The semiconductor industry represented the largest share of the global market for high-purity quartz as it is essential for the development of silicon wafers, crucibles, and quartz glass components used in semiconductor manufacturing. High-purity quartz provides high heat resistance, optical clarity, and low contamination, which are all crucial characteristics that allow complex semiconductor processes to be carried out. This category dominates the market for high-purity quartz and is further supported by the continued rise in semiconductor production as a result of the increasing demand for electronics, 5G technologies, and AI-powered devices.

Regional Segment Analysis of the High-Purity Quartz Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share with approximately 64% of the High-Purity Quartz market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the high-purity quartz market over the predicted timeframe. High-purity quartz is used extensively in China, Taiwan, South Korea, Japan, and other countries to produce silicon wafers, which are necessary for integrated circuits. Industry growth is being driven by large investments in semiconductor manufacturing and the rising demand for sophisticated microchips. The demand for solar cells in HPQ is also being increased by renewable energy efforts in the Asia-Pacific. As the global leader in the production of solar energy, China plays a major role in the expansion of the market. China found a new high-purity quartz mineral in April 2025, which is anticipated to boost the country's semiconductor and solar industries and lessen reliance on imports.

North America is expected to grow the fastest market share with approximately 18.5% at a rapid CAGR in the high-purity quartz market during the forecast period. The top semiconductor businesses and recent advancements in microchip production have increased demand for ultra-pure quartz. More energy is produced from renewable sources as solar technology advances, which increases the demand for high-purity quartz in this industry. North America promotes the use of high-purity quartz because it has professionals, a well-developed infrastructure, and excellent research facilities. Demand is rising as a result of the proliferation of electronics in phones, automobiles, and appliances. It is anticipated that new technology, appropriate legislation, and a rise in the usage of green energy will establish North America as a dominant force in the market for high-purity quartz.

Europe is expected to grow at a rapid CAGR in the high-purity quartz market during the forecast period. The region's solar manufacturing is scaling up rapidly with government assistance and strong ambitions for renewable energy initiatives. Ultra-pure quartz is vital to the European semiconductor sector because of its essential applications, including wafer fabrication. High-quality quartz will continue to stimulate optical sales in the production of lenses, prisms, and fibre optics. There will be increased demands for ultra-pure quartz in the solar, renewable, semiconductor, and optical industries in the coming years as Europe transitions towards low-carbon technology and innovation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the high-purity quartz market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Australian Silica Quartz Group Ltd

- Jiangsu Pacific Quartz Co., Ltd

- Russian Quartz LLC

- Sibelco

- The Quartz Corp.

- Hunter Quartz

- Hoshine Silicon Industry Co., Ltd

- Elkem ASA

- Gansu Hoshine Silicon Materials Co., Ltd

- Magies Quartz Pvt Ltd

- Jilin Quartz Industry, Inc.

- Feldspar Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, with the launch of the Weatherbond Quartz series, Nippon Paint (Coatings) Philippines, Inc. signalled its intention to take the lead in protecting residences and structures from weather-related damage.

- In October 2023, A sizable, highly pure quartz mine in South Carolina, USA, was acquired by Ferroglobe PLC. With an additional $4 million anticipated in capital expenditures to build out the infrastructure, including loadout, rail connections, and a processing facility, the transaction price was nearly $11 million in cash.

- In April 2023, in order to increase the installed capacity of high-purity quartz (HPQ) at its Spruce Pine facility in North Carolina, Sibelco announced an expenditure of almost USD 200 million.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the high-purity quartz market based on the below-mentioned segments:

Global High-Purity Quartz Market, By Product Type

- HPQ Powder

- Grade I

- Grade II

- Grade III

Global High-Purity Quartz Market, By Application

- Semiconductor

- Solar

- Lighting

- Telecom & Optics

- Microelectronics

- Others

Global High-Purity Quartz Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the High-Purity Quartz market over the forecast period?The global High-Purity Quartz market is projected to expand at a CAGR of 6.92% during the forecast period.

-

2. What is the market size of the High-Purity Quartz market?The global High-Purity Quartz market size is expected to grow from USD 1.26 Billion in 2024 to USD 2.63 Billion by 2035, at a CAGR of 6.92% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the High-Purity Quartz market?Asia Pacific is anticipated to hold the largest share of the High-Purity Quartz market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global High-Purity Quartz market?Australian Silica Quartz Group Ltd, Jiangsu Pacific Quartz Co., Ltd, Russian Quartz LLC, Sibelco, The Quartz Corp., Hunter Quartz, Hoshine Silicon Industry Co., Ltd, Elkem ASA, Gansu Hoshine Silicon Materials Co., Ltd, and Magies Quartz Pvt Ltd.

-

5. What factors are driving the growth of the High-Purity Quartz market?The market for high-purity quartz is expanding because of increased demand from the fiber-optic, solar, and semiconductor industries. Consumption is increased by growing 5G deployment, the rise of renewable energy, and developments in AI and electronics manufacturing. High-performance technological applications require it because of its exceptional purity, thermal stability, and optical clarity.

-

6. What are the market trends in the High-Purity Quartz market?Rising demand from the semiconductor, solar-photovoltaic, and 5G industries; adoption of large-wafer and kerf-free technologies; investments in purification and production capacity; Asia-Pacific market dominance; North America's rapid growth; and a growing emphasis on environmentally conscious, sustainable manufacturing are some of the major trends in the high-purity quartz market.

-

7. What are the main challenges restricting wider adoption of the High-Purity Quartz market?High production costs, a lack of ultra-pure raw materials, complicated manufacturing procedures, strict quality standards, and reliance on a few number of important regional suppliers are the main obstacles impeding the widespread use of high-purity quartz.

Need help to buy this report?