Global Gunshot Detection Systems Market Size, Share, and COVID-19 Impact Analysis, By Installation (Fixed Installation, Soldier Mounted, and Vehicle Installation), By Application (Commercial and Defense), By System (Indoor and Outdoor), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Aerospace & DefenseGlobal Gunshot Detection Systems Market Insights Forecasts to 2033

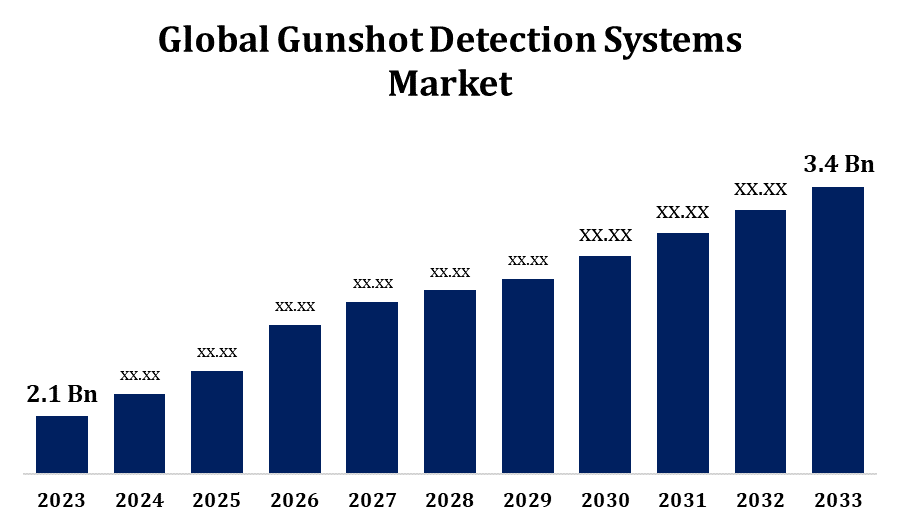

- The Gunshot Detection Systems Market Size was valued at USD 2.1 Billion in 2023.

- The Market is growing at a CAGR of 4.94% from 2023 to 2033.

- The Worldwide Gunshot Detection Systems Market Size is Expected to reach USD 3.4 Billion by 2033.

- Asia Pacific is Expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Gunshot Detection Systems Market is expected to reach USD 3.4 billion by 2033, at a CAGR of 4.94% during the forecast period 2023 to 2033.

The Global Gunshot Detection Systems Market is experiencing steady growth, driven by rising security concerns and increasing incidents of gun violence. These systems, which use acoustic sensors, infrared cameras, and AI-based analytics, help law enforcement and military forces quickly detect and respond to gunfire. Governments worldwide are investing in smart surveillance technologies to enhance public safety, boosting market demand. North America dominates due to high crime rates and strong government funding, while Asia-Pacific is witnessing rapid adoption in defense applications. The integration of gunshot detection with smart city projects and surveillance networks further fuels market expansion. However, high installation costs and privacy concerns may hinder growth. Advancements in AI and IoT-based detection solutions are expected to create new opportunities, making this a dynamic and evolving sector.

- Gunshot Detection Systems Market Value Chain Analysis

The gunshot detection systems market value chain involves multiple stages, from raw material suppliers to end users. It begins with component suppliers providing key elements like acoustic sensors, infrared cameras, and AI-driven analytics software. System manufacturers integrate these components to develop advanced gunshot detection solutions, ensuring accuracy and reliability. Distributors and system integrators then customize and deploy these solutions for law enforcement agencies, military forces, and commercial sectors. Government agencies and private organizations serve as primary end users, utilizing these systems for enhanced security and rapid response. Additionally, data analytics firms play a crucial role in refining detection accuracy through AI and IoT integration. Continuous technological advancements, regulatory frameworks, and partnerships among stakeholders drive innovation and efficiency within the gunshot detection systems value chain.

- Gunshot Detection Systems Market Opportunity Analysis

The gunshot detection systems market presents significant growth opportunities due to increasing security concerns, urbanization, and advancements in AI-driven surveillance. Governments worldwide are investing in smart city initiatives, integrating gunshot detection with surveillance networks to enhance public safety. Rising crime rates and mass shooting incidents are driving demand for real-time gunfire detection in schools, public spaces, and commercial areas. Additionally, defense and law enforcement agencies are adopting these systems for border security and military applications. Emerging economies in Asia-Pacific and the Middle East offer untapped potential due to increasing defense budgets and urban security programs. Innovations in IoT, cloud-based analytics, and AI-powered gunshot localization further expand market prospects. However, cost-effective solutions and scalable deployments will be key to widespread adoption.

Global Gunshot Detection Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 2.1 Billion |

| Forecast Period: | 2023 – 2033 |

| Forecast Period CAGR 2023 – 2033 : | 4.94% |

| 023 – 2033 Value Projection: | USD 3.4 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | Installation Analysis, Application Analysis, System Analysis, Regional Analysis |

| Companies covered:: | ACOEM Group; RTX Corporation; Thales Group; QinetiQ Group; IAI; ArianeGroup; SoundThinking, Inc.; Tracer Technology Systems, Inc.; Databuoy; Omnilert LLC. |

| Pitfalls & Challenges: | COVID-19 Impact Analysis and Forecast 2023 - 2033 |

Get more details on this report -

Market Dynamics

Gunshot Detection Systems Market Dynamics

- Rising Adoption of Gunshot Detection Systems by Law Enforcement Agencies

The growing adoption of gunshot detection systems by law enforcement agencies is a key driver of market growth. With rising crime rates and mass shooting incidents, police departments are investing in advanced surveillance technologies to enhance public safety and improve response times. These systems use acoustic sensors, AI, and real-time analytics to accurately detect and locate gunfire, enabling faster emergency responses. Government initiatives and increased funding for smart policing further boost demand. Additionally, integration with city-wide surveillance networks and IoT-based security solutions enhances system efficiency. North America leads in adoption due to strong law enforcement budgets, while developing regions are gradually investing in such technologies. As innovations in AI and cloud computing improve detection accuracy, the market is expected to expand significantly in the coming years.

