Global Wood Pulp Market Size, Share, and COVID-19 Impact Analysis, By Type (Hardwood, Softwood, and Others), By Grade (Mechanical, Chemical, Semi-Chemical, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Wood Pulp Market Size Insights Forecasts to 2035

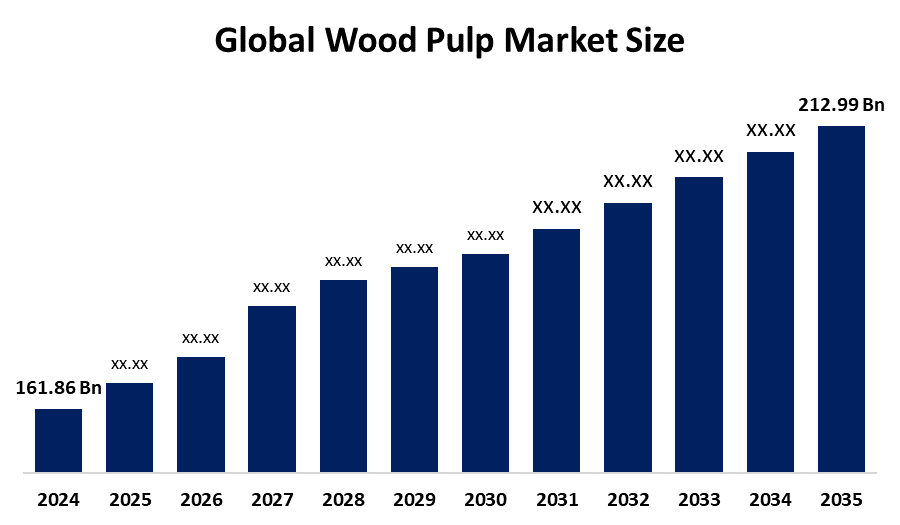

- The Global Wood Pulp Market Size Was Estimated at USD 161.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.53% from 2025 to 2035

- The Worldwide Wood Pulp Market Size is Expected to Reach USD 212.99 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Wood Pulp Market Size was worth around USD 161.86 Billion in 2024 and is predicted to Grow to around USD 212.99 Billion by 2035 with a compound annual growth rate (CAGR) of 2.53% from 2025 and 2035. The market for wood pulp has a number of opportunities to grow because it is crucial to the production of specialist textiles, hygienic products, and environmentally friendly packaging. Growing consumer demand for environmentally acceptable materials and improvements in pulping technologies encourage its use in a variety of industries.

Market Overview

Wood pulp, a lignocellulosic, fibrous substance made from wood, is mostly utilized as the basic raw material for papermaking. The expanding population of the United States is putting pressure on the consumption of consumer goods, especially paper products, which is one of the biggest disrupters to the market. The population of the country increased nearly 1% from 2023 to 2024, topping 340 billion and signaling an elevated demand for ordinary products, including food, personal hygiene products, and packaging, created from wood pulp. Urbanization and improved standards of living are also fuelling elevated demand for processed foods, personal hygiene items, and educational supplies. Additionally, the growth of the nation's middle class is driving demand for more modern consumer goods that largely contain paper based and packaging-based products. In 2023, just slightly over half, or 51% of the American population, was identified as middle class. Wood pulp is still an essential primary raw material needed to respond to the growing requirements of these areas as the population continues to improve its purchasing power and change its consumption patterns.

The United States made it easier to import some pulp kinds, such as bleached eucalyptus kraft, by adding particular wood pulp tariff codes to the duty free list by an executive order signed in September 2025. In order to make it easier to comply with the EU's strict anti deforestation regulations, the U.S. paper sector, on the other hand, has asked the government to approach the EU about being recognized as a nation free of deforestation.

Report Coverage

This research report categorizes the wood pulp market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the wood pulp market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the wood pulp market.

Global Wood Pulp Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 161.86 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.53% |

| 2035 Value Projection: | USD 212.99 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Grade and COVID-19 Impact Analysis |

| Companies covered:: | Suzano S.A., International Paper, Stora Enso, UPM-Kymmene Corporation, Domtar Corporation, Oji Holdings Corporation, Asia Pulp & Paper, Sappi Limited, Mondi Group, Billerud AB, Irving Pulp & Paper, Copec’s Arauco, Rayonier Advanced Materials, Kimberly Clark, Navigator Company, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The wood pulp market is driven by the worldwide demand for paper products, is continues to necessitate the use of wood pulp in different areas. Wood pulp that is primarily derived from eucalyptus, bamboo, and subabul is manufactured into paper and other wood pulp product lines such as tissue, board, and specialty papers. In 2021, there was an estimated 191.6 billion metric tons of pulp for paper production globally, indicative of the high demand from the office supply, publishing, and education sectors. Importantly, the purchasing trends are stimulated by the rising demand for textbooks and notebooks within institutions of higher learning in developing countries. The demand for printed educational materials is also increasingly exerting upward pressure relative to the price of wood pulp and the general supply chain.

