Global Healthcare ERP Market Size, Share, and COVID-19 Impact Analysis, By Function (Inventory & Material Management, Supply Chain & Logistics Management, Patient Relationship Management, Finance and Billing, and Others), By Deployment (On-premises and Cloud), By End-use (Hospitals, Clinics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Healthcare ERP Market Size Forecasts to 2035

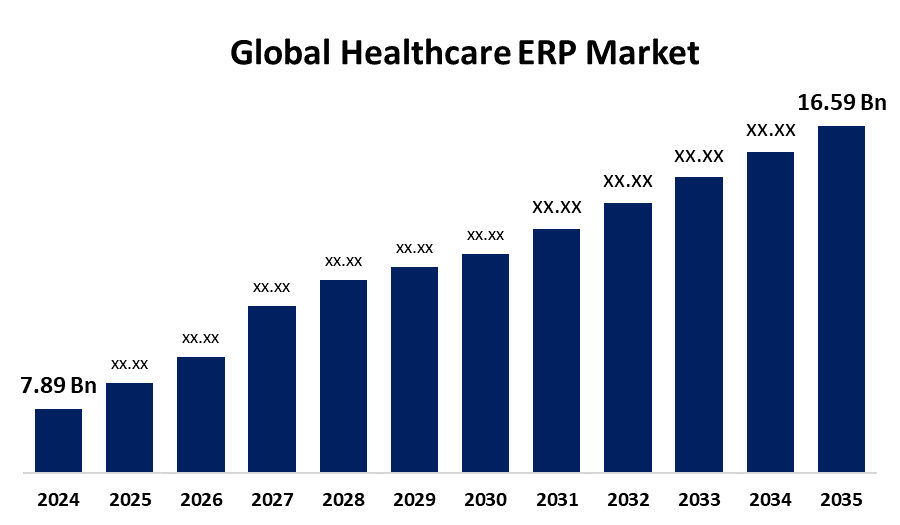

- The Global Healthcare ERP Market Size Was Estimated at USD 7.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.99% from 2025 to 2035

- The Worldwide Healthcare ERP Market Size is Expected to Reach USD 16.59 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global healthcare ERP market size was worth around USD 7.89 billion in 2024 and is predicted to grow to around USD 16.59 billion by 2035 with a compound annual growth rate (CAGR) of 6.99% from 2025 to 2035. The market growth is boosted by technological advancements, and rising operational demands are fueling the widespread adoption of ERP in healthcare. Cloud deployment and AI integration are key drivers propelling the industry's continuous growth and transformation.

Market Overview

The healthcare ERP market refers to a comprehensive software application designed to manage and combine essential healthcare operations, such as finance, supply chain management, human resources, patient data, and administrative processes, under a unified digital platform. By centralizing data and streamlining workflows, healthcare ERP enhances operational effectiveness, promotes informed decision-making, and improves patient care in hospitals, clinics, and other healthcare facilities.

The market growth is driven by an increasing demand for effective data and resource management. ERP solutions are being adopted by healthcare firms more frequently in an effort to improve patient outcomes and streamline operations. One significant development is the move to cloud-based ERP systems, which provide increased accessibility, scalability, and cost-effectiveness. These systems facilitate data-driven decision-making by enabling real-time analytics. The implementation of ERP is essential to promoting operational excellence and high-quality care as the healthcare industry develops further.

Report Coverage

This research report categorizes the healthcare ERP market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the healthcare ERP market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the healthcare ERP market.

Healthcare ERP Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.99% |

| 2035 Value Projection: | USD 16.59 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Function, By Deployment, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | McKesson Corporation, QAD Inc, Oracle, SAGE Group PLC, SAP SE, Epicor Software Corporation, Microsoft, Infor, Aptean, Odoo, WebPT, Google, Cognizant, NextGen Healthcare, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The need for ERP solutions is being driven by growing healthcare costs, a lack of workers, and ineffective hospital administration. Because of their affordability and simplicity of implementation, cloud-based ERP systems are becoming more and more popular, particularly among small and medium-sized healthcare organizations. ERP adoption was further accelerated by the COVID-19 pandemic, which brought to light the urgent need for remote access and optimized processes. AI technology integration is improving ERP features, allowing for more intelligent decision-making and individualized patient care. To increase ERP capabilities, major firms are spending money on partnerships and innovations. When taken as a whole, these developments propel the global healthcare ERP industry toward steady expansion and change.

