Global High Electron Mobility Transistor (HEMT) Market Size, Share, and COVID-19 Impact Analysis, By Type (Gallium Nitride (GaN), Silicon Carbide (SiC), Gallium Arsenide (GaAs), Others), By End-Users (Consumer Electronics, Automotive, Industrial, Aerospace & Defense, Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Semiconductors & ElectronicsGlobal High Electron Mobility Transistor (HEMT) Market Insights Forecasts to 2032

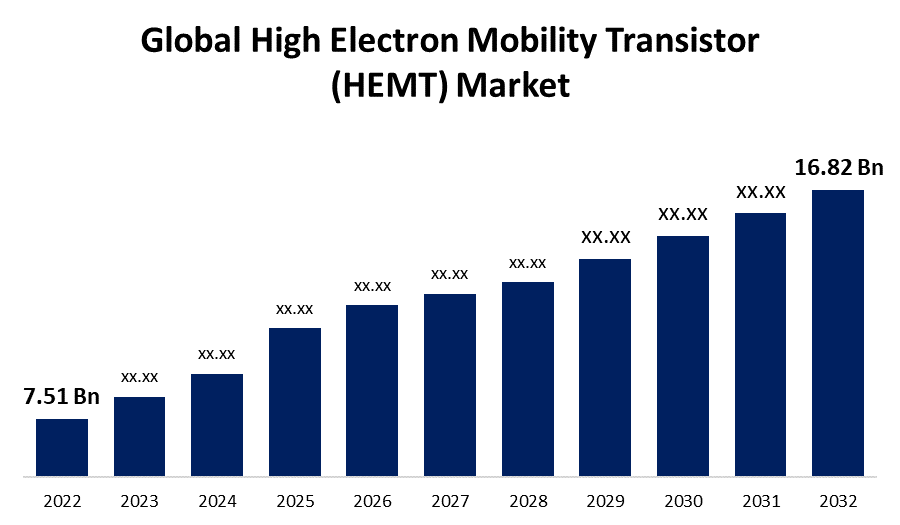

- The Global High Electron Mobility Transistor Market Size was valued at USD 7.51 Billion in 2022.

- The Market is Growing at a CAGR of 8.4% from 2022 to 2032

- The Worldwide High Electron Mobility Transistor Market is expected to reach USD 16.82 Billion by 2032

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global High Electron Mobility Transistor (HEMT) Market Size is expected to reach USD 16.82 Billion by 2032, at a CAGR of 14.27% during the forecast period 2022 to 2032.

The High Electron Mobility Transistor, or HEMT, is a type of field effect transistor (FET) that provides an extremely low noise ratio and highly significant levels of efficiency at microwave frequency ranges. Aluminium Gallium Arsenide (AlGaAs) and Gallium Arsenide (GaAs) were among the most commonly used materials for the production of high electron mobility transistor. Gallium Arsenide is commonly utilized because it has greater mobilities and carrier drift velocities than Si material and gives a high level of basic conductivity. High electron mobility transistors, which are capable of functioning at millimeter-wavelength frequencies, are utilized in high-frequency devices, which include smartphones, satellite-TV receivers, power conversion devices, and radar detection systems. They're frequently encountered in microwave receivers, low-power amplifiers, and the aerospace and defense industries. Currently, HEMTs are typically utilized in semiconductor devices. These Monolithic Microwave Integrated Circuit (MMIC) chips are frequently utilized in RF design.

The major players in the Global High Electron Mobility Transistor (HEMT) Market include Intel Corporation, Mitsubishi, ROHM, NXP Semiconductor N.V., Infineon, ST Microelectronics, Qorvo, Renesas Electronics, and Microsemi. Players in the industry are employing a variety of strategies, including product launches, partnerships, joint ventures, and acquisitions, to increase their market share in the High Electron Mobility Transistor (HEMT) market.

For instance, ROHM Semiconductor announced the mass production of 650V GaN (Gallium Nitride) HEMTs GNP1070TC-Z and GNP1150TCA-Z in May 2023. These devices were tailored for a variety of applications in power supply systems. Together, Delta Electronics, Inc. and Ancora Semiconductors, Inc., a subsidiary that creates GaN devices, have developed these innovative products. A major obstacle to establishing a decarbonized civilization is increasing the efficiency of power sources and motors, which consume the majority of the world's electricity. The adoption of novel materials like GaN and SiC is essential for raising power supply efficiency.

