Global Glyoxal Market Size, Share, and COVID-19 Impact Analysis, By Application (Cross-Linking Polymer and Sulfur Scavenger), By End Use (Oil & Gas, Textile, Paper & Packaging, Leather, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Glyoxal Market Insights Forecasts to 2035

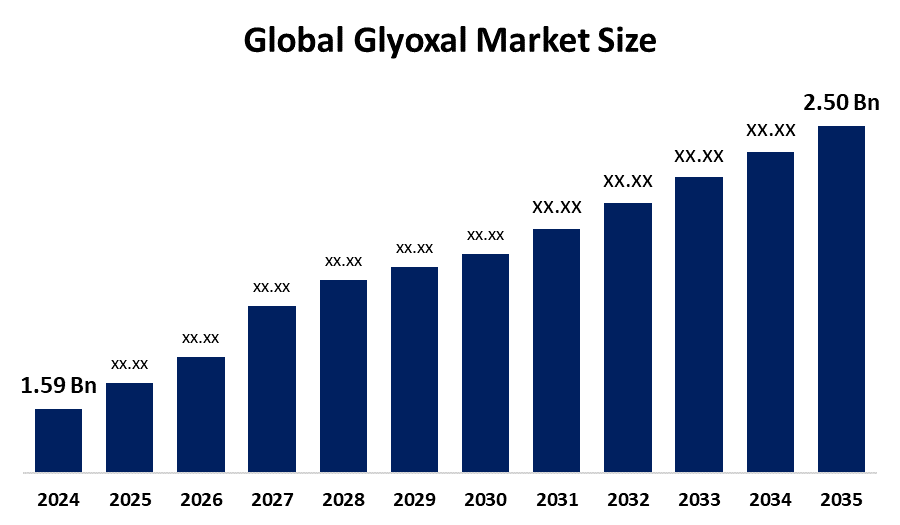

- The Global Glyoxal Market Size Was Estimated at USD 1.59 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.20% from 2025 to 2035

- The Worldwide Glyoxal Market Size is Expected to Reach USD 2.50 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Glyoxal Market Size was worth around USD 1.59 Billion in 2024 and is predicted to grow to around USD 2.50 Billion by 2035 with a compound annual growth rate (CAGR) of 4.20% from 2025 and 2035. The market for glyoxal has a number of opportunities to grow due to the global safety standards, along with growing industrialization and urbanization.

Market Overview

The global industry of glyoxal encompasses the production, distribution, and consumption of glyoxal, which is a highly reactive chemical used as a cross-linking agent and an intermediate in producing other chemicals. Glyoxal is an organic crystalline solid compound, and is the smallest dialdehyde (a compound with two aldehyde groups). It is usually handled as a 40% aqueous solution (density near 1.24 g/mL) and forms a series of hydrates, like oligomers, which behave equivalently to glyoxal. In coated paper and textile finishing, glyoxal is used as a crosslinker for starch-based formulations, for wrinkle-resistant chemical treatments of clothing, i.e. permanent press. Further, it is used in polymer chemistry and organic synthesis of heterocycles, as well as a histology fixative. There is a growing trend towards bio-based and low-formaldehyde glyoxal products owing to increasing environmental and health concerns.

Innovation and market expansion are anticipated as a result of major players' growing emphasis on expanding glyoxal offerings catering to specific end-use requirements and R&D in the novel production methods, owing to environmental concerns associated with traditional production methods and responsible waste management practices. The growing prioritization towards creating glyoxal-based goods that are sustainable and eco-friendly is driving a huge surge in the global glyoxal market.

Report Coverage

This research report categorizes the glyoxal market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the glyoxal market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the glyoxal market.

Global Glyoxal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.59 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 4.20% |

| 2033 Value Projection: | USD 2.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Application, By End Use and By Region |

| Companies covered:: | BASF SE, Amzole India Pvt Ltd, Haihang Industry, hubei hongyuan pharmaceutical technology co., ltd, Jinan Huashihang Chemical Co., Ltd., INEOS, Merck KGaA, Otto Chemie Pvt. Ltd., Spectrum Chemical, Thermo Fisher Scientific, Tokyo Chemical Industry India Pvt. Ltd., WeylChem International GmbH, Zhonglan Industry Co., Ltd., Others, and |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The use of glyoxal as crosslinked polymers (hydrocolloids) in the personal care and cosmetics industries drives the market demand. Glyoxal is considered safe for use in products intended to be applied to the nail at concentrations less than or equal to 1.25% according to the CIR Expert Panel review. High-quality glyoxal 40% (CAS 107-22-2) is widely used, known for its crosslinking, disinfecting, and chemical synthesis capabilities. Further, its use in textile processing, paper manufacturing, oil & gas, and water treatment industries is propelling the market expansion.

Restraining Factors

The glyoxal market is restricted by factors like volatility in raw material prices that affect the glyoxal production and the continuous supply of glyoxal. Glyoxal’s toxicity and stringent workplace exposure are limiting the market growth. Additionally, competition from dialdehyde starch and other green cross-linkers is challenging the glyoxal market.

Market Segmentation

The glyoxal market share is classified into application and end use.

- The cross-linking polymer segment accounted for a significant share in 2024 and is anticipated to grow at a significant CAGR of 4.4% during the forecast period.

