Global Hemophilia A and B Recombinant Factor Replacement Therapy Market Size, Share, and COVID-19 Impact Analysis, Russia-Ukraine War Impact, Tariff Analysis, By Product Type (Factor VIII and Factor IX), Application (Prophylaxis and On-Demand), End-User (Hospitals, Clinics, and Homecare Settings), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareHemophilia A and B Recombinant Factor Replacement Therapy Market Summary, Size & Emerging Trends

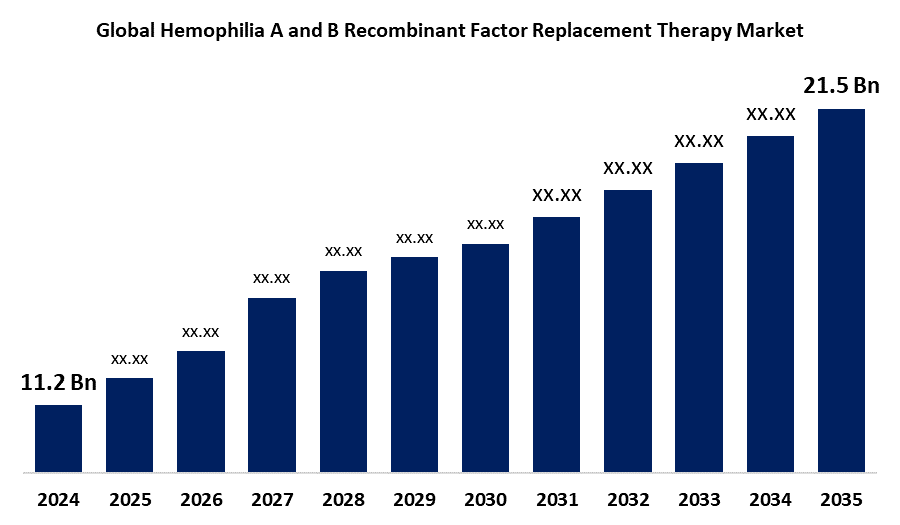

According to Spherical Insights, The Global Hemophilia A and B Recombinant Factor Replacement Therapy Market Size is expected to Grow from USD 11.2 Billion in 2024 to USD 21.5 Billion by 2035, at a CAGR of 6.11% during the forecast period 2025-2035. Technological advancements in the biotech industry, haemophilia treatment awareness, and increasing healthcare expenditure are the key growth drivers for the global hemophilia A and B recombinant factor replacement therapy market.

Get more details on this report -

Key Market Insights

- North America is expected to account for the largest share in the hemophilia A and B recombinant factor replacement therapy market during the forecast period.

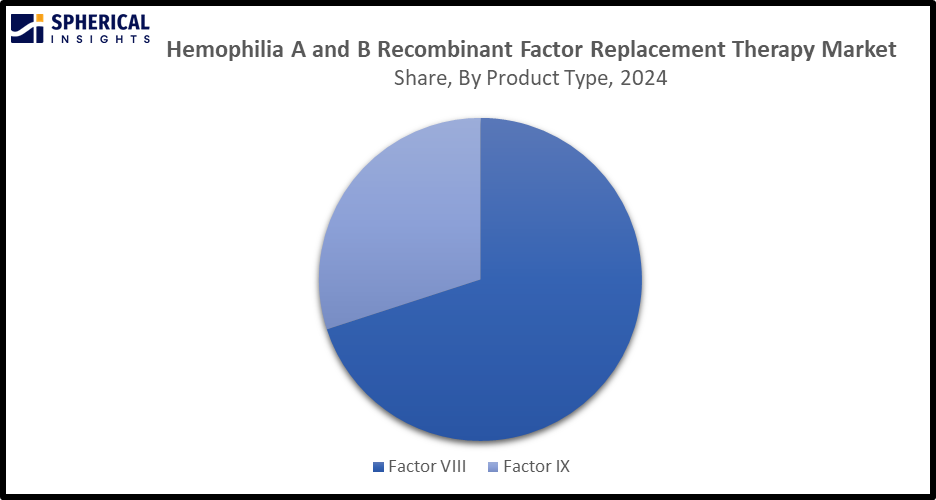

- In terms of product type, the factor VIII segment is projected to lead the Hemophilia A and B Recombinant Factor Replacement Therapy market in terms of equipment throughout the forecast period

- In terms of application, the on-demand segment is projected to lead the Hemophilia A and B Recombinant Factor Replacement Therapy market during the forecast period.

