Global Healthcare Staffing Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Travel Nurse, Per Diem Nurse, Locum Tenens, and Allied Healthcare), By End-use (Hospitals, Clinics, Ambulatory Facilities, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Healthcare Staffing Market Insights Forecasts to 2035

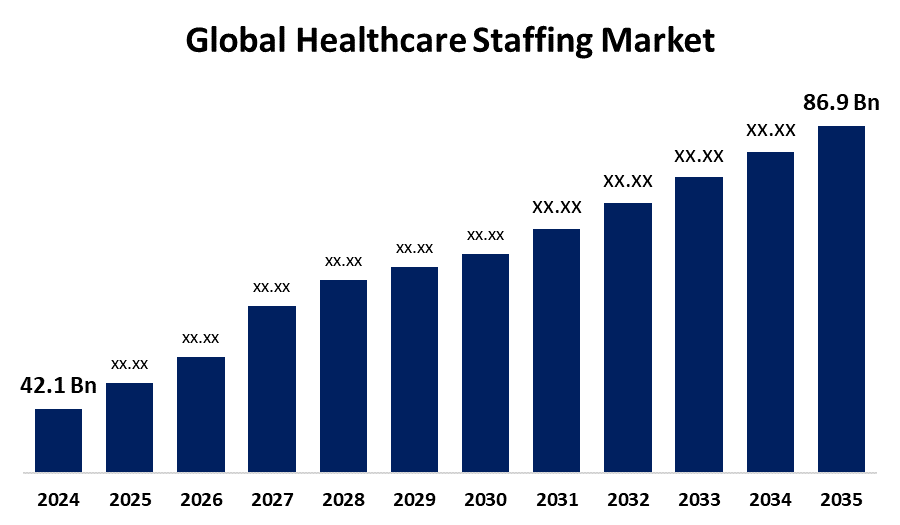

- The Global Healthcare Staffing Market Size Was Estimated at USD 42.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.81% from 2025 to 2035

- The Worldwide Healthcare Staffing Market Size is Expected to Reach USD 86.9 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Healthcare Staffing Market Size was worth around USD 42.1 Billion in 2024 and is projected to grow from USD 45.0 Billion in 2025 to around USD 86.9 Billion by 2035 at a compound annual growth rate (CAGR) of 6.81% during the forecast period (2025–2035). One of the key opportunities is that the demand for nurses, doctors, and other allied health professionals is growing globally due to aging populations and high turnover rates. Telehealth and medical informatics are two examples of advances brought about by advancements in medical devices and technologies, which have raised the need for a skilled workforce that can handle both technical and operational aspects.

Global Healthcare Staffing Market Forecast and Revenue Size

- 2024 Market Size: USD 42.1 Billion

- 2025 Market Size: USD 45.0 Billion

- 2035 Projected Market Size: USD 86.9 Billion

- CAGR (2025-2035): 6.81%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

Healthcare staffing is the process of identifying, hiring, and managing healthcare professionals, such as nurses, physicians, allied health workers, and administrative staff, to ensure that healthcare facilities have enough staff to provide high quality patient care. Hospitals, diagnostic services and ambulatory surgery centers are expanding because of the need to provide healthcare services globally due to increasing mortality rates. With an increase in healthcare expansion, there is an increase in demand for healthcare workers, which drives market growth. For example, the U.S. Government proposed a federally funded USD 1 billion program designed to upgrade rural hospital facilities, in part to alleviate the shortage of medical personnel, especially telehealth professionals, all while promoting the improved health of the service population of patients receiving the services remotely.

Governments all throughout the world are putting strategic plans into action to deal with the escalating difficulties in the global healthcare workforce. A comprehensive framework that helps countries efficiently plan, educate, manage, and retain healthcare personnel is the World Health Organization's Health Workforce 2030 approach. Based on best practices and research, this approach promotes multi sectoral initiatives and highlights the significance of integrating healthcare workforce planning with more general social services.

Key Market Insights

- North America is expected to account for the largest share in the healthcare staffing market during the forecast period.