- Restraints & Challenges

High installation and maintenance costs make these systems less accessible, especially for smaller municipalities and private organizations. False alarms due to environmental noises, such as fireworks or construction sounds, can reduce reliability and lead to unnecessary emergency responses. Privacy concerns also pose a challenge, as these systems often involve continuous audio surveillance, raising ethical and legal issues. Integration with existing security infrastructure can be complex and costly, requiring significant technological upgrades. Additionally, in developing regions, budget constraints and limited awareness slow adoption. Cybersecurity threats targeting cloud-based and AI-driven detection systems further add to market risks.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Gunshot Detection Systems Market from 2023 to 2033. The region's increasing concern over gun violence, mass shootings, and urban crime has led to significant investments in advanced security technologies. The U.S., in particular, is at the forefront, with federal, state, and local governments integrating gunshot detection systems into urban surveillance networks and law enforcement operations. Additionally, strong defense budgets and initiatives aimed at enhancing national security further boost market growth. The region's well-established infrastructure for smart city projects and the growing focus on IoT and AI integration also contribute to market expansion. However, privacy concerns and the high cost of deployment remain potential barriers to widespread adoption in some areas.

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. India, China, and Australia are progressively adopting these systems to combat crime and enhance law enforcement capabilities. The growing focus on modernizing military forces and border security has also driven demand for gunshot detection technologies. Additionally, the region's emphasis on smart city initiatives, integrated with advanced surveillance systems, offers significant opportunities for growth. However, challenges such as budget constraints, limited awareness, and the high cost of deployment could slow down market penetration in some countries. As economies in the region continue to develop and security concerns rise, the market for gunshot detection systems is expected to expand rapidly in the coming years.

Segmentation Analysis

- Insights by Installation

The vehicle installation segment accounted for the largest market share over the forecast period 2023 to 2033. The growth is driven by the increasing need for enhanced security in law enforcement, military, and emergency response vehicles. These systems provide real-time gunfire detection, allowing quick and accurate identification of threats, improving response times during incidents. Law enforcement agencies are increasingly equipping patrol cars, SWAT vehicles, and armored response units with these technologies to enhance situational awareness and improve safety for officers. Military vehicles, especially those operating in conflict zones, also benefit from such systems to detect sniper fire and other gun-related threats. The growing focus on integrated security solutions and mobile surveillance systems further propels this segment's growth. As vehicle-based security solutions become a priority for agencies globally, the market for vehicle-installed gunshot detection systems is expected to continue expanding.

- Insights by Application

The defence segment accounted for the largest market share over the forecast period 2023 to 2033. Armed forces are adopting these systems to detect sniper fire, gunshots, and other hostile fire in real-time, ensuring quicker responses and better protection of personnel. Military applications include installation on armored vehicles, border security, and forward-operating bases, particularly in conflict zones where rapid detection is critical. The growing emphasis on modernizing defense capabilities, coupled with rising defense budgets globally, supports the demand for advanced gunshot detection technologies. Additionally, the integration of these systems with broader surveillance and command-control networks enhances operational efficiency. As military forces continue to prioritize cutting-edge security solutions, the defense segment is expected to experience sustained growth in the market.

- Insights by System

The outdoor segment accounted for the largest market share over the forecast period 2023 to 2033. This includes parks, public squares, schools, and large-scale events where mass shootings and gun violence pose significant risks. Law enforcement agencies and event organizers are increasingly adopting gunshot detection systems to ensure quick response times and protect civilians. Additionally, the growth of smart city initiatives and urban surveillance networks contributes to the expansion of these systems in outdoor environments. Technologies like acoustic sensors and AI-driven analytics help detect gunshots in real-time, improving overall public safety. As urbanization and outdoor event frequencies increase, the demand for reliable gunshot detection solutions in open spaces is expected to grow, further driving market expansion.

Recent Market Developments

- In April 2020, Aselsan has secured a contract with a NATO member country to supply a gunshot detection system and advanced remote-controlled stabilized weapon stations.

Competitive Landscape

Major players in the market

- ACOEM Group

- RTX Corporation

- Thales Group

- QinetiQ Group

- IAI

- ArianeGroup

- SoundThinking, Inc.

- Tracer Technology Systems, Inc.

- Databuoy

- Omnilert LLC

Market Segmentation

- This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Gunshot Detection Systems Market, Installation Analysis

- Fixed Installation

- Soldier Mounted

- Vehicle Installation

Gunshot Detection Systems Market, Application Analysis

- Commercial

- Defense

Gunshot Detection Systems Market, System Analysis

- Indoor

- Outdoor

Gunshot Detection Systems Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Gunshot Detection Systems Market?The global Gunshot Detection Systems Market is expected to grow from USD 2.1 billion in 2023 to USD 3.4 billion by 2033, at a CAGR of 4.94% during the forecast period 2023-2033.

-

2. Who are the key market players of the Gunshot Detection Systems Market?Some of the key market players of the market are ACOEM Group; RTX Corporation; Thales Group; QinetiQ Group; IAI; ArianeGroup; SoundThinking, Inc.; Tracer Technology Systems, Inc.; Databuoy; Omnilert LLC.

-

3. Which segment holds the largest market share?The defence segment holds the largest market share and is going to continue its dominance.

-

4. Which region dominates the Gunshot Detection Systems Market?North America dominates the Gunshot Detection Systems Market and has the highest market share.

Need help to buy this report?