Global Green Energy Market Size, Share, and COVID-19 Impact Analysis, By Energy Source (Solar Energy, Wind Energy, Hydropower, Geothermal Energy, Biomass Energy, and Others), By Application (Electricity Generation, Heating, Transportation, Industrial Processes, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Energy & PowerGlobal Green Energy Market Size Forecasts to 2033

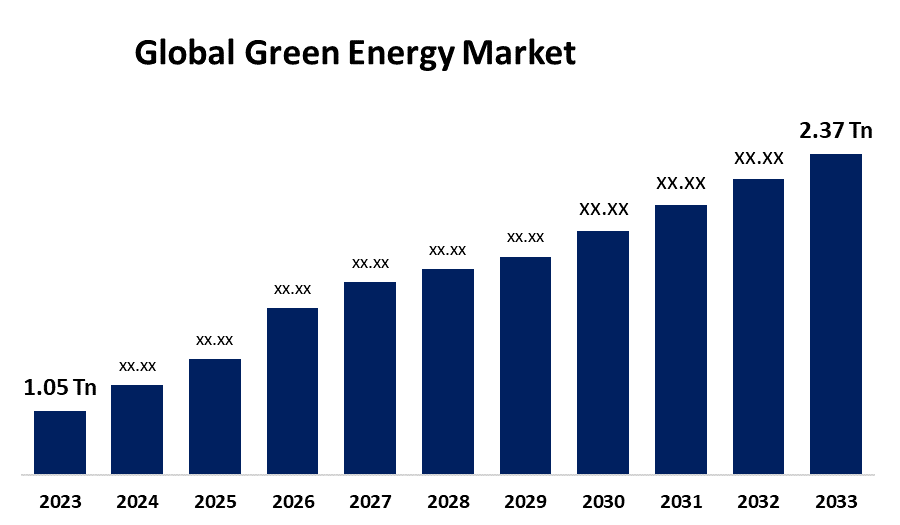

- The Global Green Energy Market Size was estimated at USD 1.05 Trillion in 2023

- The Market Size is Expected to Grow at a CAGR of around 8.48% from 2023 to 2033

- The Worldwide Green Energy Market Size is Expected to Reach USD 2.37 Trillion by 2033

- Asia-Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Green Energy Market Size is expected to cross USD 2.37 Trillion by 2033, Growing at a CAGR of 8.48% from 2023 to 2033.

Market Overview

The global green energy market includes the production, distribution, and use of energy derived from renewable and environmentally friendly sources such as solar, wind, hydroelectric, geothermal, and biomass. These energy sources are notable for their low environmental impact, particularly in terms of greenhouse gas emissions, making them critical in combating climate change and promoting sustainable development. The green energy sector offers numerous opportunities, driven by global initiatives to reduce carbon footprints and achieve net-zero emissions. Advances in technology have reduced the cost of renewable energy installations, making them more accessible and economically viable. Because of their abundant natural resources and rising energy demands, emerging markets, particularly Asia, Africa, and Latin America, hold enormous potential for renewable energy deployment.

Report Coverage

This research report categorizes the green energy market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the green energy market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the green energy market.

Global Green Energy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.05 Trillion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.48% |

| 2033 Value Projection: | USD 2.37 Trillion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 118 |

| Segments covered: | By Energy Source, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Brookfield Renewable Partners, Vestas Wind Systems, Enel, Iberdrola, China Longyuan Power Group, Siemens Gamesa Renewable Energy, GE Renewable Energy, Canadian Solar, China Three Gorges Corporation, RWE, SolarEdge Technologies, NextEra Energy, Orsted, EDP Renewables, First Solar, and Others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A variety of policy, economic, technological, and environmental factors are propelling the green energy market. Governments around the world are implementing mandates, subsidies, and carbon pricing schemes to hasten the energy transition. Renewable energy technologies, such as solar panels, wind turbines, and battery storage, are now cheaper than fossil fuels in many markets. Consumer preferences are becoming more aligned with sustainability, encouraging both individuals and businesses to adopt clean energy solutions. Rising electricity consumption, particularly in emerging economies, is driving demand for new, clean power plants. Furthermore, global supply chain disruptions, energy security concerns, and geopolitical instability are causing countries to diversify their energy portfolios and invest in domestic, renewable energy sources.

