Global Grapefruit Oil Market Size, Share, and COVID-19 Impact Analysis, Impact of Tariff and Trade War Analysis, By Grade (F&F Grade, Aromatherapy Grade, and Pharmaceutical Grade), By Type (White Grapefruit and Pink/Red Grapefruit), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGrapefruit Oil Market Summary, Size & Emerging Trends

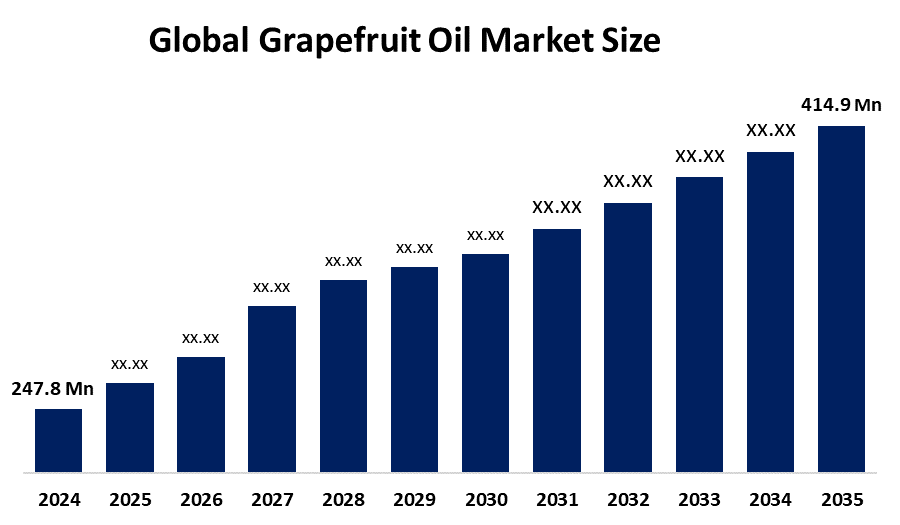

According to Spherical Insights, The Global Grapefruit Oil Market Size is expected to Grow from USD 247.8 Million in 2024 to USD 414.9 Million by 2035, at a CAGR of 4.8% during the forecast period 2025-2035. Increasing demand from the flavor & fragrance industry and rising consumer preference for natural and organic products are key driving factors for the grapefruit oil market.

Get more details on this report -

Key Market Insights

- Asia Pacific is expected to hold the largest market share in the grapefruit oil market during the forecast period.

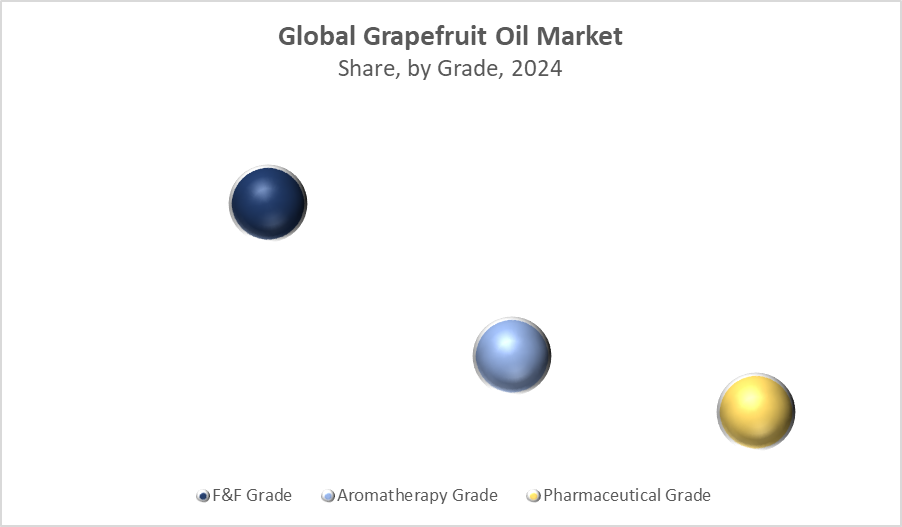

- In terms of grade, the F&F (Flavors & Fragrances) grade segment dominated in revenue during the forecast period.

