Global High Purity Lithium Hydroxide Market Size, Share, and COVID-19 Impact Analysis, By Product Form (Anhydrous Lithium Hydroxide, and Lithium Hydroxide Monohydrate), By Purity Level (Battery Grade (≥56.5% / ≥99.9% pure), and Technical Grade (≥55%)), By Application (Lithium-Ion Batteries (Electric Vehicles (EVs), Energy Storage Systems (ESS), Consumer Electronics), Lubricating Greases, Glass & Ceramics, Air Purification (CO2 scrubbing), and Other Niche Applications), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal High Purity Lithium Hydroxide Market Insights Forecasts to 2035

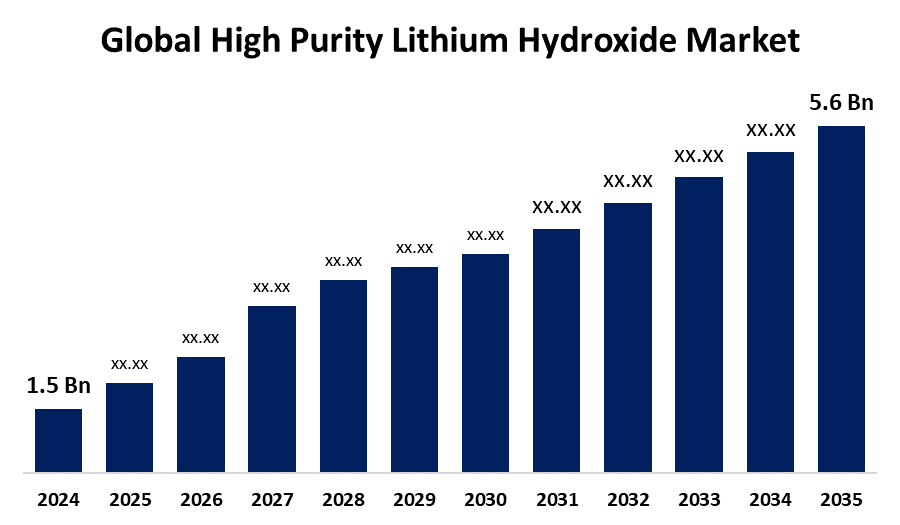

- The Global High Purity Lithium Hydroxide Market Size Was Estimated at USD 1.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.72% from 2025 to 2035

- The Worldwide High Purity Lithium Hydroxide Market Size is Expected to Reach USD 5.6 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global High Purity Lithium Hydroxide Market Size was worth around USD 1.5 Billion in 2024, Growing to USD 1.68 Billion in 2025, and is predicted to grow to around USD 5.6 billion by 2035 with a compound annual growth rate (CAGR) of 12.72% from 2025 to 2035. Rising demand for electric vehicles, growing energy storage applications, and developments in environmentally friendly recycling technologies are all driving strong industry growth and offering substantial opportunities in the high-purity lithium hydroxide market.

Global High Purity Lithium Hydroxide Market Forecast and Revenue Size

- 2024 Market Size: USD 1.5 Billion

- 2025 Market Size: USD 1.68 Billion

- 2035 Projected Market Size: USD 5.6 Billion

- CAGR (2025-2035): 12.72%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

Lithium hydroxide or its monohydrate, LiOH·H2O, that meets very stringent impurity and compositional standards is referred to as high-purity lithium hydroxide. The U.S. Geological Survey (USGS) defined the high-purity lithium hydroxide market in its Mineral Commodity Summaries 2024 as the worldwide production, processing, trading, and consumption of lithium hydroxide monohydrate that is more than 99.5% pure and is mostly obtained from hard-rock and brine sources. Lithium-ion batteries in electric cars and energy Applications depend on this battery-grade substance, which aids in the shift to sustainable energy. The increasing popularity of electric vehicles and energy storage technologies has increased demand for high-purity lithium hydroxide. For Instance, in July 2025, Syensqo and Cylib announced a significant milestone in circular battery materials processing by successfully producing high-purity lithium hydroxide from spent EV batteries, marking a major advancement in battery-grade lithium recovery and supporting sustainable electric vehicle battery production. Additionally, the increasing need for energy storage solutions brought on by the expansion of renewable energy sources is making high-purity lithium hydroxide increasingly vital. The quick global adoption of electric vehicles (EVs) is one of the main drivers of growth.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the high purity lithium hydroxide market during the forecast period.

