Global Healthcare IT Spending Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Deployment Mode (On-premises, Cloud-based / SaaS, and Hybrid), By Technology (Electronic Health Records (EHR) / EMR, Telehealth / Telemedicine, mHealth & Wearables, Healthcare Analytics & Big Data / AI, Medical Imaging & PACS, Cybersecurity & Identity Access Management, and Interoperability / Health Information Exchange (HIE)), By End User (Hospitals & Health Systems, Physician Offices & Ambulatory Care Centers, Diagnostic & Imaging Centers, Long-term Care Facilities, Pharmacies & Retail Clinics, Payers & Insurance Providers, and Government & Public Health Agencies), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Healthcare IT Spending Market Insights Forecasts to 2035

- The Market Size is Expected to Grow at a CAGR of around 11.5% from 2025 to 2035

- The Worldwide Healthcare IT Spending Market size is expected to hold a significant share by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Healthcare IT Spending Market Size is Expected to hold a significant share by 2035, at a CAGR of 11.5% during the forecast period 2025-2035. Opportunities for digital transformation, telehealth expansion, AI-driven analytics, interoperability solutions, cloud adoption, cybersecurity improvement, and data-driven decision-making to boost productivity and patient outcomes are all available in the healthcare IT spending market.

Global Healthcare IT Spending Market Forecast and Revenue Outlook

- CAGR (2025-2035) 11.5%

- Asia Pacific Largest market in 2024

- North America Fastest growing market

Market Overview

The global distribution of financial resources for the creation, deployment, upkeep, and optimization of IT systems in the healthcare industry is included in the healthcare IT spending market. Electronic health records (EHRs), telemedicine platforms, AI driven diagnostics, cloud-based data analytics, and cybersecurity infrastructures are just a few examples of the hardware, software, and services that are integrated in this market to improve patient outcomes, operational efficiency, and data interoperability. For Instance, in July 2025, CMS launched the Digital Health Tech Ecosystem Initiative to foster patient-centric data sharing, while America’s AI Action Plan under Executive Order 14179 accelerates AI driven clinical decision making. The growing need for digital transformation across healthcare systems to enhance productivity, accuracy, and patient care outcomes is the main driver of the healthcare IT spending market. Technological developments, the growing use of telehealth solutions, and the growing significance of user generated digital health data are the primary factors driving the healthcare IT spending markets expansion. The market is expanding due in large part to technological developments in healthcare IT solutions, the growing need for better data standards, and the increasing use of integrated solutions in clinical applications.

Key Market Insights

- North America is expected to account for the largest share in the healthcare IT spending market during the forecast period.

- In terms of component, the software segment is projected to lead the healthcare IT spending market throughout the forecast period

- In terms of deployment mode, the on-premises segment is projected to lead the healthcare IT spending market throughout the forecast period

- In terms of technology, the electronic health records (EHR) EMR segment captured the largest portion of the market

- In terms of end user, the hospitals & health systems segment captured the largest portion of the market

Healthcare IT Spending Market Trends

- Adoption of Machine Learning (ML) and Artificial Intelligence (AI) AI is being used more frequently for clinical decision support, diagnostics, and predictive analytics.

- Growth in Telehealth and Remote Care Solutions: Increasing funding for digital health platforms, remote monitoring, and virtual consultations.

- Cloud Computing Integration: For scalability, interoperability, and cost-effectiveness, move to cloud-based technologies.

- Emphasis on Data Interoperability Adherence to interoperability standards and smooth data transfer between healthcare systems are prioritized.

- Growth of Wearable and IoT gadgets: The use of linked gadgets for real-time data collecting and ongoing patient monitoring.

Report Coverage

This research report categorizes the healthcare IT spending market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the healthcare IT spending market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub segment of the healthcare IT spending market.

Global Healthcare IT Spending Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Technology, By End User and By Region |

| Companies covered:: | Epic Systems Corporation, Oracle Health (Cerner Corporation), Microsoft Corporation, Amazon Web Services (AWS), Google LLC (Google Cloud Healthcare), Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips Healthcare, Allscripts Healthcare Solutions (Veradigm), Meditech, Accenture plc, Cognizant Technology Solutions, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving factors

Healthcare providers are investing in cutting-edge information technology solutions due to rising healthcare expenses and the increasing need to streamline operations. By facilitating real-time access to patient data and improving clinical decision-making, the extensive use of electronic health records (EHRs), telehealth platforms, and healthcare analytics tools is driving healthcare IT spending market expansion. The Internet of Things (Iot), cloud computing, artificial intelligence (AI), and machine learning (ML) are examples of emerging technologies whose quick development is driving industry growth. Increasing cooperation between tech companies and healthcare providers promotes scalability and innovation.

