Global Healthcare IT Integration Market Size, Share, and COVID-19 Impact Analysis, By Product (Interface/Integration Engines, Medical Device Integration, Media Integration, and Others), By Service (Implementation Services, Support and Maintenance Services, Training Services, and Consulting Services), By End-User (Hospitals, Laboratories, Clinics, Diagnostic Imaging Centers, and Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Healthcare IT Integration Market Insights Forecasts To 2035

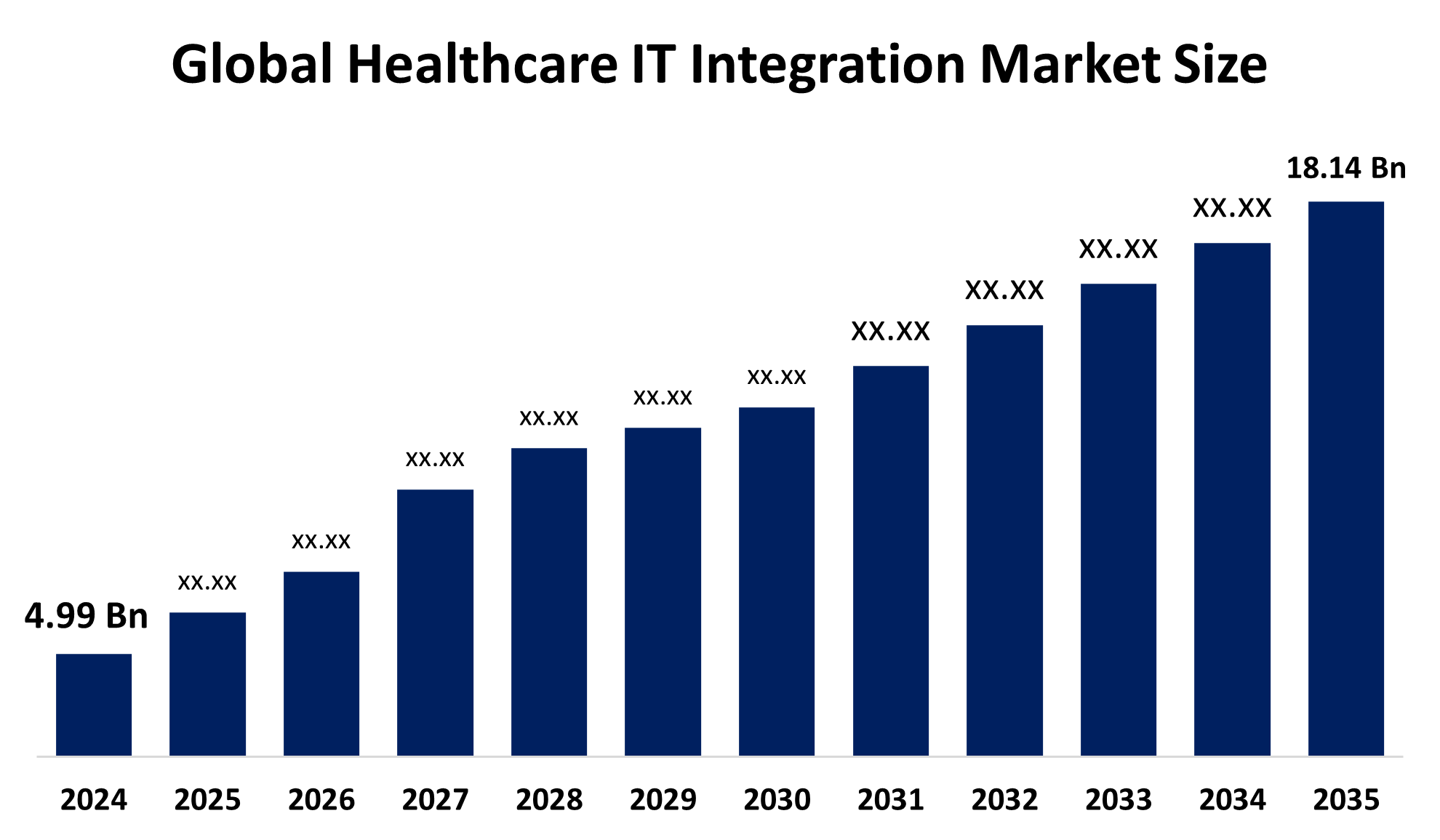

- The Global Healthcare IT Integration Market Size Was Estimated at USD 4.99 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.45% from 2025 to 2035

- The Worldwide Healthcare IT Integration Market Size is Expected to Reach USD 18.14 Billion by

- 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Healthcare IT Integration Market Size was worth around USD 4.99 Billion in 2024 and is Predicted To Grow to around USD 18.14 Billion by 2035 with a compound annual growth rate (CAGR) of 12.45% from 2025 to 2035. The healthcare IT integration market is propelled by the pressing need for data interoperability, growing demand for telehealth and chronic disease management, encouraging government policy initiatives, and the increasing adoption of connected care technologies. The emergence of EHRs, the expanding amount of healthcare data, and the demand for optimal, cost-efficient, and patient-centered care models drive the growth of the market further.