- In terms of product form, the lithium hydroxide monohydrate segment is projected to lead the high purity lithium hydroxide market throughout the forecast period

- In terms of purity level, the battery grade segment captured the largest portion of the market

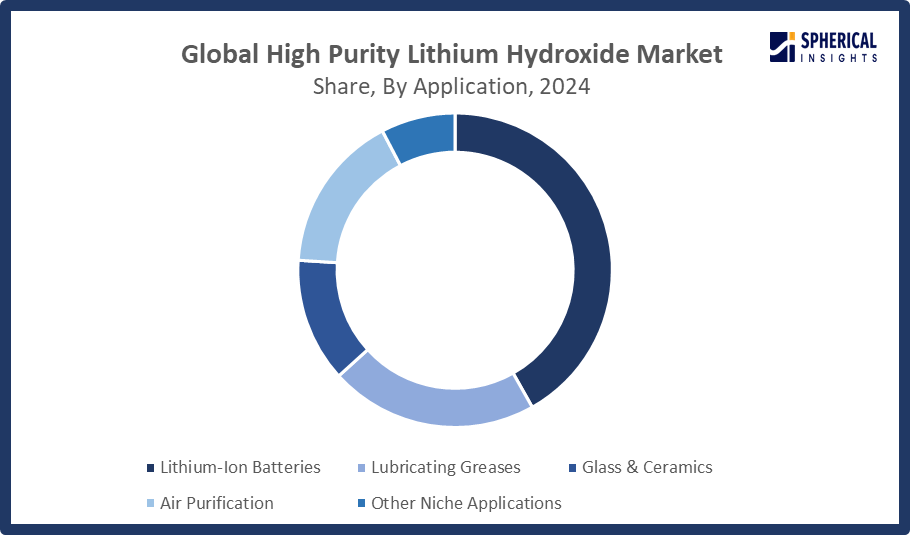

- In terms of application, the lithium-ion batteries segment captured the largest portion of the market

High Purity Lithium Hydroxide Market Growth Factors

- Pressures from the environment and ESG: A greater emphasis on environmentally friendly lithium extraction and refining techniques, such as low-carbon or green lithium production.

- Direct Lithium Extraction (DLE) Development: New DLE technologies seek to increase lithium yields while reducing their negative effects on the environment, which will affect supply dynamics in the future.

- Price volatility and speculative activity: The market is still susceptible to fluctuations in the price of lithium because of supply constraints, demand spikes, and speculation.

- Innovation in Cathode Chemistry: Lithium hydroxide specifications and purity requirements are still being shaped by ongoing research and development in battery chemistries

Report Coverage

This research report categorizes the high purity lithium hydroxide market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the high purity lithium hydroxide market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the high purity lithium hydroxide market.

Global High Purity Lithium Hydroxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.72% |

| 2035 Value Projection: | USD 1.68 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product Form, By Purity Level, By Application |

| Companies covered:: | SQM, LG Chem, Livent Corporation, Allkem Limited, Pilbara Minerals, Mineral Resources, Albemarle Corporation, Lithium Americas Corp., Albemarle Corporation, Piedmont Lithium Limited, Galaxy Resources Limited, Tianqi Lithium Corporation, Ganfeng Lithium Group Co., Ltd, Sichuan Yahua Industrial Group Co., Ltd, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving factors:

The growing demand for electric vehicles, developments in high-nickel cathode battery technologies, pro-clean energy government policies, and the growth of battery production facilities worldwide are the main factors driving the market for high-purity lithium hydroxide. The need for high-purity lithium hydroxide is also being driven by continuous developments in battery technology, which are concentrating on improving energy density, charging speed, and cycle life. Since effective energy storage solutions are necessary for the stability and dependability of renewable energy sources like solar and wind power, the growing popularity of renewable energy storage systems is driving market expansion. This expansion is fueled by both advances in battery technology and the growing need for lithium-ion batteries, especially for portable gadgets and electric vehicles (EVs).

Restraining Factor:

The price volatility of raw materials and supply chain interruptions are two of the main obstacles. Environmental concerns, mining laws, and geopolitical considerations can all have an impact on the price and availability of lithium, the primary raw material used to produce lithium hydroxide.

