Global Glycine Market Size, Share, and COVID-19 Impact Analysis, By Grade (Pharma Grade, Food Grade, and Tech Grade), By Form (Solid and Liquid), By Application (Feed and Food Additive, Ph buffers and Stabilizers, Pharmaceutical Ingredient, Chemical Intermediate, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Glycine Market Insights Forecasts to 2035

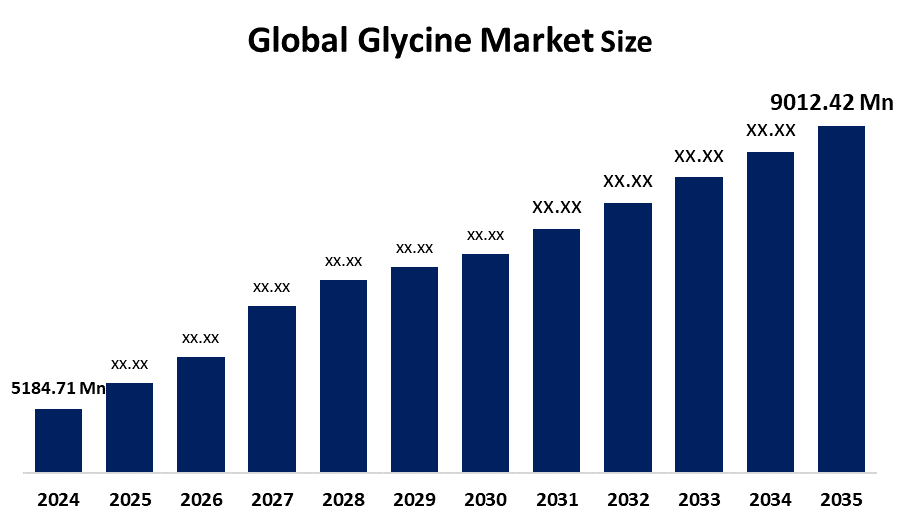

- The Global Glycine Market Size Was Estimated at USD 5184.71 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.15% from 2025 to 2035

- The Worldwide Glycine Market Size is Expected to Reach USD 9012.42 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global glycine market size was worth around USD 5184.71 million in 2024 and is predicted to grow to around USD 9012.42 million by 2035 with a compound annual growth rate (CAGR) of 5.15% from 2025 to 2035. The glycine market witnesses growth due to the rising demand emanating from pharmaceuticals, food and beverages, and cosmetics, driven by increasing health awareness, preference for functional foods, expanding applications of animal feed, and versatility in the amino acid's role in protein synthesis and nutrition.

Market Overview

The Global Glycine Market refers to the production and utilization of glycine, a non-essential amino acid that plays a crucial role in protein synthesis, neurotransmission, and various metabolic pathways. Glycine finds widespread applications across multiple industries, including food and beverages, pharmaceuticals, cosmetics, and animal nutrition.In the food industry, glycine is used as a flavor enhancer, sweetener, and nutritional additive. Within pharmaceutical applications, it serves in intravenous nutrition formulations, aids in the treatment of neurological and metabolic disorders, and functions as an active ingredient in several drug preparations. In cosmetics, glycine contributes to skin hydration, anti-aging effects, and protection, while in animal feed, it supports growth, metabolism, and immune function.Key market drivers include increasing health awareness, rising demand for functional foods and dietary supplements, and expanding pharmaceutical applications. Technological advancements in production methods, such as bio-fermentation and synthetic processes, have further improved product quality while reducing costs—creating substantial growth opportunities.Emerging fields such as nutraceuticals, cosmeceuticals, and animal nutrition are expanding the scope of the glycine market. With the growing health-conscious population and rapid expansion of the food and pharmaceutical sectors, Asia-Pacific, North America, and Europe are expected to remain key growth regions.Leading market players include Ajinomoto Co., Inc., Evonik Industries AG, Kyowa Hakko Bio Co., Ltd., and CJ CheilJedang Corporation, which are strengthening their market positions through strategic partnerships, research and development initiatives, and geographic expansion.In April 2025, the International Trade Administration (ITA) under the U.S. Department of Commerce concluded a changed-circumstances review of antidumping duty orders on glycine imports from China, India, Japan, and Thailand. The review determined that Indian-processed glycine made from Chinese inputs is not substantially transformed and therefore remains subject to the existing antidumping order on China.

Report Coverage

This research report categorizes the glycine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the glycine market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the glycine market.

