Global Healthcare Satellite Connectivity Market Size, Share, and COVID-19 Impact Analysis, By Component (Medical Devices, System & Software, and Services), By Application (Telemedicine, Clinical Operations, and Connected Imaging), By Connectivity (Mobile Satellite Services (MSS), Fixed Satellite Services (FSS), and Specialty markers), By End Use (Clinical Research Organization, Hospitals & Clinics, Research & Diagnostic Laboratories, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Healthcare Satellite Connectivity Market Insights Forecasts to 2035

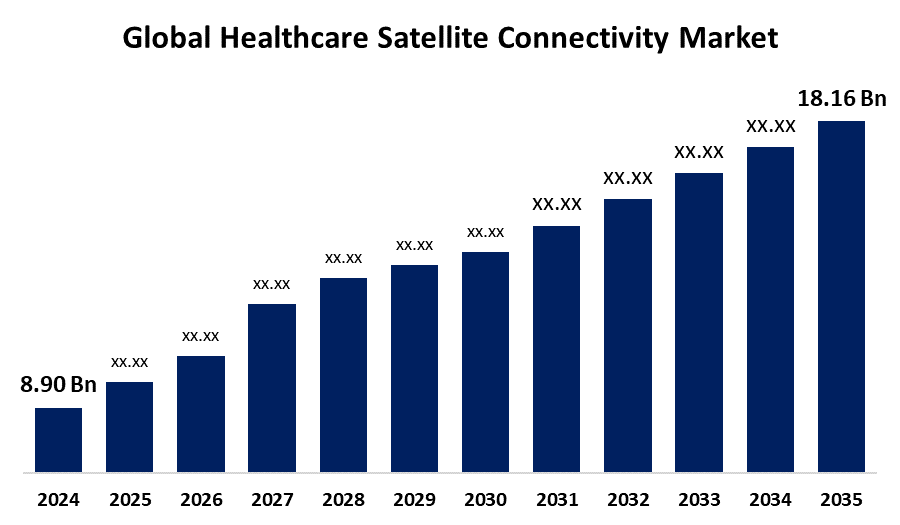

- The Global Healthcare Satellite Connectivity Market Size Was Estimated at USD 8.90 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.70% from 2025 to 2035

- The Worldwide Healthcare Satellite Connectivity Market Size is Expected to Reach USD 18.16 Billion by 2035

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global Healthcare Satellite Connectivity Market Size was worth around USD 8.90 Billion in 2024 and is predicted to Grow to around USD 18.16 Billion by 2035 with a compound annual growth rate (CAGR) of 6.70% from 2025 to 2035. The market growth is boosted by the rise of chronic diseases and telemedicine, amplified by COVID-19, underscoring the importance of satellite connectivity in delivering reliable remote care. AI innovations and expanding internet infrastructure continue to drive its role in advancing global health access.

Market Overview

The healthcare satellite connectivity market refers to the use of satellite communication technology to facilitate safe and dependable audio, video, and data transfer between medical institutions, patients, and providers, particularly in underserved, rural, or remote places where traditional network infrastructure is scarce or nonexistent.

The remote and underdeveloped areas, healthcare satellite connectivity is quickly becoming a vital component of telemedicine and remote treatment. Better chronic illness management and emergency care are supported by its capacity to guarantee constant connectivity and real-time data exchange. LEO satellites and 5G integration are examples of technological developments that are improving service quality and reaching a wider audience. Rising healthcare expenses and the increasing demand for effective care delivery are driving the market. Additionally, satellite connectivity improves worker training, disaster resilience, and healthcare logistics. All things considered, it is essential to the advancement of global equity in digital health.

Report Coverage

This research report categorizes the healthcare satellite connectivity market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the healthcare satellite connectivity market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the healthcare satellite connectivity market.

Healthcare Satellite Connectivity Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8.90 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.70% |

| 2035 Value Projection: | USD 18.16 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Component, By Application, By Connectivity, By End Use and By Region |

| Companies covered:: | X2nSat, Nigado Network, Inmarsat Global Limited, DISH Network L.L.C., Hughes Network Systems, LLC, EUTELSAT COMMUNICATIONS SA, SES S.A., Globalstar, Expedition Communications, Evitalz, Johnson & Johnson, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is driven by the growing burden of chronic illnesses and the increased demand for emergency care. Its significance in facilitating remote consultations and telemedicine services was further underscored by the COVID-19 pandemic. AI-integrated platforms are improving the delivery of virtual care due to innovations from organizations like Cigna and Wheel Health. Even in remote locations, satellite communication guarantees dependable access to healthcare, promoting improved results. This rise is still being driven by the use of AI and the development of internet infrastructure. Satellite connectivity is a key component of global health accessibility as virtual healthcare gains traction.

Restraining Factors

The market growth is hindered by the widespread use of healthcare satellite communication due to the high initial investment expenses. It is less accessible due to the cost of satellite launches and user gear, particularly in areas with limited resources. When compared to less expensive terrestrial alternatives, these cost obstacles may cause implementation to be delayed. Consequently, even though satellite-enabled care has many advantages, market expansion might be limited.