Global Healthcare IT Integration Market Analysis

- 2024 Market Size: USD 4.99 Billion

- 2035 Projected Market Size: USD 18.14 Billion

- CAGR (2025-2035): 12.45%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The healthcare IT integration market refers to the implementation of sophisticated technologies for efficient communication and data exchange between various healthcare systems, such as electronic health records (EHRs), lab info systems, imaging, billing, and patient management systems. The integration helps in improving clinical processes, improving patient care, and enhancing operational efficiency through real-time, accurate data availability for healthcare professionals. The growth of the market is mostly influenced by growing digital transformation projects, growing adoption of cloud computing, and the rising demand for interoperability in order to provide coordinated and efficient healthcare. In addition to this, the growing IT and telecom industries and the transition towards value-based care models also drive the growth of the market.

Realistic prospects encompass growth in telemedicine, AI-based healthcare analytics, and new markets where healthcare infrastructure is dynamically changing. Such industry leaders as Philips Healthcare, IBM Watson Health, Epic Systems, and Cerner Corporation are already forging innovative integration offerings on the basis of artificial intelligence (AI) and sophisticated analytics to enhance diagnostics and treatment results. Government regulation is also responsible, as in the case of the US 21st Century Cures Act and FHIR standards, which facilitate interoperability and data standardization, and India's Pradhan Mantri Digital Health Mission, which looks towards countrywide digitization of medical records. Facilitator policies, financial incentives for EHR adoption, and draconian data privacy legislation all drive adoption in pervasive integration, and such a market becomes essential to the future of effective, patient-centered healthcare globally.

Key Market Insights

- North America is expected to account for the largest share in the healthcare IT integration market during the forecast period.

- In terms of product, the interface/integration engines segment is projected to lead the healthcare IT integration market throughout the forecast period

- In terms of service, the support and maintenance services segment captured the largest portion of the market

