Global High Octane Racing Fuel Market Size, Share, and COVID-19 Impact Analysis, By Classification (Unleaded Fuel and Leaded Fuel), By Application (Racing Cars, Road Racing Motorcycles, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal High Octane Racing Fuel Market Insights Forecasts to 2035

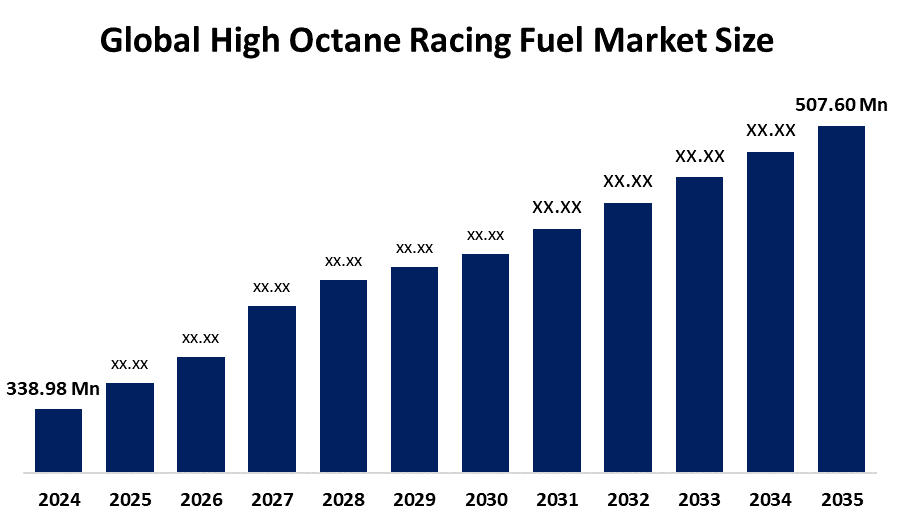

- The Global High Octane Racing Fuel Market Size Was Estimated at USD 338.98 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.74% from 2025 to 2035

- The Worldwide High Octane Racing Fuel Market Size is Expected to Reach USD 507.60 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global High Octane Racing Fuel Market Size was worth around USD 338.98 Million in 2024 and is predicted to Grow to around USD 507.60 Million by 2035 with a compound annual growth rate (CAGR) of 3.74% from 2025 to 2035. Opportunities for technological breakthroughs, rising motorsport involvement, the need for fuels that improve performance, growth in emerging markets, and collaborations with automakers and racing teams are all present in the high octane racing fuel market.

Market Overview

The production, distribution, and use of premium unleaded fuels with high octane ratings typically more than 100 RON for high-performance internal combustion engines in professional racing, including Formula 1, NASCAR, and drag racing, constitute the high octane racing fuel market. These fuels are highly controlled in terms of safety and emissions, but they are also conflict-free, power-efficient, and combustion-efficient. The high octane racing fuel market includes a wide range of goods, such as innovative automotive applications, high-performance sports automobiles, and gasoline blends designed especially for professional races. According to VP Racing Fuels launched its role as the official NHRA supplier in 2025, focusing on unleaded fuels, while Sunoco Race Fuels launched a partnership with the zMAX CARS Tour to enhance supply reliability. The growing need for high-performance fuels that improve engine economy, power output, and dependability in competitive racing conditions is the main driver of the high octane racing fuel market's growth. Industry development is further fueled by the adoption of performance-oriented formulas that adhere to efficiency and pollution rules, as well as the increasing technological sophistication of racing car engines.

Report Coverage

This research report categorizes the high octane racing fuel market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the high octane racing fuel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the high octane racing fuel market.

Global High Octane Racing Fuel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 338.98 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.74% |

| 2035 Value Projection: | USD 507.60 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 242 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Classification, By Application |

| Companies covered:: | Anglo American Oil Company, Chevron, ETS Racing Fuels, ExxonMobil, Fuel Factory, Haltermann Carless, Renegade Race Fuel, Shell, Sunoco Race Fuels, Torco Race Fuels, TotalEnergies AFS, VP Racing Fuels, And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in professional and amateur motorsport events across the world is one of the biggest factors driving the demand for high-octane racing fuel market. Strategic alliances and sponsorships between fuel producers and racing teams also contribute to the expansion of the market for high-octane racing fuel. There is a significant need for specialty fuels that can perform better in harsh environments due to the growth of motorsport leagues like Formula 1, NASCAR, MotoGP, and several regional championships. The high octane racing fuel market has witnessed significant growth primarily due to the global participation in motorsports, which is increasing, and the demand for high-performance cars, which is rising.

Restraining Factors

Strict environmental laws, high manufacturing and distribution costs, little consumer adoption outside of racing, and volatile crude oil prices all restrict the expansion and broad accessibility of the high octane racing fuel market.

Market Segmentation

The high octane racing fuel market share is classified into classification and application.

- The unleaded fuel segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the classification, the high octane racing fuel market is divided into unleaded fuel and leaded fuel. Among these, the unleaded fuel segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In light of their cleaner combustion profile, adherence to pollution standards, and compatibility with cutting-edge racing engines built for precise performance, unleaded high-octane formulas have become the industry standard.

