Global Glutamic Acid Market Size, Share, and COVID-19 Impact Analysis, Russia-Ukraine War Impact, Tariff Analysis, By Type (L-glutamic acid and DL-glutamic acid), By Application (Flavour Enhancer, Nutritional Supplement, Pharmaceutical Ingredient, and Animal Feed Additive), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Glutamic Acid Market Size Insights Forecasts to 2035

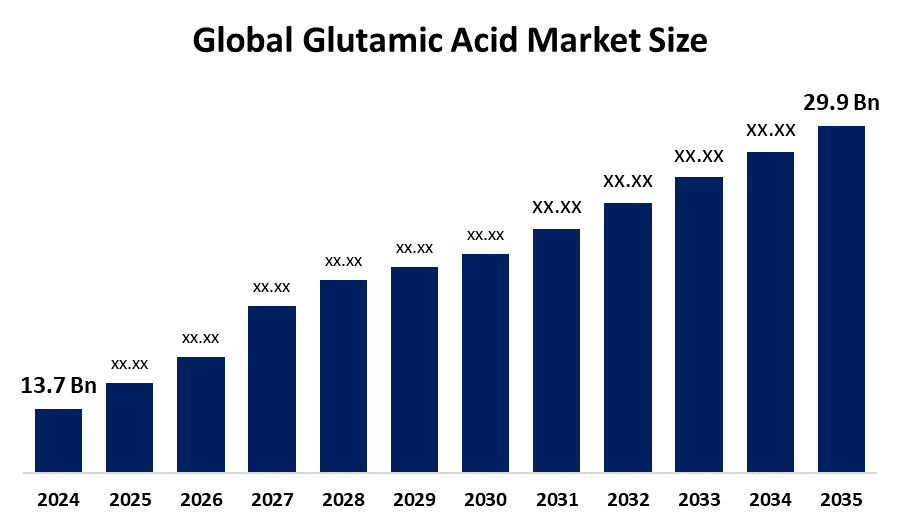

- The Global Glutamic Acid Market Size Was Estimated at USD 13.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.35% from 2025 to 2035

- The Worldwide Glutamic Acid Market Size is Expected to Reach USD 29.9 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Glutamic Acid Market Size was worth around USD 13.7 Billion in 2024 and is projected to Grow from USD 14.7 Billion in 2025 to around USD 29.9 Billion by 2035 with a compound annual growth rate (CAGR) of 7.35 % from 2025 to 2035. Glutamic acid is increasingly used in nutritional supplements and protein powders as well as in the pharmaceutical industry for drug formulation. It is anticipated that the increasing demand for food enhancers, food additives, and animal feed in the food & beverage industry is a major contributor to the worldwide glutamic acid market growth.

Global Glutamic Acid Market Forecast and Revenue Outlook

- 2024 Market Size: USD 13.7 Billion

- 2035 Projected Market Size: USD 29.9 Billion

- CAGR (2025-2035): 7.35%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The glutamic acid market is the industry encompassing the production, sale, and distribution of glutamic acid, which is an amino acid used across industries like food, animal feed, pharmaceuticals, and cosmetics. Glutamic acid is an alpha amino acid, used by almost all living beings in protein biosynthesis and is also the most abundant excitatory neurotransmitter in the vertebrate nervous system, serving as the precursor for the synthesis of the inhibitory GABA in GABAergic neurons. With an increasing use of glutamic acid in the food & beverage industry, consumers' growing health consciousness is driving the use of glutamic acid in nutritional supplements and protein powders.

The global market share is anticipated to be supported by expanding R&D efforts by major industry participants, including Ajinomoto Group, and others, for developing innovative applications. There are opportunities in the developing market due to the growing consumer awareness about the health advantages of amino acids, enabling manufacturers to introduce new goods, boost production capacity, and raise capital.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the Glutamic Acid Market during the forecast period.

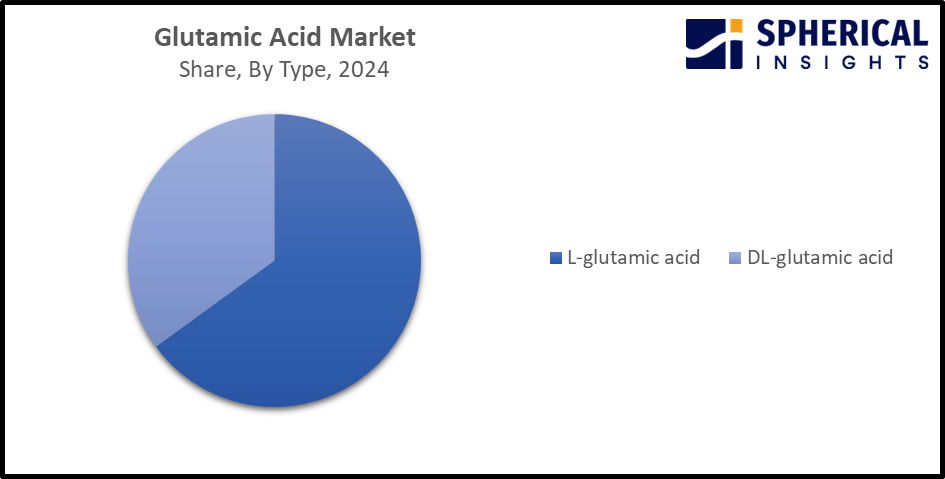

- In terms of type, the L-glutamic acid segment is projected to lead the glutamic acid market throughout the forecast period

