Global Groundnut Oil Market Size, Share, and COVID-19 Impact Analysis, By Type (Refined and Unrefined), By Application (Food, Personal Care, Pharmaceuticals, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Groundnut Oil Market Insights Forecasts to 2035

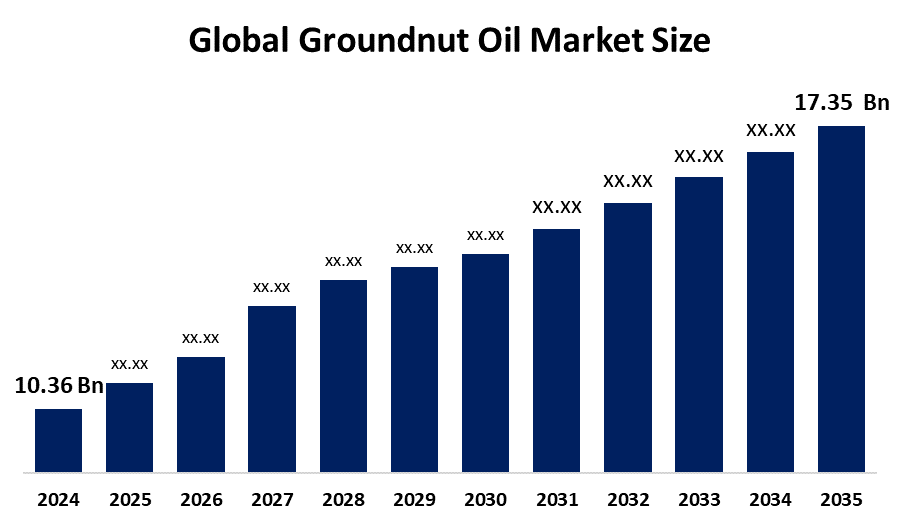

- The Global Groundnut Oil Market Size Was Estimated at USD 10.36 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.8 % from 2025 to 2035

- The Worldwide Groundnut Oil Market Size is Expected to Reach USD 17.35 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global Groundnut Oil Market Size Was Valued At Around USD 10.36 Billion In 2024 And Is Predicted To Grow To Around USD 17.35 Billion By 2035 With A Compound Annual Growth Rate (CAGR) Of 4.8 % From 2025 To 2035. Opportunities in the groundnut oil market include rising demand for natural oils, expanding food processing industries, heightened health consciousness, export potential, and growing use in medicinal and cosmetic applications.

Market Overview

The production, processing, refining, distribution, trading, and consumption of edible oil derived from groundnut (peanut) kernels using solvent extraction or mechanical pressing techniques are all included in the global and regional economic ecosystem known as the groundnut oil market.

Global Groundnut Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.36 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.8% |

| 2035 Value Projection: | USD 17.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 268 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Type, By Application and By Region |

| Companies covered:: | De Hekserij, Eurovanille, Fujian Qina Trading Co. Ltd., Gemini Edibles & Fats India Ltd, Georgia-Pacific Chemicals LLC, GrantChem, Inc., LLC PK “XimProm”, Matole Ltd, PAG KIMYA SAN. TIC. LTD. STI., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the groundnut oil market is also fueled by the expansion of distribution channels, which include the emergence of online grocery shopping and strategic product advancements by leading companies. The demand for groundnut oil has increased as a result of customers looking for healthier substitutes for conventional cooking oils due to the growth in lifestyle-related disorders like obesity, diabetes, and cardiovascular conditions. Additionally, groundnut oil's widespread use in a variety of international cuisines and growing health consciousness support the product's ongoing demand and groundnut oil market growth.

Restraining Factors

The market for groundnut oil is restricted by a number of factors, including volatile raw material prices, reliance on weather patterns, scarcity of groundnuts, competition from less expensive edible oils, and high production costs that impact pricing stability and market penetration.

Market Segmentation

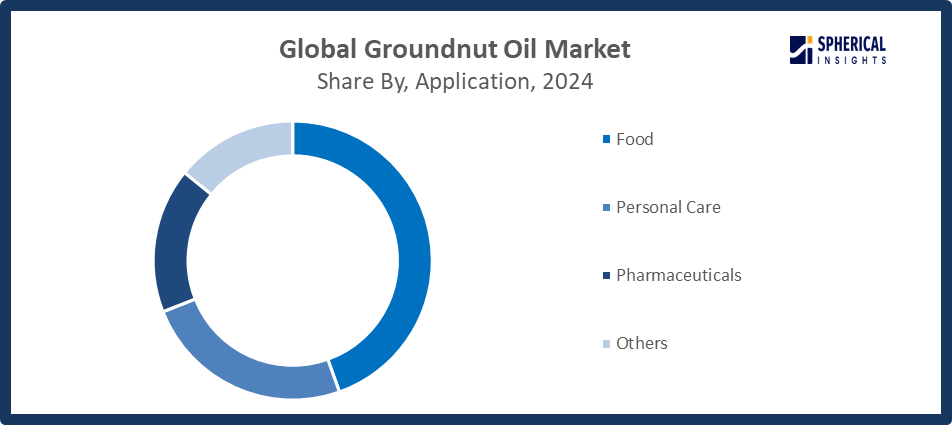

The groundnut oil market share is classified into type and application.

