Global Heart Health Products Market Size, Share, and COVID-19 Impact Analysis, By Type (Grains & Pulses, Fruits and Vegetables), By Application (Child and Adult), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Heart Health Products Market Insights Forecasts To 2035

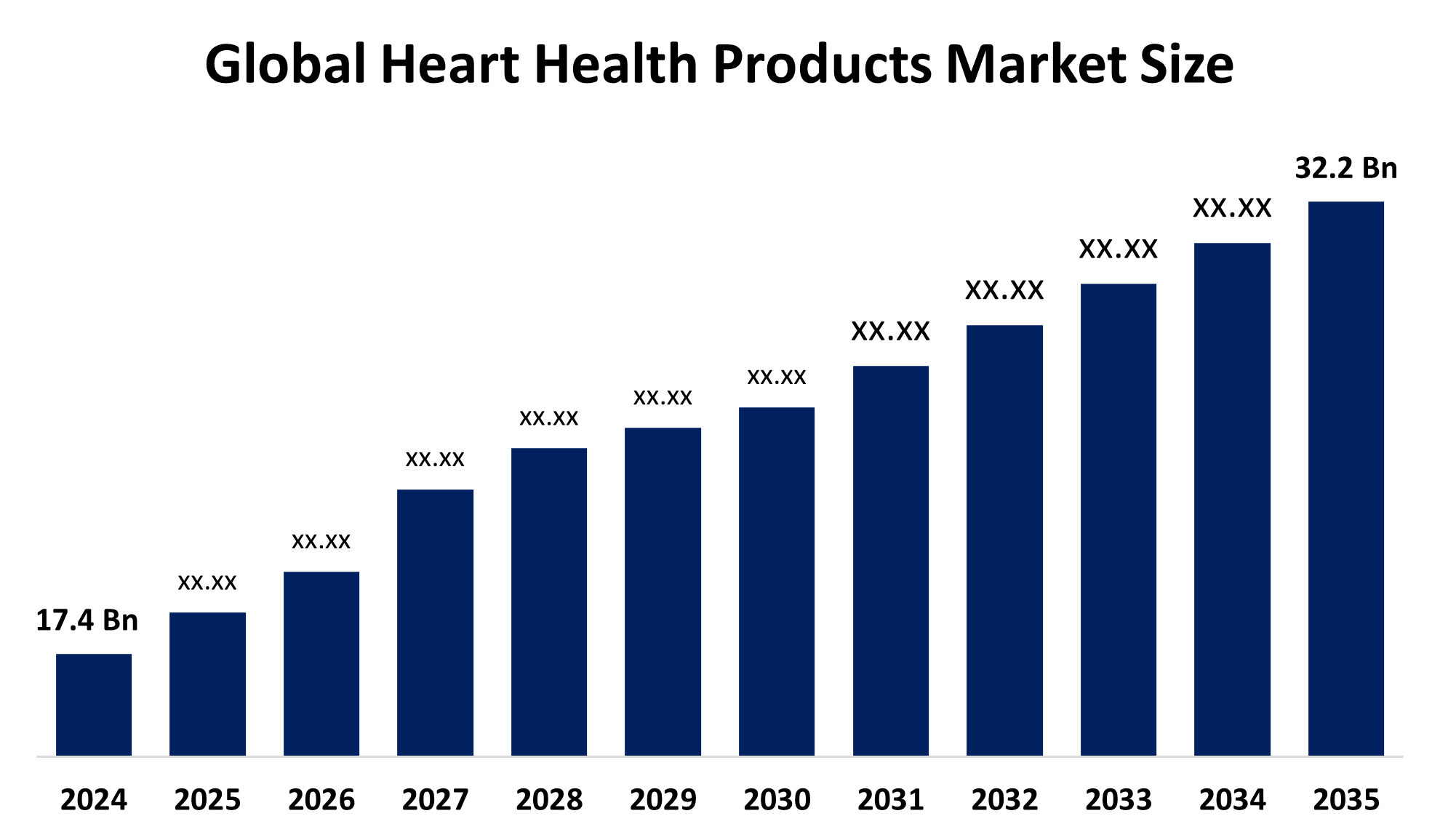

- The Global Heart Health Products Market Size Was Estimated at USD 17.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.75% from 2025 to 2035

- The Worldwide Heart Health Products Market Size is Expected to Reach USD 32.2 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Heart Health Products Market Size was worth around USD 17.4 Billion in 2024 and is Predicted To Grow to around USD 32.2 Billion by 2035 with a compound annual growth rate (CAGR) of 5.75% from 2025 and 2035. The market for heart health products has a number of opportunities to grow due to an increase in lifestyle risk factors, an aging population, and an increase in the prevalence of cardiovascular disease. Clean-label, plant-based ingredients like omega-3s, phytosterols, and functional foods supported by technology and internet connection help the market grow as consumers look for preventive remedies.