- In terms of application, the flavour enhancer segment captured the largest portion of the market

Glutamic Acid Market Trends

- Adoption of fermentation-based glutamic acid production to meet clean-label standards

- Incorporation of glutamic acid in plant-based and functional food formulations

- R&D investment in the pharmaceutical industry

- Expanding use of glutamic acid in animal feed as a performance enhancer and gut health booster

Report Coverage

This research report categorizes the glutamic acid market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the glutamic acid market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the glutamic acid market.

Global Glutamic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.35% |

| 2035 Value Projection: | USD 29.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Ajinomoto, Trobas Gelatin, Darling Ingredients, Archimica, PB Gelatins, Weishardt Group, Lapi Gelatine, Kyowa Hakko Kirin, CJ CheilJedang, Tessenderlo Group, Meihua Holdings Group, Nitta Gelatin, Gelita, Rousselot, Nippon Shokubai, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The glutamic acid market is driven by an increasing application of glutamic acid in the food & beverage industry as a flavour enhancer and nutritional supplement. Further, its application in the manufacturing of animal feed additives is propelling market demand. The use of advanced fermentation technologies for improving yield by developing high-yield strains with reduced environmental impact of glutamic acid positively influences the market growth. Integration of AI and automation for monitoring and controlling fermentation process, transforming production efficiency in the bio-based glutamic acid industry, is escalating the market growth.

Restraining Factor

One of the main factors restraining the glutamic acid market is the increasing health concerns associated with the excessive intake of glutamic acid. Raw material price volatility is impacting the production cost, thereby hampering the market. Further, limited consumer awareness as well as regulatory complexities on labelling and permissible usage in food products are challenging the market growth of glutamic acid.

Market Segmentation

The global glutamic acid market is divided into type and application.

Global Glutamic Acid Market, By Type:

- The L-glutamic acid segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on type, the global glutamic acid market is segmented into L-glutamic acid and DL-glutamic acid. Among these, the L-glutamic acid segment dominated the market with the largest revenue share in 2024 and is projected to grow at a substantial CAGR during the forecast period. L-glutamic acid is an optically active form of glutamic acid with L-configuration, playing an essential role in nutraceuticals, a micronutrient, an Escherichia coli metabolite, a mouse metabolite, a ferroptosis inducer and a neurotransmitter. The growth of processed and ready-to-eat foods, as well as the pharmaceutical industry, is a major contributor to driving the market in the L-glutamic acid segment.

Get more details on this report -

The DL-glutamic acid segment is anticipated to grow at a significant CAGR during the forecast period, driven by an increasing need for processed food and beverages and the expanding pharmaceutical industry. DL-glutamic acid is the conjugate acid of glutamic acid, acting as a fundamental metabolite and presenting better stability.

Global Glutamic Acid Market, By Application:

- The flavour enhancer segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global glutamic acid market is segmented into flavour enhancer, nutritional supplement, pharmaceutical ingredient, and animal feed additive. Among these, the flavour enhancer segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Glutamic acid aids in inducing the unique taste called umami, which is one of the five basic tastes. It is also available in its sodium salt form of monosodium glutamate, which is widely used as a flavour enhancer in the food industry. An increasing consumption of ready-to-eat meals, snacks, and beverages, with prioritization towards convenient and processed foods, is contributing to driving the market demand.

The nutritional supplement segment is anticipated to grow at a significant CAGR during the forecast period, due to its crucial role in brain health, metabolism, and protein synthesis. With an increasing consumer health consciousness, the growing need for glutamic acid in dietary supplements and protein powders is driving the market demand in the nutritional supplement segment.

Regional Segment Analysis of the Global Glutamic Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific Glutamic Acid Market Trends

Get more details on this report -

Asia Pacific is expected to hold the largest share of the global glutamic acid market over the forecast period.

In the Asia Pacific market, the rapid industrialization, along with growing glutamic acid demand from the food & beverage sector, in China, India, and Japan, is promoting the glutamic acid market. Further, consumers' increasing inclination towards natural and healthier options, which drives the need for high-quality natural L-glutamic acid, is anticipated to propel market growth.