- In terms of service type, the travel nurse segment is projected to lead the healthcare staffing market throughout the forecast period

- In terms of end-use, the hospitals segment captured the largest portion of the market

Healthcare Staffing Market Trends

- Integration of additive manufacturing and personalized grafts

- Cost, accessibility & market adoption in emerging regions

- Material innovation and biofunctionality improvements, personalization

- Personalization, custom enabled grafts

- Stringent regulatory oversight and demand for clinical evidence

Report Coverage

This research report categorizes the healthcare staffing market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the healthcare staffing market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the healthcare staffing market.

Global Healthcare Staffing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Service Type, By End-use, By Region |

| Companies covered:: | Aya Healthcare, Trustaff, Adecco Group, LocumTenens.com, CHG Management, Inc., AMN Healthcare, Almost Family, Envision Healthcare Corporation, inVentiv Health, TeamHealth, Maxim Healthcare Services, Inc., Cross Country Healthcare, Inc., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors: Rising demand for healthcare services drives the healthcare staffing market.

One major contributing factor to the healthcare staffing market is a growing number of physicians, primarily in secondary care settings. Recent years have seen a rapid acceleration of change, which is expected to reach a rate of about 5% per year by 2024. By tackling the past underfunding and undervaluation of physicians, the BMA is urging the government to increase medical retention. Telehealth services encourage market expansion since they are advantageous to both patients and health system providers.

Restraining Factor: Burnout and high turnover rates concern restrict the market.

The market for healthcare staffing is restricted by several important factors, such as persistent labor shortages brought on by high turnover, burnout, and low training institution production, complex licensing and regulatory requirements across jurisdictions that add time and expense.

Market Segmentation

The global healthcare staffing market is divided into service type and end-use.

Global Healthcare Staffing Market, By Service Type:

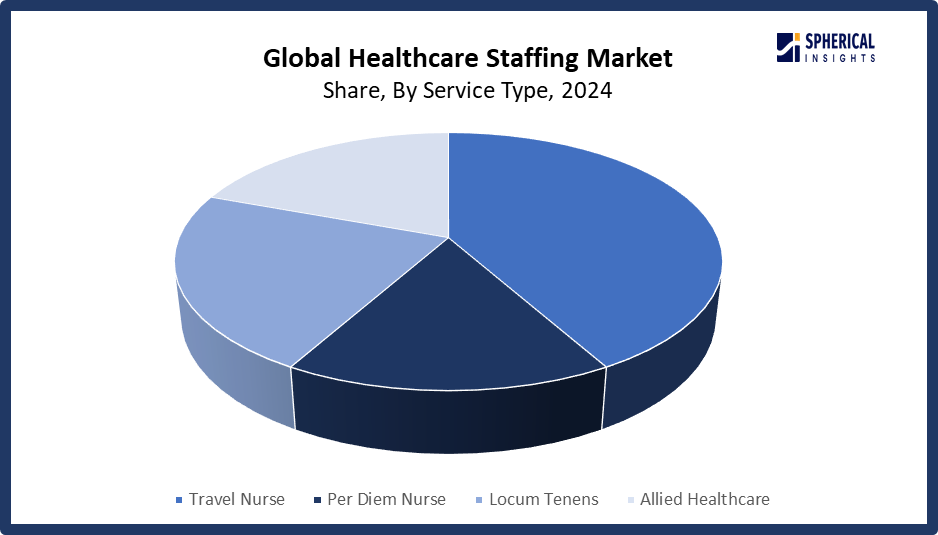

Why does the travel nurse segment hold the largest revenue share in the global healthcare staffing market, accounting for approximately 31.3% of the total market during the forecast period?

The travel nurse segment led the healthcare staffing market, generating the largest revenue share. The travel nurse material is praised for its rapid service, cost-effectiveness, and the dearth of nurses are the reasons for the travel nurse staffing segment's explosive growth. In the upcoming years, this situation is expected to persist.