Market Overview

The heart health products industry includes a wide range of products and services used to prevent or treat heart related conditions and promote cardiovascular wellbeing. The market for heart health products is being stimulated by the result of a greater awareness of the necessity to live a healthy life. Increased awareness of the association between healthy living and nutritional value has been heightened by the familiarity and acceptance of higher quality products with consistent nutritional value that foster health. Increased cases of cardiovascular disease are one of the key causes of early death. Therefore, consumers are moving towards eating healthy and living healthy lifestyles. Additionally, healthy heart products are being fueled by consumer awareness of the harmful effects of consuming goods composed of harmful substances. New products available as supplements for heart health assist in meeting certain demands and requirements. There has been an increased sales of heart health supplements in connection with a growing concern for obesity, which has resulted in an increase in heart disease due to sedentary lifestyles and eating practices. Consumers have shifted their predisposition to include healthy eating practices and their engagement in healthy lifestyle behaviors, being the result of their noticeably greater acknowledgment of high-quality foods that enhance proper health and nutritional value. The acquisition of UAS Laboratories LLC by Hansen Holdings AS in 2020 was made to bolster the latter's human health division. Through this acquisition, the company is able to extend its human health and microbial platform business while also expanding its product line.

In May 2024, J&J agreed to acquire Shockwave Medical for USD 12.5 billion to strengthen its cardiovascular device portfolio. Shockwave’s intravascular lithotripsy device helps break down calcified plaque in arteries. The WHO-CDC Global Hearts Initiative helps nations lower the burden of CVD by implementing evidence-based packages, such as MPOWER, SHAKE, REPLACE, ACTIVE, and HEARTS. The HEARTS concept is being implemented in basic health care throughout multiple countries in the Americas.

Report Coverage

This research report categorizes the heart health products market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the heart health products market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the heart health products market.

Global Heart Health Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 17.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.75% |

| 2035 Value Projection: | USD 32.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Region |

| Companies covered:: | Amway, Herbalife Nutrition, Nature’s Bounty, NOW Foods, Nordic Naturals, GNC Holdings, LLC, Thorne HealthTech, Inc., InVite Health, Pure Encapsulations, Amarin Corporation, Johnson & Johnson, Edwards Lifesciences, Stryker Corporation, LivaNova, Terumo Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The heart health products market is driven by advancements in technology that continue to enhance the effectiveness and accessibility of heart health treatments, thereby transforming the worldwide marketplace for heart health products. Technology has made it easier for consumers to monitor their heart health through telemedicine, wearable technology, and mobile health applications. Smartwatches that offer ECG and heart rate monitoring are becoming increasingly normal. These advancements allow not only for greater engagement of patients but also the identification and treatment of heart disease at its earliest stages. With consumers increasingly seeking products that capitalize on technology, it is likely that technology's integration will support the growth of the marketplace.

Restraining Factors

The heart health products market is restricted by factors like price sensitivity in emerging markets, limited large-scale clinical evidence, high costs of functional and nutraceutical ingredients, stringent and complex global regulatory and health claim approval processes, and limitations in the supply chain materials.

Market Segmentation

The heart health products market share is classified into type and application.

