Global Smoke Grenade Market Size, Share, and COVID-19 Impact Analysis, By Type (Handheld Smoke Grenades, Vehicle Launched Smoke Grenades, and Large Area Smoke Generators), By Application (Military Training, Law Enforcement, Theatrical Use, and Emergency Services), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Aerospace & Defense

Global Smoke Grenade Market Insights Forecasts to 2035

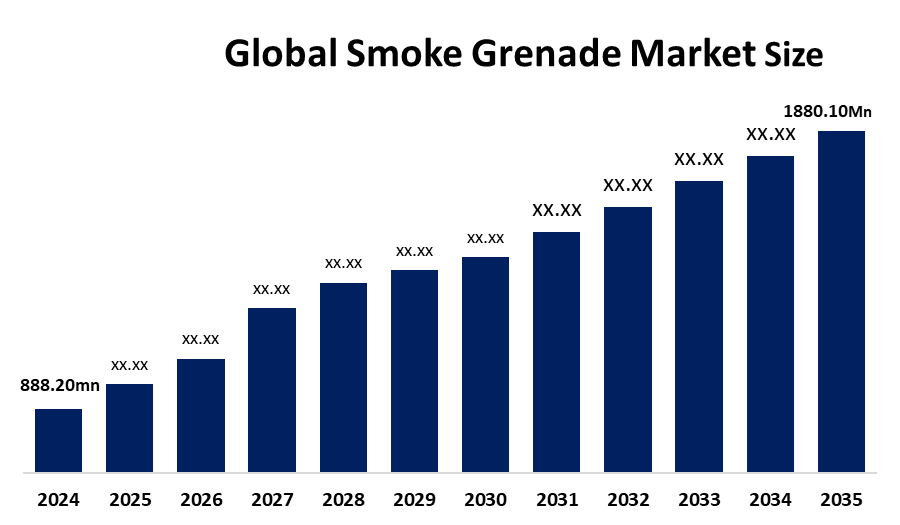

- The Global Smoke Grenade Market Size Was Estimated at USD 888.20 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.05 % from 2025 to 2035

- The Worldwide Smoke Grenade Market Size is Expected to Reach USD 1880.10 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global smoke grenade market size was worth around USD 888.20 million in 2024 and is predicted to grow to around USD 1880.10 million by 2035 with a compound annual growth rate (CAGR) of 7.05 % from 2025 to 2035. Opportunities in defense modernization, law enforcement training, crowd control, and tactical simulation are presented by the smoke grenade industry, which is fueled by growing security concerns, technical improvements, and a global need for non-lethal alternatives.

Market Overview

The design, production, distribution, and acquisition of pyrotechnic devices that produce thick smoke clouds for tactical obscuration, signaling, diversion, and non-lethal crowd control are all included in the worldwide smoke grenade market. These weapons, which include vehicle-mounted systems, 40mm launcher rounds, and hand-thrown canisters, are used in the military, law enforcement, training, and recreational sectors to conceal movements, interfere with electro-optical sensors, and mark areas during operations. Rheinmetall unveiled the ROSY_VL vertical-launch smoke system in June 2024, while EDGE Group acquired CONDOR Non-Lethal Technologies in May 2025. The British Army also selected ISTEC’s Smoke Discharger System for M270 MLRS platforms in January 2025. Military applications are driving increased demand in the global smoke grenade market. The upgrading of defense and law enforcement equipment, growing acceptance of non-lethal tactical solutions, and growing security concerns are some of the major factors driving the smoke grenade market.

Report Coverage

This research report categorizes the smoke grenade market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the smoke grenade market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the smoke grenade market.

Global Smoke Grenade Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 888.20 Million |

| Forecast Period: | 2025 – 2035 |

| Forecast Period CAGR 2025 – 2035 : | CAGR of 7.05% |

| 025 – 2035 Value Projection: | USD 1880.10 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type,By Application |

| Companies covered:: | Alsetex, Chemring Group, Diehl Defence, EURENCO, Lacroix Defense, Nammo AS, NonLethal Technologies, Primetake Ltd, Rheinmetall AG, ST Engineering, and Others Players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for smoke grenades is driven by growing threats to international security, which push law enforcement and defense organizations to use creative non-lethal tactical solutions. The increasing effectiveness, safety, and mobility are a result of growing military modernization, increasing training and operational readiness needs, and technological developments in smoke grenade design. The industry is also fueled by acquisitions, strategic partnerships, and the integration of smoke grenade systems with cutting-edge weapon platforms. As the employment of tiny drones and networked electro-optical and infrared cameras spreads throughout contemporary battlefields, the industry is growing. This expansion makes quick, multispectral smoke more necessary to interfere with cycles of detection and targeting.

