Global Grow Light Market Size, Share, and COVID-19 Impact Analysis, By Product (< 300 Watt, > 300 Watt), By Installation (New Installation, and Retrofit), By Technology (High Intensity Discharge, LED, Fluorescent, Plasma), By Application (Indoor Farming, Vertical Farming, Commercial Greenhouse, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Information & TechnologyGlobal Grow Light Market Insights Forecasts to 2035

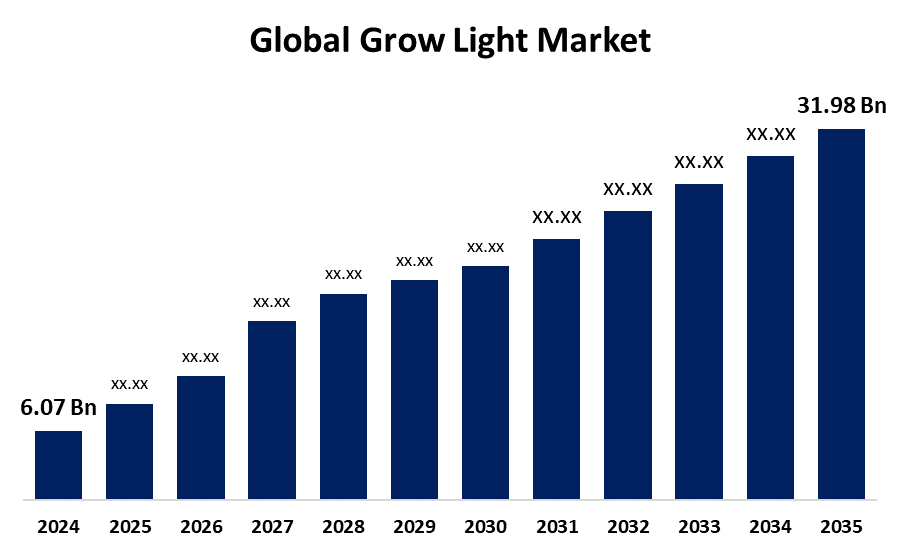

- The Global Grow Light Market Size Was Estimated at USD 6.07 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.31% from 2025 to 2035

- The Worldwide Grow Light Market Size is Expected to Reach USD 31.98 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Grow Light Market Size was Worth around USD 6.07 Billion in 2024 and is Predicted to Grow to around USD 31.98 Billion by 2035 with a compound annual growth rate (CAGR) of 16.31% from 2025 to 2035. The rising need for sustainable, high-yield farming is driving steady growth in the grow light market. Controlled environment agriculture and demand for local, organic produce are key factors fueling adoption.

Market Overview

The grow light market refers to an artificial electric light source that mimics the spectrum of natural sunshine or is tailored to the demands of particular plants to promote their growth. These lights provide certain wavelengths, usually red and blue, to support different growth stages like germination, vegetative growth, and flowering, making them useful for growing plants indoors or in places with insufficient natural light.

The need for dependable lighting solutions that promote local and sustainable agriculture by enabling food production in constrained locations is being driven by urbanization and the growth of indoor farming. Modern farming needs are best served by technological improvements, particularly in LED lighting, which has enhanced energy efficiency, spectrum management, and overall performance. Initiatives such as Horizon 2020 promote indoor agriculture innovation even further. Meanwhile, there is a specific need for grow lights that promote the best possible plant development as a result of the legalization and growth of the cannabis sector. The market for sophisticated lighting solutions in a variety of industries is expanding as a result of these trends taken together.

Report Coverage

This research report categorizes the grow light market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the grow light market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the grow light market.

Global Grow Light Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.07 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 16.31% |

| 2035 Value Projection: | USD 31.98 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product, By Technology, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | AeroFarms, Sunlight Supply, Inc., EVERLIGHT ELECTRONICS CO., LTD., Signify Holding, GAVITA Holland BV, Osram Licht AG, Heliospectra AB, LumiGrow Inc, Hortilux Schréder, Illumitex, ams-OSRAM AG, Mars Hydro, California LightWorks, Shenzhen Juson Technology Co. Ltd., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for alternative agricultural practices like indoor and vertical farming is being driven by the world's growing population and the scarcity of arable land. Grow lights are essential for these systems because they increase crop yields and growing hours. Their popularity is accelerating due to growing awareness of food security and sustainable agriculture. Agriculture in a controlled setting, shielded from harsh weather conditions, enables year-round cultivation. Advanced grow lighting is also becoming more popular due to the need for local, organic, and pesticide-free vegetables. The market for grow lights is expected to increase steadily as a result of these trends.

Restraining Factors

The high upfront cost of LED grow lights remains a significant obstacle to wider adoption, particularly among small-scale farmers. Despite their long-term efficiency and performance benefits, initial investment barriers prevent market penetration. Competing technologies, such as plasma and induction lighting, suffer similar cost constraints. However, increased competition and predicted price cuts may alleviate these restraints, boosting future market development.