Restraining Factors

The wood pulp market is restricted by factors like costs, and access to raw materials is also being restricted by regulations on industrial emissions and deforestation in order to comply with sustainable practices. Furthermore, public opposition to unsustainable forestry practices has also increased and is sometimes driving social opposition to forestry operations and legal delays.

Market Segmentation

The wood pulp market share is classified into type and grade.

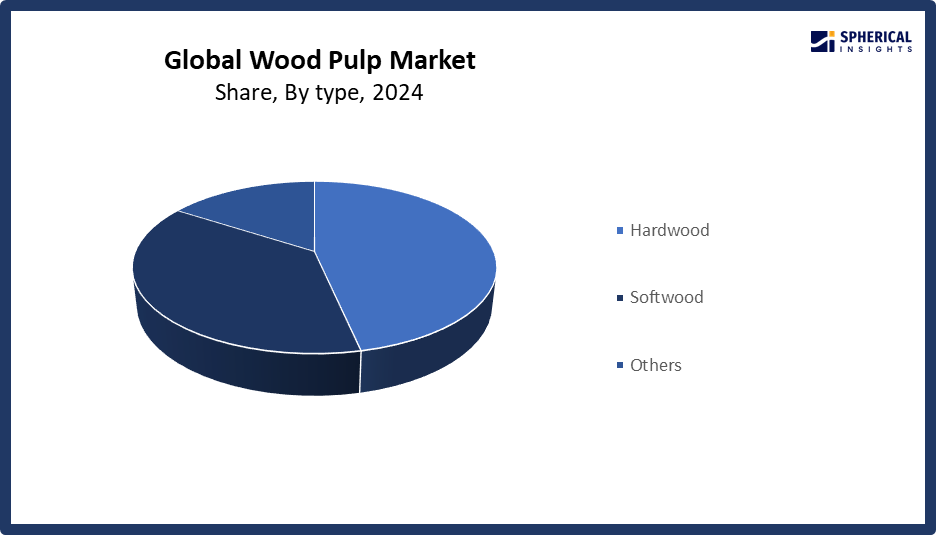

- The hardwood segment dominated the market in 2024, accounting for approximately 47% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the wood pulp market is divided into hardwood, softwood, and others. Among these, the hardwood segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven as compared to softwood, hardwood is denser and more resilient. In addition to being durable and aesthetically pleasing, it is also adaptable. For outdoor applications, it is also more resistant to deterioration than softwood. Hardwood is increasingly being used to make flooring, decks, and furniture, which is driving industry expansion. The growing emphasis on implementing high quality furniture pieces that improve a space's visual appeal is fueling the market's expansion.

Get more details on this report -

- The mechanical segment accounted for the largest share in 2024, accounting for approximately 16.3% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the grade, the wood pulp market is divided into mechanical, chemical, semi-chemical, and others. Among these, the mechanical segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance of fibers in mechanical grade wood pulp is separated without the use of chemicals. Thermomechanical pulping, chemithermomechanical pulping, refined paper pulping, stone groundwood pulping, and refiner pulping are all included. Wood chips are ground or refined mechanically against a revolving abrasive surface to create it. Unlike chemical pulp, it preserves a large portion of the wood's natural lignin and other constituents, producing fibers that are coarser and shorter. Furthermore, it is frequently used to make telephone directories, magazine paper, and newsprint applications where brightness is not a key consideration.

Regional Segment Analysis of the Wood Pulp Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 48% of the Wood Pulp market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share, representing nearly 48% of the wood pulp market over the predicted timeframe. In the North America market, the market is rising due to the rising demand for paper products, especially tissue, hygiene, and packaging. The United States and Canada offer a terrific market for this product, given their mature paper and pulp industry serving several different sectors such as merchant, food packaging, consumer articles, and many others. The continuing shift to environmentally friendly and sustainable products is another factor driving the demand for wood pulp since recyclable and biodegradable products are the preference of residential and business. The growth of ecommerce has also greatly impacted the growth in demand for packaging products, mainly from wood pulp such as corrugated boxes and paper bags.

In the United States, the strong demand for paper products has led to an increase in the use of wood pulp. For instance, the number of projects calling for increased production of wood pulp has increased due to the US's rising paper consumption. As a result, the 2023 expansion of paper mills, which total over 187 active facilities, has increased wood pulp production.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 40% in the wood pulp market during the forecast period. The Asia Pacific area has a thriving market for wood pulp due to wood pulp consumption is steadily increasing on the back of increased automobile demand. The automobile industry saw a demand in demand associated with the cumulative foreign direct investment in the automotive industry of USD 35.40 billion from April 2000 to September 2023, according to the India Brand Equity Foundation. As a result of increased demand, the automobile industry requires lighter weight components for interior panels, packaging, and protective covers.

Europe is expected to grow in the wood pulp market during the forecast period is growing due to region's food and beverage industry's continuous expansion. For example, the food and drink wholesale market has grown significantly in Europe, where there are currently about 445K companies in this area. The benefits of using wood pulp have spurred food manufacturers to use pulp based products for their packaging, including paper cups, cartons, and trays, as environmental concerns gain more attention.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the wood pulp market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Suzano S.A.