Restraining Factor

The market for healthcare IT spending is restricted by high implementation costs, data protection issues, interoperability issues, a lack of technical know-how, and complicated regulations that make it difficult for healthcare companies to adopt and integrate technology seamlessly.

Market Segmentation

The global healthcare IT spending market is divided into component, deployment mode, technology, and end user.

Global Healthcare IT Spending Market, By Component:

- The software segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on component, the global healthcare IT spending market is segmented into hardware, software, and services. Among these, the software segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The broad use of clinical decision support tools, hospital information systems (HIS), and electronic health records (EHRs) is driving the software market. Software investment has been greatly impacted by the growing need for digital solutions that guarantee regulatory compliance, improve patient care, and increase operational efficiency.

The services segment in the healthcare IT spending market is expected to grow at the fastest CAGR over the forecast period. The growing need for IT consulting, system integration, managed services, and support services in the healthcare industry is driving the expansion of the services category. The need for expert services for deployment, upkeep, and optimization is growing as healthcare organizations embrace sophisticated digital infrastructures, such as cloud-based systems and AI-enabled platforms.

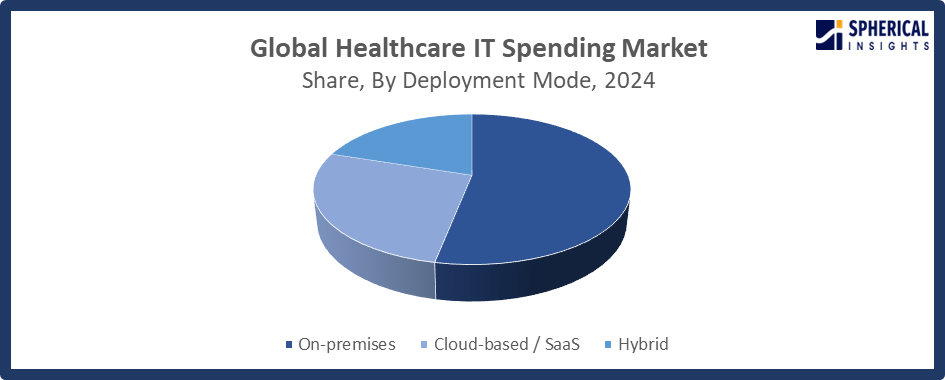

Global Healthcare IT Spending Market, By Deployment Mode:

- The on-premises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on deployment mode, the global healthcare IT spending market is segmented into on premises, cloud based Saas, and hybrid. Among these, the on-premises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Healthcare providers have direct control over data storage, security, and system administration using on-premises solutions, which complies with strict patient information regulations and compliance standards. The on-premises nature of many legacy healthcare IT systems contributes to their ongoing market.

Get more details on this report -

The cloud-based Saas segment in the healthcare IT spending market is expected to grow at the fastest CAGR over the forecast period. Cloud based deployments are very appealing to small and medium sized healthcare providers as well as government healthcare programs since they lower infrastructure administration costs and facilitate seamless updates and system integration.

Global Healthcare IT Spending Market, By Technology:

- The electronic health records (EHR) / EMR segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on technology, the global healthcare IT spending market is segmented into electronic health records (EHR) EMR, telehealth/telemedicine, mHealth & wearables, healthcare analytics & big data AI, medical imaging & PACS, cybersecurity & identity access management, and interoperability/health information exchange (HIE). Among these, the electronic health records (EHR) EMR segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. EHR EMR solutions have solidified their dominant position in the industry by acting as the fundamental platforms for healthcare IT infrastructure, facilitating interoperability, safe data storage, and effective patient care management.

The healthcare analytics & big data / AI segment in the healthcare IT spending market is expected to grow at the fastest CAGR over the forecast period. The growing need for population health management, AI-enabled clinical decision support, predictive analytics, and individualized treatment regimens is driving the expansion of the healthcare analytics & big data/AI industry. Real-time insights from vast amounts of clinical and operational data are being made possible by developments in machine learning, deep learning, and big data platforms.

