Global Hematology Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Product (Instrument and Consumables), By Test (Blood Count, Platelet Function, Hemoglobin, and Hematocrit), By End Use (Hospitals, Diagnostic labs, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Hematology Diagnostics Market Insights Forecasts to 2035

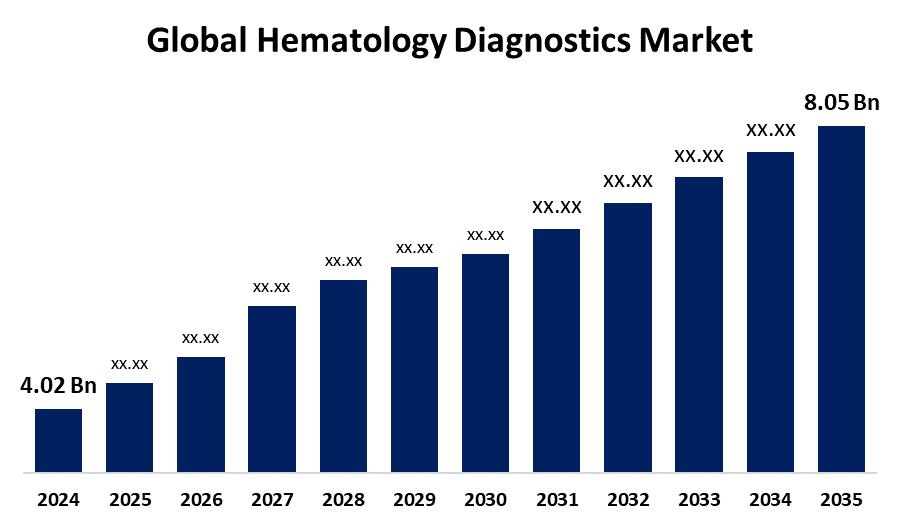

- The Global Hematology Diagnostics Market Size Was Estimated at USD 4.02 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.52% from 2025 to 2035

- The Worldwide Hematology Diagnostics Market Size is Expected to Reach USD 8.05 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest During the Forecast Period.

Get more details on this report -

The Global Hematology Diagnostics Market Size was Worth around USD 4.02 Billion in 2024 and is Predicted to Grow to around USD 8.05 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 6.52% from 2025 to 2035. The growing prevalence of blood-related disorders, demand for accurate & comprehensive diagnostic solutions, and technological advancements for delivering safer diagnoses are driving the hematology diagnostics market worldwide.

Market Overview

The hematology diagnostics market refers to the industry of tools and services used for the diagnosis and monitoring of blood diseases, encompassing a wide range of tests and instruments. Hematology diagnostics aids in determining the causes of various blood disorders, such as anemia, bleeding problems, infections, and even certain cancers, such as leukemia. The market growth for hematology diagnostics is primarily driven by the growing number of blood donations and incidence of blood disorders, as well as demand for sophisticated diagnostic solutions. There is growing emphasis on improving the efficiency and accuracy of hematology diagnostics owing to the changes in diagnostics technologies, such as automation, AI integration, and point-of-care testing methods. Integration of automation technology across pre-analytical, analytical, and post-analytical phases for enhancing the reliability is escalating the market growth. Further, the reduced errors with accurate results have been obtained by the automation in sample collection, the diagnostic process, and recognition tests, and others are creating new growth opportunities in the hematology diagnostics market.

Report Coverage

This research report categorizes the hematology diagnostics market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hematology diagnostics market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hematology diagnostics market.

Global Hematology Diagnostics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Product, By Test, By End Use, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | Abbott, Beckman Coulter, Inc., Sysmex Corporation, Horiba, Bio-Rad Laboratories, Siemens Healthineers AG, F. Hoffmann-La Roche Ltd, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., NIHON KOHDEN CORPORATION., EKF Diagnostics and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The significant number of incidences of blood disorders, especially anemia, with growing public health concerns, is anticipated to drive the hematology diagnostics market. It was estimated that in 2021, 1.92 billion people had anemia, a 420 million increase over three decades. Over 330,000 inherited haemoglobin disorders affected infants are born annually (83% sickle cell disorders, 17% thalassaemias). Haemoglobin disorders account for about 3.4% of deaths in children less than 5 years of age. The use of a variety of tools for analysing blood and bone marrow that aids in identifying and diagnosing of wide array of blood disorders for accurate and comprehensive diagnosis is driving the market demand for hematology diagnostics. The use of advanced technologies, including laser-based flow cytometry, automation, and AI/ML algorithms for improved accuracy, faster analysis, and expanded diagnostic capabilities, is contributing to propelling the market growth.