Based on the application, the glyoxal market is divided into cross-linking polymer and sulfur scavenger. Among these, the cross-linking polymer segment accounted for a significant share in 2024 and is anticipated to grow at a significant CAGR of 4.4% during the forecast period. Glyoxal is a reactive dialdehyde which is commonly used for crosslinking chitosan, increasing structural stability and improving resistance to microbial attack. The increased use of cross-linking polymers due to their exceptional durability and resistance to environmental factors is propelling the market in the cross-linking polymer segment.

- The paper & packaging segment dominated the market with the largest revenue share, of about 28% in 2024 and is projected to grow at a substantial CAGR of 5.9% during the forecast period.

Based on the end use, the glyoxal market is divided into oil & gas, textile, paper & packaging, leather, and others. Among these, the paper & packaging segment dominated the market with the largest revenue share, of about 28% in 2024 and is projected to grow at a substantial CAGR of 5.9% during the forecast period. Glyoxal is used as a cross-linking and hardening agent in the paper industry, improving the physical properties of papers that are used for different products like toilet paper and recycled paper, as well as high-quality papers. Further, an increasing paper consumption, driven by the packaging and printing industries, is contributing to the market growth in the paper & packaging segment.

Regional Segment Analysis of the Glyoxal Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the glyoxal market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of over 40% in the glyoxal market over the predicted timeframe. The market ecosystem in Asia Pacific is growing, due to an increasing use of glyoxal across the oil & gas industry for improving the effectiveness and efficiency of drilling & extraction processes and textile industries for improving the durability, appearance, and antimicrobial properties. For instance, in January 2020, Bozzetto and Asutex joined forces in textile chemistry. The demand for glyoxal has been driven by the rapid industrialization and urbanization that are responsible for the growth of the textile, paper, and oil & gas sectors. China is leading the Asia Pacific glyoxal market, with about 65% share, owing to an increasing demand for eco-friendly glyoxal production methods.

North America is expected to grow at a rapid CAGR between 4.2%-7.5% in the glyoxal market during the forecast period. The North America area has a thriving market for glyoxal due to the region’s increasing industrial production and advanced manufacturing processes. The United States is leading the North America glyoxal market, due to advanced economies and an increased need for processed oil products in various industries. The region's higher oil refining activities have also fueled the expansion of the glyoxal market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the glyoxal market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Amzole India Pvt Ltd

- Haihang Industry

- hubei hongyuan pharmaceutical technology co., ltd

- Jinan Huashihang Chemical Co., Ltd.

- INEOS

- Merck KGaA

- Otto Chemie Pvt. Ltd.

- Spectrum Chemical

- Thermo Fisher Scientific

- Tokyo Chemical Industry India Pvt. Ltd.

- WeylChem International GmbH

- Zhonglan Industry Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2023, INEOS announced an agreement with LyondellBasell to buy its Ethylene Oxide and Derivatives business at the Bayport Underwood site, Texas. The deal includes the 420 kt Ethylene Oxide plant, the 375 kt Ethylene Glycols plant and the 165kt Glycol Ethers plant together with all associated third-party business on the site, for $700 million.

- In June 2022, Univar Solutions was named the exclusive distributor for BASF’s Chemical Intermediates’ Glyoxal in the United States and Canada. With this agreement, BASF and Univar Solutions expand their collaboration to better serve customers through a host of sustainable solutions across a range of applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the glyoxal market based on the below-mentioned segments:

Global Glyoxal Market, By Application

- Cross-Linking Polymer

- Sulfur Scavenger

Global Glyoxal Market, By End Use

- Oil & Gas

- Textile

- Paper & Packaging

- Leather

- Others

Global Glyoxal Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the glyoxal market?The global glyoxal market size is expected to grow from USD 1.59 Billion in 2024 to USD 2.50 Billion by 2035, at a CAGR of 4.20% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the glyoxal market?Asia Pacific is anticipated to hold the largest share of the glyoxal market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Glyoxal Market from 2024 to 2035?The market is expected to grow at a CAGR of around 4.20% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Glyoxal Market?Key players include BASF SE, Amzole India Pvt Ltd, Haihang Industry, hubei hongyuan pharmaceutical technology co., ltd, Jinan Huashihang Chemical Co., Ltd., INEOS, Merck KGaA, Otto Chemie Pvt. Ltd., Spectrum Chemical, Thermo Fisher Scientific, Tokyo Chemical Industry India Pvt. Ltd., and WeylChem International GmbH.

-

5. Can you provide company profiles for the leading glyoxal manufacturers?Yes. For example, Amzole India Pvt Ltd boasts of being the largest manufacturer of Glyoxal-40% in India and has a production capacity of 500 MT of Glyoxal-40% per month. Haihang Industry, consisting Haihang Industry Co., Ltd., Zhonglan Industry Co., Ltd., and METISARC PTE. LTD., is a large manufacturer of fine chemicals and cosmetic materials that integrates R&D, production and sales.

-

6. What are the main drivers of growth in the glyoxal market?The growing application of glyoxal across the textile, oil & gas, and paper industries is a major market growth driver of the glyoxal market.

-

7. What challenges are limiting the glyoxal market?Volatility in raw material prices and competition from dialdehyde starch & other green cross-linkers remain key restraints in the glyoxal market.

Need help to buy this report?