Restraining Factors

The market for smoke grenades is restricted by stringent regulations, expensive production, and environmental issues pertaining to chemical emissions. Market expansion and wider acceptance are also hampered by low awareness, adoption in some areas, and safety concerns.

Market Segmentation

The smoke grenade market share is classified into type and application.

- The large area smoke generators segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the smoke grenade market is divided into handheld smoke grenades, vehicle launched smoke grenades, and large area smoke generators. Among these, the large area smoke generators segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Large Area Smoke Generators are essential for training exercises and greater operational areas since they need heavy-duty performance. The growing need for creative smoke solutions across several industries is reflected in this diverse structure. Large area smoke generators are utilized in military, emergency response, and industrial settings because of their wide range of operational capabilities.

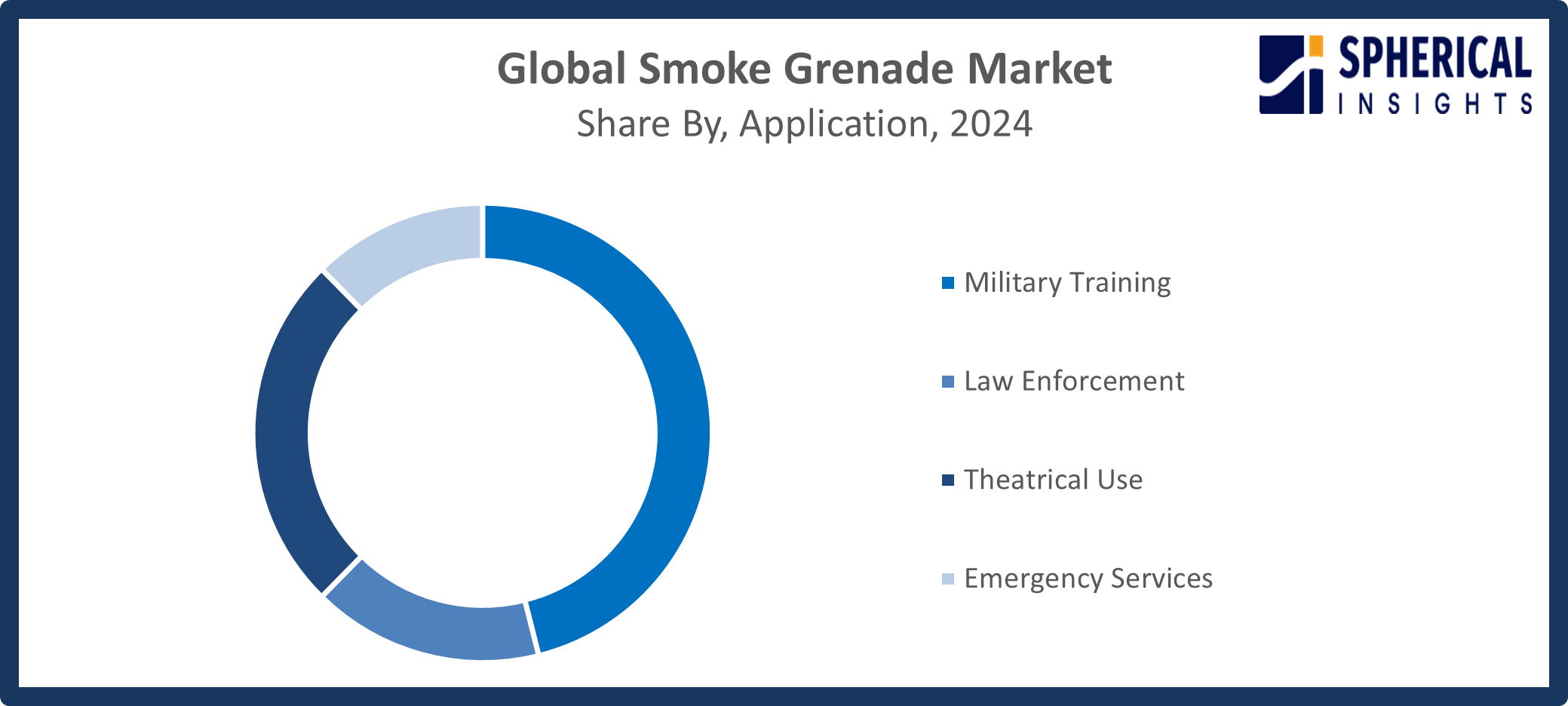

- The military training segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the smoke grenade market is divided into military training, law enforcement, theatrical use, and emergency services. Among these, the military training segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The need for realistic battlefield simulation technologies is widespread and persistent in the military training market. The military training segment's supremacy is further reinforced by ongoing investments in defense modernization and the growing focus on advanced training programs.