Restraining Factors

The market growth is hindered by the strict adherence to regulations when implementing healthcare ERP. Regular audits and ongoing monitoring are necessary to ensure that these systems adhere to changing regulatory standards. HIPAA compliance necessitates stringent access controls and frequent security audits. Therefore, modifications to HIPAA rules pose a big problem for healthcare institutions.

Market Segmentation

The healthcare ERP market share is classified into function, deployment, and end use.

- The finance and billing segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the function, the healthcare ERP market is classified into inventory & material management, supply chain & logistics management, patient relationship management, finance and billing, and others. Among these, the finance and billing segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the ERP solutions are being quickly adopted by healthcare firms in order to streamline operations and reduce barriers between back-end chores like claims processing and front-end revenue cycle management tasks. These systems are being adopted by businesses to manage ledgers, reporting, risk management, fixed asset management, tax management, multi-currency management, and financial data silos.

- The on-premises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the deployment, the healthcare ERP market is divided into on-premises and cloud. Among these, the on-premises segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by a number of advantages, such as inexpensive maintenance, less reliance on vendors, remote access, lower expenses, total operational control, simple customization, and improved security and privacy. Installing systems and solutions on the company's computers is known as "shrink-wrap," or on-premises software deployment. These solutions can be accessed remotely even if they are deployed on local servers, which lowers implementation costs and power usage.

- The hospitals segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the healthcare ERP market is classified into hospitals, clinics, and others. Among these, the hospitals segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the requirement for effective patient and physician management solutions that lower paperwork, boost efficiency, and improve patient care, while keeping budgetary costs under control is a major factor propelling the hospital segment of the market. ERP software is being used by a lot of healthcare firms to improve hospital operations.

Regional Segment Analysis of the Healthcare ERP Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the healthcare ERP market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the healthcare ERP market over the predicted timeframe. The regional growth can be attributed to the increasing demand for enhanced infrastructure, regulatory compliance, and operational efficiency. This trend is emphasized by market participants' strategic actions, such as Tecsys' partnership with AMG. ERP skills are further improved by the combination of cloud computing and data analytics. All of these developments contribute to the healthcare ERP market's steady expansion.

Asia Pacific is expected to grow at a rapid CAGR in the healthcare ERP market during the forecast period. The region's growth is being driven by the increasing healthcare costs and the growing scarcity of workers. The Asia Pacific market is also expanding due to the inadequate management of health institutions' services, the expanding patient base, the growing use of cutting-edge technology, and the rise of start-ups. Additionally, the sector is drawing in both public and private infrastructure and promoting both economic growth and infrastructural development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the healthcare ERP market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- McKesson Corporation

- QAD Inc

- Oracle

- SAGE Group PLC

- SAP SE

- Epicor Software Corporation

- Microsoft

- Infor

- Aptean

- Odoo

- WebPT

- Cognizant

- NextGen Healthcare

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, SAP announced the integration of Amazon Web Services' Bedrock generative AI into its AI Core. This integration intends to improve the performance and efficiency of cloud-based enterprise workloads while also integrating generative AI capabilities into clients' important business applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the healthcare ERP market based on the below-mentioned segments:

Global Healthcare ERP Market, By Function

- Inventory & Material Management

- Supply Chain & Logistics Management

- Patient Relationship Management

- Finance and Billing

- Others

Global Healthcare ERP Market, By Deployment

- On-premises

- Cloud

Global Healthcare ERP Market, By End-use

- Hospitals

- Clinics

- Others

Global Healthcare ERP Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the healthcare ERP market over the forecast period?The global healthcare ERP market is projected to expand at a CAGR of 6.99% during the forecast period.

-

2. What is the market size of the healthcare ERP market?The global healthcare ERP market size is expected to grow from USD 7.89 Billion in 2024 to USD 16.59 Billion by 2035, at a CAGR of 6.99% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the healthcare ERP market?North America is anticipated to hold the largest share of the healthcare ERP market over the predicted timeframe.

Need help to buy this report?