Global Heavy-Duty Electric Vehicle Charging Infrastructure Market Size, Share, and COVID-19 Impact Analysis, By Charger Type (DC Charger, AC Charger), By Charging Method (Fast Charging, Slow Charging), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Automotive & TransportationGlobal Heavy-Duty Electric Vehicle Charging Infrastructure Market Insights Forecasts to 2032

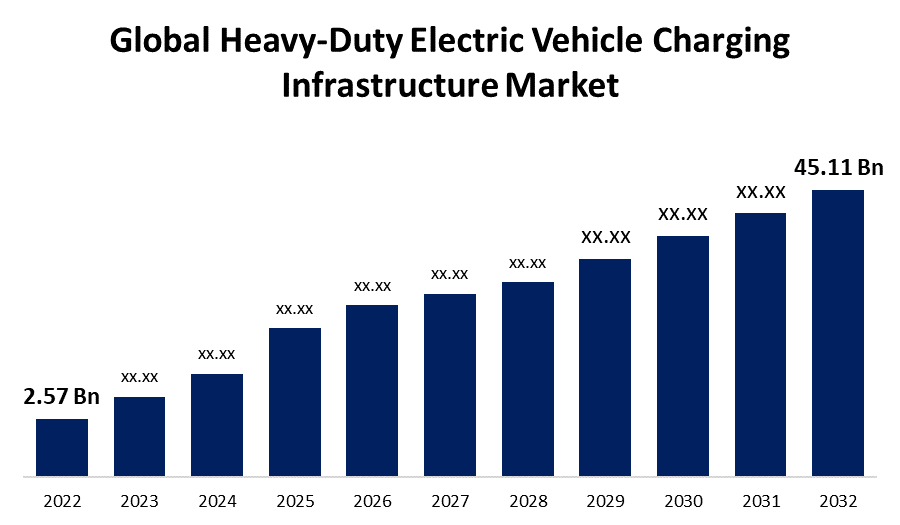

- The Global Heavy-Duty Electric Vehicle Charging Infrastructure Market Size was valued at USD 2.57 Billion in 2022.

- The Market is growing at a CAGR of 33.18% from 2022 to 2032

- The Worldwide Heavy-Duty Electric Vehicle Charging Infrastructure Market is expected to reach USD 45.11 Billion by 2032.

- North America is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Heavy-Duty Electric Vehicle Charging Infrastructure Market Size is expected to reach USD 76.39 billion by 2032, at a CAGR of 33.18% during the forecast period 2022 to 2032. Rising government initiatives and increased demand for electricity-powered cars and trucks are propelling the worldwide heavy-duty electric vehicle charging infrastructure market forward.

In the present day, leading automobile manufacturers like Volvo, Scania, and Tesla are now rapidly creating battery electric vehicle (BEV) trucks for long-distance transportation. In addition to boosting productivity several of these companies are currently accepting orders from consumers. However, a shortage of charging infrastructure and the demand for action to address it could hamper the rapid utilization of electric heavy-duty vehicles (HDVs). The heavy-duty electric vehicle charging infrastructure is a fully assembled system that transfers electricity from the power grid and distributes it to charge electric vehicles for example electric buses and trucks as well. In addition, electric car charging entails getting AC electricity from the AC power grid, converting it to DC electricity, and storing it in the DC battery packs of EV. The charger functions as a power electronic, converting AC to DC and controlling the process of charging batteries.

Furthermore, the number of electric vehicles (EVs) is growing, and various new kinds of EVs have recently entered the marketplace regularly. EVs are likely to represent a significant portion of the entire transportation sector in the coming years. Heavy-duty electric vehicles, such as commercial vehicles, have been introduced into the mainstream by manufacturers such as Tesla. Electric trucks, compared to light-duty EVs, demand rapid charging speeds and bigger charge loads to facilitate long-distance travel. As a result, heavy-duty EV charging stations may exhibit irregular load profiles with huge peak power demands (>1 MW for a single port) and exceptionally high transition speeds. As a result, it is critical to comprehend the implications of integrating heavy-duty electric vehicle (EV) charging stations into the infrastructure.

