Global Health Information Exchange Market Size, Share, and COVID-19 Impact Analysis, By Setup (Private HIE and Public HIE), By Implementation Model (Centralized HIE Model, Decentralized HIE Model, and Hybrid HIE Model), and by Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Health Information Exchange Market Insights Forecasts to 2035

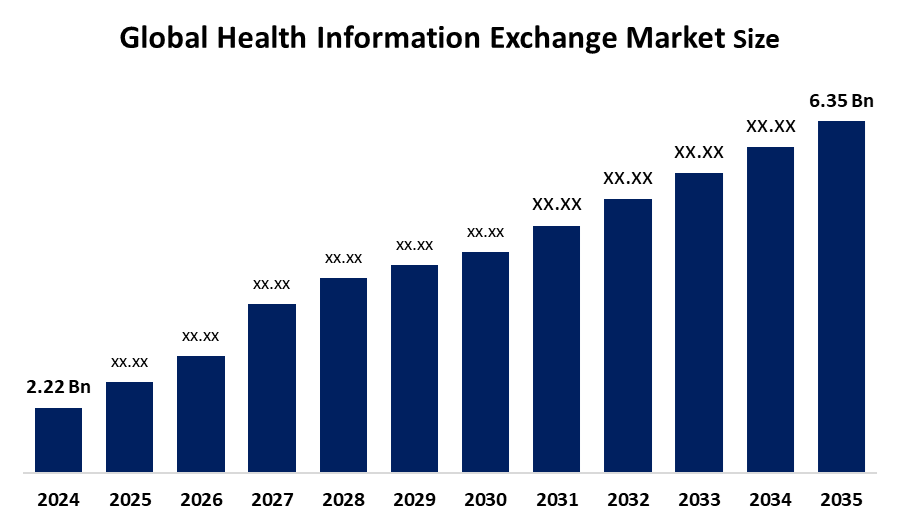

- The Global Health Information Exchange Market Size Was Estimated at USD 2.22 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.03 % from 2025 to 2035

- The Worldwide Health Information Exchange Market Size is Expected to Reach USD 6.35 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The global Health Information Exchange market Size was worth around USD 2.22 Billion in 2024 and is predicted to Grow to around USD 6.35 Billion by 2035 with a compound annual growth rate (CAGR) of 10.03% from 2025 to 2035. Future opportunities include AI-driven analytics, cloud-based HIE platforms, expanded telehealth integration, predictive population health insights, and increased government funding for interoperable digital health infrastructure.

Market Overview

Health information exchange (HIE) refers to the electronic sharing of patient health data across healthcare organizations to improve care coordination, safety, and efficiency. The market is driven by the rising adoption of electronic health records (EHRs), increasing prevalence of chronic diseases, and the need to reduce medical errors and duplicate tests. According to the World Health Organization, over 70% of countries have a national digital health strategy, supporting interoperable data exchange. Government initiatives such as the U.S. 21st Century Cures Act and India’s Ayushman Bharat Digital Mission (ABDM) promote standardized health data sharing. Additionally, studies show HIE use can reduce hospital readmissions by 10–15%, highlighting its growing importance in modern healthcare systems.

Report Coverage

This research report categorizes the health information exchange market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the health information exchange market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the health information exchange market.

Global Health Information Exchange Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.22 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.03% |

| 2035 Value Projection: | USD 6.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Segments covered: | By Setup |

| Companies covered:: | BM, Siemens Healthcare Private Limited, Orion Health group of companies, Veradigm LLC, CareEvolution, LLC., Oracle, eClinicalWorks, RelayHealth (McKinsey & Company) , and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the health information exchange market is driven by increasing demand for interoperable healthcare systems and real-time access to patient data. Rising chronic disease burden and aging populations require coordinated, data-driven care across providers. Government mandates promoting EHR adoption and data standardization further accelerate HIE implementation. Additionally, growing focus on value-based care, reduction of medical errors, and improved clinical decision-making is encouraging hospitals and payers to invest in secure and scalable health information exchange solutions.