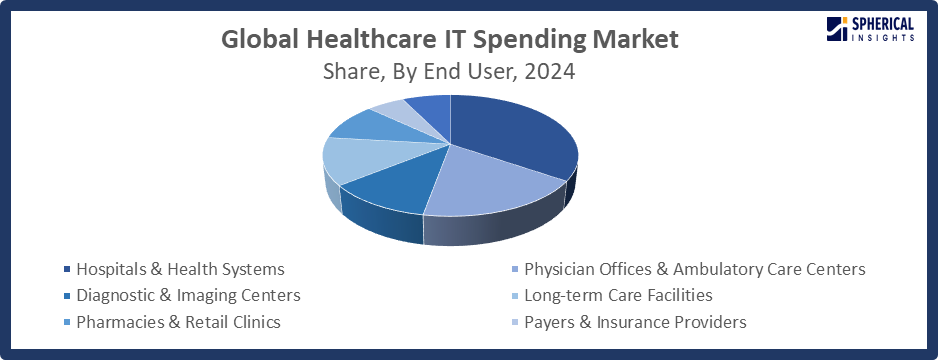

Global Healthcare IT Spending Market, By End User:

- The hospitals & health systems segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on end user, the global healthcare IT spending market is segmented into hospitals & health systems, physician offices & ambulatory care centers, diagnostic & imaging centers, long-term care facilities, pharmacies & retail clinics, payers & insurance providers, and government & public health agencies. Among these, the hospitals & health systems segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The large number of patients under management, intricate clinical workflows, and the significant investments hospitals make in IT infrastructure such as electronic health records (EHRs), telehealth systems, clinical decision support tools, and cybersecurity solutions are what propel the hospitals and health systems market.

Get more details on this report -

The physician offices & ambulatory care centers segment in the healthcare IT spending market is expected to grow at the fastest CAGR over the forecast period. Investments in ambulatory care facilities are being accelerated by growing government incentives, digital health programs, and the demand for affordable, scalable IT solutions.

Regional Segment Analysis of the Global Healthcare IT Spending Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Healthcare IT Spending Market Trends

North America is expected to hold the largest share of the global healthcare IT spending market over the forecast period.

The extensive use of telehealth platforms, electronic health records (EHRs), and healthcare analytics systems in hospitals, clinics, and research facilities is largely responsible for the North American region. Healthcare providers in the US and Canada are increasing their IT spending due to the growing emphasis on patient-centered care, data-driven clinical decision-making, and value-based healthcare models. The adoption of cutting-edge IT solutions is also being fueled by the increasing prevalence of chronic illnesses and the need for effective healthcare management systems.

U.S Healthcare IT Spending Market Trends

Digital transformation and technology innovation are driving major changes in the U.S. healthcare IT spending market. In order to improve treatment delivery and operational efficiency, telehealth services, remote patient monitoring systems, and electronic health records (EHRs) have become widely used. Predictive analytics, clinical decision support, and administrative automation are using artificial intelligence (AI) and machine learning (ML) more and more. The use of cloud computing is growing in order to increase cost-effectiveness, scalability, and interoperability.

Canada Healthcare IT Spending Market Trends

Growing investments in digital health solutions targeted at enhancing patient care and operational effectiveness are what define the Canada Healthcare IT Spending Market. The use of telemedicine platforms, remote patient monitoring systems, and electronic health records (EHRs) to improve accessibility and continuity of care are important trends. Data analytics and artificial intelligence (AI) are being used more and more for resource management, clinical decision support, and predictive insights. Cloud-based healthcare management systems are becoming more popular since they are safe, scalable, and economical.

Asia Pacific Healthcare IT Spending Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the healthcare IT spending market during the forecast period.

A variety of coordinated government-led initiatives and technical advancements across numerous nations are driving the expansion of the Asia Pacific area. For instance, India's Ayushman Bharat Digital Mission is to establish a single digital health ecosystem that includes telemedicine access, electronic health records, and health-ID linkage. Healthcare practitioners are able to access underserved communities, particularly in rural and isolated locations, thanks to the rapid rollout of telehealth platforms, mobile health (mHealth) apps, cloud-based services, artificial intelligence diagnostics, and remote patient monitoring.

