Global Green Supplement Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Algae, Grasses, and Vegetables), By Form (Tablets, Capsules, and Powder), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Green Supplement Market Size Insights Size Forecasts to 2035

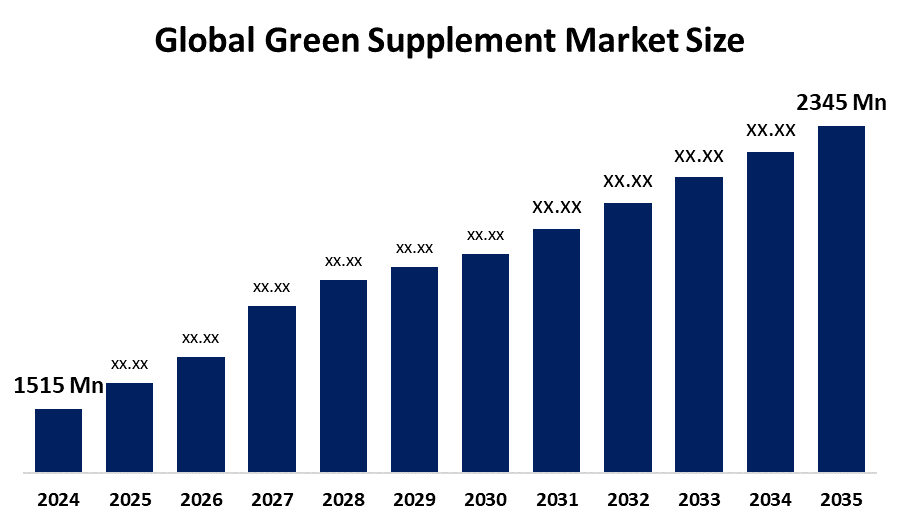

- The Global Green Supplement Market Size Was Estimated at USD 1515.0 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.05% from 2025 to 2035

- The Worldwide Green Supplement Market Size is Expected to Reach USD 2345.0 Million by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Green Supplement Market Size was worth around USD 744.3 Million in 2024 and is predicted to Grow to around USD 3502.2 Million by 2035 with a compound annual growth rate (CAGR) of 15.12% from 2025 and 2035. The market for green supplement has a number of opportunities to grow due to the introduction of various green supplement products. Further, the upsurging trend of health and wellness, including cognitive, mindfulness, and mental health and longevity are promoting the green supplement market.

Market Overview

The global industry for green supplement encompasses the nutrient-dense, plant-based products, often in powder, capsule, or tablet form, designed to fill nutritional gaps with leafy greens, algae (spirulina/chlorella), and grasses. Green supplements available in powder form are believed to help in supporting the immune system, energy levels and detoxification. They also claim to be highly absorbable, and as such, help your body meet its nutritional needs. Furthermore, the integration of adaptogens for stress management and management of gut health and energy are trends in the green supplement market.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the introduction of innovative products. For instance, in April 2025, SparkOptimus helps consumer health business Opella accelerate product innovation. A rapidly evolving market with constant new product introductions, Opella partnered with SparkOptimus to enhance its product development capabilities and dramatically reduce the time it takes to bring new offerings to market.

Report Coverage

This research report categorizes the green supplement market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the green supplement market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the green supplement market.

Global Green Supplement Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1515.0 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.05% |

| 2035 Value Projection: | USD 2345.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 168 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Form and COVID-19 Impact Analysis |

| Companies covered:: | GNC Holdings Inc., Herbalife Nutrition Ltd., Amway Corporation, Vitacost.com Inc., Herbal Hills, General Nutrition Centers Inc., Puritan’s Pride, Inc., Pharmafreak, NOW Foods, New England Greens LLC, Cyane, Earthrise Nutritional, Tate & Lyle, BASF, DSM, Danone, Blue California, Changsha Sunfull Bio-tech Co. Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Government incentives for organic products, promoting sustainable agriculture, eco-friendly manufacturing, and the reduction of carbon footprints in food processing, are contributing to driving the green supplement market. The introduction of green protein, a vegan plant-based protein, is propelling the market, particularly for sports and fitness enthusiasts, who are drawn to pea protein. Innovation in formulation technology, advanced health supplementation, development of specialized green supplement solutions is anticipated to propel market growth. The growing incidence of deficiency diseases like anemia scurvy, and beriberi is responsible for driving the market demand.

Restraining Factors

The green supplement market is restricted due to factors like taste and palatability of the product that may affect consumer trust and loyalty. Further, supply chain disruptions, increased prices, and a lack of regulatory oversight are challenging the market growth.

Market Segmentation

The green supplement market share is classified into product type and form.