Global High Electron Mobility Transistor (HEMT) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 7.51 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 8.4% |

| 022 – 2032 Value Projection: | USD 16.82 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End-Users and By Region. |

| Companies covered:: | Ampleon, Mitsubishi Electric, Fujitsu, TOSHIBA, Infineon, Renesas Electronics, Cree, Qorvo, Microsemi, Wolfspeed, Lake Shore Cryotronics, ST Microelectronics, Texas Instruments, Oki Electric. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for cost-effective power systems, as well as increasing consumer demand for consumer electronics, are among the main trends driving high electron mobility transistor market expansion. Given the benefits it offers over alternative materials such as GaAs and SiC, the GaN high electron mobility transistor segment is likely to hold a significant proportion of the worldwide high electron mobility transistor market throughout the period of forecasting.

From the initial stages, the huge number of potential uses for these semiconductors propelled the extremely rapid growth of these transistors. The adoption of gallium nitride (GaN) HEMT devices in electric vehicles, train engines, power distribution, and other applications needing high voltage and high-frequency switching will minimize the price of acquiring such reliable and cost-effective transistors necessary in power electronics. Furthermore, the growing demand for innovative high electron mobility transistor technologies in the aerospace and military industries, as well as automobile manufacturing, is likely to provide growth opportunities for the global high electron mobility transistor market to continue growing.

The majority of semiconductor device manufacturers across the world produce high electron mobility transistors. They can be discrete transistors, but they are currently more commonly included in integrated circuits. These Monolithic Microwave Integrated Circuit (MMIC) chips are commonly utilized for RF design applications, and MMICs based on high electron mobility transistors are frequently used to give the requisite degree of performance in many sectors. Furthermore, major drivers contributing to the global high electron mobility transistor market growth include increased HEMT device expenditures and growth and development, as well as increased technological improvements in the high electron mobility transistor sector.

Restraining Factors

However, the lack of conventional procedures for producing and developing HEMT transistor devices is expected to stymie the growth of the high electron mobility transistor market. Furthermore, the performance of GAN HEMTs and the cost of microwave-integrated circuits remains a challenge in terms of market adoption. In addition, temperature's effect in promoting GAN HEMT loss is unresolved and the increased intensity of deterioration variables is also unexplored.

Market Segmentation

By Type Insights

The Gallium Nitride (GaN) segment is dominating the market with the largest revenue share over the forecast period.

On the basis of type, the global high electron mobility transistor market is segmented into the Gallium Nitride (GaN), Silicon Carbide (SiC), Gallium Arsenide (GaAs), and Others. Among these, the Gallium Nitride (GaN) segment is dominating the market with the largest revenue share of 48.6% over the forecast period. When opposed to existing technologies such as Silicon (SI) or Gallium Arsenide (GaAs), the most exciting HEMT devices currently depend on Gallium Nitride (GaN), a material that offers high-quality, high-power density, and excellent wide transmission. GaN is also sought for a wide range of electronics applications due to its excellent electron transport and electrical characteristics. AlGaN / GaN HEMTs have captured a significant portion of the attention amongst several GaN-based electronic components due to their remarkable performance in high-powered and millimetre waveband applications.

By End-Users Insights

The consumer electronics segment accounted for the largest revenue share of more than 36.2% over the forecast period.

On the basis of end-uses, the global high electron mobility transistor market is segmented into consumer electronics, automotive, industrial, aerospace & defense, and others. Among these, the consumer electronics segment is dominating the market with the largest revenue share of 36.2% over the forecast period. Because of their better large-frequency, low-noise, and wideband applications, high electron mobility transistor semiconductors are used in consumer electronics. HEMTs are the best devices for amplifying, oscillating, and generating radio frequency (RF) signals. Gallium arsenide (GA) electronic components, which have higher electron mobility than silicon materials for semiconductors, are used in the vast majority of high electron mobility transistors. In addition, high electron mobility transistors are gaining popularity in the industrial end-user market for signal amplification in industrial applications. These are highly helpful in electrical power distribution because they allow for the effective transmission of high-voltage electricity across great distances, reducing energy loss and cost.

Regional Insights

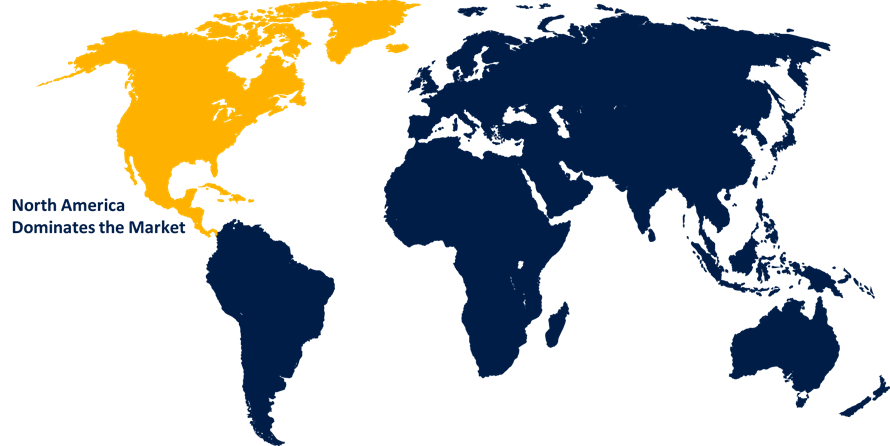

North America has a dominant market share in the high electron mobility transistor market over the predicted period.