- In terms of type, the Pink/Red Grapefruit segment accounted for the largest revenue share globally.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 247.8 Million

- 2035 Projected Market Size: USD 414.9 Million

- CAGR (2025-2035): 4.8%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Grapefruit Oil Market

The Grapefruit Oil Market Size focuses on the extraction and application of essential oils derived from grapefruit peel, used extensively in flavoring, aromatherapy, and pharmaceuticals. Grapefruit oil is valued for its refreshing citrus aroma and health benefits such as antimicrobial and anti-inflammatory properties. It is widely applied in cosmetics, personal care products, and natural remedies. Growing consumer inclination toward natural ingredients and clean-label products fuels demand, while increasing applications in aromatherapy and pharmaceutical sectors further support market expansion.

Grapefruit Oil Market Trends

- Rising popularity of natural and organic ingredients in personal care and food products is driving market growth.

- Increasing incorporation of grapefruit oil in aromatherapy for stress relief and wellness is a growing trend.

- Expansion of the natural flavors segment due to consumer preference for clean-label products is boosting demand.

Grapefruit Oil Market Dynamics

Driving Factors: Growing demand from flavor & fragrance and wellness industries

The grapefruit oil market is propelled by increased use in food and beverage flavoring, cosmetics, and wellness products. Consumer preference for natural aromatherapy products and the rising trend of organic personal care are key contributors. Additionally, the pharmaceutical industry’s adoption of grapefruit oil for its therapeutic properties enhances market growth. Expanding applications in aromatherapy and natural wellness products, coupled with rising disposable incomes, are further driving demand globally.

Restrain Factors: Seasonal availability and susceptibility to adulteration

Grapefruit oil production is highly dependent on seasonal fruit harvests, leading to supply fluctuations. Moreover, the risk of adulteration with cheaper oils affects product authenticity and consumer trust. Limited large-scale cultivation in some regions and sensitivity to climatic changes can impact raw material availability. High production costs and strict regulatory requirements for natural essential oils also pose challenges to market expansion, particularly in emerging economies.

Opportunity: Innovation in extraction technologies and new application areas

Advancements in extraction techniques such as cold pressing and supercritical CO2 extraction improve oil yield and purity, creating opportunities for product innovation. Growing consumer awareness about health benefits is encouraging new uses in pharmaceuticals, nutraceuticals, and personal care. Emerging markets show increasing interest in aromatherapy and natural wellness, providing untapped potential. Strategic collaborations and product launches targeting clean-label and organic certifications offer further avenues for market growth.

Challenges: Regulatory hurdles and quality standardization

Complex regulatory landscapes concerning essential oils and natural extracts challenge market participants. Ensuring consistent quality, purity, and compliance with international standards requires significant investment. Adherence to labeling and safety regulations, especially in the pharmaceutical and food sectors, adds complexity. Additionally, competition from synthetic substitutes and price sensitivity among consumers may restrict growth. Maintaining sustainable sourcing and traceability also remains a pressing issue for manufacturers.

Global Grapefruit Oil Market Ecosystem Analysis

The grapefruit oil market ecosystem comprises raw material suppliers (citrus growers), essential oil manufacturers, flavor and fragrance companies, cosmetic and personal care product formulators, and pharmaceutical companies. Key suppliers are primarily located in citrus-producing regions such as the U.S., China, Mexico, and South Africa. Manufacturers focus on sustainable sourcing, quality assurance, and product innovation. Regulatory agencies oversee safety and environmental compliance, shaping market dynamics and encouraging sustainable production practices.

Global Grapefruit Oil Market, By Grade

The flavors & fragrances (F&F) grade segment holds the largest share in the grapefruit oil market, estimated at around 55% of total revenue in 2024. This dominance is primarily due to its extensive application in the food and beverage industry, where grapefruit oil is valued for its fresh, citrus aroma and flavoring properties. It is widely used in products like beverages, confectioneries, baked goods, and sauces. Additionally, F&F Grade oil is a key ingredient in personal care products such as perfumes, soaps, shampoos, and lotions, where natural scent and fragrance are highly sought after. The growing global demand for natural flavoring agents and clean-label products has significantly boosted the consumption of this grade. Manufacturers are investing in sustainable extraction methods to meet consumer demand for purity and quality, further supporting the segment’s growth and market leadership.

