Global Graphitized Petroleum Coke Market Size, Share, and COVID-19 Impact Analysis, By Grade (High Purity and Low Purity), By Application (Aluminum, Steel, Titanium, Foundry, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Graphitized Petroleum Coke Market Insights Forecasts to 2035

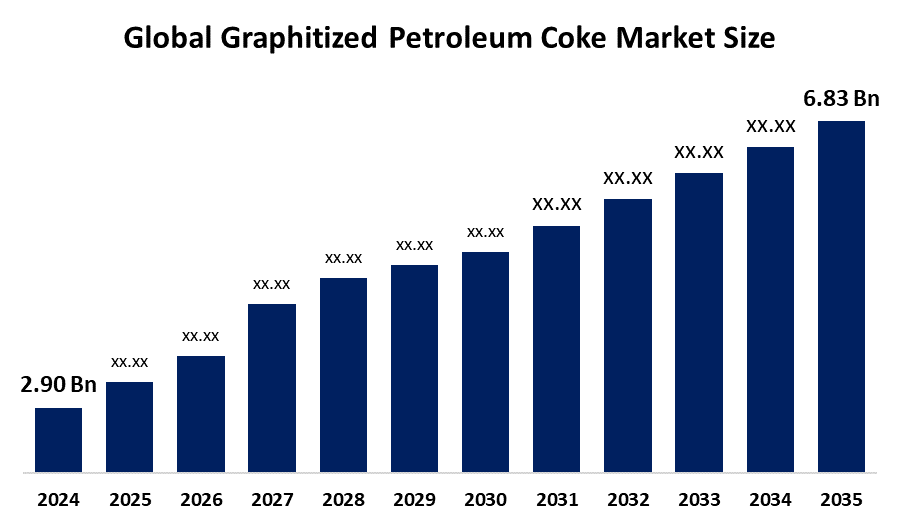

- The Global Graphitized Petroleum Coke Market Size Was Estimated at USD 2.90 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.1% from 2025 to 2035

- The Worldwide Graphitized Petroleum Coke Market Size is Expected to Reach USD 6.83 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Graphitized Petroleum Coke Market Size was worth around USD 2.90 Billion in 2024 and is predicted to grow to around USD 6.83 Billion by 2035 with a compound annual growth rate (CAGR) of 8.1% from 2025 and 2035. The market for graphitized petroleum coke has a number of opportunities to grow due to the demand for lithium ion batteries, which need high purity GPC for anode manufacture, has surged because of the electric vehicle industry's explosive growth. Furthermore, GPC must be used as a recarburizer to retain carbon content due to the steel industry's transition to electric arc furnaces.

Market Overview

Graphitized petroleum coke is a high purity carbon product made from low sulfur, low ash petroleum coke that has been treated at extremely high temperatures to change its amorphous carbon structure into a crystalline structure resembling graphite. Growing technological breakthroughs in steelmaking, a shift to dependable technologies like Electric Arc Furnaces, the establishment of supportive environmental rules, and shifting global trade dynamics are the main factors driving the product's demand. Additionally, because of steel's exceptional qualities, particularly its corrosion resistance, its use is expanding quickly in key industries including aircraft, automotive, electrical and electronics, and construction. Pet coke is therefore increasingly being used in the production of steel. The product's cost effectiveness, high energy and carbon content, and enhanced quality are the primary factors driving the market's expansion. These characteristics aid in the creation of an overall energy balance in steel, which leads to the search for high energy and efficient inputs, the reduction of iron oxide to iron during the smelting process, and cost savings. As a result, the expanding steel sector will increase the product's uptake.

The Directorate General of Foreign Trade in India has allocated about 1.87 million tonnes of GPC import quotas for the fiscal year 2025–2026 this is a slight drop from the year before. Out of the 25 calciners, Rain CII Carbon is given the greatest portion of these quotas, totaling 462,589 tons. China has placed stringent environmental regulations on the production of GPC, especially in provinces like Shandong and Henan. Facilities with annual emissions over 260,000 tons are required to undergo carbon capture retrofits, which increases operational costs and frequently leads to production halts.

Report Coverage

This research report categorizes the graphitized petroleum coke market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the graphitized petroleum coke market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the graphitized petroleum coke market.