Get more details on this report -

The locum tenens segment in the healthcare staffing market is expected to grow at the fastest CAGR over the forecast period. The locum tenens segment is propelled because of the cost to employers and the need for locum tenens labor on behalf of physicians. Locum tenens is more affordable, so Hospitals, groups, and clinics are more likely to use locum tenens labor during times of increased patient volume, vacationing permanent physicians, and sabbaticals of permanent physicians.

Global Healthcare Staffing Market, By End-use:

Why do hospitals represent the largest application segment, capturing approximately 42% market share during the forecast period in the global healthcare staffing market?

The hospitals segment held the largest market share in the healthcare staffing market. Most hospitals are hiring more personnel in accordance with constraints established by government authorities. Hospitals have to follow guidelines and ratios of nurse-to-patient staffing regulated by various government authorities. To address the increased demand, patient-oriented legislation and regulations are increasing the per diem hospital workforce.

The clinics segment in the healthcare staffing market is expected to grow at the fastest CAGR over the forecast period. Sources suggest that the impending growth of primary care systems will likely contribute to the number of clinics and the number of available physicians. There was also a shortage of nurses for clinics as a result of the COVID-19 pandemic. As a result, clinics struggled to find and employ qualified staff.

Regional Segment Analysis of the Global Healthcare Staffing Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Healthcare Staffing Market Trends

Get more details on this report -

What factors contribute to the North America region holding the largest share, approximately 58%, of the global healthcare staffing market during the forecast period?

North America is dominant in the global healthcare staffing market, with an estimated 58% share during the forecast period. The healthcare staffing market in North America has expanded greatly in recent years, mainly because of the existing major participants in the local market, the growth of the geriatric population, and hospitals' growing interest in staffing the medical workforce, given the financial burden that recruiting permanent staff places on hospitals.

Why does the United States lead the North American healthcare staffing market?

The healthcare staffing market in the United States encompasses a large portion of the older population as well as the increased prevalence of chronic diseases such as diabetes, heart disease, and cancer. The healthcare personnel market is propelling due to the well-established healthcare system that consists of hospitals, clinics, and other healthcare organizations. The growing demand for healthcare professionals in the United States is driven by the development of specialty healthcare professionals due to technological advancements, including telemedicine and medical informatics. All of which has propelled the market due to the increased demand for skilled healthcare professionals in emergency rooms and specialty clinics.

Asia Pacific Healthcare Staffing Market Trends

How is the Asia Pacific region expected to capture approximately 23% of the healthcare staffing market by 2025, with the fastest growth rate?

Asia Pacific is expected to capture approximately 23% of the healthcare staffing market by 2025, with the fastest growth rate due to several key factors. The Asia Pacific region is driven by the increasing demand for contract employees. The rising demand may be because contract hires are free of the obligations of a permanent employee. Recruiters are also able to cast a wider net and hire more quickly.

Why is China expected to register the highest CAGR in the healthcare staffing market during the forecast period?

China is one of the largest contributors to the healthcare staffing market. Demand for healthcare staffing is driven by a huge population and an increasing demand for healthcare services. The rising demand for long term care and more specialized geriatric services is also pushing demand for healthcare staffing, driven by increasing demand for physicians, nurses, and allied health professionals. Also, the increasing prevalence of chronic diseases such as diabetes, cancer, heart disease, and chronic respiratory disease increases the demand for healthcare providers. The expanding digital revolution in the healthcare sector adds to the overall aging in demand for healthcare staffing. are driving the growth of the China healthcare staffing market.

Europe Healthcare Staffing Market Trends

Europe has been witnessing a severe shortage of care professionals in the past few years. In 2021, the omicron waves exacerbated the condition. In January 2022, the European Public Service Union estimated that Europe would need 2 billion healthcare workers. In addition, the European Commission states that by 2025, 24,009,000 professionals will work in health, with local retirements or other departures accounting for over half.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global healthcare staffing market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Healthcare Staffing Market Include

- Aya Healthcare

- Trustaff

- Adecco Group

- LocumTenens.com

- CHG Management, Inc.