Market Segmentation

The Healthcare Satellite Connectivity Market Share is classified into component, application, connectivity, and end use.

- The system & software segment dominated the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the component, the healthcare satellite connectivity market is classified into medical devices, system & software, and services. Among these, the system & software segment dominated the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the increase in medical devices used to track and monitor health data. Complementary software is necessary for the hardware to function properly, which supports the expansion of the market. Additionally, the segment's expansion is being driven by the necessity of maintaining patient databases and medical records, as well as the growing demand for data analytics. The FDA is creating standards and a framework to direct the use of AI and ML in healthcare software, per the National Library of Medicine paper released in September 2023.

- The telemedicine segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the healthcare satellite connectivity market is classified into telemedicine, clinical operations, and connected imaging. Among these, the telemedicine segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the increased demand for virtual treatment due to better internet connectivity and the COVID-19 pandemic. The proliferation of telemedicine services in remote locations has been made possible by increased mobile broadband availability. Market development is further accelerated by strategic partnerships such as that between Teladoc and Cigna.

- The fixed satellite services (FSS) segment dominated the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the connectivity, the healthcare satellite connectivity market is classified into mobile satellite services (MSS), fixed satellite services (FSS), and specialty markers. Among these, the fixed satellite services (FSS) segment dominated the market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the increase in real-time video conferencing and virtual consultations. Due to the rise in remote medical services and the transmission of medication data to patients in rural locations, FSS is anticipated to expand quickly in the healthcare industry. EUTELSAT COMMUNICATIONS SA, SES S.A., and Intelsat are the main participants in the market, and they all help it expand.

- The hospitals & clinics segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period.

Based on the end use, the healthcare satellite connectivity market is categorized into clinical research organization, hospitals & clinics, research & diagnostic laboratories, and others. Among these, the hospitals & clinics segment accounted for the largest share in 2024 and is estimated to grow at a remarkable CAGR during the forecast period. The segmental growth can be attributed to the rise in health problems, the need to manage hospital operations, patient safety, and the decrease in prescription errors. By improving communication between clinics and hospitals, satellite connectivity helps lower diagnostic and prescription errors.

Regional Segment Analysis of the Healthcare Satellite Connectivity Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the healthcare satellite connectivity market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the healthcare satellite connectivity market over the predicted timeframe. The regional growth can be attributed to the expansion of satellite connectivity in the area responsible for both the increase in internet infrastructure and the rise in internet users. Market expansion is driven by the growing participation of businesses, up-and-coming entrepreneurs, and technological developments brought about by the rise in serious medical diseases. For example, the Canadian company Terrestar Solutions Inc. is committed to providing satellites that are operational and supported by satellite architecture in order to deliver dependable and smooth connections. It is anticipated that such occurrences would propel market expansion.

Asia Pacific is expected to grow at a rapid CAGR in the healthcare satellite connectivity market during the forecast period. The market growth is being driven by the region's growing internet connectivity and the growing number of chronic patients. Numerous towns and businesses are entering the market to provide cutting-edge solutions. For example, data released in October 2022 shows that Dargo Bush Nursing Centre in Australia is using a new satellite technology to provide medical support in rural locations. It is anticipated that these technological adoptions by different establishments would propel market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the healthcare satellite connectivity market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- X2nSat

- Nigado Network

- Inmarsat Global Limited

- DISH Network L.L.C.

- Hughes Network Systems, LLC

- EUTELSAT COMMUNICATIONS SA

- SES S.A.

- Globalstar

- Expedition Communications

- Evitalz

- Johnson & Johnson

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Recent Development

- In June 2022, Johnson & Johnson established the J&J Satellite Center for Global Health Discovery (Satellite Center) at Singapore's Duke-NUS Medical School, a collaboration between Duke University and the National University of Singapore (NUS).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the healthcare satellite connectivity market based on the below-mentioned segments:

Global Healthcare Satellite Connectivity Market, By Component

- Medical Devices

- System & Software

- Services

Global Healthcare Satellite Connectivity Market, By Application

- Telemedicine

- Clinical Operations

- Connected Imaging

Global Healthcare Satellite Connectivity Market, By Connectivity

- Mobile Satellite Services (MSS)

- Fixed Satellite Services (FSS)

- Specialty markers

Global Healthcare Satellite Connectivity Market, By End Use

- Clinical Research Organization

- Hospitals & Clinics

- Research & Diagnostic Laboratories

- Others

Global Healthcare Satellite Connectivity Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the healthcare satellite connectivity market over the forecast period?The global healthcare satellite connectivity market is projected to expand at a CAGR of 6.70% during the forecast period.

-

2. What is the market size of the healthcare satellite connectivity market?The global healthcare satellite connectivity market size is expected to grow from USD 8.90 Billion in 2024 to USD 18.16 Billion by 2035, at a CAGR of 6.70% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the healthcare satellite connectivity market?North America is anticipated to hold the largest share of the healthcare satellite connectivity market over the predicted timeframe.

Need help to buy this report?