Restraining Factors

High implementation costs, data privacy and cybersecurity concerns, lack of interoperability standards, and resistance to data sharing among healthcare providers limit widespread adoption of health information exchange systems.

Market Segmentation

The health information exchange market share is classified into setup and implementation model.

- The private HIE segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the setup, the health information exchange market is divided into private HIE and public HIE. Among these, the private HIE segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The private HIE segment accounted for the largest share in 2024, capturing around 58–63% of the setup-type market due to healthcare providers’ preference for secure, controlled, and customizable data exchange environments. This segment is also anticipated to grow at a significant CAGR over the forecast period, outpacing the public HIE segment, as private networks offer enhanced data governance and are widely adopted by large hospital networks and integrated delivery systems.

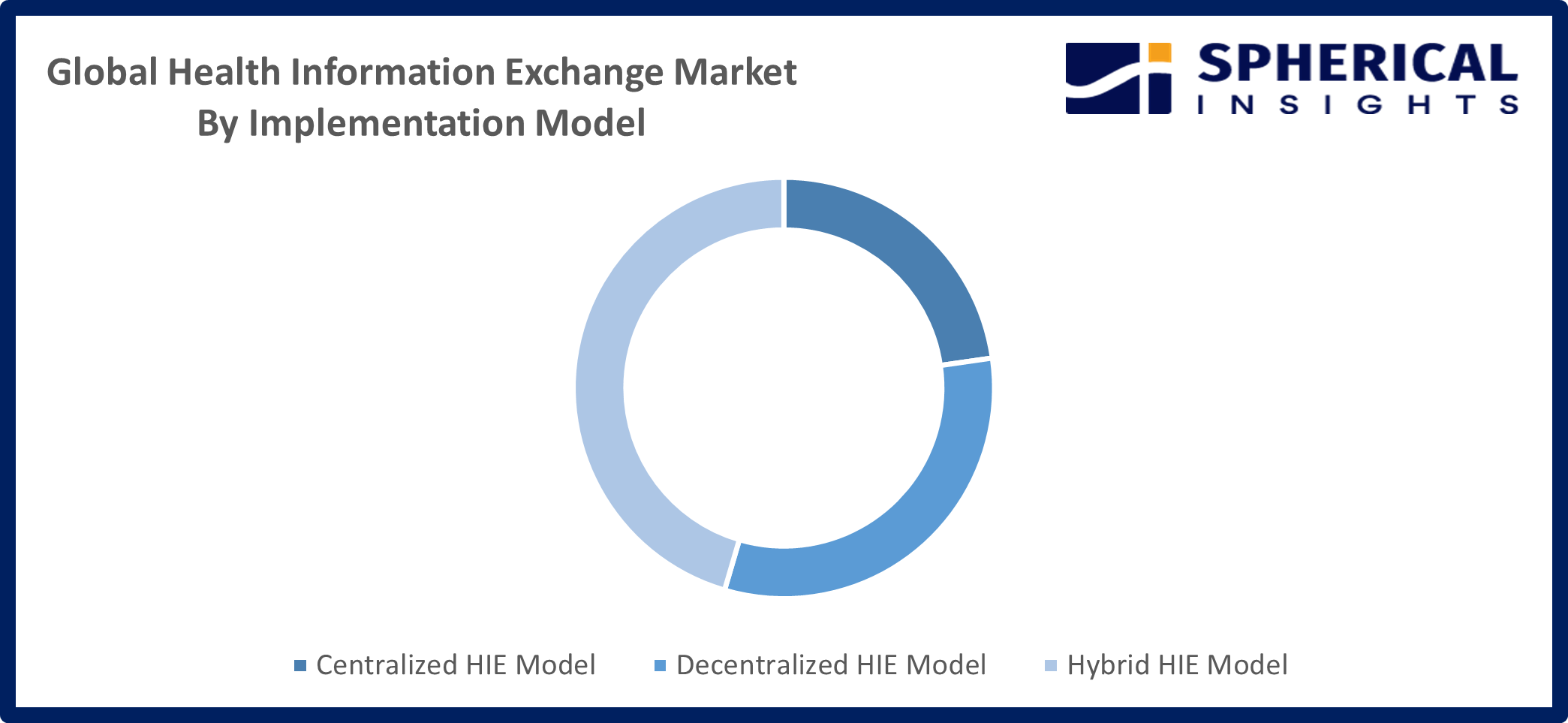

- The hybrid HIE model segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the implementation Model, the health information exchange market is divided into centralized HIE model, decentralized HIE model, and hybrid HIE model. Among these, the hybrid HIE model segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This architecture supports both broad interoperability and localized control, making it preferable for diverse healthcare organizations. The hybrid HIE Model is also anticipated to grow at a significant CAGR during the forecast period as healthcare systems increasingly seek scalable, secure, and adaptable data-sharing solutions.

Get more details on this report -

Regional Segment Analysis of the Health Information Exchange Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Health Information Exchange market over the predicted timeframe.

North America is anticipated to hold the largest share of the health information exchange market over the predicted timeframe. This dominance is driven by the region’s advanced healthcare IT infrastructure, widespread adoption of electronic health records (EHRs), strong regulatory mandates supporting interoperability, and significant investments in digital health solutions, particularly in the United States and Canada. North America accounted for the largest portion of global HIE revenue in 2024, with about 46–47% share, and is expected to maintain its leadership throughout the forecast period.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR in the health information exchange market during the forecast period. Asia Pacific is expected to grow at a rapid CAGR due to increasing healthcare digitization, expanding EHR adoption, rising patient volumes, and strong government initiatives such as India’s ABDM and China’s health IT reforms, which promote interoperable data sharing and improved healthcare delivery across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the health information exchange market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- Siemens Healthcare Private Limited