Global Graphitized Petroleum Coke Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.90 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.1% |

| 2035 Value Projection: | USD 6.83 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Grade, By Application and By Region |

| Companies covered:: | GrafTech International Ltd., Asbury Carbons, HEG Limited, Tokai Carbon Co., Ltd., Nippon Carbon Co., Ltd., SGL Carbon SE, Fangda Carbon New Material Co., Ltd., Graphite India Limited, China Carbon Graphite Group, Shandong Zhongpeng Special Carbon Co., Ltd., Lianyungang Jinli Carbon Co., Ltd., Qingdao Tennry Carbon Co., Ltd., Mitsubishi Chemical Corporation, Showa Denko K.K., EPM Group, Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The graphitized petroleum coke market is driven by the growing need for high performance materials across multiple sectors. Great purity graphitized petroleum coke is in great demand due to the increasing focus on quality, efficiency, and performance in sectors including electronics, automotive, and aerospace. Manufacturers can profit from this trend by improving the purity and caliber of their products and investing in cutting-edge production methods. Graphitized petroleum coke's growing uses in cutting edge fields like sustainable manufacturing and improved battery technologies also present new opportunities for development and innovation. The growing emphasis on environmentally friendly and sustainable production methods presents another opportunity in the market for graphitized petroleum coke. The need for sustainable raw materials is growing as businesses around the world work to lower their carbon footprints and implement greener practices. Graphitized petroleum coke is in a good position to satisfy this demand because it has a smaller environmental impact than conventional carbon products.

Restraining Factors

The graphitized petroleum coke market is restricted by factors like the price fluctuation of raw materials. The cost and accessibility of feedstocks obtained from petroleum are critical factors in the manufacturing of graphitized petroleum coke. Changes in the price of crude oil and interruptions in the supply chain can affect enterprises' cost structures and profitability.

Market Segmentation

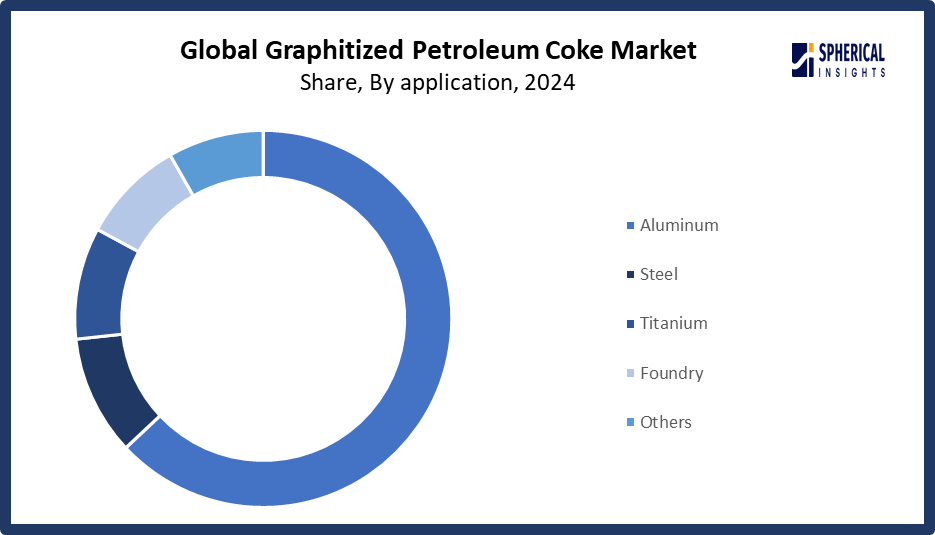

The graphitized petroleum coke market share is classified into grade and application.

- The high purity segment dominated the market in 2024, accounting for approximately 55% and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the graphitized petroleum coke market is divided into high purity and low purity. Among these, the high purity segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven, as it is often used in upscale applications that demand exceptional quality and performance, and it has a sizable market share. For their sophisticated manufacturing processes, industries including electronics, aerospace, and specialty chemicals require high-purity graphite materials. High purity graphitized petroleum coke is essential for these applications due to its resistance to corrosive conditions and high temperatures.

- The aluminum segment accounted for the largest share in 2024, accounting for approximately 63% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the graphitized petroleum coke market is divided into aluminum, steel, titanium, foundry, and others. Among these, the aluminum segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is because graphitized petroleum coke is widely used in the smelting and manufacturing of aluminum. Aluminum consumption is rising due to the growing need for lightweight materials, especially in the automotive and aerospace industries, which in turn is fueling the demand for graphitized petroleum coke as a vital raw ingredient.