Market Segmentation

The global high purity lithium hydroxide market is divided into product form, purity level, and application.

Global High Purity Lithium Hydroxide Market, By Product Form:

Why does lithium hydroxide monohydrate hold a strong market position?

The lithium hydroxide monohydrate segment led the high purity lithium hydroxide market, generating the largest revenue share. Lithium hydroxide monohydrate is widely used in the manufacturing of lithium-ion batteries, especially for applications that need reliable and effective performance. The lithium hydroxide monohydrate's excellent market position is further reinforced by the availability of well-established supply chains and processing technologies.

The anhydrous lithium hydroxide segment in the high purity lithium hydroxide market is expected to grow at the fastest CAGR over the forecast period. Manufacturers are using anhydrous lithium hydroxide forms due to their appropriateness in high-nickel cathode chemistries and developing battery technologies, which is driving up demand for high-efficiency electric vehicles and sophisticated energy storage systems.

Global High Purity Lithium Hydroxide Market, By Purity Level:

What does the battery-grade segment (≥56.5% / ≥99.9% pure) of high-purity lithium hydroxide reflect?

The battery grade segment held the largest market share in the high purity lithium hydroxide market. The market for high-purity lithium hydroxide's battery-grade segment (≥56.5% / ≥99.9% pure) reflects its crucial role in the creation of cutting-edge lithium-ion batteries. Battery-grade lithium hydroxide is in high demand due to the growing global trend toward sustainable energy and the electrification of transportation, since it guarantees the best possible electrochemical performance, stability, and endurance in battery cells.

The technical grade segment in the high purity lithium hydroxide market is expected to grow at the fastest CAGR over the forecast period. The cost-effectiveness and versatility of technical grade products make them a desirable choice, especially in developing economies with expanding industrial and manufacturing operations, as lithium hydroxide continues to find new applications outside of batteries.

Global High Purity Lithium Hydroxide Market, By Application:

How is high-purity lithium hydroxide used in lithium-ion batteries?

The lithium-ion batteries segment held the largest market share in the high purity lithium hydroxide market. The growing demand for consumer electronics, energy storage systems, and electric vehicles (EVs), all of which rely significantly on lithium-ion battery technology, is driving the lithium-ion batteries market. The need for high-purity lithium hydroxide, a vital raw material for the production of lithium-ion battery cathodes, has increased dramatically as a result of the growing global focus on clean energy and sustainable transportation.

Get more details on this report -

The lubricating greases segment in the high purity lithium hydroxide market is expected to grow at the fastest CAGR over the forecast period. The growing need for high-performance lubricants in sectors including heavy machinery, industrial equipment, and the automotive industry is the main factor propelling the lubricating greases market.

Regional Segment Analysis of the Global High Purity Lithium Hydroxide Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific High Purity Lithium Hydroxide Market Trends

Get more details on this report -

What is contributing to the growth of the high-purity lithium hydroxide market in Asia-Pacific?

The existence of large battery producers and substantial automotive production facilities in nations like China, Japan, and South Korea is credited with the region known as Asia Pacific. The market for high-purity lithium hydroxide is being driven by the region's established production infrastructure and ongoing expenditures in battery technology developments. POSCO Pilbara Lithium Solution opened its second lithium hydroxide plant, which has a 21,500-ton yearly capacity, at the Yulchon Industrial Complex in Gwangyang.

What is driving the demand for high-purity lithium hydroxide in China?

The market for high-purity lithium hydroxide in China, a crucial area of the worldwide battery materials industry, is driven by the country's leadership in the manufacturing of electric vehicles and the refining of lithium. In the face of growing demand for renewable energy, vertical integration is supported by leading companies like Ganfeng Lithium and Tianqi Lithium, who hold significant refining capacity.

North America High Purity Lithium Hydroxide Market Trends

The demand for high pure lithium hydroxide is anticipated to be driven by the region's emphasis on improving energy storage solutions and developing battery technology. Over the course of the forecast period, the North American market is anticipated to grow at a CAGR of 11.8%. Due to the increasing use of electric vehicles and the growth of renewable energy projects, North America is another important market for high purity lithium hydroxide.