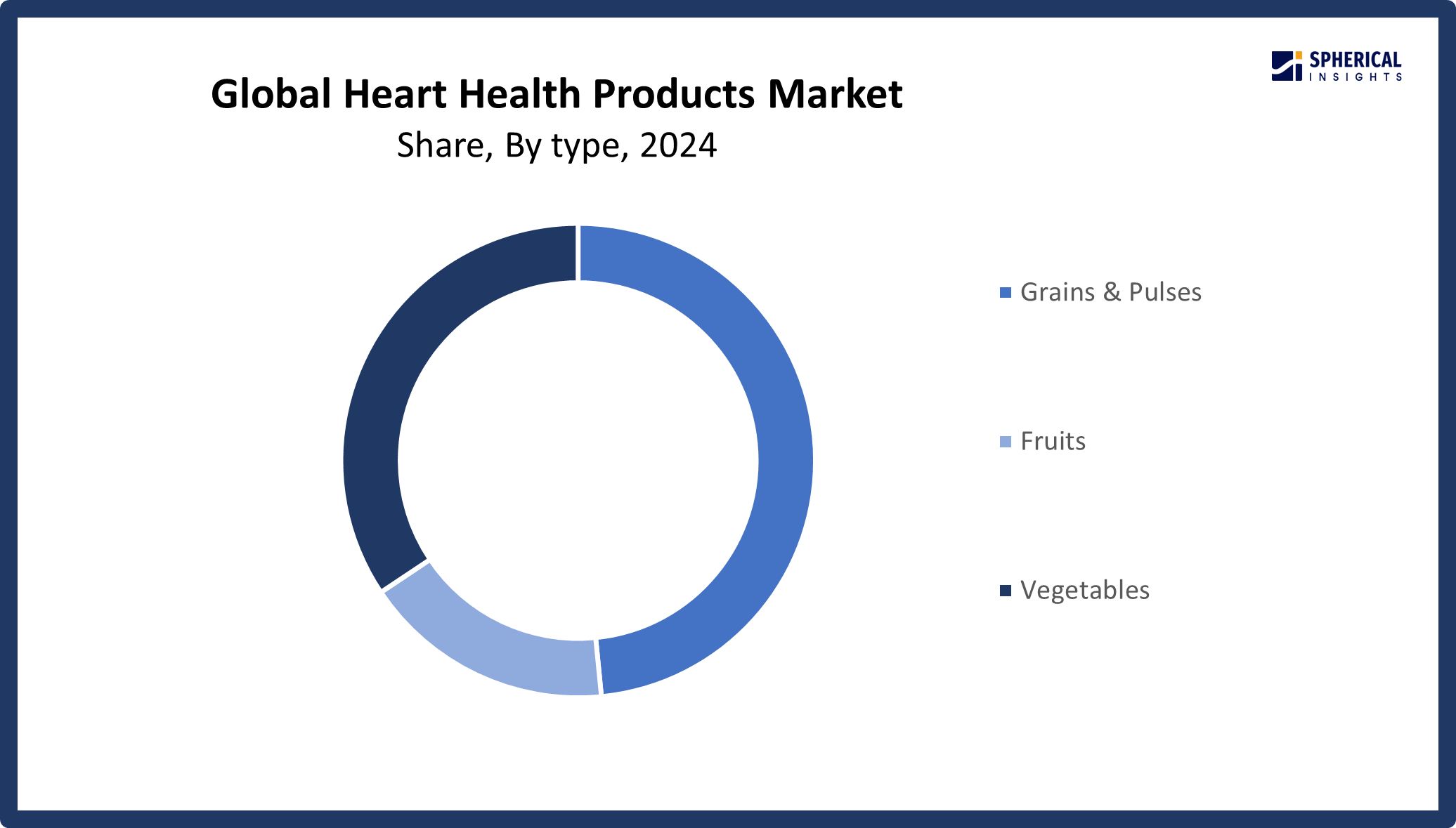

- The grains & pulses segment dominated the market in 2024, accounting for approximately 28.9% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the heart health products market is divided into grains & pulses, fruits and vegetables. Among these, the grains & pulses segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven as they lower blood pressure and enhance heart health generally. Plant based foods such as grains and pulses are abundant in fiber, vitamins, minerals, and other important nutrients. They boast multiple health benefits, such as heart health. Eating grains and legumes significantly lowers the risk of coronary heart disease and cholesterol levels.

Get more details on this report -

- The child segment accounted for the largest share in 2024, accounting for approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the heart health products market is divided into child and adult. Among these, child segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to an increased awareness of the nutritional value of food for children, children traditionally preferring cereal foods over non cereal foods, and overall increased consumption of milk and milk products. By utilizing heart health products, children's cholesterol levels can be lowered, ultimately lowering their chances of developing heart disease later in life. It can also help improve cardiovascular health by providing important nutrients beneficial for heart health, including antioxidants and omega 3 fatty acids.

Regional Segment Analysis of the Heart Health Products Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 41% of the heart health products market over the predicted timeframe.

North America is anticipated to hold the largest share, representing nearly 41% of the heart health products market over the predicted timeframe. In the North American market, the market is rising due to the added influence of major market players, increasing consumer awareness of preventive health, and rising numbers of consumers suffering from lifestyle diseases. Furthermore, the U.S. is the largest contributor within the North American market for heart health products.