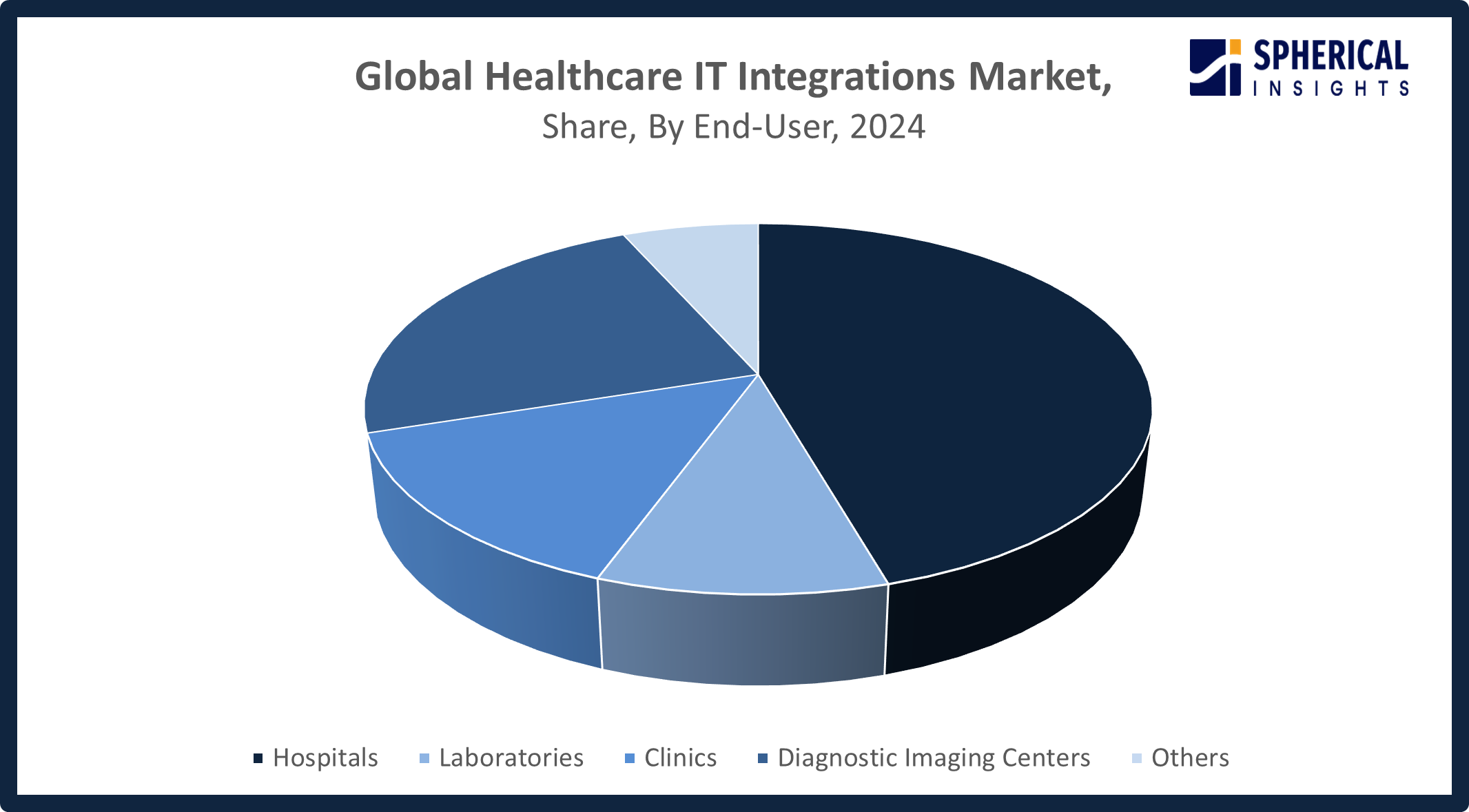

- In terms of end-user, the hospitals segment captured the largest portion of the market

Healthcare IT Integration Market Trends

- Telehealth growth increases demand for integrated virtual care platforms.

- Cloud-based solutions boost scalability and flexibility in healthcare IT integration.

- Interoperability standards such as FHIR enhance seamless data exchange.

- AI and machine learning improve predictive analytics and patient care.

- Stronger cybersecurity protects sensitive healthcare data from cyber threats.

Report Coverage

This research report categorizes the healthcare IT integration market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the healthcare IT integration market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the healthcare IT integration market.

Global Healthcare IT Integration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.99 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.45% |

| 2035 Value Projection: | USD 18.14 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Service, By End-User, By Region |

| Companies covered:: | GE HealthCare, Epic Systems Corporation, Siemens Healthineers, Orion Health Group Ltd., IBM Corporation, Medtronic, Philips Healthcare, Allscripts, Oracle Corporation, Infor, Inc., AstraZeneca, NextGen Healthcare, Inc., InterSystems Corporation, Teva Pharmaceutical Industries, Others, and |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving factors

The healthcare IT integration is propelled by digital transformation, cloud adoption, interoperability needs, AI integration, telehealth expansion, government efforts, and cost savings. Digital transformation revamps healthcare through the application of sophisticated technologies. Cloud adoption supports scalable and agile data handling. Interoperability provides smooth data transfer between systems. AI improves diagnostics and precision medicine. Telehealth expansion facilitates remote monitoring and virtual care. Government efforts encourage healthcare digitization and data protection standards. Cost-effectiveness enables the providers to reduce costs while enhancing care with integrated IT solutions.

Restraining Factor

The key restraints hindering healthcare IT integration are high cost, risk of data security, integration complexity, absence of standardization, and shortage of skilled professionals, inhibiting development. High cost renders it impossible for small providers to implement. Data security threats create patient privacy concerns. Integration complexity prevents system compatibility. Absence of universal standards discourages smooth data exchange. Shortage of skilled professionals retards adoption and efficient system administration.

Market Segmentation

The global healthcare IT integration market is divided into product, service, and end-user.

Global Healthcare IT Integration Market, By Product:

- The interface/integration engines segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on product, the global healthcare IT integration market is segmented into interface/integration engines, medical device integration, media integration, and others. Among these, the interface/integration engines segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The expansion of the interface/integration engines market is spurred by the growing demand for effortless data transfer between various intricate systems, especially in healthcare. Regulatory environments, as well as the emergence of elastic cloud computing and API-based integration offerings, drive adoption even faster, as these engines turn into a vital collection of tools for contemporary healthcare ecosystems.