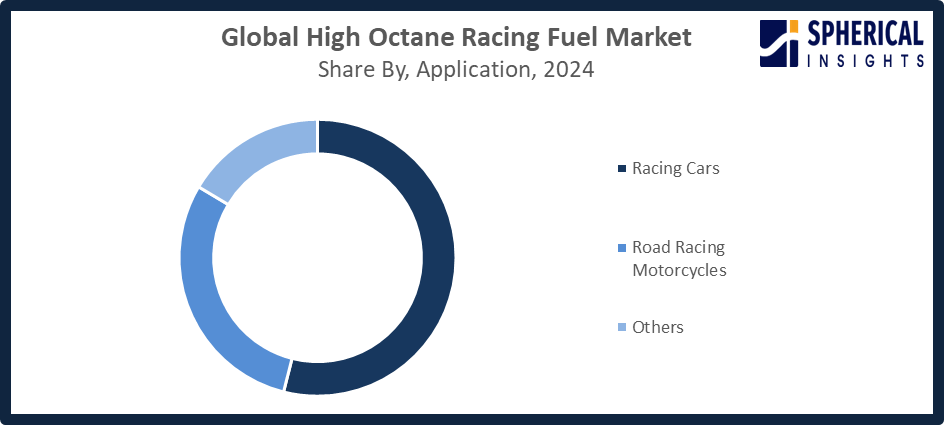

- The racing cars segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the high octane racing fuel market is divided into racing cars, road racing motorcycles, and others. Among these, the racing cars segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The popularity of professional and amateur motorsports, including major racing leagues that continuously require high-performance fuels, is what propels racing automobiles. Consumption is also fueled by the growing quantity of high-performance sports cars and fan participation in competitive racing events.

Get more details on this report -

Regional Segment Analysis of the High Octane Racing Fuel Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the high octane racing fuel market over the predicted timeframe.

North America is anticipated to hold the largest share of the high octane racing fuel market over the predicted timeframe. The strong customer demand for performance-oriented cars and the region's well-established motorsports ecosystem are what propel North America. Consistent supply, dependability, and market penetration are guaranteed by North America's sophisticated distribution networks and collaborations between gasoline manufacturers and racing associations. Major racing series, such as NASCAR, IndyCar, and NHRA drag racing, are particularly prevalent in the United States and contribute significantly to the need for specialty fuels. great-octane racing fuels are also in great demand due to increased disposable incomes and a strong car culture. In January 2025, the U.S. Department of Agriculture launched funding for 586 biofuel projects, while Shell launched its 100% renewable IndyCar fuel from Generation 2 biowaste, advancing racing sustainability.

Asia Pacific is expected to grow at a rapid CAGR in the high octane racing fuel market during the forecast period. The Asia Pacific area has a complicated regulatory environment and a wide range of consumer tastes, which pose difficulties and offer a way out at the same time for fuel creators that need to tailor their products to the local markets and be at the forefront of the trends. The demand for specialized high-performance fuels has been raised by the increasing number of motorsport events, both local and international racing leagues, etc. Moreover, the car makers in the region are putting more and more emphasis on the production of high-performance and sports cars, which, in turn, leads to a greater need for high-octane fuel solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the High high octane racing fuel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Anglo American Oil Company

- Chevron

- ETS Racing Fuels

- ExxonMobil

- Fuel Factory

- Haltermann Carless

- Renegade Race Fuel

- Shell

- Sunoco Race Fuels

- Torco Race Fuels

- TotalEnergies AFS

- VP Racing Fuels

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, IndianOil launched production of STORM-X, a high-octane racing fuel at its Paradip refinery, Odisha, and launched its maiden consignment, targeting performance enhancement for adrenaline-pumping motorsport applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the high octane racing fuel market based on the below-mentioned segments:

Global High Octane Racing Fuel Market, By Classification

- Unleaded Fuel

- Leaded Fuel

Global High Octane Racing Fuel Market, By Application

- Racing Cars

- Road Racing Motorcycles

- Others

Global High Octane Racing Fuel Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the high octane racing fuel market over the forecast period?The global high octane racing fuel market is projected to expand at a CAGR of 3.74% during the forecast period.

-

2. What is the market size of the high octane racing fuel market?The global high octane racing fuel market size is expected to grow from USD 338.98 million in 2024 to USD 507.60 million by 2035, at a CAGR of 3.74% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the high octane racing fuel market?North America is anticipated to hold the largest share of the high octane racing fuel market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global high octane racing fuel market?Anglo American Oil Company, Chevron, ETS Racing Fuels, ExxonMobil, Fuel Factory, Haltermann Carless, Renegade Race Fuel, Shell, Sunoco Race Fuels, Torco Race Fuels, TotalEnergies AFS, VP Racing Fuels, and Others.

-

5. What factors are driving the growth of the high octane racing fuel market?The market for high-octane racing gasoline is being driven by a number of factors, including rising participation in motorsports, expanding demand for high-performance automobiles, technological developments in fuel formulas, rising disposable incomes, and strategic partnerships between manufacturers and racing organizations.

-

6. What are the market trends in the high octane racing fuel market?The creation of unleaded high-octane fuels, the use of bio-based and sustainable racing fuels, the growth of motorsport events, collaborations with automakers, and the incorporation of cutting-edge supply chain and distribution techniques are some of the major trends.

-

7. What are the main challenges restricting the wider adoption of the high octane racing fuel market?The main challenges preventing high octane racing fuel from being widely used worldwide include high manufacturing costs, tight environmental restrictions, limited usage outside of racing, unstable crude oil prices, and complicated supply chains.

Need help to buy this report?