ABB, Siemens, Kempower OY, Tesla, Chargepoint, Inc., BP, Daimler Trucks, and others are among the leading participants in the Global Heavy-Duty Electric Vehicle Charging Infrastructure Market. Globally, the heavy-duty electric vehicle charging infrastructure market is extremely competitive, with prominent industry players employing various strategies to increase their market positions, such as product development, alliances, and acquisitions. For instance, on April 2023, Greenlane, a joint venture between Daimler Truck North America, NextEra Energy Resources, and BlackRock Alternatives, aims to build a high-performance, zero-emission public charging, and hydrogen fueling network for heavy-duty battery-electric and hydrogen fuel cell vehicles across the United States. The business will focus on infrastructure design, development, installation, and operation, and renderings of the site layout were released as a crucial step in the project's progress.

Global Heavy-Duty Electric Vehicle Charging Infrastructure Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.57 Bn |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 33.18% |

| 022 – 2032 Value Projection: | USD 45.11 Bn |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Charger Type, By Charging Method and By Region. |

| Companies covered:: | ABB, Siemens, Kempower OY, Tesla, Chargepoint, Inc., BP, Daimler Trucks, Proterra, Schunk Group, EFACEC, Kehua Hengsheng Co., Ltd., Shijiazhuang Tonhe Electronics Technologies Co., Ltd., State Grid Corporation of China, TGOOD Global Ltd, Shell, Webasto, Blink Charging, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for electric vehicles is increasing, which is boosting demand for charging infrastructure in the automobile sector, which is one of the main factors propelling the rapid expansion of the global heavy-duty electric vehicle charging infrastructure market. In addition, growing public awareness of the environmental impact of fossil fuel automobiles has increased global demand for electric vehicles. Government programs also encourage the utilization of electric vehicles. Most countries are in the early stages of selling electric vehicles and developing charging infrastructures. Nevertheless, governments around the world are focused on the development of charging stations in order to accelerate the widespread acceptance of electric vehicles.

Furthermore, a worldwide collaborative strategy among enterprises to help finance and build heavy-load EV charging infrastructure has begun to acquire traction. Tesla Inc., for example, has established strategic agreements with UPS Inc. and Ryder System Inc for the development of charging infrastructure for maintaining preordered tractor fleets. Moreover, numerous European countries are continually developing tax breaks to promote the usage of electric vehicles across the rest of Europe.

Restraining Factors

As a result of the rapid increase in crude oil costs over the last ten years and the progressively dwindling availability of crude oil, a large percentage of the population is shifting to alternatively powered cars such as CNG and LNG as their preferred form of transportation. Along with developing countries, advanced economies such as the United States and the United Kingdom have focused on establishing infrastructure to support CNG automobiles. As a result, all of these variables are projected to constrain market expansion during the forecast period.

Market Segmentation

By Charger Type Insights

The DC charger segment is dominating the market with the largest revenue share over the forecast period.

On the basis of charger type, the global heavy-duty electric vehicle charging infrastructure market is segmented into the DC charger and AC charger. Among these, the DC charger segment is dominating the market with the largest revenue share of 43.6% over the forecast period. The phrase DC charger pertains to the direct current (DC) fast charging technique, which delivers electricity directly into an electric vehicle's battery system in order to facilitate faster charging at charging points. This type of adapter includes a converter that converts AC power into DC power prior to entering the vehicle and delivers the current required for charging an electric vehicle's batteries. The demand for direct current (DC) chargers is expected to skyrocket owing to the increasing adoption of fast charging for heavy-duty electric vehicles. Furthermore, DC charger connector types include the Combined Charging System (CCS), CHAdeMO, and Tesla Superchargers.