The medical device integration segment in the healthcare IT integration market is expected to grow at the fastest CAGR over the forecast period. The medical device integration market is rapidly growing due to increasing demand for real-time monitoring of patients, enhanced workflow effectiveness, and growing use of connected medical devices within healthcare centers.

Global Healthcare IT Integrations Market, By Service:

- The support and maintenance services segment accounted for the largest share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

Based on service, the global healthcare IT integration market is segmented into implementation services, support and maintenance services, training services, and consulting services. Among these, the support and maintenance services segment accounted for the largest share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The maintenance and support segment's growth is fueled by the growing use of intricate, tech-intensive systems needing expert maintenance and cybersecurity. Companies depend on such services to ensure smooth operations and address the growing need for regulatory compliance, keeping systems in top performance and highly secure against advanced cyberattacks, as per industry reports.

The implementation services segment in the healthcare IT integration market is expected to grow at the fastest CAGR over the forecast period. The segment of implementation services is rapidly growing due to the increasing healthcare IT adoption, the necessity of hassle-free system deployment, expanding digital transformation initiatives, and the requirement for tailored integration solutions.

Global Healthcare IT Integrations Market, By End-User:

- The hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on end-user, the global healthcare IT integration market is segmented into hospitals, laboratories, clinics, diagnostic imaging centers, and others. Among these, the hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The hospital segment increased based on factors such as the increasing burden of chronic diseases, the aging population, and greater adoption of new medical technologies. The hospitals are also expanding to accommodate escalating volumes of inpatients and investing in new infrastructure and integrated facilities for enhanced patient care and operational effectiveness.

Get more details on this report -

The diagnostic imaging centers segment in the healthcare IT integration market is expected to grow at the fastest CAGR over the forecast period. The fastest expansion in the diagnostic imaging segment is attributed to the growing incidence of chronic ailments, requirements for early detection of disease, and greater uptake of sophisticated technologies such as AI and telemedicine, enhancing diagnosis precision and patient care in integrated IT platforms.

Regional Segment Analysis of the Global Healthcare IT Integration Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Healthcare IT Integration Market Trends

North America is expected to hold the largest share of the global healthcare IT integration market over the forecast period.

Get more details on this report -

North America is dominating the global market for healthcare IT integration due to its superior healthcare infrastructure, high rate of digital technology adoption, and robust governmental backing for digitization programs in healthcare. It gains from huge investments in AI, cloud technology, and standards such as FHIR for interoperability. In addition, growing needs for effective patient data management, rising demand for telehealth, and aggressive regulatory environments are further driving data security, further propelling the market's growth in North America.

U.S. Healthcare IT Integration Market Trends

U.S. healthcare IT integration market expands with growing adoption of digital health, government support in the form of the 21st Century Cures Act, telehealth growth, integration of AI, and data interoperability and security.

Asia Pacific Healthcare IT Integration Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the healthcare IT integration market during the forecast period. The Asia Pacific is rapidly growing in the healthcare IT integration market, attributed to the increasing digitalization in healthcare systems and growing adoption of innovative technologies such as AI, cloud computing, and IoT. Increased government spending on healthcare infrastructure, increasing telehealth services, and raising awareness of the value of integrated healthcare solutions further propel market expansion. Furthermore, Asia Pacific's huge population, rising chronic disease rate, and enhancement in healthcare facilities boost demand for effective data management and interoperability, and hence, Asia Pacific emerges as a prominent growth area for healthcare IT integration.

India Healthcare IT Integration Market Trends

India's healthcare IT integration market is expanding due to government programs such as the Digital Health Mission, mounting EHR adoption, growing use of telemedicine, growing healthcare infrastructure, and increased need for interoperability and effective patient data management among healthcare providers.

China Healthcare IT Integration Market Trends

China's healthcare IT integration market is expanding due to government policies of digitization, growing investments in healthcare IT, growing adoption of telehealth, growing adoption of AI, and the need for uninterrupted data exchange between healthcare systems.

Japan Healthcare IT Integration Market Trends

Japan's healthcare IT integration market expands owing to aging population needs, government encouragement for digital healthcare, deployment of AI and IoT technologies, focus on interoperability, and greater investments in healthcare IT infrastructure.

Europe Healthcare IT Integration Market Trends

Europe's healthcare IT integration market is expanding, attributed to robust government initiatives fostering digital health and interoperability, high adoption of AI and cloud-based technologies, and heightened demand for effective patient data management. Moreover, increased investments in telehealth, robust data privacy laws such as GDPR, and emphasis on enhancing healthcare outcomes propel the market growth across the region.