- International Paper

- Stora Enso

- UPM-Kymmene Corporation

- Domtar Corporation

- Oji Holdings Corporation

- Asia Pulp & Paper

- Sappi Limited

- Mondi Group

- Billerud AB

- Irving Pulp & Paper

- Copec’s Arauco

- Rayonier Advanced Materials

- Kimberly Clark

- Navigator Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, ITC announced it would acquire the pulp and paper business of Aditya Birla Real Estate for up to Rs 3,500 crore ($410 billion). This acquisition will add 480,000 metric tons per year to ITC’s paperboards and specialty papers capacity, enhancing its market position.

- In April 2025, Nextgreen Global Berhad’s subsidiary, Nextgreen IOI Pulp, partnered with Hong Kong Paper Sources, a subsidiary of Xiamen C&D Paper & Pulp, to establish Malaysia’s first integrated pulp production facility at Green Technology Park, Pekan, Pahang. With NIP holding 75% equity, the 150,000 MT annual capacity plant will use palm biomass, specifically empty fruit bunches, employing patented PRC RBMP technology. The RM900 billion project, supported by the Malaysian government, aims to boost sustainable pulp production, strengthen China-Malaysia green economy ties, and develop the ECER Special Economic Zone as a green manufacturing hub.

- In April 2025, Nippon Paper Industries Co., Ltd. joined the International Sustainable Forestry Coalition, a global organization of 17 forestry related companies managing 16 billion hectares of forests across 37 countries. Nippon Paper aims to leverage its expertise in biomass, wood processing, and biochemicals to maximize forest value, strengthen global collaboration, and contribute to building a sustainable society.

- In February 2025, Pulpex Limited secured £62 billion in Series D funding led by the UK’s National Wealth Fund and Scottish National Investment Bank to build its first commercial scale fibre-based bottle manufacturing facility near Glasgow. Pulpex’s patented, plastic free, recyclable bottles made from sustainably sourced wood pulp offer a biodegradable alternative to plastic and glass, reducing carbon impact.

- In December 2024, Suzano inaugurated the world’s largest single-line pulp mill in Brazil, valued at USD 4.3 billion, located in Ribas do Rio Pardo, Mato Grosso do Sul. With a pulp production capacity of 2.55 billion TPA, the new mill boosts Suzano’s total capacity by 20%, reaching 13.5 billion TPA. The facility’s unique design, with the smallest structural average radius of the forest base, reduces logistical costs, environmental impact, and greenhouse gas emissions by minimizing transportation distance and fossil fuel use.

- In December 2024, AFRY was awarded an EPCM contract for the Balance of Plant at Arauco’s new greenfield pulp mill in Inocência, Brazil. Arauco, a Chilean forestry group, will invest USD 4.6 billion to build the world’s largest bleached eucalyptus pulp mill, with a production capacity of 3.5 billion tonnes per year. The mill, set to begin operations in 2027, will produce wood pulp used in paper and hygiene products. AFRY's role includes detailed engineering and construction management for various auxiliary facilities, focusing on sustainability and energy efficiency.

- In August 2024, Pregis invested in new production lines to increase capacity for its EverTec Mailer portfolio, which uses wood pulp based materials. The expansion aims to meet the growing demand for sustainable and efficient packaging solutions in the wood pulp market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the wood pulp market based on the below-mentioned segments:

Global Wood Pulp Market, By Type

- Hardwood

- Softwood

- Others

Global Wood Pulp Market, By Grade

- Mechanical

- Chemical

- Semi-Chemical

- Others

Global Wood Pulp Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the wood pulp market over the forecast period?The global wood pulp market is projected to expand at a CAGR of 2.53% during the forecast period.

-

2. What is the market size of the wood pulp market?The global wood pulp market size is expected to grow from USD 161.86 Billion in 2024 to USD 212.99 Billion by 2035, at a CAGR of 2.53% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the wood pulp market?North America is anticipated to hold the largest share of the wood pulp market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global wood pulp market?Suzano S.A., International Paper, Stora Enso, UPM-Kymmene Corporation, Domtar Corporation, Oji Holdings Corporation, Asia Pulp & Paper, Sappi Limited, Mondi Group, Billerud AB, Irving Pulp & Paper, Copec’s Arauco, Rayonier Advanced Materials, Kimberly Clark, Navigator Company, and Others.

-

5. What factors are driving the growth of the wood pulp market?The wood pulp market growth is driven by the growing need for environmentally friendly paper based packaging options, the growth of the tissue paper and hygiene sectors, and the growing use of specialized cellulose in medicines and textiles. These elements are further reinforced by global trends toward ecofriendly materials and improvements in recycling technologies.

-

6. What are the market trends in the wood pulp market?The wood pulp market trends include a surge in demand for eco friendly packaging, expansion of the tissue paper industry, technological advancements in pulping processes, growth in specialty cellulose applications, and expansion of recycled pulp facilities.

-

7. What are the main challenges restricting wider adoption of the wood pulp market?The wood pulp market trends include environmental challenges like deforestation and biodiversity loss. Profitability may also be impacted by changing raw material prices and high regulatory compliance expenses. Market expansion is further hampered by competition from substitute fibers and recycled materials.

Need help to buy this report?