- In terms of end-user, the hospitals segment captured the largest portion of the market

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 11.2 Billion

- 2035 Projected Market Size: USD 21.5 Billion

- CAGR (2025-2035): 6.11%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Hemophilia A and B Recombinant Factor Replacement Therapy Market

The hemophilia A and B recombinant factor replacement therapy market is the global industry for therapeutic products in which lab-engineered clotting factors are used for treating patients with haemophilia A (missing Factor VIII) or haemophilia B (missing Factor IX). Hemophilia A and B replacement therapy refers to the treatment for haemophilia and von Willebrand diseases, in which there is replacement of the missing protein in the blood to improve blood clotting. The therapy aids in reducing the chances of developing serious bleeding episodes. An increasing prevalence of haemophilia drives the need for effective treatment options, including recombinant factor replacement therapies. Further, technological advancement in diagnostic techniques and awareness are anticipated to drive the need for therapeutic interventions for cases. Access to medical care for diagnosis and treatment of haemophilia, along with the upsurging demand for advanced treatment modalities like clotting factor concentrates, gene therapy, and prophylactic therapies, aids in the market growth of haemophilia A and B recombinant factor replacement therapy.

Hemophilia A and B Recombinant Factor Replacement Therapy Market Trends

- Gene therapy and bio-engineered hemostatic molecules

- Next-generation mimetics and agents that rebalance hemostasis are evaluated in clinical trials

- Point of care musculoskeletal ultrasound and AI for improving patient diagnostic and treatment outcomes

- Strategic partnerships and collaborations between patient & clinician, stakeholder engagement, and pharmaceutical industry support

- Novel patient haemophilia therapies with patient patient-centered care approach improve health equity for all patients.

Hemophilia A and B Recombinant Factor Replacement Therapy Market Dynamics

Global Hemophilia A and B Recombinant Factor Replacement Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.11% |

| 2035 Value Projection: | USD 21.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Bayer AG, Pfizer Inc., Novo Nordisk A/S, Sanofi S.A., CSL Behring, Shire (Takeda Pharmaceutical Company Limited), Octapharma AG, Grifols S.A., BioMarin Pharmaceutical Inc., Kedrion Biopharma Inc., Biogen Inc., Genentech, Inc. (Roche), Alnylam Pharmaceuticals, Inc., Aptevo Therapeutics Inc., Catalyst Biosciences, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

Technological advancements in the biotech industry, haemophilia treatment awareness, and increasing healthcare expenditure are driving growth in the hemophilia A and B recombinant factor replacement therapy market

The growth of the hemophilia A and B recombinant factor replacement therapy market is driven by the increasing technological advancements in the biotech industry, haemophilia treatment awareness, and growing healthcare expenditure. Gene editing, microbiome therapeutics, and AI-driven drug discovery are some of the emerging trends in the biotechnology industry that are changing research and clinical development approaches. An increasing haemophilia treatment awareness, driven by initiatives like World Haemophilia Day, for promoting better diagnosis and accessibility to care, is propelling the market.

Restrain Factors:

The hemophilia A and B recombinant factor replacement therapy market faces challenges due to the increased production cost of recombinant factor products

The increased production cost of recombinant factor products may hinder their adoption, especially in the low and middle-income countries, resulting in restraining the haemophilia A and B recombinant factor replacement therapy market.

Opportunity:

Increasing investment in the development of novel products is creating new opportunities in the hemophilia A and B recombinant factor replacement therapy market

Introduction of novel products like next-generation recombinant factors that have been improved therapeutic profiles by the pharmaceutical companies for better therapeutic outcomes is providing growth opportunities in the haemophilia A and B recombinant factor replacement therapy.

Challenges:

In the Hemophilia A and B Recombinant Factor Replacement Therapy market, reduced accessibility to specialized healthcare infrastructure and a lack of trained healthcare providers

Despite its potential, the hemophilia A and B recombinant factor replacement therapy market struggles with several obstacles. The lack of specialized healthcare infrastructure due to inadequate health systems, insufficient financial resources, and limited accessibility, especially in low and middle-income countries, is a challenging factor. Further, trained healthcare providers lead to delayed diagnosis, inadequate treatment, and hamper the therapy adoption.