By Charging Method Insights

The fast charging segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of charging method, the global heavy-duty electric vehicle charging infrastructure market is segmented into fast charging and slow charging. Among these, the fast charging segment is dominating the market with the largest revenue share of 57.2% over the forecast period. In comparison to the slow charging method's lengthy charging timeframes, the rapid charging method allows operators of heavy-duty vehicles to recharge the battery in greatly shorter periods of time. The fast charging technology can rapidly charge buses, trucks, and other heavy-duty vehicles. When using these charging strategies, a DC charger is often necessary to charge the battery packs of heavy-duty electric vehicles. The fast charging technique market is expected to grow significantly as global demand for heavy-duty electric vehicles market rises.

Regional Insights

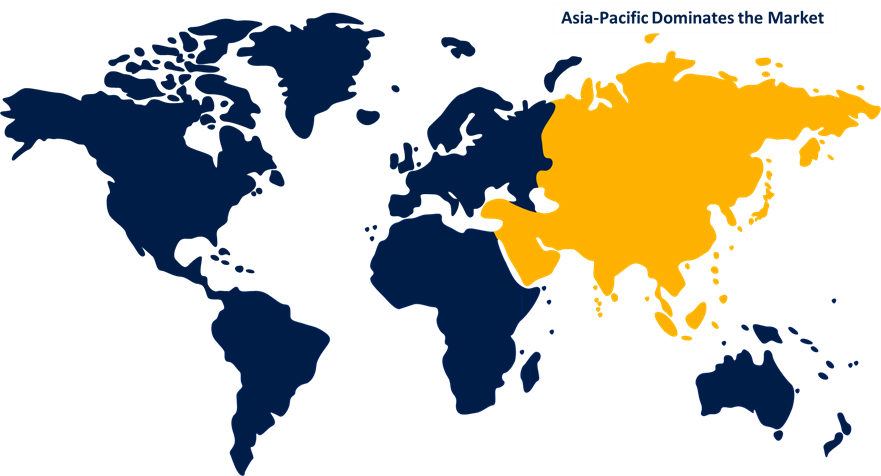

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 41.7% market share over the forecast period. The market for heavy-duty EV charging infrastructure in the Asia Pacific region will increase dramatically due to increasing customer demand for electric buses and efforts by governments in the region such as China, Japan, and India to foster the growth of heavy-duty electric vehicles. The market for electric vehicles in this region is rising as a result of the increased requirement for charging infrastructure construction and increasing collaboration among local automakers. Furthermore, due to initiatives from the government, severe regulation, and rising interest in heavy-duty electric vehicles which include buses and trucks, China is one of the major markets in the Asia Pacific. This causes a spike in the development of EV charging infrastructure for buses and trucks around the nation.

North America, on the contrary, is expected to grow the fastest during the forecast period. The majority of heavy-duty electric vehicle manufacturers, such as Tesla Inc., Volkswagen AG, and Volvo Group, rely heavily on the region's charging infrastructure. Because of the broad deployment of heavy-duty electric vehicles to meet the region's growing demand, this region is expected to hold the majority of the market share.

The Europe market is expected to register a substantial CAGR growth rate during the forecast period. The growing need for charging stations is mostly influenced by the region's manufacturers and downstream companies' increased demand for electric buses and trucks. Furthermore, there is a growing concern in the region about decreasing automotive carbon emissions, which is expected to drive increasing demand for charging stations for electric vehicles.

Furthermore, the market in the Middle East, Africa, and South America is likely to grow as buses and trucks become more popular in the region as a result of the existence of key EV manufacturers. The easy availability of charging stations and affordable batteries are expected to drive up demand for electric vehicles in these regions.

List of Key Market Players

- ABB

- Siemens

- Kempower OY

- Tesla

- Chargepoint, Inc.

- BP

- Daimler Trucks

- Proterra

- Schunk Group

- EFACEC

- Kehua Hengsheng Co., Ltd.

- Shijiazhuang Tonhe Electronics Technologies Co., Ltd.