- AMN Healthcare

- Almost Family

- Envision Healthcare Corporation

- inVentiv Health

- TeamHealth

- Maxim Healthcare Services, Inc.

- Cross Country Healthcare, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In May 2025, Phlebotomy on Wheels, a leading mobile lab service provider, made an announcement about their new staffing solutions to offer for healthcare providers, including doctors' offices, nursing homes, and hospitals that need dependable Healthcare staffing with maximum people due to fluctuating patient volume. Phlebotomy on wheels is offering continuous and rigorous training with a curated team, along with experience.

- In May 2025, a national leader in healthcare staffing solutions, GHR Healthcare, unveiled that it has acquired Barton Healthcare Staffing, which offers nurse and allied health staffing members of Barton Associates, Inc. The Acquisition offered a client centric staffing solution with flexibility and support, quality care for patients across the nation by offering GHR’s team a high touch service model and expertise in expected operations.

- In April 2025, a Titan Workforce solution was launched by Titan Medical Group. It is an innovative managed service provider that is designed to profoundly change and streamline healthcare staffing solutions across the nation by offering a single point of contact and exceptional coordination for hospitals and healthcare facilities.

- In March 2025, four leaders in the industry, AB Staffing Solutions, Adaptive Workforce Solutions, Prime Time Healthcare, and Prime Workforce Solutions, came together under one innovative brand with the formal launch of Fortis Healthcare Solutions. By merging these outstanding brands with decades of experience, Fortis Healthcare Solutions establishes the new benchmark in next generation healthcare.

- In April 2024, leading staffing software provider Ceipal introduced its new suite of software, called Ceipal Healthcare, which is especially made for hiring and staffing in the healthcare industry. Designed as a single platform for all healthcare staffing and hiring requirements, Ceipal Healthcare makes it simple and quick for healthcare staffing and recruitment professionals to find, connect with, and place top talent.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the healthcare staffing market based on the following segments:

Global Healthcare Staffing Market, By Service Type

- Travel Nurse

- Per Diem Nurse

- Locum Tenens

- Allied Healthcare

Global Healthcare Staffing Market, By End-use

- Hospitals

- Clinics

- Ambulatory Facilities

- Others

Global Healthcare Staffing Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the healthcare staffing market over the forecast period?The global healthcare staffing market is projected to expand at a CAGR of 6.81% during the forecast period.

-

2. What is the market size of the healthcare staffing market?The global healthcare staffing market size is expected to grow from USD 42.1 billion in 2024 to USD 86.9 billion by 2035, at a CAGR 6.81% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the healthcare staffing market?North America is expected to hold the largest share of the healthcare staffing market over the forecast period.

-

4. Who are the top 12 companies operating in the global healthcare staffing market?Aya Healthcare, Trustaff, Adecco Group, LocumTenens.com, CHG Management, Inc., AMN Healthcare, Almost Family, Envision Healthcare Corporation, inVentiv Health, TeamHealth, Maxim Healthcare Services, Inc., Cross Country Healthcare, Inc., and Others.

-

5. What factors are driving the growth of the healthcare staffing market?The healthcare staffing market growth is driven due to an aging population with a higher prevalence of chronic diseases, a global shortage of qualified medical personnel, particularly in nursing and specialized physician roles, the expansion of healthcare facilities and infrastructure, the growing use of flexible staffing models, and technological advancements that make hiring and deployment easier, such as telehealth, digital credentialing, and AI-driven recruitment tools.

-

6. What are market trends in the healthcare staffing market?The healthcare staffing market trends include integration of additive manufacturing and personalized grafts, cost, accessibility & market adoption in emerging regions, material innovation and biofunctionality improvements, personalization, custom enabled grafts, and stringent regulatory oversight and demand for clinical evidence.

-

7. What are the main challenges restricting wider adoption of the healthcare staffing market?The healthcare staffing market trends include high turnover and burnout, combined with a severe lack of qualified healthcare workers, particularly in specialized positions and rural locations, which threatens the stability of the workforce. Regional differences in regulatory complexity and licensing requirements increase time and expense.

Need help to buy this report?