Who is supporting the rise of the high-purity lithium hydroxide market in the U.S.?

The growing demand for electric vehicles (EVs), government backing for sustainable energy projects, and smart investments in local battery supply chains are all contributing to the notable rise of the high purity lithium hydroxide market in the United States. The development of domestic lithium refining capabilities is a top priority as the United States seeks to reduce its reliance on foreign sources.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global high purity lithium hydroxide market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The High Purity Lithium Hydroxide Market Include

- SQM

- LG Chem

- Livent Corporation

- Allkem Limited

- Pilbara Minerals

- Mineral Resources

- Albemarle Corporation

- Lithium Americas Corp.

- Albemarle Corporation

- Piedmont Lithium Limited

- Galaxy Resources Limited

- Tianqi Lithium Corporation

- Ganfeng Lithium Group Co., Ltd

- Sichuan Yahua Industrial Group Co., Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In September 2025, SK Innovation and the U.S.-based engineering firm KBR launched a strategic Memorandum of Understanding (MOU) during the 2025 European Battery Raw Materials Conference in Lisbon. Together with KBR's PureLi crystallization method, the cooperation will commercialize SK Innovation's exclusive Battery Metal Recycling (BMR) technology, establishing an affordable route to high-purity lithium hydroxide recovery from spent batteries.

- In December 2024, European Metals launched an updated production plan, announcing a 42% increase in lithium output from its Cinovec project in the Czech Republic, targeting 41,658 tonnes of battery-grade lithium hydroxide annually to support EV batteries and renewable energy growth.

- In December 2024, at its Shaakichiuwaanaan property in Quebec, Canada, Atriot Battery Metals launched a marketable and battery-grade lithium hydroxide monohydrate sample from CV5 pegmatite that meets specifications.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the high purity lithium hydroxide market based on the following segments:

Global High Purity Lithium Hydroxide Market, By Product Form

- Anhydrous Lithium Hydroxide

- Lithium Hydroxide Monohydrate

Global High Purity Lithium Hydroxide Market, By Purity Level

- Battery Grade (≥56.5% / ≥99.9% pure)

- Technical Grade (≥55%)

Global High Purity Lithium Hydroxide Market, By Application

- Lithium-Ion Batteries

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Consumer Electronics

- Lubricating Greases

- Glass & Ceramics

- Air Purification (CO2 scrubbing)

- Other Niche Applications

Global High Purity Lithium Hydroxide Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the high purity lithium hydroxide market over the forecast period?The global high purity lithium hydroxide market is projected to expand at a CAGR of 12.72% during the forecast period.

-

2. What is the market size of the high purity lithium hydroxide market?The global high purity lithium hydroxide market size is expected to grow from USD 1.5 billion in 2024 to USD 5.6 billion by 2035, at a CAGR 12.72% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the high purity lithium hydroxide market?Asia Pacific is anticipated to hold the largest share of the high purity lithium hydroxide market over the predicted timeframe.

-

4. Who are the top companies operating in the global high purity lithium hydroxide market?SQM, LG Chem, Livent Corporation, Allkem Limited, Pilbara Minerals, Mineral Resources, Albemarle Corporation, Lithium Americas Corp., Piedmont Lithium Limited, Galaxy Resources Limited, Tianqi Lithium Corporation, Ganfeng Lithium Group Co., Ltd, Sichuan Yahua Industrial Group Co., Ltd, and others.

-

5. What factors are driving the growth of the high purity lithium hydroxide market?The growth of the high purity lithium hydroxide market is driven by rising electric vehicle adoption, increasing demand for lithium-ion batteries, advancements in battery technology, and supportive government policies promoting clean energy.

-

6. What are market trends in the high purity lithium hydroxide market?The high-purity lithium hydroxide market exhibits robust growth trends driven by escalating electric vehicle demand, expanding energy storage applications, and advancements in sustainable recycling. Government incentives and vertical integration enhance supply chain resilience, with Asia-Pacific leading regional expansion.

-

7. What are the main challenges restricting wider adoption of the high purity lithium hydroxide market?The main challenges restricting wider adoption of the High Purity Lithium Hydroxide market include supply chain constraints, high production costs, raw material scarcity, environmental concerns, and volatility in lithium prices affecting market stability.

Need help to buy this report?