Get more details on this report -

Regional Segment Analysis of the Graphitized Petroleum Coke Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 60% of the graphitized petroleum coke market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share, representing nearly 60% of the graphitized petroleum coke market over the predicted timeframe. In the Asia Pacific market, the rise is fueled by nations like China and India's fast urbanization, industrialization, and infrastructure advancements. High quality carbon materials are in high demand due to the region's thriving industrial sector, especially in metallurgy and electronics. The Asia Pacific region's expanding automotive and aerospace sectors are also causing graphitized petroleum coke demand to rise. The Asia Pacific market is expected to rise significantly due to investments in industrial expansion and favorable government policies.

North America is expected to grow at a rapid CAGR, representing nearly 7.5% in the graphitized petroleum coke market during the forecast period. The North American area has a thriving market for graphitized petroleum coke due to constant expansion and advances in technology. The need for high purity graphitized petroleum coke is being driven by the region's existing chemical and metallurgical industries. The market is being further stimulated by the adoption of new technologies and the growing emphasis on sustainable production methods. With a significant number of large manufacturers and an increasing focus on high performance materials, the United States, in particular represents a significant market in North America.

Europe's advanced industrial and automotive industries are the main drivers of the continent's sizeable market share in graphitized petroleum coke. The market is propelled due to the increased emphasis on sustainability and the growing need for lightweight materials in the automotive sector. Major auto and electronics manufacturers are well represented in Germany, France, and the United Kingdom, three important European marketplaces. The market for graphitized petroleum coke is expanding due in part to the region's well established regulatory framework and emphasis on environmental compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the graphitized petroleum coke market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GrafTech International Ltd.

- Asbury Carbons

- HEG Limited

- Tokai Carbon Co., Ltd.

- Nippon Carbon Co., Ltd.

- SGL Carbon SE

- Fangda Carbon New Material Co., Ltd.

- Graphite India Limited

- China Carbon Graphite Group

- Shandong Zhongpeng Special Carbon Co., Ltd.

- Lianyungang Jinli Carbon Co., Ltd.

- Qingdao Tennry Carbon Co., Ltd.

- Mitsubishi Chemical Corporation

- Showa Denko K.K.

- EPM Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, Alba announced a new project 2025 to increase the production capacity of calcined petroleum coke by 20%, aimed at catering to the growing demand from the aluminum sector.

- In September 2024, Phillips 66 launched an improved petroleum coke variant 2025 that offers better conductivity, making it highly suitable for use in high-performance industrial applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the graphitized petroleum coke market based on the below-mentioned segments:

Global Graphitized Petroleum Coke Market, By Grade

- High Purity

- Low Purity

Global Graphitized Petroleum Coke Market, By Application

- Aluminum

- Steel

- Titanium

- Foundry

- Others

Global Graphitized Petroleum Coke Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the graphitized petroleum coke market over the forecast period?The global graphitized petroleum coke market is projected to expand at a CAGR of 8.1% during the forecast period.

-

2. What is the market size of the graphitized petroleum coke market?The global graphitized petroleum coke market size is expected to grow from USD 2.90 Billion in 2024 to USD 6.83 Billion by 2035, at a CAGR of 8.1% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the graphitized petroleum coke market?Asia Pacific is anticipated to hold the largest share of the graphitized petroleum coke market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global graphitized petroleum coke market?GrafTech International Ltd., Asbury Carbons, HEG Limited, Tokai Carbon Co., Ltd., Nippon Carbon Co., Ltd., SGL Carbon SE, Fangda Carbon New Material Co., Ltd., Graphite India Limited, China Carbon Graphite Group, Shandong Zhongpeng Special Carbon Co., Ltd., Lianyungang Jinli Carbon Co., Ltd., Qingdao Tennry Carbon Co., Ltd., Mitsubishi Chemical Corporation, Showa Denko K.K., EPM Group, and Others.

-

5. What factors are driving the growth of the graphitized petroleum coke market?The graphitized petroleum coke market growth is driven by the need for high purity GPC as a crucial component in synthetic graphite anodes has increased dramatically due to the growing demand for lithium ion batteries, especially in electric vehicles and energy storage systems.

-

6. What are the market trends in the graphitized petroleum coke market?The graphitized petroleum coke market trends include a surge in demand from energy storage and electric vehicles, surge in demand from energy storage and electric vehicles, shift towards sustainable and low emission production, technological advancements in production processes, and geopolitical and regulatory influences on trade dynamics.

-

7. What are the main challenges restricting wider adoption of the graphitized petroleum coke market?The graphitized petroleum coke market trends include that production costs are variable because of fluctuating pricing for raw materials, especially petroleum coke. Furthermore, stricter environmental laws force investments in greener technologies, which raises operating costs. The graphitization process's high energy consumption drives up costs even more.

Need help to buy this report?