China Glutamic Acid Market Trends

China is dominating the glutamic acid market in the Asia Pacific region during the forecast period, owing to the increasing consumer base seeking flavour-enhanced products, along with an extensive food processing industry.

North America Glutamic Acid Market Trends

North America is expected to grow at the fastest CAGR in the glutamic acid market during the forecast period. In the North American region, there is a major food and beverage sector, along with an increasing need for glutamate-based products. Consumers' growing need for monosodium glutamate as a flavour enhancer in processed foods is propelling the market demand. Further, the incorporation of glutamic acid in the formulation that promotes gut health, cognitive function, and overall well-being is supporting the market growth.

U.S. Glutamic Acid Market Trends

The U.S. is dominating the North America glutamic acid market during the forecast period, owing to the country’s diverse cultural population with the availability of various culinary preferences. Further, the country’s advanced food processing industry, along with the surging trend towards healthy eating, is promoting market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global glutamic acid market, along with a comparative evaluation primarily based on their product of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The Glutamic Acid Market Include

- Ajinomoto

- Trobas Gelatin

- Darling Ingredients

- Archimica

- PB Gelatins

- Weishardt Group

- Lapi Gelatine

- Kyowa Hakko Kirin

- CJ CheilJedang

- Tessenderlo Group

- Meihua Holdings Group

- Nitta Gelatin

- Gelita

- Rousselot

- Nippon Shokubai

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In April 2025, BASF Care Chemicals introduced Trilon G, a new sustainable chelating agent based on GLDA (glutamic acid diacetate) technology. This launch is strengthening BASF’s expanding portfolio of environmentally responsible solutions and supports the rising global demand for sustainable cleaning products in both the Home Care and Industrial & Institutional (I&I) cleaning sectors.

- In February 2025, Seawin Biotech is showcasing its next-generation marine biostimulant, APAA (Poly-γ-Glutamic Acid Rhamnolipid Ester), at the CAC Exhibition, presenting its latest research achievements in the biostimulant field to a global audience. As a leading enterprise in China's marine biotechnology sector, Seawin Biotech Group is dedicated to promoting sustainable agriculture through technological innovation.

- In March 2024, Kyowa Hakko Bio, Co., Ltd. and Kyowa Hakko USA, Inc., a subsidiary of Kirin Holdings Co., have opened its expanded ciricoline manufacturing facility at its Kyowa Hakko Bio Yamaguchi Production Center in Hofu City, Yamaguchi Prefecture, Japan.

- In October 2023, Baxter Korea announced the release of Olimel N12E, a protein-rich Total Parenteral Nutrition (TPN) fluid for critically ill patients. Olimel N12E contains 76 grams of amino acids and 950 calories per 1,000 mL, marking an approximately 33 percent increase in amino acids per 1,000 mL when compared to Baxter's previous multivitamin fluid, Olimel N9E. This enhancement enables the new product to deliver a higher amino acid content in the same dosage.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Glutamic Acid Market based on the following segments:

Global Glutamic Acid Market, By Type

- L-glutamic acid

- DL-glutamic acid

Global Glutamic Acid Market, By Application

- Flavour Enhancer

- Nutritional Supplement

- Pharmaceutical Ingredient

- Animal Feed Additive

Global Glutamic Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the glutamic acid market?The global glutamic acid market size is expected to grow from USD 13.7 Billion in 2024 to USD 29.9 Billion by 2035, at a CAGR of 7.35% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the glutamic acid market?Asia Pacific is anticipated to hold the largest share of the glutamic acid market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Glutamic Acid Market from 2024 to 2035?The market is expected to grow at a CAGR of around 7.35% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Glutamic Acid Market?Key players include Ajinomoto, Trobas Gelatin, Darling Ingredients, Archimica, PB Gelatins, Weishardt Group, Lapi Gelatine, Kyowa Hakko Kirin, CJ CheilJedang, Tessenderlo Group, Meihua Holdings Group, Nitta Gelatin, Gelita, Rousselot, and Nippon Shokubai.

-

5. Can you provide company profiles for the leading glutamic acid manufacturers?Yes. For example, Ajinomoto is a Japanese multinational food and biotechnology corporation which produces seasonings, cooking oils, frozen foods, beverages, sweeteners, amino acids, insulating films, and pharmaceuticals. Trobas Gelatin is an independent family-owned business based in the Netherlands, with its modern production facilities in Dongen, Trobas produces high-quality gelatine for food and pharma applications.

-

6. What are the main drivers of growth in the glutamic acid market?The expanding food & beverage industry and increasing advancement in production are major market growth drivers of the glutamic acid market.

-

7. What challenges are limiting the glutamic acid market?Health concerns related to excessive intake of glutamic acid and regulatory complexities remain key restraints in the glutamic acid market.

Need help to buy this report?