Get more details on this report -

Regional Segment Analysis of the Smoke Grenade Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the smoke grenade market over the predicted timeframe.

North America is anticipated to hold the largest share of the smoke grenade market over the predicted timeframe. The North America region is mainly ascribed to large defense expenditures, sophisticated military technology, increased military and law enforcement spending, and the expansion of both commercial and recreational applications. North America's market is further supported by the growing need for advanced smoke grenades for uses like crowd control, signaling, and hiding. In October 2025, the U.S. Army began buying 65,000 pounds of powdered sugar to sustain battlefield obscurants. A crucial part of M18 smoke grenades is this sugar. March 2025 industry day for M67/M111 grenade fuzes indicates continued innovation in low-emission, sustainable alternatives. The growing demand is further driven by urbanization, increasing technological adoption in defense systems, and regional security concerns.

Asia Pacific is expected to grow at a rapid CAGR in the smoke grenade market during the forecast period. The localization and licensed fills that shorten lead times, meet offset goals, and encourage a regular training schedule, the Asia-Pacific region is supported by coastal and amphibious operations that demand quick-build, corrosion-resistant smokes. Countries like South Korea, China, Japan, and India are the major markets for smoke grenades, as they are increasingly using them for military training, crowd control, and operational preparedness purposes. In November 2025, the People's Liberation Army of China unveiled a 25 mm smart grenade launcher with programmable smoke rounds, and in August 2025, they unveiled an airborne IFV equipped with advanced smoke grenade launchers for counter-drone operations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the smoke grenade market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alsetex

- Chemring Group

- Diehl Defence

- EURENCO

- Lacroix Defense

- Nammo AS

- NonLethal Technologies

- Primetake Ltd

- Rheinmetall AG

- ST Engineering

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2025, the British Army launched a new upgrade initiative, selecting ISTEC Services Limited to provide advanced Smoke Discharger Systems for the improved M270 MLRS A2, strengthening operational capability and modernizing defense platforms.

- In May 2024, Rheinmetall announced a USD 77 million contract from the Bundeswehr to deliver around one million DM45 smoke hand grenades under a framework agreement valid until 2027, enabling flexible yearly ammunition procurement.

- In June 2024, Rheinmetall launched its ROSY_VL Rapid Obscuring System Vertical Launch at Eurosatory 2024, unveiling the first vertically launched smoke protection system utilizing proven ROSY Mod launcher modules arranged in a vertical configuration.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the smoke grenade market based on the below-mentioned segments:

Global Smoke Grenade Market, By Type

- Handheld Smoke Grenades

- Vehicle Launched Smoke Grenades

- Large Area Smoke Generators

Global Smoke Grenade Market, By Application

- Military Training

- Law Enforcement

- Theatrical Use

- Emergency Services

Global Smoke Grenade Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the smoke grenade market over the forecast period?The global smoke grenade market is projected to expand at a CAGR of 7.05% during the forecast period

-

2. What is the market size of the smoke grenade market?The global smoke grenade market size is expected to grow from USD 888.20 million in 2024 to USD 1880.10 million by 2035, at a CAGR of 7.05 % during the forecast period 2025-2035

-

3. Which region holds the largest share of the smoke grenade market?North America is anticipated to hold the largest share of the smoke grenade market over the predicted timeframe

-

4. Who are the top 10 companies operating in the global smoke grenade market?Alsetex, Chemring Group, Diehl Defence, EURENCO, Lacroix Defense, Nammo AS, NonLethal Technologies, Primetake Ltd, Rheinmetall AG, ST Engineering, and Others

-

5. What factors are driving the growth of the smoke grenade market?Rising global security threats, defense modernization, technological advancements in non-lethal solutions, increasing demand for tactical training, crowd control, and emergency signaling are key drivers of the smoke grenade market

Need help to buy this report?