- Orion Health group of companies

- Veradigm LLC

- CareEvolution, LLC.

- Oracle

- eClinicalWorks

- RelayHealth (McKinsey & Company)

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, HL7 International has launched a new Artificial Intelligence (AI) Office to lead the development of global standards for safe, explainable, interoperable and scalable AI in healthcare

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the health information exchange market based on the below-mentioned segments:

Global Health Information Exchange Market, By Setup

- Private HIE

- Public HIE

Global Health Information Exchange Market, By Implementation Model

- Centralized HIE Model

- Decentralized HIE Model

- Hybrid HIE Model

Global Health Information Exchange Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the health information exchange market over the forecast period?The global health information exchange market is projected to expand at a CAGR of 10.03% during the forecast period.

-

2. What is the market size of the health information exchange market?The global health information exchange market size is expected to grow from USD 2.22 billion in 2024 to USD 6.35 billion by 2035, at a CAGR of 10.03 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the health information exchange market?North America is anticipated to hold the largest share of the health information exchange market over the predicted timeframe

-

4. Who are the top 10 companies operating in the global health information exchange market?IBM, Siemens Healthcare Private Limited, Orion Health Group, Veradigm LLC, CareEvolution, LLC., Oracle, eClinicalWorks, and RelayHealth (McKinsey & Company).

-

5. What factors are driving the growth of the health information exchange market?Rising EHR adoption, demand for interoperable healthcare systems, government digital health initiatives, value-based care models, and need for secure real-time patient data exchange

-

6. What are the market trends in the health information exchange market?Key trends include AI integration, cloud-based HIE solutions, enhanced cybersecurity, interoperability standards adoption, and rising partnerships among healthcare stakeholders.

-

7. What are the main challenges restricting the wider adoption of the health information exchange market?High implementation costs, data privacy and security concerns, interoperability issues, regulatory complexity, and resistance to data sharing among healthcare providers

Need help to buy this report?