Get more details on this report -

The aromatherapy grade segment currently accounts for approximately 25% of the grapefruit oil market revenue, and it is the fastest-growing segment, with a projected CAGR of about 7% between 2025 and 2035. The growth in this segment is fueled by rising consumer interest in wellness, self-care, and natural therapeutic products. Grapefruit oil is widely used in aromatherapy for its uplifting, stress-relieving, and mood-enhancing properties. It is popular in essential oil blends, diffusers, massage oils, and skincare formulations targeting relaxation and mental health benefits. Increasing awareness about the benefits of holistic health practices, along with a growing shift towards natural remedies over synthetic chemicals, has significantly boosted the demand for aromatherapy grade oils. Wellness brands and spas are incorporating grapefruit oil in their product lines and treatments, further driving market expansion. Additionally, the rise in e-commerce and social media awareness has made aromatherapy products more accessible to a broader consumer base.

Global Grapefruit Oil Market, By Type

The pink/red grapefruit oil segment commands the largest share of the market, accounting for approximately 60% of the total revenue in 2024. This dominance is largely due to its richer, sweeter aroma and higher concentration of essential oils compared to the White Grapefruit variety. The stronger fragrance makes Pink/Red Grapefruit oil highly preferred in applications such as perfumes, cosmetics, and aromatherapy, where a robust citrus scent is desirable. Its enhanced essential oil content also boosts its efficacy in therapeutic uses, driving demand in wellness and pharmaceutical sectors. Additionally, Pink/Red Grapefruit oil is favored in food and beverage flavoring for products requiring a more intense grapefruit taste profile. These factors collectively contribute to its leading position and steady market growth.

The white grapefruit oil segment holds a steady market share of about 40% in 2024. It is valued for its lighter, more delicate fragrance and milder flavor, making it suitable for specific flavoring applications where a subtle citrus note is preferred. White Grapefruit oil is commonly used in beverages, confectionery, and certain personal care products that benefit from a fresher, less overpowering aroma. Its consistent demand is supported by food manufacturers and fragrance developers who require nuanced scent profiles. While its growth rate is comparatively moderate, the segment benefits from steady consumption in niche applications and continues to play an important role in the overall grapefruit oil market.

Asia Pacific is projected to hold the largest market share in the grapefruit oil market throughout the forecast period, accounting for approximately 40% of the global revenue by 2035. This dominance is supported by extensive citrus cultivation in major producing countries such as China, India, and several Southeast Asian nations. The region benefits from abundant raw material availability, which helps keep production costs competitive. Rapid growth in the food and beverage sector, coupled with an expanding personal care and cosmetics market, fuels demand for grapefruit oil. Additionally, rising health awareness and increased consumer preference for natural and herbal products across these countries significantly boost consumption. Government initiatives to support agricultural development and improve supply chains further strengthen Asia Pacific’s leading position.

India is a key growth driver within the Asia Pacific grapefruit oil market, benefiting from its vast citrus cultivation regions, especially in states like Maharashtra, Andhra Pradesh, and Punjab. The country’s expanding food processing and personal care industries are major consumers of grapefruit oil, using it for flavoring, fragrances, and therapeutic products. Rising disposable incomes and growing health consciousness among consumers are increasing demand for natural and organic products, including essential oils. Additionally, government initiatives supporting agriculture modernization and exports help strengthen India’s position as a significant supplier and consumer in the global grapefruit oil market. With rapid urbanization and an expanding middle class, India is expected to register a strong CAGR of around 9% through 2035.

North America is the fastest-growing grapefruit oil market, expected to grow at a robust CAGR of around 7.5%. The region’s growth is driven by increasing consumer demand for organic, natural, and wellness-focused products. Heightened awareness about the benefits of aromatherapy and natural personal care solutions encourages higher adoption of grapefruit oil in health and beauty industries. Strong regulatory support ensuring product safety and quality enhances market confidence, while continuous innovation in extraction and distillation technologies improves product purity and efficacy. Moreover, the well-established food and beverage sector in the U.S. and Canada continues to adopt grapefruit oil for flavor enhancement, supporting steady growth. These factors collectively position North America as a rapidly expanding market within the global grapefruit oil landscape.

