Global Halo Butyl Rubber Market Size, Share, and COVID-19 Impact Analysis, By Type (Chloro-Butyl Rubber, Bromo-Butyl Rubber, and Others), By Application (Tubes & Tires, Pharmaceuticals, Construction, Automotive, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Halo Butyl Rubber Market Insights Forecasts to 2035

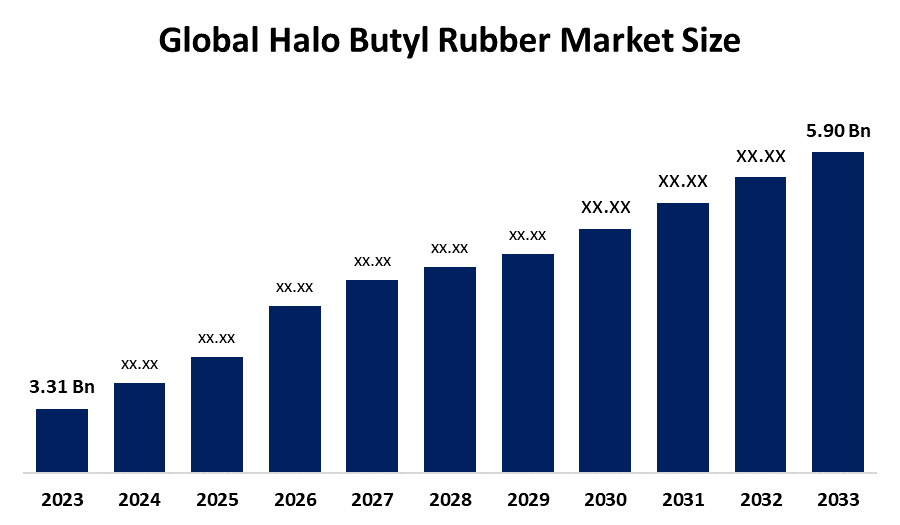

- The Global Halo Butyl Rubber Market Size Was Estimated at USD 3.31 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.4% from 2025 to 2035

- The Worldwide Halo Butyl Rubber Market Size is Expected to Reach USD 5.90 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global halo butyl rubber market size was worth around USD 3.31 billion in 2024 and is predicted to grow to around USD 5.90 billion by 2035 with a compound annual growth rate (CAGR) of 5.4% from 2025 to 2035. Opportunities in the halo butyl rubber market include growing demand in the automotive and pharmaceutical industries, improvements in polymer modification technologies, an increase in air-retention component applications, and a rise in the use of compliant sealing solutions.

Market Overview

The Halo Butyl Rubber market Size is an ecosystem that includes the synthesis, trade, and application of halo butyl rubber, a specialty synthetic elastomer made from butyl rubber halogenation. Halobutyl rubber, consisting of around 98% isobutylene copolymer with isoprene, capitalizes on its advantages through impermeability to gases, bonding properties, and rapid vulcanization, making it a high-performance application. In primarily used in automotive tire inner liners for the purpose of keeping the air inside the tire and saving fuel consumption. They are also used in pharmaceutical closures and construction sealants. Moreover, the industrial adhesives market is also attracted by the strong safety and sustainability standards and regulations. The food and beverage sector is a fast-growing sector, and as a result, there is an increasing requirement for halo butyl rubber to be used in the processing and packing of food. The market for Halo Butyl Rubber is driven by demand as the Tyre and Inner Tube industry continues to use increasingly Besides, the continuous improvements in the manufacturing techniques coupled with the process optimization are predicted to be the major factors in the growth of the halo butyl rubber market as the quality of the product is improved and the production costs are reduced, and the application areas are expanded.

Report Coverage

This research report categorizes the halo butyl rubber market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the halo butyl rubber market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the halo butyl rubber market.

