Global Ground Penetrating Radar Market Size, Share, and COVID-19 Impact Analysis, Product Type (Handheld Systems, Cart-Based Systems, and Vehicle-Mounted Systems), By Application (Utility Detection, Concrete Investigation, Transportation Infrastructure, Archaeology, Geology and Environment, and Law Enforcement and Military), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Semiconductors & ElectronicsGlobal Ground Penetrating Radar Market Insights Forecasts to 2035

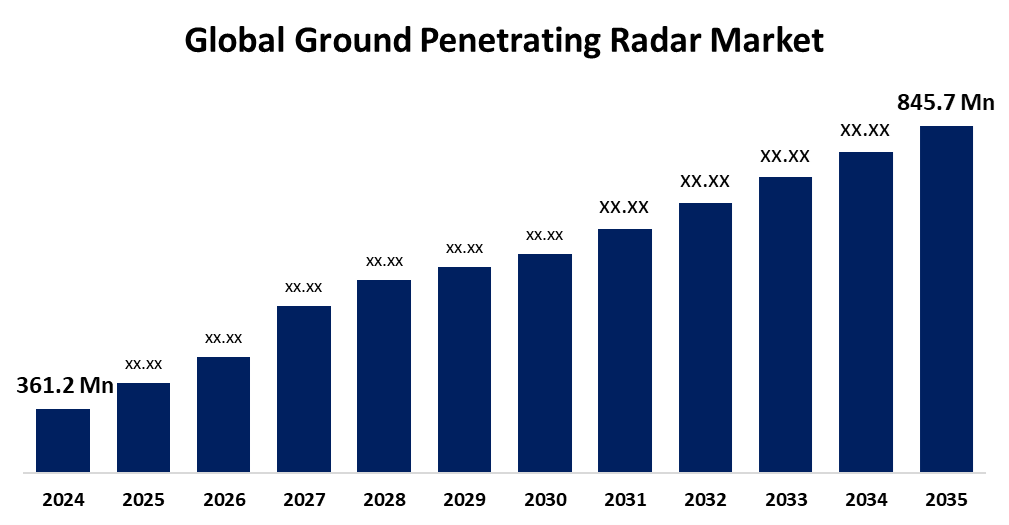

- The Global Ground Penetrating Radar Market Size Was Estimated at USD 361.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.04% from 2025 to 2035

- The Worldwide Ground Penetrating Radar Market Size is Expected to Reach USD 845.7 Million by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Ground Penetrating Radar Market Size was Worth around USD 361.2 Million in 2024 and is predicted to Grow to around USD 845.7 Million by 2035 with a Compound Annual Growth Rate (CAGR) of 8.04% from 2025 to 2035. The growth of the ground penetrating radar market is being driven by the growing need for GPR for a variety of applications, including geology and the environment, archeology, municipal inspections, transportation infrastructure, concrete surveys, and disaster inspections.

Market Overview

Technologies and solutions for subsurface imaging, analysis, and mapping across industries are included in the ground penetrating radar (GPR) market. It consists of GPR sensors, systems, and services that allow for the high-resolution, effective identification of geological features, utilities, and subterranean structures. In the fields of construction, archeology, environmental research, and defense, these technologies improve survey quality, safety, and decision-making.

One of the main potential opportunities for the ground penetrating radar (GPR) industry is the growing use of GPR in the military. For Instance, in September 2023, Hexagon-owned IDS GeoRadar launched the Chaser XR, a small and light ground-penetrating radar (GPR) system intended for subsurface profiling. The gadget, which is outfitted with Equalized Scrambled Technology (EsT), sets a new standard for geophysical surveying by providing unparalleled resolution and penetration.

The necessity for reliable subsurface detection to avoid expensive infrastructure damage is driving the market for ground penetrating radar (GPR) technology, which is in high demand in utility safety and damage prevention. As infrastructure modernization proceeds, it is expected that the need for GPR in utility protection will rise sharply, supporting long-term growth in the ground penetrating radar market.

Report Coverage

This research report categorizes the ground penetrating radar market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ground penetrating radar market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ground penetrating radar market.

Global Ground Penetrating Radar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 361.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.04% |

| 2035 Value Projection: | USD 845.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Region |

| Companies covered:: | Saab AB, IDS Georadar, Pipehawk Plc, Geoscanners, Thales Group, Radiodetection Ltd., Israel Aerospace Industries Ltd, Geophysical Survey Systems Inc., Guideline Geo, Raytheon Technologies Corporation, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for subsurface mapping in mining, construction, and archaeology, as well as improvements in GPR technology including increased resolution and mobility, are driving the market for ground penetrating radars. Growth is also fueled by strict safety and quality requirements, growing urbanization, and the requirement for effective utility management.