Market Segmentation

The grow light market share is classified into product, installation, technology, and application.

- The < 300-watt segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the grow light market is divided into < 300 watt, > 300 watt. Among these, the < 300-watt segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by the increased demand for high-intensity illumination in commercial horticulture, and vertical farming is pushing up demand for improved grow lights. High-wattage systems provide homogeneous coverage and promote optimal plant development, particularly during critical growth periods. Commercial growers want to improve production and quality by using high PPFD lighting solutions. This chart highlights the growing use of < 300-watt grow lights in large-scale enterprises.

- The retrofit segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the installation, the grow light market is divided into new installations and retrofits. Among these, the retrofit segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the proliferation of vertical and urban farming. These activities frequently entail refurbishing existing commercial or industrial buildings where installing completely new lighting infrastructure is impossible due to structural limitations and electrical systems. With the help of scalable and adaptable retrofit grow light solutions, operators can improve illumination intensity and quality to meet the needs of particular crops without having to undertake major renovations. Retrofitting is a very alluring alternative for small and medium-sized businesses looking to enter the controlled-environment agriculture market because of its versatility.

- The LED segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the technology, the grow light market is divided into high-intensity discharge, LED, fluorescent, and plasma. Among these, the LED segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to growing urban farming and government programs to implement energy-efficient LEDs. The most efficient LED bulbs are more expensive. The precise wavelength of the desired light is produced using LEDs. It can concurrently produce a dual-band spectrum (red and blue). All stages of growth can benefit from LEDs. At first, LEDs are costlier, but they eventually become less expensive.

- The commercial greenhouse segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the grow light market is divided into indoor farming, vertical farming, commercial greenhouse, and others. Among these, the commercial greenhouse segment accounted for the largest share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The segmental growth is due to the rising demand for fresh fruits and vegetables worldwide. Furthermore, the use of sophisticated grow lighting systems has increased dramatically as a result of the legalization and commercialization of cannabis in several nations. The market is growing as a result of technological advancements, declining LED grow light costs, and government subsidies for environmentally friendly farming methods. Advanced grow lighting solutions are becoming more and more essential in contemporary greenhouse farming as growers look for ways to maximize yield while cutting expenses.

Regional Segment Analysis of the Grow Light Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the grow light market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the grow light market over the predicted timeframe. The region's improvements in agricultural technology and the growing demand for wholesome, locally produced food, particularly in North America. Because of the harsh weather and lengthy winters, artificial lighting is necessary for year-round farming. Adoption in indoor farming has been further accelerated by advancements in LED technology and declining costs. The legalization of cannabis has also increased demand for accurate, energy-efficient lighting systems designed to maximize plant development.

Asia Pacific is expected to grow at a rapid CAGR in the grow light market during the forecast period. In this region, the rising investments in agritech innovation and smart agriculture. To solve agricultural inefficiencies and climate-related issues, governments and private businesses around the region are encouraging modern farming techniques. Particularly, South Korea and Japan have made significant investments in vertical farming projects, where grow lights are essential for plant growth in completely enclosed spaces. LED grow lights are used because they offer adjustable light spectrums and enhance energy economy, two important factors in sophisticated indoor farms that operate in urban areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the grow light market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AeroFarms

- Sunlight Supply, Inc.

- EVERLIGHT ELECTRONICS CO., LTD.

- Signify Holding

- GAVITA Holland BV

- Osram Licht AG

- Heliospectra AB

- LumiGrow Inc

- Hortilux Schréder

- Illumitex

- ams-OSRAM AG

- Mars Hydro

- California LightWorks

- Shenzhen Juson Technology Co. Ltd.

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, Heliospectra AB introduced the Dynamic MITRA X multi-channel LED lights, which integrate smoothly with the company's HelioCORE Software to improve light control for professional growers and researchers. These new multi-channel solutions are intended to supplement Heliospectra's fixed and Flex spectrum offerings, answering commercial growers' rising demand for greater operational adaptability and flexibility.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the grow light market based on the below-mentioned segments:

Global Grow Light Market, By Product

- < 300 Watt

- 300 Watt

Global Grow Light Market, By Installation

- New Installation

- Retrofit

Global Grow Light Market, By Technology

- High Intensity Discharge

- LED

- Fluorescent

- Plasma

Global Grow Light Market, By Application

- Indoor Farming

- Vertical Farming

- Commercial Greenhouse

- Others

Global Grow Light Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the grow light market over the forecast period?The global grow light market is projected to expand at a CAGR of 16.31% during the forecast period.

-

2. What is the market size of the grow light market?The global grow light market size is expected to grow from USD 6.07 Billion in 2024 to USD 31.98 Billion by 2035, at a CAGR of 16.31% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the grow light market?North America is anticipated to hold the largest share of the grow light market over the predicted timeframe.

Need help to buy this report?