Global Halo Butyl Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.31 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 5.4% |

| 024 – 2035 Value Projection: | USD 5.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Companies covered:: | Eswar Rubber Products Pvt. Ltd., Natraj Rubbers, Japan Butyl Co. Ltd, Zhejiang Cenway Materials Co., Ltd., Reliance Industries Limited, Sinopec Group, SIBUR Holding PJSC, Lanxess AG, ARLANXEO Holding BV, Exxon Mobil Corporation, And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The continuous progress in manufacturing technologies and process optimization is driving the halo butyl rubber market growth further by, besides other things, product quality improvement, production cost reduction, and application opportunity expansion. The factors driving the halo butyl rubber market growth are polymer engineering, high-performance elastomers demand, product quality standards, and global industrialization. Another factor propelling the halo butyl rubber market growth is the increasing use of halo butyl rubber in the construction sector for producing waterproofing membranes, sealants, and adhesives. The healthcare industry is another sector that pushes the market forward; the demand for HBR in medical packaging and equipment, in which sterility and chemical resistance are a must, is growing.

Restraining Factors

The halo butyl rubber market is restricted by the changes in the pricing of raw materials, the high cost of production, the scarcity of specialized manufacturing facilities, and the competition from other elastomer types, coupled with the strict environmental regulations that have an impact on the processing and disposal of halogenated polymers.

Market Segmentation

The halo butyl rubber market share is classified into type and application.

- The bromo-butyl rubber segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the halo butyl rubber market is divided into chloro-butyl rubber, bromo-butyl rubber, and others. Among these, the bromo-butyl rubber segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The bromo-butyl rubber market is driven by its improved compatibility with different polymers, air impermeability, and greater chemical resistance. Additionally, the market for bromo-butyl rubber is developing owing to the healthcare and automotive industries' rising need, the regulatory focus on product safety, and the continuous development of polymer modification technologies that improve durability and performance.

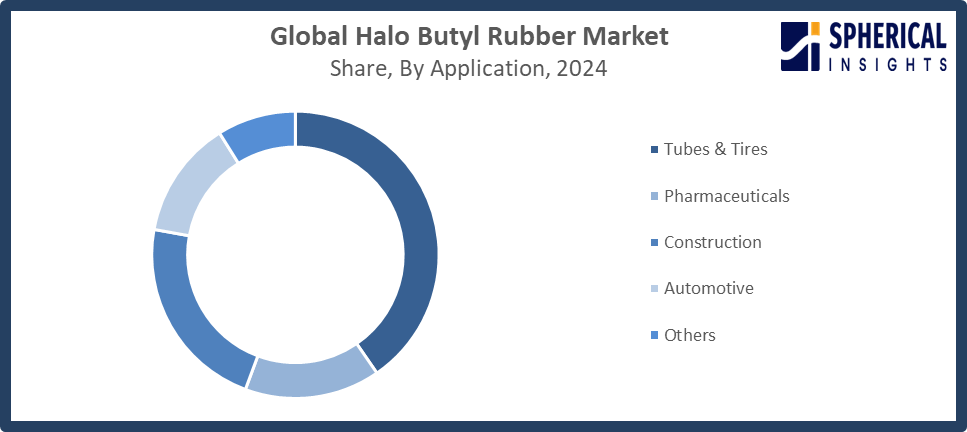

- The tubes & tires segment accounted for the highest market revenue in 2024, and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the halo butyl rubber market is divided into tubes & tires, pharmaceuticals, construction, automotive, and others. Among these, the tubes & tires segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growing automotive industry, rising demand for electric vehicle (EV) tires that need high-performance inner liners, and increased manufacturing of tubeless and energy-efficient tires are the main drivers of the tubes and tires sector. In the production of tires, halo-butyl rubber is essential due to its exceptional air retention and resilience to oxidative degradation and heat.