Restraining Factors

An increased price of advanced diagnostic instruments and maintenance requirements, restriction its adoption in low resource healthcare facilities, is restraining the market growth. Further, regulatory challenges in the hematology diagnostic equipment extend the time of the product approval process, slowing down the market. The lack of a skilled workforce and data security issues may also hamper the hematology diagnostics market.

Market Segmentation

The hematology diagnostics market share is classified into product, test, and end use.

- The consumables segment dominated the market with a major share in 2024 and is projected to grow at the fastest CAGR during the forecast period.

Based on the product, the hematology diagnostics market is divided into instrument and consumables. Among these, the consumables segment dominated the market with a major share in 2024 and is projected to grow at the fastest CAGR during the forecast period. It includes blood collection tubes, reagents, stains, and various labware that are required for the diagnosis of hematological conditions. An increasing need for diagnosis of blood disorders & other infections, as well as the development of consumables like reagents for hematology analyzers contributing to propel the market.

- The blood count segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the test, the hematology diagnostics market is divided into blood count, platelet function, hemoglobin, and hematocrit. Among these, the blood count segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. It includes the measurement of various blood cell types, such as RBC, WBC, and platelets, as well as haemoglobin and haematocrit levels. The growing consumer inclination towards having frequent WBC tests owing to the increasing awareness about chronic disease conditions like Neutropenia leads to drives the market demand.

- The hospitals segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the hematology diagnostics market is divided into hospitals, diagnostic labs, and others. Among these, the hospitals segment accounted for the largest revenue share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. In the hematology department of hospitals, haematologists conduct comprehensive evaluations using blood tests to accurately diagnose hematological conditions. An increasing demand for hematology diagnostics in hospital medical labs for disease diagnosis, detecting illegal drug use, thyroid function assessment, and other purposes is propelling the market demand.

Regional Segment Analysis of the Hematology Diagnostics Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the hematology diagnostics market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the hematology diagnostics market over the predicted timeframe. The growing prevalence of blood-related diseases, including anemia, haemophilia, leukemia, sickle cell anemia, and lymphoma, as well as other infections, is anticipated to drive the market demand. As per the report of the Leukemia and Lymphoma Society, 184,720 people are estimated to be diagnosed with leukemia, lymphoma, or myeloma in the US. Further, the technological advancements and increasing popularity of point-of-care diagnosis methods are driving the market growth.

Asia Pacific is expected to grow at a rapid CAGR in the hematology diagnostics market during the forecast period. Investments in hematology diagnostics technologies, along with government support for improving the healthcare infrastructure, are contributing to driving the market growth for hematology diagnostics. A growing incidence of blood disorders and increasing mortality rates due to hematologic malignancies in many countries of the region are anticipated to propel the market demand.

Europe is anticipated to hold a significant share of the hematology diagnostics market during the projected timeframe. The emergence of innovative technologies, including in vitro diagnostic devices addressing unmet medical needs impacting public health, is driving the market growth. Further, increasing healthcare spending and advancements in diagnostic technologies are propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hematology diagnostics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott

- Beckman Coulter, Inc.

- Sysmex Corporation

- Horiba

- Bio-Rad Laboratories

- Siemens Healthineers AG

- F. Hoffmann-La Roche Ltd

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- NIHON KOHDEN CORPORATION.

- EKF Diagnostics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Beckman Coulter, a clinical diagnostics leader, and Scopio Labs, a medtech company that develops digital cell morphology workflow solutions, jointly announced the expansion of their long-term partnership to include a global distribution agreement of Scopio’s full-field bone marrow Aspirate application. Scopio’s X100 / X100HT with FF-BMA Application is CE-Marked.

- In January 2024, HORIBA Medical launched the new HELO 2.0 high-throughput automated hematology platform, which is CE-IVDR approved, with pending US FDA approval. HELO 2.0 offers a highly flexible and efficient modular hematology solution that is fully scalable with many possible configurations for mid to large-scale laboratories.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hematology diagnostics market based on the below-mentioned segments:

Global Hematology Diagnostics Market, By Product

- Instrument

- Consumables

Global Hematology Diagnostics Market, By Test

- Blood Count

- Platelet Function

- Hemoglobin

- Hematocrit

Global Hematology Diagnostics Market, By End Use

- Hospitals

- Diagnostic labs

- Others

Global Hematology Diagnostics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the hematology diagnostics market over the forecast period?The global hematology diagnostics market is projected to expand at a CAGR of 6.52% during the forecast period.

-

2. What is the market size of the hematology diagnostics market?The global hematology diagnostics market size is expected to grow from USD 4.02 Billion in 2024 to USD 8.05 Billion by 2035, at a CAGR of 6.52% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the hematology diagnostics market?North America is anticipated to hold the largest share of the hematology diagnostics market over the predicted timeframe.

Need help to buy this report?