The primary factors propelling the market's expansion are the rising need for GPR equipment for utility safety and damage avoidance, as well as the rise in demand for real-time ground penetrating radar services. The advantages of GPR systems over other conventional technologies, such radiography, and growing concerns about the safety and preservation of subsurface utilities are anticipated to propel the global ground penetrating radar market. .

Restraining Factors

High equipment costs, restricted penetration depth, signal interference, regulatory restrictions, and a shortage of trained operators are some of the factors restricting the market for ground penetrating radars (GPRs), which affects adoption across industries.

Market Segmentation

The ground penetrating radar market share is classified into product type and application.

- The vehicle-mounted systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the ground penetrating radar market is divided into handheld systems, cart-based systems, and vehicle-mounted systems. Among these, the vehicle-mounted systems segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growing use of vehicle-mounted equipment for road and infrastructure surveys is the reason for this. It eliminates the need for long-term traffic management strategies and permits users to spend less time in roadway environments.

- The concrete investigation segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the ground penetrating radar market is divided into utility detection, concrete investigation, transportation infrastructure, archaeology, geology and environment, and law enforcement and military. Among these, the concrete investigation segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The increasing need for GPR as a non-destructive testing technique for reinforced concrete investigation is the reason behind the concrete investigation market.

Regional Segment Analysis of the Ground Penetrating Radar Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the ground penetrating radar market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the ground penetrating radar market over the predicted timeframe. The United States' substantial defense expenditures and acquisition of cutting-edge military radar are the main causes of North America's expansion. The global ground penetrating radar market was controlled by North America. North America has seen a rise in demand for GPRs in recent years. Initiatives and programs like aerial missile defense radar and 3D expedition long-range radar are intended to propel market expansion. The development of the construction industry, especially the boom in real estate projects and the building of infrastructure like roads and bridges, has fueled this requirement.

Asia Pacific is expected to grow at a rapid CAGR in the ground penetrating radar market during the forecast period. The need for ground penetrating radar systems is expected to rise in the Asia-Pacific region as a result of the rapid expansion of transportation and construction infrastructure. The increase is ascribed to the development of subways and the extension of road infrastructure, which provide affordable and secure transportation to address issues with pollution and trip time. Additionally, it is anticipated that Japan's growing automotive sector and military expenditures will accelerate regional market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ground penetrating radar market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Saab AB

- IDS Georadar

- Pipehawk Plc

- Geoscanners

- Thales Group

- Radiodetection Ltd.

- Israel Aerospace Industries Ltd

- Geophysical Survey Systems Inc.

- Guideline Geo

- Raytheon Technologies Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, Hexagon AB launched the Leica DSX Pro, a cutting-edge ground-penetrating radar system intended for subsurface imaging with high precision. The solution streamlines field operations with automated reporting tools and incorporates AI-driven data processing to improve detection accuracy for utilities, archeology, and geophysical applications.

- In January 2024, The C-thrue XS handheld GPR scanner and NDT Reveal software, the newest concrete inspection tools from IDS GeoRadar, a division of Hexagon, launched at World of Concrete in Las Vegas. Construction crews may now perform safer and more accurate inspections due to these advancements in subsurface detection and data analysis efficiency.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ground penetrating radar market based on the below-mentioned segments:

Global Ground Penetrating Radar Market, By Product Type

- Handheld Systems

- Cart-based Systems

- Vehicle-mounted Systems

Global Ground Penetrating Radar Market, By Application

- Utility Detection

- Concrete Investigation

- Transportation Infrastructure

- Archaeology

- Geology and Environment

- Law Enforcement and Military

Global Ground Penetrating Radar Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ground penetrating radar market over the forecast period?The global ground penetrating radar market is projected to expand at a CAGR of 8.04% during the forecast period.

-

2. What is the market size of the ground penetrating radar market?The global ground penetrating radar market size is expected to grow from USD 361.2 million in 2024 to USD 845.7 million by 2035, at a CAGR of 8.04% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the ground penetrating radar market?North America is anticipated to hold the largest share of the ground penetrating radar market over the predicted timeframe.

Need help to buy this report?