Global Petroleum Coke Market Size, Share, and COVID-19 Impact Analysis, By Type (Fuel Grade Coke and Calcined Coke), By Application (Aluminum, Cement, Power, Iron and Steel, Storage, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal Petroleum Coke Market Insights Forecasts to 2035

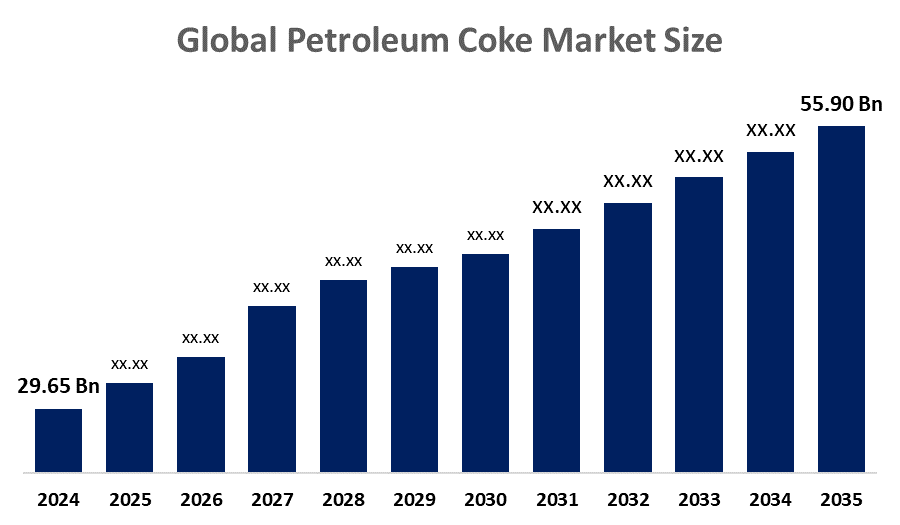

- The Global Petroleum Coke Market Size Was Estimated at USD 29.65 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.55 % from 2025 to 2035

- The Worldwide Petroleum Coke Market Size is Expected to Reach USD 55.90 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global petroleum coke market size was worth around USD 29.65 billion in 2024 and is predicted to grow to around USD 55.90 billion by 2035 with a compound annual growth rate (CAGR) of 6.55 % from 2025 to 2035. Opportunities in the petroleum coke market include increased manufacturing of steel and aluminum, rising demand for cement, increased use of power generation, and growing use in emerging economies, propelled by infrastructure development and industrialization.

Market Overview

The entire process of producing, trading, and utilizing petroleum coke, a carbon-rich solid that is a byproduct of the oil refinery industry, is included in the global trade system known as the petroleum coke market. Petcoke, often known as petroleum coke, is produced by thermally breaking heavy oil leftovers to produce lighter petroleum products. The market includes numerous grades of crude oil applications, such as fuel-grade and calcined petroleum coke, each of which is associated with a distinct industrial use. The global trade and use of petroleum coke, a solid byproduct with a high carbon content that is produced during the thermal cracking and coking processes in oil refineries, is included in the petroleum coke market. For Instance, in December 2024, India’s Bharat Petroleum Corp has launched plans to expand refining capacity from 35.3 million tpy to 45 million tpy by 2028, boosting Kochi, Mumbai, and Bina refineries by May 2028 under a major modernization program. Growing urbanization and population, the real estate sector's explosive growth, infrastructural development, and technical improvements are the main drivers of this industry's growth. It is anticipated that the increasing use of this material in the manufacturing of steel, fuel, and anode will accelerate the petroleum coke market expansion.

Report Coverage

This research report categorizes the petroleum coke market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the petroleum coke market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the petroleum coke market.

Global Petroleum Coke Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 29.65 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.55% |

| 2035 Value Projection: | USD 55.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application, By Regional Analysis |

| Companies covered:: | Aminco Resources LLC, British Petroleum, Chevron Corporation, Graphite India Limited, Indian Oil Corporation Ltd, Marathon Petroleum Corporation, Nippon Coke & Engineering Co., Ltd., Oxbow Corporation, Petroleum Coke Industries Company, Phillips 66 Company, Renelux Cyprus Ltd., Suncor Energy Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing environmental laws and the need for petroleum coke in the cement and power generation industries are driving the petroleum coke market's notable expansion. The petroleum coke market will expand due to the quickly expanding power and construction sectors, as well as the increased demand for aluminum from the automotive and aerospace industries. Petroleum coke, which is widely available from oil refining wastes, provides an inexpensive substitute for conventional fossil fuels. These elements are driving up the use of cement in building construction, which is driving up demand for pet coke in the cement industry.