Get more details on this report -

Regional Segment Analysis of the Halo Butyl Rubber Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the halo butyl rubber market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the halo butyl rubber market over the predicted timeframe. Strong automobile manufacturing and industrial activity in nations like China and India power the Asia-Pacific region. China, a significant manufacturer and consumer, gains from high manufacturing capacity and rising car demand. Additionally, several corporations have their manufacturing facilities in China, which is the center of the vehicle industry. In October 2025, the Rubber Council and Green Technology Corporation signed a Memorandum of Understanding to expedite net-zero transitions in halobutyl manufacturing, bringing national output into compliance with international sustainability mandates. This marked the beginning of a significant endeavor in Malaysia. Asia Pacific launched a new industry milestone as its supremacy reaches over 60% market penetration, driven by cost-effective production systems and strategic proximity to abundant raw material sources, strengthening regional competitiveness.

North America is expected to grow at a rapid CAGR in the halo butyl rubber market during the forecast period. The growing need for high-performance elastomers in industrial, medicinal, and automotive applications is driving North America. The area benefits from strong research and development efforts, sophisticated production capabilities, and the existence of significant end-use industries that need materials with exceptional air retention and chemical resistance. In order to reduce toxicity and encourage the creation of more environmentally friendly halobutyl formulations throughout the industry, the U.S. EPA released its FY 2025–2028 Action Plan addressing 6PPD and 6PPD-quinone, focusing on tire rubber deterioration.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the halo butyl rubber market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eswar Rubber Products Pvt. Ltd.

- Natraj Rubbers

- Japan Butyl Co. Ltd

- Zhejiang Cenway Materials Co., Ltd.

- Reliance Industries Limited

- Sinopec Group

- SIBUR Holding PJSC

- Lanxess AG

- ARLANXEO Holding BV

- Exxon Mobil Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2024, ARLANXEO announced that it has improved its production of sustainable halo-butyl rubber under the "Eco" label by obtaining ISCC PLUS accreditation for its butyl rubber facility in Singapore. The company's dedication to environmentally friendly tire and pharmaceutical solutions is reinforced by this development.

- In December 2023, SIBUR launched an expansion at Nizhnekamskneftekhim, boosting halo-butyl rubber capacity from 150 to 200 kilotons with six new units and renovations to meet domestic and export demand.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the halo butyl rubber market based on the below-mentioned segments:

Global Halo Butyl Rubber Market, By Type

- Chloro-Butyl Rubber

- Bromo-Butyl Rubber

- Others

Global Halo Butyl Rubber Market, By Application

- Tubes & Tires

- Pharmaceuticals

- Construction

- Automotive

- Others

Global Halo Butyl Rubber Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the halo butyl rubber market over the forecast period?The global halo butyl rubber market is projected to expand at a CAGR of 5.4% during the forecast period.

-

2. What is the market size of the halo butyl rubber market?The global halo butyl rubber market size is expected to grow from USD 3.31 billion in 2024 to USD 5.90 billion by 2035, at a CAGR of 5.4% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the halo butyl rubber market?Asia Pacific is anticipated to hold the largest share of the halo butyl rubber market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global halo butyl rubber market?Eswar Rubber Products Pvt. Ltd., Natraj Rubbers, Japan Butyl Co. Ltd, Zhejiang Cenway Materials Co., Ltd., Reliance Industries Limited, Sinopec Group, SIBUR Holding PJSC, Lanxess AG, ARLANXEO Holding BV, and Exxon Mobil Corporation.

-

5. What factors are driving the growth of the halo butyl rubber market?The market for halo butyl rubber is driven by a number of factors, including increased demand from the automotive and pharmaceutical industries, technological developments in polymer modification, strict quality standards, and growing uses in sealing, packaging, and industrial products.

-

6. What are the market trends in the halo butyl rubber market?Increasing acceptance of sustainable and high-performance elastomers, development of greener halobutyl formulations, integration in medical and tire applications, and expansion in new markets define current halo butyl rubber market trends.

-

7. What are the main challenges restricting wider adoption of the halo butyl rubber market?Halo Butyl Rubber's wider industry adoption is restricted by high production costs, volatile raw material prices, limited manufacturing capacity, regulatory constraints, and competition from other elastomers.

Need help to buy this report?