Global Hemophilia A and B Recombinant Factor Replacement Therapy Market Ecosystem Analysis

The Global Hemophilia A and B Recombinant Factor Replacement Therapy Market ecosystem includes patients, manufacturers, healthcare providers, regulatory bodies, distributors, R&D institutions, and payers. Key technologies involve the use of genetically engineered protein for replacing deficient clotting factors, which is a significant advancement from earlier plasma derived products. Market growth is driven by the biotech industry, haemophilia treatment awareness, and increasing healthcare expenditure, while increased production costs and a lack of healthcare providers and healthcare infrastructure remain challenges. Opportunities lie in increasing investment in the development of novel products.

Global Hemophilia A and B Recombinant Factor Replacement Therapy Market, By Product Type

The factor VIII segment led the hemophilia A and B recombinant factor replacement therapy market, with a major market share. This is attributed to the increasing biotech advancements in recombinant factor VIII production as well as supportive regulatory policies and healthcare reimbursement programs. The therapy of factor VIII involves the infusion of factor VIII concentrates to restore the body’s clotting ability and prevent bleeding episodes.

Get more details on this report -

The factor IX segment in the haemophilia A and B recombinant factor replacement therapy market is anticipated to grow at a significant CAGR, driven by significant advancements like the introduction of extended half-life versions that make treatment more convenient. In factor IX replacement therapy, the congenitally deficient coagulation factor IX is replaced, which ultimately aids in relaxing prophylactic dosing and reducing treatment burden.

Global Hemophilia A and B Recombinant Factor Replacement Therapy Market, By Application

The on-demand segment led the hemophilia A and B recombinant factor replacement therapy market, generating the largest revenue share. This dominance can be attributed to the driving need for managing acute bleeding episodes and preventing complications. On-demand therapy is episodic replacement therapy in which CFCs are administered only at the time of bleed.

The prophylaxis segment in the hemophilia A and B recombinant factor replacement therapy market is expected to grow at the fastest CAGR over the forecast period, driven by its proven effectiveness for reducing bleeding episodes and improving patients’ overall quality of life. Prophylaxis therapy involves regular infusion of clotting factors for preventing bleeding.

Global Hemophilia A and B Recombinant Factor Replacement Therapy Market, By End-User

The hospitals segment held the largest market share in the hemophilia A and B recombinant factor replacement therapy market, due to the presence of multidisciplinary teams in hospitals, including haematologists, nurses, and physiotherapists for managing complex conditions.

The clinics segment in the hemophilia A and B recombinant factor replacement therapy market is projected to register a significant CAGR, driven by a range of services provided in clinics, including diagnostic tests, routine check-ups, and therapeutic interventions.

North America is expected to account for the largest share of the hemophilia A and B recombinant factor replacement therapy market during the forecast period,

Get more details on this report -

Driven by the presence of robust healthcare infrastructure and leading biotechnology companies. Further, the presence of a concentrated patient pool, strong clinical guidelines endorsement for prophylaxis, and expanding diagnostic initiatives are propelling the haemophilia A and B recombinant factor replacement therapy market.

The United States is experiencing steady growth in the hemophilia A and B recombinant factor replacement therapy market,

Fueled by emerging technologies like gene therapy. Favorable reimbursement policies in the country encourage patients to seek medical help, which thereby promotes haemophilia A and B recombinant factor replacement therapy market.

Asia Pacific is expected to grow at the fastest CAGR in the hemophilia A and B recombinant factor replacement therapy market during the forecast period.

This rapid growth is driven by the increasing popularity of preventative treatments and awareness about early diagnosis. Further, the supportive government initiatives for enabling early diagnosis of conditions are promoting the market for haemophilia A and B recombinant factor replacement therapy.