The United States is a leading market for grapefruit oil in North America, driven by high consumer demand for wellness and natural personal care products. The country’s well-established food and beverage industry extensively uses grapefruit oil for flavor enhancement in beverages, confectioneries, and snacks. Growing interest in aromatherapy and holistic health has boosted its use in therapeutic oils and cosmetics. Regulatory bodies like the FDA ensure product safety and quality, fostering consumer trust. Innovation in extraction methods, such as cold-pressing and steam distillation, enhances oil purity and effectiveness, attracting premium buyers. The U.S. market is expected to maintain strong growth at a CAGR of approximately 7% due to these favorable market conditions.

Global Grapefruit Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 247.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.8% |

| 2035 Value Projection: | USD 414.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Grade, By Region |

| Companies covered:: | DoTERRA International LLC, Young Living Essential Oils, Symrise AG, Firmenich SA, Mane SA, Givaudan SA, Robertet SA, Aveda Corporation, International Flavors & Fragrances Inc. (IFF), Plant Therapy LLC, and Other key player |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

WORLDWIDE TOP KEY PLAYERS IN THE GRAPEFRUIT OIL MARKET INCLUDE

- DoTERRA International LLC

- Young Living Essential Oils

- Symrise AG

- Firmenich SA

- Mane SA

- Givaudan SA

- Robertet SA

- Aveda Corporation

- International Flavors & Fragrances Inc. (IFF)

- Plant Therapy LLC

- Others

Product Launches in Grapefruit Oil Market

- In March 2024, DoTERRA International LLC launched a new line of organic aromatherapy-grade grapefruit oils, highlighting sustainable sourcing and enhanced purity. This product expansion aims to meet growing consumer demand for natural wellness solutions and strengthen the company’s market presence in aromatherapy and personal care.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Decision Advisor has segmented the Grapefruit Oil market based on the below-mentioned segments:

Global Grapefruit Oil Market, By Grade

- F&F Grade

- Aromatherapy Grade

- Pharmaceutical Grade

Global Grapefruit Oil Market, By Type

- White Grapefruit

- Pink/Red Grapefruit

Global Grapefruit Oil Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is driving the growth of the global grapefruit oil market?The market is driven primarily by rising demand from the flavor & fragrance industry, increasing consumer preference for natural and organic products, and expanding applications in aromatherapy and pharmaceuticals.

-

Which region holds the largest share in the grapefruit oil market?Asia Pacific holds the largest share, supported by major citrus-producing countries like China and India, abundant raw materials, and strong demand from food, beverage, and personal care sectors.

-

What are the main types of grapefruit oil in the market?The market is mainly segmented into Pink/Red Grapefruit oil and White Grapefruit oil. Pink/Red Grapefruit oil holds the larger share due to its richer aroma and higher essential oil concentration.

-

What are the different grades of grapefruit oil, and which is the most popular?The three main grades are Flavors & Fragrances (F&F) Grade, Aromatherapy Grade, and Pharmaceutical Grade. F&F Grade dominates due to its widespread use in food, beverages, and personal care products.

-

What are the challenges facing the grapefruit oil market?Challenges include seasonal availability of raw materials, risk of adulteration, high production costs, complex regulatory requirements, and competition from synthetic alternatives.

-

How is the aromatherapy grade segment performing?The aromatherapy grade segment is the fastest growing, fueled by rising consumer interest in natural wellness, stress relief, and self-care products.

-

What opportunities exist in the grapefruit oil market?Opportunities include innovations in extraction technology, expansion into new applications like nutraceuticals and pharmaceuticals, growing consumer awareness of health benefits, and increasing demand in emerging markets.

-

Who are the key players in the grapefruit oil market?Major players include DōTERRA International LLC, Young Living Essential Oils, Symrise AG, Firmenich SA, Mane SA, Givaudan SA, Robertet SA, and International Flavors & Fragrances Inc. (IFF).

-

How is the North American market performing?North America is the fastest-growing market, driven by consumer demand for organic and wellness products, robust food and beverage industries, and regulatory support for product safety.

-

Are there any recent product launches in the grapefruit oil market?Yes, for example, in March 2024, DōTERRA International LLC launched a new line of organic aromatherapy-grade grapefruit oils emphasizing sustainable sourcing and high purity.

Need help to buy this report?