- State Grid Corporation of China

- TGOOD Global Ltd

- Shell

- Webasto

- Blink Charging

Key Market Developments

- On May 2023, WattEV, an electric mobility developer, announced today the completion of its 26-truck charging plaza at the Port of Long Beach, the nation's largest public truck charging station. The WattEV facility will house the first 14 Nikola electric trucks, which will run on WattEV's zero-emission fleet-transportation platform. With the installation of more charging stations in Southern California, the fleet is expected to grow to more than 100 electric trucks by the end of 2023.

- On March 2023, San Diego Gas & Electric (SDG&E), in partnership with municipal and state officials, has announced the installation of four public direct current (DC) fast chargers at a busy truck stop just north of the Otay Mesa Port of Entry. This is the first of its sort in California, catering to medium and heavy-duty trucks. The 250-kilowatt (kW) chargers can charge a passenger car at up to 250 kilometers per hour. For medium-duty box trucks, the chargers can charge from 20% to 80% in about an hour and fully charge from empty to 100% in about two hours.

- On December 2022, Prologis, the logistics and real estate company, has launched two electric truck charging stations as part of its Prologis Mobility platform. The two charging stations will allow Performance Team, a national logistics organization, to charge up to 38 Volvo VNR Electric Class 8 battery-electric trucks at the same time.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Global Heavy-Duty Electric Vehicle Charging Infrastructure Market based on the below-mentioned segments:

Heavy-Duty Electric Vehicle Charging Infrastructure Market, Charger Type Analysis

- DC Charger

- AC Charger

Heavy-Duty Electric Vehicle Charging Infrastructure Market, Charging Method Analysis

- Fast Charging

- Slow Charging

Heavy-Duty Electric Vehicle Charging Infrastructure Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Heavy-Duty Electric Vehicle Charging Infrastructure market?The Global Heavy-Duty Electric Vehicle Charging Infrastructure Market is expected to grow from USD 2.57 billion in 2022 to USD 45.11 billion by 2032, at a CAGR of 33.18% during the forecast period 2022-2032.

-

2. Which are the key companies in the market?ABB, Siemens, Kempower OY, Tesla, Chargepoint, Inc., BP, Daimler Trucks, Proterra, Schunk Group, EFACEC, Kehua Hengsheng Co., Ltd., Shell, Webasto, Blink Charging

-

3. Which segment dominated the Heavy-Duty Electric Vehicle Charging Infrastructure market share?The fast charging segment in charging method type dominated the Heavy-Duty Electric Vehicle Charging Infrastructure market in 2022 and accounted for a revenue share of over 57.2%.

-

4. Which region is dominating the Heavy-Duty Electric Vehicle Charging Infrastructure market?Asia Pacific is dominating the Heavy-Duty Electric Vehicle Charging Infrastructure market with more than 41.7% market share.

-

5. Which segment holds the largest market share of the Heavy-Duty Electric Vehicle Charging Infrastructure market?The DC charger segment based on charger type holds the maximum market share of the Heavy-Duty Electric Vehicle Charging Infrastructure market.

-

1. What is the CAGR of the global medical service dog market over the forecast period?The medical service dog Market is anticipated to hold a significant share by 2033, growing at a CAGR of 5.6% from 2023 to 2033.

-

2. Which region is expected to hold the highest share of the global medical service dog market?North America is projected to hold the largest share of the global medical service dog market over the forecast period.

-

3. Who are the top key players in the global medical service dog market?Assistance Dogs International (ADI), Canine Companions for Independence (CCI), The Guide Dogs for the Blind Association, The Seeing Eye, Inc., Paws With A Cause, Dogs for Good, 4 Paws for Ability, Service Dogs, Inc., Guardian Angels Medical Service Dogs, Tender Loving Canines Assistance Dogs, International Association of Assistance Dog Partners (IAADP), Help Dogs, and Others.

Need help to buy this report?