- The refined segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the groundnut oil market is divided into refined and unrefined. Among these, the refined segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market is further strengthened by its ease of refining and reliable quality control, making it the go-to option for both homes and the foodservice sector. Furthermore, purifying procedures are used to eliminate contaminants from refined groundnut oil, improving its quality, safety, and acceptability by consumers.

- The food segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the groundnut oil market is divided into food, personal care, pharmaceuticals, and others. Among these, the food segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The increasing popularity of ethnic and traditional dishes in international markets, where groundnut oil is a crucial component, is another factor driving the food industry's need for groundnut oil. Its use in food applications is further fueled by the growing popularity of healthy cooking techniques and the rising desire for natural, plant-based oils.

Get more details on this report -

Regional Segment Analysis of the Groundnut Oil Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the groundnut oil market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the groundnut oil market over the predicted timeframe. The strong demand is driven by the region's rapidly expanding food processing industry as well as the widespread use of groundnut oil in traditional cuisine. Due to their extensive agricultural bases and long history of using groundnut oil in traditional cooking methods, nations like China, Vietnam, Indonesia, and India are significant contributors. The R 2025-2026 changes include improvements to the export process through APEDA's Peanut and a 7% rise in the Minimum Support Price (MSP) for peanuts to Rupees 7,263 quintal in May 2025. Net platform for quality compliance (effective November 2025) and USDA estimates that, due to robust local demand, India's Groundnut oil consumption will increase by 10% during MY 2025–2026.

North America is expected to grow at a rapid CAGR in the groundnut oil market during the forecast period. Groundnut oil is frequently utilized in ethnic and gourmet dishes, which is another factor contributing to the region's explosive expansion. The rise of the groundnut oil market in North America is further accelerated by the growth of the organic and specialty food markets in the United States and Canada. Expanded processing capabilities, such as ADMs 2024 Georgia plant improvements for organic peanut oil targeting foodservice and Cargill's February 2025 blockchain traceability pilot for Georgia operations to guarantee quality and sustainability, are among the industry announcements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the groundnut oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- De Hekserij

- Eurovanille

- Fujian Qina Trading Co. Ltd.

- Gemini Edibles & Fats India Ltd

- Georgia-Pacific Chemicals LLC

- GrantChem, Inc.

- LLC PK “XimProm”

- Matole Ltd

- PAG KIMYA SAN. TIC. LTD. STI.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2025, Rajkot-based Fishfa Agri World Ltd. launched PeanutJi Vedic, India’s first high-oleic groundnut oil, combining Vedic purity principles with advanced technology to offer enhanced health benefits, stability, and premium quality for consumers.

- In August 2023, Tata Consumer Products launched its premium Cold Pressed Groundnut Oil under the 'Tata Simply Better' brand, offering 100% pure, unrefined oil. This launch marks Tata’s strategic entry into the growing premium cold-pressed edible oils market.

- In June 2022, Gulab Oils launched a revamped range of groundnut oil nationwide, expanding production capacity from 100 to 1000 tons daily to meet growing demand across 10 states.

- In April 2022, Gemini Edibles & Fats India Ltd announced the launch of a 5-liter Freedom Groundnut Oil jar, enhancing their healthy cooking oil range with nutty flavor and traditional culinary appeal.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the groundnut oil market based on the below-mentioned segments:

Global Groundnut Oil Market, By Type

- Refined

- Unrefined

Global Groundnut Oil Market, By Application

- Food

- Personal Care

- Pharmaceuticals

- Others

Global Groundnut Oil Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the groundnut oil market over the forecast period?The global groundnut oil market is projected to expand at a CAGR of 4.8% during the forecast period.

-

2. What is the market size of the groundnut oil market?The global Groundnut Oil market size is expected to grow from USD 10.36 billion in 2024 to USD 17.35 billion by 2035, at a CAGR of 4.8 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the groundnut oil market?Asia Pacific is anticipated to hold the largest share of the Groundnut Oil market over the predicted timeframe.

-

4. Who are the top companies operating in the global groundnut oil market?De Hekserij, Eurovanille, Fujian Qina Trading Co. Ltd., Gemini Edibles & Fats India Ltd, Georgia-Pacific Chemicals LLC, GrantChem, Inc., LLC PK “XimProm”, Matole Ltd, PAG KIMYA SAN. TIC. LTD. STI., and Others.

-

5. What factors are driving the growth of the groundnut oil market?Growth in the market is driven by factors such as increased health consciousness, rising demand for natural oils, the expansion of the food processing and hospitality industries, government assistance for oilseed farming, high nutritional value, and expanding cosmetic and medicinal uses.

-

6. What are the market trends in the groundnut oil market?Adoption of organic and cold-pressed oils, high-end packaging, incorporation into health-conscious diets, growing appeal in ethnic cuisines, advances in extraction technology, and growing use in non-food applications are some trends.

-

7. What are the main challenges restricting the wider adoption of the groundnut oil market?Variations in raw material prices, reliance on the climate, scarcity of groundnuts, high production costs, competition from less expensive edible oils, inefficiencies in the supply chain, and customer price sensitivity are some of the difficulties.

Need help to buy this report?