The U.S. growth is attributed to a high prevalence of cardiovascular disease, high consumer awareness of preventive health, advanced nutraceutical & supplement regulation, a well developed health infrastructure, the highest disposable incomes, and broad distribution channels for wellness products.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 39% in the heart health products market during the forecast period. The Asia Pacific area has a thriving market for heart health products due to relatively large populations in the region and the rise in per capita income among consumers. Additionally, India was the fastest growing marketer of heart health products in the Asia Pacific region, while the largest market share belonged to China.

China's growth is by the consumer healthcare market in 2024 due to a large aging population, growing middle-class wealth, and a greater focus on preventative health. The government's focus on preventative nutrition and the rise of e commerce platforms have both contributed to this surge.

Europe is growing with 29% due to a well established, highly developed infrastructure and growing awareness among consumers of the importance of leading a healthy lifestyle. Additionally, the UK Heart Health Products market grew at the fastest rate in the European region, while the largest market share belonged to the German heart health products market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the heart health products market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway

- Herbalife Nutrition

- Nature's Bounty

- NOW Foods

- Nordic Naturals

- GNC Holdings, LLC

- Thorne HealthTech, Inc.

- InVite Health

- Pure Encapsulations

- Amarin Corporation

- Johnson & Johnson

- Edwards Lifesciences

- Stryker Corporation

- LivaNova

- Terumo Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2025, Profound Therapeutics & Novartis entered a USD 750 million collaboration to work on novel cardiovascular therapies using proteome-based drug ducovery to find new targets.

- In June 2025, Lilly egreed to buy Verve (deal up to USD 1.3 billion) to get access to a one-time gene editing therapy (VERVE 102) targeting LDL-C reduction for cardiovascular disease.

- In December 2024, Novartis Australia, Advara HeartCare, and TerryWhite Chemmart launched The Heart Health Collective to combine expertise and community reach to improve cardiovascular outcomes, Includes community pharmacies, cardiologist networks, and focuses on newer therapies like Lequio inclisiran) for cholesterol control

- In November 2023, NHCS & Novoheart collaborated to develop the first Asian patient-specific miniature heart model for heart failure with preserved ejection fraction. This supports drug

- screening and precision medicine research.

- In October 2024, MDisrupt & American Heart Association Ventures investment a $1 million investment and collaboration to expand the adoption of an Al-powered expert marketplace that helps companies design, build, and commercialize health tech, med-device, and cardiovascular health products

- In April 2024, GE HealthCare launched Vscan Air SL with Caption Ar A handheld ultrasound device enhanced by Al, for rapid cardiac assessments at the point of care. It's designed so that even non-expert users can capture useful cardiac images

- In April 2024, Dr. Reddy’s & Bayer's partnership signed a marketing and distribution agreement for a second brand of vericiguat, used for chronic heart failure, to widen access in India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the heart health products market based on the below-mentioned segments:

Global Heart Health Products Market, By Type

- Grains & Pulses

- Fruits

- Vegetables

Global Heart Health Products Market, By Application

- Child

- Adult

Global Heart Health Products Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the heart health products market over the forecast period?The global heart health products market is projected to expand at a CAGR of 5.75% during the forecast period.

-

2. What is the market size of the heart health products market?The global heart health products market size is expected to grow from USD 17.4 Billion in 2024 to USD 32.2 Billion by 2035, at a CAGR of 5.75% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the heart health products market?North America is anticipated to hold the largest share of the heart health products market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global heart health products market?Amway, Herbalife Nutrition, Nature's Bounty, NOW Foods, Nordic Naturals, GNC Holdings, LLC, Thorne HealthTech, Inc., InVite Health, Pure Encapsulations, Amarin Corporation, Johnson & Johnson, Edwards Lifesciences, Stryker Corporation, LivaNova, Terumo Corporation, and Others.

-

5. What factors are driving the growth of the heart health products market?The heart health products market growth is driven by the need for preventative health treatments is growing as the world's aging population becomes more vulnerable to cardiovascular illnesses. Additionally, consumers are looking for items that enhance cardiovascular well-being as a result of growing awareness about heart health and the significance of lifestyle changes.

-

6. What are market trends in the heart health products market?The heart health products market trends include personalized nutrition and supplements, integration of artificial intelligence and digital health platforms, advancements in wearable technology, emphasis on natural and organic ingredients, and focus on preventive healthcare.

-

7. What are the main challenges restricting wider adoption of the heart health products market?The heart health products market trends include that for international firms, product approvals, labeling, and marketing are difficult due to regulatory complexity and disparate national norms. Smaller players may find it prohibitively expensive to invest in clinical trials, research, and quality management systems to ensure consistent quality, safety, and efficacy.

Need help to buy this report?