China is rapidly expanding in the hemophilia A and B recombinant factor replacement therapy market,

Due to the growing cases of haemophilia, and government support for managing the disease. Further, the improvement in the healthcare infrastructure and awareness about haemophilia are promoting the haemophilia A and B recombinant factor replacement therapy market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hemophilia A and B recombinant factor replacement therapy market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

WORLDWIDE TOP KEY PLAYERS IN THE HEMOPHILIA A AND B RECOMBINANT FACTOR REPLACEMENT THERAPY MARKET INCLUDE

- Bayer AG

- Pfizer Inc.

- Novo Nordisk A/S

- Sanofi S.A.

- CSL Behring

- Shire (Takeda Pharmaceutical Company Limited)

- Octapharma AG

- Grifols S.A.

- BioMarin Pharmaceutical Inc.

- Kedrion Biopharma Inc.

- Biogen Inc.

- Genentech, Inc. (Roche)

- Alnylam Pharmaceuticals, Inc.

- Aptevo Therapeutics Inc.

- Catalyst Biosciences, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Product Launches in Hemophilia A and B Recombinant Factor Replacement Therapy

- In April 2025, Roche’s HEMLIBRA achieved significant uptake across key haemophilia A markets. HEMLIBRA has strong market potential due to its unique, subcutaneous prophylactic treatment for Hemophilia A, including patients with and without factor VIII inhibitors.

- In October 2024, the U.S. FDA approved Pfizer’s HYMPAVZI (marstacimab-hncq) for the treatment of adults and adolescents with Hemophilia A or B without Inhibitors.

- In January 2018, Sanofi plans to acquire Bioverativ for approximately $11.6 billion, in a deal that the companies said would expand the buyer’s portfolio in specialty care and strengthen the rare disease presence it established.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hemophilia A and B recombinant factor replacement therapy market based on the below-mentioned segments:

Global Hemophilia A and B Recombinant Factor Replacement Therapy Market, By Product Type

- Factor VIII

- Factor IX

Global Hemophilia A and B Recombinant Factor Replacement Therapy Market, By Application

- Prophylaxis

- On-Demand

Global Hemophilia A and B Recombinant Factor Replacement Therapy Market, By End-User

- Hospitals

- Clinics

- Homecare Settings

Global Hemophilia A and B Recombinant Factor Replacement Therapy Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Hemophilia A and B Recombinant Factor Replacement Therapy market?The global Hemophilia A and B Recombinant Factor Replacement Therapy market size is expected to grow from USD 11.2 Billion in 2024 to USD 21.5 Billion by 2035, at a CAGR of 6.11% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the Hemophilia A and B Recombinant Factor Replacement Therapy market?North America is anticipated to hold the largest share of the Hemophilia A and B Recombinant Factor Replacement Therapy market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Hemophilia A and B Recombinant Factor Replacement Therapy Market from 2024 to 2035?The market is expected to grow at a CAGR of around 6.11% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Hemophilia A and B Recombinant Factor Replacement Therapy Market?Key players include Bayer AG, Pfizer Inc., Novo Nordisk A/S, Sanofi S.A., CSL Behring, Shire (Takeda Pharmaceutical Company Limited), Octapharma AG, Grifols S.A., BioMarin Pharmaceutical Inc., and Kedrion Biopharma Inc.

-

5. Can you provide company profiles for the leading Hemophilia A and B Recombinant Factor Replacement Therapy manufacturers?Yes. For example, Bayer AG is a German multinational pharmaceutical and biotechnology company and is one of the largest pharmaceutical and biomedical companies in the world, headquartered in Leverkusen, and areas of business include: pharmaceuticals, consumer healthcare products, agricultural chemicals, seeds, and biotechnology products. Pfizer Inc. is an American multinational pharmaceutical and biotechnology corporation that develops and produces medication and vaccines for immunology, oncology, cardiology, endocrinology, and neurology.

-

6. What are the main drivers of growth in the Hemophilia A and B Recombinant Factor Replacement Therapy market?Technological advancements in the biotech industry, haemophilia treatment awareness, and increasing healthcare expenditure are major market growth drivers of the hemophilia A and B recombinant factor replacement therapy market.

-

7. What challenges are limiting the hemophilia A and B recombinant factor replacement therapy market?An increased production cost, as well as the lack of specialized healthcare providers and infrastructure, remain key restraints in the hemophilia A and B recombinant factor replacement therapy market.

Need help to buy this report?