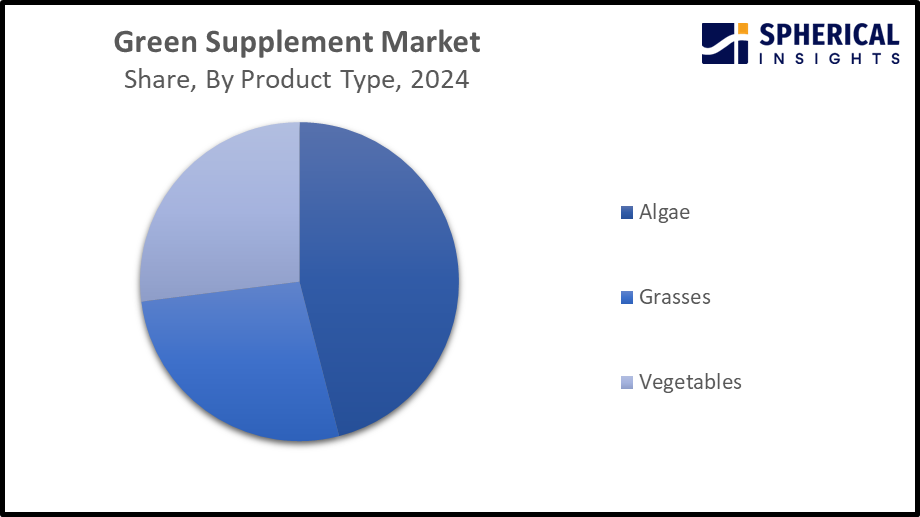

- The algae segment dominated the market with the largest share of about 46.0% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the green supplement market is divided into algae, grasses, and vegetables. Among these, the algae segment dominated the market with the largest share of about 46.0% in 2024 and is projected to grow at a substantial CAGR during the forecast period. It is believed that the use of blue-green algae, primarily Spirulina and Chlorella, can help treat high blood pressure and act as a protein supplement. It is also used for high levels of cholesterol or other fats (lipids) in the blood, diabetes, obesity, and many other conditions. An increased preference for algae sourced supplement with an increasing number of vegans is driving the segmental market.

Get more details on this report -

- The powder segment accounted for the largest share of about 35.4% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the green supplement market is divided into tablets, capsules, and powder. Among these, the powder segment accounted for the largest share of about 35.4% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Powdered green supplements are made from dried, pulverized leafy greens, algae, grasses, and vegetables, designed for boosting daily intake. Greens like wheatgrass, spirulina and chlorella are among the many types of greens used to make green powder, containing a wealth of vitamins and nutrients that can improve your overall health.

Regional Segment Analysis of the Green Supplement Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share about 39.5% in the green supplement market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 39.5% in the green supplement market over the predicted timeframe. The market ecosystem in North America is strong, with the introduction of innovative products. For instance, in May 2025, AGI unveiled the major upgrade of its all-in-one supplement powder mix, which is only available on the North American market. The market demand for green supplement has been driven by the region's strong technological infrastructure and increased adoption rates. The United States is leading the North America green supplement market with around 68.1% regional share, due to consumers’ increasing health consciousness and availability of green supplements in health stores, e-commerce platforms, and retail outlets.

Asia Pacific is expected to grow at a rapid CAGR of nearly 8.5% in the green supplement market during the forecast period. The Asia Pacific area has a thriving market for green supplement due to the region’s health and wellness trend. For instance, in September 2025, at Vitafoods Asia 2025 in Bangkok, Thailand, exhibitors spotlighted the latest concepts and ingredients like healthy ageing, active nutrition, beauty-from-within, and gut health spaces that meet the emerging trends and consumer demands in the APAC region. Due to their governments actively supporting environmental programs like the “green growth” concept, the market is expected to grow. China is the leading country in the regional green supplement market, accounting for 43.0% share, owing to the growing trend of veganism, along with an increasing disposable income and high living standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the green supplement market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GNC Holdings Inc.

- Herbalife Nutrition Ltd.

- Amway Corporation

- Vitacost.com Inc.

- Herbal Hills

- General Nutrition Centers Inc.

- Puritan's Pride, Inc.

- Pharmafreak

- NOW Foods

- New England Greens LLC

- Cyane, Earthrise Nutritional

- Tate & Lyle

- BASF

- DSM

- Danone

- Blue California

- Changsha Sunfull Bio-tech Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2026, Green Lumber LLC updated its consumer alert for its Green Lumber dietary supplements due to counterfeit products falsely marked as genuine Green Lumber products that may pose a health risk to consumers, according to the U.S. Food and Drug Administration.

- In August 2025, Green Tea and a Vitamin Supplement could protect against Alzheimer’s. A natural compound found in green tea forms a powerful brain cleaner when combined with a common vitamin, researchers have found, potentially putting the brakes on the buildup of waste associated with diseases like Alzheimer’s.

- In May 2025, Vykee Nutrition, a leader in high-performance supplements, is gearing up with a slate of new product innovations and expansion initiatives.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the green supplement market based on the below-mentioned segments:

Global Green Supplement Market, By Product Type

- Algae

- Grasses

- Vegetables

Global Green Supplement Market, By Form

- Tablets

- Capsules

- Powder

Global Green Supplement Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the green supplement market?The global green supplement market size is expected to grow from USD 1515.0 Million in 2024 to USD 2345.0 Million by 2035, at a CAGR of 4.05% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the green supplement market?North America is anticipated to hold the largest share of the green supplement market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Green supplement Market from 2024 to 2035?The market is expected to grow at a CAGR of around 4.05% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Green supplement Market?Key players include GNC Holdings Inc., Herbalife Nutrition Ltd., Amway Corporation, Vitacost.com Inc., Herbal Hills, General Nutrition Centers Inc., Puritan's Pride, Inc., Pharmafreak, NOW Foods, New England Greens LLC, Cyane, Earthrise Nutritional, Tate & Lyle, BASF, DSM, Danone, Blue California, and Changsha Sunfull Bio-tech Co. Ltd.

-

5. Can you provide company profiles for the leading green supplement manufacturers?Yes. For example, GNC Holdings Inc. is an American multinational retail and nutritional manufacturing company, and a wholly owned subsidiary of Harbin Pharmaceutical Group, specializes in health and nutrition related products, including vitamins, supplements, minerals, herbs, and energy products.

-

6. What are the main drivers of growth in the green supplement market?Government incentives for organic products, introduction of green proteins, and growing incidence of deficiency diseases are major market growth drivers of the green supplement market.

-

7. What challenges are limiting the green supplement market?Product’s taste & palatability issues, supply chain disruptions, increased prices, and a lack of regulatory oversight, remain key restraints in the green supplement market.

Need help to buy this report?