U.K. Healthcare IT Integration Market Trends

The U.K. healthcare IT integration market expands owing to the government digital health initiatives, NHS modernization strategies, growing adoption of AI, telehealth services, and intense emphasis on data interoperability and patient data security compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global healthcare IT integration market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Healthcare IT Integration Market Include

- GE HealthCare

- Epic Systems Corporation

- Siemens Healthineers

- Orion Health Group Ltd.

- IBM Corporation

- Medtronic

- Philips Healthcare

- Allscripts

- Oracle Corporation

- Infor, Inc.

- AstraZeneca

- NextGen Healthcare, Inc.

- InterSystems Corporation

- Teva Pharmaceutical Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In August 2025, NextGen Healthcare announced its NextGen Enterprise EHR version 8 achieved ONC Health IT Certification, meeting stringent ASTP and ONC standards and becoming one of the few healthtech companies to comply with these advanced health IT requirements.

- In July 2025, Philips launched its ECG AI marketplace, centralizing cardiac care solutions. Anumana, the first third-party vendor, offers its FDA-cleared ECG AI LEF algorithm, which analyzes ECGs to detect reduced ejection fraction, an early heart failure indicator.

- In June 2025, AstraZeneca expanded its Global Hub in Bangalore, adding 400 jobs and nearly 1,300 employees, enhancing AI-driven innovation in R&D, Global Business Services, IT, and Digital Health within India.

- In June 2025, Oracle announced the Oracle Defense Ecosystem, a global initiative to enhance U.S. and allied security by accelerating defense innovation through cloud and AI technologies, creating new opportunities for defense technology developers worldwide.

- In March 2025, InterSystems launched IntelliCare, an AI-powered EHR and healthcare information system designed to transform how clinicians, administrators, and patients interact with healthcare technology worldwide.

- In April 2025, Siemens Healthineers introduced MAGNETOM Flow and SOMATOM Pro. Pulse at Vietnam’s Expanding the Future of Care event, showcasing innovations aimed at enhancing diagnostic accuracy, efficiency, and sustainability to over 120 leading healthcare professionals nationwide.

- In June 2024, Oracle NetSuite launched SuiteSuccess Healthcare Edition, enabling healthcare organizations to boost efficiency, ensure HIPAA compliance, and leverage cloud and AI technologies for better decision-making, resource management, and enhanced patient care.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the healthcare IT integration market based on the following segments:

Global Healthcare IT Integration Market, By Product

- Interface/Integration Engines

- Medical Device Integration

- Media Integration

- Others

Global Healthcare IT Integrations Market, By Service

- Implementation Services

- Support and Maintenance Services

- Training Services

- Consulting Services

Global Healthcare IT Integrations Market, By End-User

- Hospitals

- Laboratories

- Clinics

- Diagnostic Imaging Centers

- Others

Global Healthcare IT Integrations Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the healthcare IT integration market over the forecast period?The global healthcare IT integration market is projected to expand at a CAGR of 12.45% during the forecast period.

-

2. What is the market size of the healthcare IT integration market?The global healthcare IT integration market size is expected to grow from USD 4.99 billion in 2024 to USD 18.14 billion by 2035, at a CAGR 12.45% of during the forecast period 2025-2035.

-

3. What are market trends in the healthcare IT integration market?Key trends include AI integration, cloud-based solutions, telehealth expansion, interoperability standards, data security focus, and government-led digital health initiatives.

-

4. Which region holds the largest share of the healthcare IT integration market?North America is anticipated to hold the largest share of the healthcare IT integration market over the predicted timeframe.

-

5. What factors are driving the growth of the healthcare IT integration market?Growth of the healthcare IT integration market is driven by digital transformation, cloud adoption, rising telehealth use, demand for interoperability, AI integration, government initiatives, and the need for efficient patient data management.

-

6. What are the main challenges restricting wider adoption of the healthcare IT integration market?High implementation costs, data security concerns, system integration complexity, lack of interoperability standards, and shortage of skilled IT professionals hinder adoption.

-

7. Who are the top 10 companies operating in the global healthcare IT integration market?The major players operating in the healthcare IT integration market are GE HealthCare, Epic Systems Corporation, Siemens Healthineers, Orion Health Group Ltd., IBM Corporation, Medtronic, Philips Healthcare, Allscripts, Oracle Corporation, Infor, Inc., and Others.

Need help to buy this report?