China Healthcare IT Spending Market Trends

China's healthcare IT sector is growing quickly as a result of government changes and regulations for digital health. Estimates indicate that the "medical digitization" push has spurred investments. Additionally, the nation's AI-healthcare market is expected to grow tenfold by 2028 thanks to unified EMR systems, broad 5G deployment, and state-led data-sharing platforms. Strong regulatory support, infrastructure digitization, and quick adoption of AI and telehealth solutions define China's trend in healthcare IT spending.

Japan Healthcare IT Spending Market Trends

The Japanese healthcare IT market is expanding gradually, with a focus on digital transformation in clinics and hospitals. The need to improve continuity of care and decrease diagnostic duplication is driving an increase in the use of interoperable systems and electronic health records (EHRs). Furthermore, procedures for administration and diagnosis are increasingly incorporating cloud computing, IoT, machine learning, and artificial intelligence.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global Healthcare IT Spending market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Healthcare IT Spending Market Include

- Epic Systems Corporation

- Oracle Health (Cerner Corporation)

- Microsoft Corporation

- Amazon Web Services (AWS)

- Google LLC (Google Cloud Healthcare)

- Siemens Healthineers AG

- GE HealthCare Technologies Inc.

- Philips Healthcare

- Allscripts Healthcare Solutions (Veradigm)

- Meditech

- Accenture plc

- Cognizant Technology Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In October 2024, Royal Philips and Siloam Hospitals Group launched a strategic collaboration by signing an MoU to advance AI capabilities in Indonesia’s healthcare sector, promoting digital innovation, enhancing clinical efficiency, and accelerating technology adoption across healthcare systems.

- In September 2024, GE HealthCare (Nasdaq: GEHC) launched the advanced Venue ultrasound systems and Venue Sprint, integrating AI-enabled tools, wireless probe connectivity, and ViewPoint™ 6 updates. These innovations enhance point-of-care imaging, optimize clinical workflows, and are expected to drive increased adoption and spending within the Healthcare IT Spending market.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Healthcare IT Spending market based on the following segments:

Global Healthcare IT Spending Market, By Component

- Hardware

- Software

- Services

Global Healthcare IT Spending Market, By Deployment Mode

- On-premises

- Cloud-based / SaaS

- Hybrid

Global Healthcare IT Spending Market, By Technology

- Electronic Health Records (EHR) / EMR

- Telehealth / Telemedicine

- mHealth & Wearables

- Healthcare Analytics & Big Data / AI

- Medical Imaging & PACS

- Cybersecurity & Identity Access Management

- Interoperability / Health Information Exchange (HIE)

Global Healthcare IT Spending Market, By End User

- Hospitals & Health Systems

- Physician Offices & Ambulatory Care Centers

- Diagnostic & Imaging Centers

- Long-term Care Facilities

- Pharmacies & Retail Clinics

- Payers & Insurance Providers

- Government & Public Health Agencies

Global Healthcare IT Spending Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the healthcare IT spending market over the forecast period?The global healthcare IT spending market is projected to expand at a CAGR of 11.5% during the forecast period.

-

2. What is the market size of the healthcare IT spending market?The Global healthcare IT spending market size is expected to hold a significant share by 2035, at a CAGR of 11.5% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the healthcare IT spending marketNorth America is anticipated to hold the largest share of the healthcare IT spending market over the predicted timeframe

-

4. Who are the top companies operating in the global healthcare IT spending market?Epic Systems Corporation, Oracle Health (Cerner Corporation), Microsoft Corporation, Amazon Web Services (AWS), Google LLC (Google Cloud Healthcare), Siemens Healthineers AG, GE HealthCare Technologies Inc., Philips Healthcare, Allscripts Healthcare Solutions (Veradigm), Meditech, Accenture plc, Cognizant Technology Solutions, Others.

-

5. What factors are driving the growth of the healthcare IT spending market?The Healthcare IT Spending market is driven by increasing digital transformation, rising adoption of EHRs and telehealth, AI and cloud integration, regulatory support, and demand for efficient, data-driven, patient-centered care

-

6. What are market trends in the healthcare IT spending marketAI-powered analytics, telemedicine growth, cloud-based solutions, interoperability emphasis, cybersecurity improvements, IoT and wearable usage, EHR modernization, and government programs promoting digital healthcare transformation are some of the major trends.

-

7. What are the main challenges restricting wider adoption of the healthcare IT spending market?High implementation costs, worries about data security and privacy, interoperability issues, a lack of technical know-how, and complicated regulations that impede the smooth adoption and integration of healthcare IT all hamper market growth

Need help to buy this report?