Restraining Factors

Despite its promising growth trajectory, the green energy market faces several challenges. High initial capital investment remains a barrier, particularly in infrastructure-intensive sectors such as offshore wind, advanced battery systems, and grid modernization. Renewable energy sources such as solar and wind are inherently unpredictable, necessitating significant investment in energy storage or hybrid systems to ensure reliability.

Market Segmentation

The green energy market share is classified into energy source and application.

- The solar energy segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the energy source, the green energy market is divided into solar energy, wind energy, hydropower, geothermal energy, biomass energy, and others. Among these, the solar energy segment held the greatest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is largely due to the declining cost of photovoltaic (PV) technology, favorable government incentives, and the global adoption of residential, commercial, and utility-scale solar installations. Solar energy is affordable, scalable, and relatively simple to implement, making it an attractive option for both developed and developing countries seeking to transition to cleaner energy sources.

- The electricity generation segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe.

Based on the application, the green energy market is divided into electricity generation, heating, transportation, industrial processes, and others. Among these, the electricity generation segment accounted for the majority of the share in 2023 and is estimated to grow at a remarkable CAGR during the projected timeframe. This segment's dominance stems from the growing global demand for clean and sustainable electricity to replace fossil fuel-based power sources. Countries around the world are investing heavily in renewable energy infrastructure, particularly solar, wind, and hydropower, to decarbonize their power grids and meet international climate targets.

Regional Segment Analysis of the Green Energy Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Europe is anticipated to hold the largest share of the green energy market over the predicted timeframe.

Get more details on this report -

Europe is anticipated to hold the largest share of the green energy market over the predicted timeframe. The region's strong regulatory frameworks, ambitious renewable energy targets, and significant investments in wind, solar, and hydropower infrastructure have helped it maintain its leadership position. The European Union's Green Deal and initiatives to achieve carbon neutrality by 2050 are accelerating the adoption of clean energy technologies. Countries such as Germany, Denmark, and the Netherlands are driving the transition with advanced renewable integration, smart grid development, and large-scale offshore wind projects, cementing Europe's leadership in the green energy sector.

Asia-Pacific is expected to grow at the fastest CAGR growth of the green energy market during the forecast period. This rapid growth is driven by rising energy demand, urbanization, and government-led sustainability initiatives in countries such as China, India, Japan, and Australia. Massive solar and wind farm installations, particularly in China and India, combined with supportive policies and investments in green hydrogen and battery storage technologies, are transforming the region into a major renewable energy hub. Furthermore, international collaborations and climate commitments are hastening the adoption of green energy, establishing Asia-Pacific as the world's fastest-growing market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the green energy market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Brookfield Renewable Partners

- Vestas Wind Systems

- Enel

- Iberdrola

- China Longyuan Power Group

- Siemens Gamesa Renewable Energy

- GE Renewable Energy

- Canadian Solar

- China Three Gorges Corporation

- RWE

- SolarEdge Technologies

- NextEra Energy

- Orsted

- EDP Renewables

- First Solar

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the green energy market based on the below-mentioned segments:

Global Green Energy Market, By Energy Source

- Solar Energy

- Wind Energy

- Hydropower

- Geothermal Energy

- Biomass Energy

- Others

Global Green Energy Market By Application

- Electricity Generation

- Heating

- Transportation

- Industrial Processes

- Others

Global Green Energy Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the green energy market over the forecast period?The green energy market is projected to expand at a CAGR of 8.48% during the forecast period.

-

2. What is the market size of the green energy market?The Global Green Energy Market Size is Expected to Grow from USD 1.05 Trillion in 2023 to USD 2.37 Trillion by 2033, at a CAGR of 8.48% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the green energy market?Europe is anticipated to hold the largest share of the green energy market over the predicted timeframe.

Need help to buy this report?