Driving Factors

The Glycine Market Size is driven by rising demand across various industries, including food and beverages, pharmaceuticals, cosmetics, and animal feed. Glycine is widely used as a flavor enhancer, nutritional supplement, and building block in protein synthesis. Increasing health awareness and the preference for functional foods and dietary supplements fuel its consumption. In pharmaceuticals, glycine is utilized in therapies for neurological disorders, metabolic diseases, and as a component in intravenous nutrition. Growing applications in personal care products, including anti-aging and skin protection formulations, together with expanding animal husbandry and feed industries, propel the growth of the global market.

Restraining Factors

Factors such as high production costs and the fluctuating prices of raw materials are great constraints on the glycine market. In addition, strict regulatory standards for food, pharmaceuticals, and cosmetics may hamper growth in the expansion of the market. Furthermore, the availability of other amino acids and synthetic alternatives lowers demand, while poor consumer awareness in developing economies further dents growth.

Market Segmentation

The glycine market share is classified into grade, form, and application.

- The food grade segment dominated the market in 2024, approximately 39% and is projected to grow at a substantial CAGR during the forecast period.

Based on the grade, the glycine market is divided into pharma grade, food grade, and tech grade. Among these, the food grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This segment dominated the glycine market owing to its considerable use as a flavor enhancer, sweetener, and preservative in processed foods and beverages. Rising consumer demand for fortified and functional foods, along with growing awareness about nutritional supplements, further enhances adoption. Additionally, government regulations on food safety and quality are also supportive of market expansion globally.

- The solid segment accounted for the largest share in 2024, approximately 86% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the glycine market is divided into solid and liquid. Among these, the solid segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The solid segment growth is driven by its stability, longer shelf life, and ease of handling, hence making it the ideal choice for pharmaceutical, food, and industrial application areas. Increased demand in supplement and nutritional fortification, as well as drug formulation areas, drives further growth in the global market.

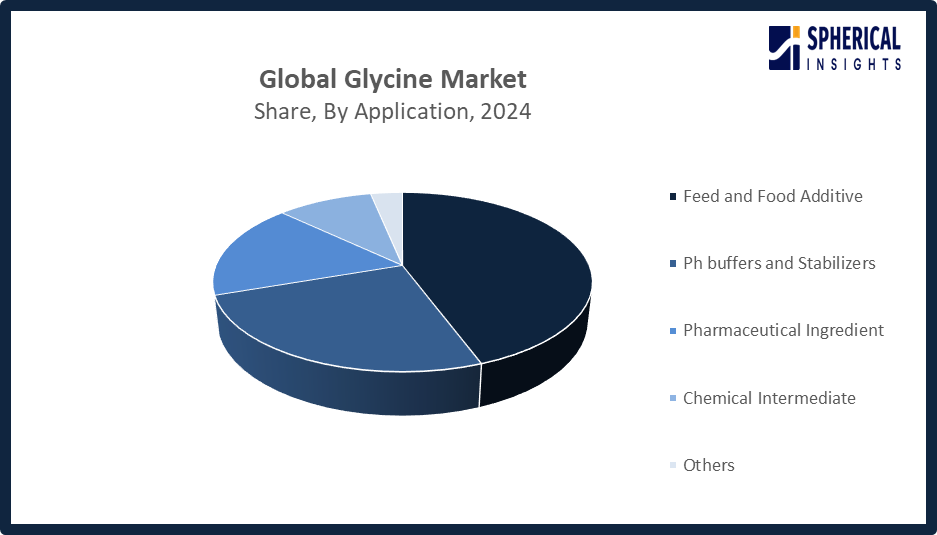

- The feed and food additive segment accounted for the highest market revenue in 2024, approximately 44% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the glycine market is divided into feed and food additive, pH buffers and stabilizers, pharmaceutical ingredient, chemical intermediate, and others. Among these, the feed and food additive segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growth in the feed and food additives segment is also driven by the rising demand for glycine as a flavor enhancer, preservative, and nutritional supplement in animal feed and human food products. Increasing awareness of protein-rich diets, expansion of the livestock and aquaculture industries, and growing consumption of processed and fortified foods further drive the segment's market growth globally.