Get more details on this report -

North America dominates more than 38.7% of the high electron mobility transistor market over the predicted period. This market dominance can be due to its widespread applications in industries like as consumer electronics, aircraft, cars, and others. The expansion of these verticals promotes market growth in this area. Furthermore, the presence of significant manufacturers in this region contributes to supporting market growth due to technological improvements.

Asia Pacific, on the contrary, is expected to grow the fastest during the forecast period. This expansion can be due to expanding consumer electronics demand and increased investment by countries such as China, India, Japan, and South Korea.

List of Key Market Players

- Ampleon

- Mitsubishi Electric

- Fujitsu

- TOSHIBA

- Infineon

- Renesas Electronics

- Cree

- Qorvo

- Microsemi

- Wolfspeed

- Lake Shore Cryotronics

- ST Microelectronics

- Texas Instruments

- Oki Electric

Key Market Developments

- On May 2023, Infineon Technologies AG has successfully integrated the CoolGaN™ 600 V hybrid-drain-embedded gate injection transistor (HD-GIT) technology into its in-house manufacturing. The company is now releasing the complete portfolio of its high-quality GaN devices to the broader market. Taking advantage of Infineon's fully owned and controlled supply chain, the expanded GaN portfolio includes a wide range of discrete and fully integrated GaN devices that far exceed JEDEC lifetime requirements. The new CoolGaN devices have been optimized for various applications ranging from industrial SMPS for servers, telecom, and solar to consumer applications, such as chargers and adapters, motor drives, TV/monitor, and led lighting systems.

- In March 2022, Teledyne e2v HiRel has introduced new space-screened versions of its popular 650 V, 60 A high reliability gallium nitride high electron mobility transistors (GaN HEMTs). GaN HEMTs from Teledyne e2v HiRel include single wafer lot traceability, an increased temperature performance range of 55 to +125 °C, and low inductance, low thermal resistance packaging.

- In September 2022, Taiwan's Industrial Technology Research Institute (ITRI) and Oxford Instruments have announced new technological advances that would assist critical hyper-growth areas such as electric vehicles, data centers, and 5G. A recessed and shielded gate junction within the aluminum gallium nitride (AlGaN) layer defines the new GaN MISHEMT high-electron-mobility transistor (HEMT) device architecture. When compared to conventional devices, the discovery allows essential transistor components to function at greater voltages, increasing performance and reliability while simultaneously attaining a safer and more energy efficient (usually off 'E-mode') operation.

- In June 2021, ST Microelectronics unveiled a new series of GaN parts called STi2GaN, which stands for ST Intelligent and Integrated GaN. To guarantee durability and dependability, the parts use ST's bond-wire-free packaging technology. The new product series seeks to utilize GaN's excellent power density and efficiency to provide a range of 100-V and 650-V high-electron-mobility transistor (HEMT) devices.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global High Electron Mobility Transistor Market based on the below-mentioned segments:

High Electron Mobility Transistor Market, Type Analysis

- Gallium Nitride (GaN)

- Silicon Carbide (SiC)

- Gallium Arsenide (GaAs)

- Others

High Electron Mobility Transistor Market, End-Users Analysis

- Consumer Electronics

- Automotive

- Industrial

- Aerospace & Defense

- Others

High Electron Mobility Transistor Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the High Electron Mobility Transistor market?The Global High Electron Mobility Transistor Market is expected to grow from USD 7.51 billion in 2022 to USD 16.82 billion by 2032, at a CAGR of 8.4% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?Ampleon, Mitsubishi Electric, Fujitsu, TOSHIBA, Infineon, Renesas Electronics, Cree, Qorvo, Microsemi, Wolfspeed, Lake Shore Cryotronics, ST Microelectronics, Texas Instruments, Oki Electric

-

3. Which segment dominated the High Electron Mobility Transistor market share?The consumer electronics segment in end-users type dominated the High Electron Mobility Transistor market in 2022 and accounted for a revenue share of over 36.2%.

-

4. Which region is dominating the High Electron Mobility Transistor market?North America is dominating the High Electron Mobility Transistor market with more than 36.2% market share.

-

5. Which segment holds the largest market share of the High Electron Mobility Transistor market?The Gallium Nitride (GaN) segment based on type holds the maximum market share of the High Electron Mobility Transistor market.

Need help to buy this report?