Get more details on this report -

Regional Segment Analysis of the Glycine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the glycine market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the glycine market over the predicted timeframe. The Asia Pacific is expected to contribute a 40% share to the glycine market during the forecast period due to rising demand from industries such as food, pharmaceuticals, and animal feed. Countries such as China, India, and Japan are significant contributors due to rapid industrialization, a growing population, and a rise in protein-rich diets. China dominates the region with its large-scale pharmaceutical manufacturing and food processing industries. Besides this, India's growing livestock and aquaculture industries further fuel the demand for glycine. In addition, several government initiatives regarding nutritional supplements, fortified foods, and improvements in healthcare infrastructure further help the continuous growth of the market.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the glycine market during the forecast period. The glycine market is rapidly growing in North America during the forecast period, with an approximate 27% market share, due to high demand in the pharmaceutical, food, and cosmetic industries. The United States represents the leading market among regional players, representing a strong influence on the growth of the global market due to advanced pharmaceutical manufacturing, well-established nutraceutical industries, and strict quality and safety regulations. High consumer awareness related to protein supplements, fortified foods, and animal feed products stimulates further growth. Furthermore, the support for food safety standards, research and development, and the surge in the adoption of glycine-based products in the healthcare and wellness sectors add to the robust expansion of this market region.

The demand for glycine is growing significantly in Europe, particularly from the pharmaceuticals, food & beverages, and animal feed sectors. Germany, France, and the UK are leading in the regional market due to the presence of well-established pharmaceutical manufacturing, tough regulatory standards, and rapidly growing health-conscious consumer behavior. The adoption of glycine in nutraceuticals, cosmetic products, and specialty food further powers growth. Government initiatives toward food fortification and animal nutrition also support market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the glycine market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Evonik Industries AG

- Showa Denko KK

- Ajinomoto Co., Inc.

- Henan HDF Chemical

- GEO Specialty Chemicals

- Cargill

- Dow Chemical

- Zexing Group

- Chattem Chemicals, Inc.

- AMINO GmbH

- Donghua Jinlong Chemical

- Yuki Gosei Kogyo Co., Ltd.

- Hubei Xingfa Chemicals Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2024, Evonik announced a strategic restructuring of its keto and pharma amino acid division, including glycine. The company is considering partnerships or divestment for its facilities in Ham, France, and Wuming, China, and will cease keto acid production in Hanau, Germany, by late 2025.

- In September 2024, Ajinomoto Co. and Danone announced a global partnership to reduce greenhouse gas emissions in the milk supply chain. The initiative leverages Ajinomoto’s AjiPro L lysine formulation, enhancing amino acid absorption while offering a cost-effective, wide-ranging solution for GHG reduction.

- In June 2024, GEO Specialty Chemicals shut down its Allentown, Pennsylvania, facility, previously producing resins and coatings. The site was later acquired by an affiliate of International Process Plants (IPP), which intends to repurpose the facility for new industrial and manufacturing applications.

- In May 2019, Evonik Nutrition & Care GmbH, a division of Evonik Industries, announced a 12% price increase for glycine effective July 1, 2019. The decision was driven by rising raw material costs experienced over the previous year.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the glycine market based on the below-mentioned segments: Global Glycine Market, By Grade

- Pharma Grade

- Food Grade

- Tech Grade

Global Glycine Market, By Form

- Solid

- Liquid

Global Glycine Market, By Application

- Feed and Food Additive

- Ph buffers and Stabilizers

- Pharmaceutical Ingredient

- Chemical Intermediate

- Others

Global Glycine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the glycine market over the forecast period?The global glycine market is projected to expand at a CAGR of 5.15% during the forecast period.

-

2.What is the market size of the glycine market?The global glycine market size is expected to grow from USD 5184.71 million in 2024 to USD 9012.42 million by 2035, at a CAGR of 5.15% during the forecast period 2025-2035.

-

3.What is the glycine market?The glycine market involves the global production and trade of glycine, the simplest amino acid, for use in various industries.

-

4.Which region holds the largest share of the glycine market?Asia Pacific is anticipated to hold the largest share of the glycine market over the predicted timeframe.

-

5.Who are the top 10 companies operating in the global glycine market?Evonik Industries AG, Showa Denko KK, Ajinomoto Co., Inc., Henan HDF Chemical, GEO Specialty Chemicals, Cargill, Dow Chemical, Zexing Group, Chattem Chemicals, Inc., AMINO GmbH, Donghua Jinlong Chemical, Yuki Gosei Kogyo Co., Ltd., Hubei Xingfa Chemicals Group, and Others.

-

6.What factors are driving the growth of the glycine market?The growth of the glycine market is primarily driven by its expanding and diverse applications across several major industries, including pharmaceuticals, food and beverages, animal feed, and agrochemicals.

-

7.What are the market trends in the glycine market?Key trends include an increasing demand for glycine supplements for health benefits, the development of new glycine-based therapies, and a shift towards more sustainable production methods such as biotechnology.

-

8.What are the main challenges restricting wider adoption of the glycine market?The main challenges restricting wider adoption of the glycine market include volatile raw material prices, stringent regulations, significant environmental concerns related to production, the availability of alternative products, and potential side effects from high consumption.

Need help to buy this report?