Restraining Factors

The market for petroleum coke is restricted by severe environmental laws, high carbon emissions, worries about air pollution, and growing limitations on the use of petcoke. The market's expansion is further constrained by the growing use of greener energy sources.

Market Segmentation

The petroleum coke market share is classified into type and application.

- The fuel-grade coke segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the type, the petroleum coke market is divided into fuel-grade coke and calcined coke. Among these, the fuel-grade coke segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Fuel-grade coke can be used as an energy source in a number of industries, including manufacturing and power generation, due to the rising need for energy worldwide, especially in emerging nations.

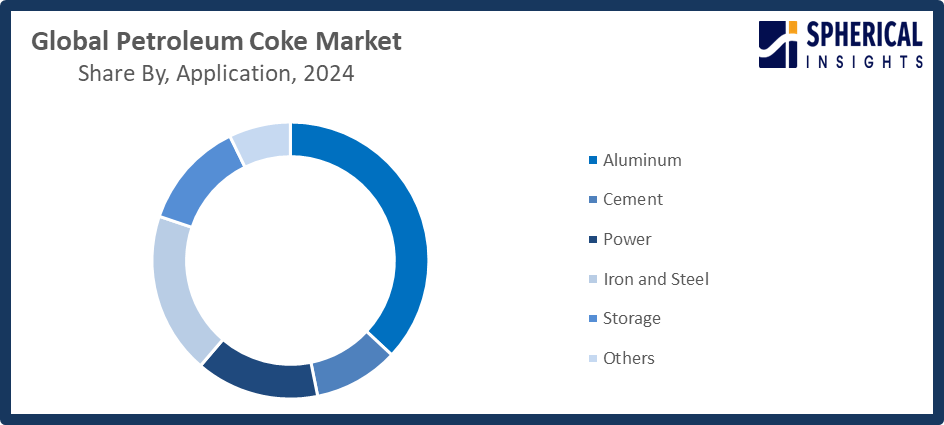

- The aluminum segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the petroleum coke market is divided into aluminum, cement, power, iron and steel, storage, and others. Among these, the aluminum segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The consumption of petroleum coke in the manufacturing of aluminum is increasing due to the growing demand for aluminum from industries like automotive and aerospace because of its lightweight nature and high strength.

Get more details on this report -

Regional Segment Analysis of the Petroleum Coke Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the petroleum coke market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the petroleum coke market over the predicted timeframe. The Asia Pacific is driven by rapid industrialization, increasing infrastructure, and strong expansion in energy-consuming sectors. The growth of the regional market is primarily linked to the rise in the number of enterprises that refine crude oil, the expansion of industrialization, and China's ongoing economic expansion, all of which contribute to the high demand for raw materials and energy, including pet coke. In order to reduce emissions, the Directorate General of Foreign Trade issued import limitations in April 2025, assigning 1.87 million tons of green petcoke and 775,000 metric tons of calcined petroleum coke for FY2025–2026. Aluminum smelters were given priority.

North America is expected to grow at a rapid CAGR in the petroleum coke market during the forecast period. Product use in power plants throughout North America is driven by the region's rising electricity demand and strong emphasis on economical energy sources. North America is propelled by sophisticated industrial infrastructure and robust refining capabilities. One of the main drivers of the expansion of the regional market is the United States. In November 2025, federal measures under the Clean Energy Framework focused on reducing carbon emissions and provided USD 2 billion in incentives to support the adoption of green petcoke in the cement and power industries. This led to a 0.9% increase in price due to supply constraints.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the petroleum coke market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aminco Resources LLC

- British Petroleum

- Chevron Corporation

- Graphite India Limited

- Indian Oil Corporation Ltd

- Marathon Petroleum Corporation

- Nippon Coke & Engineering Co., Ltd.

- Oxbow Corporation

- Petroleum Coke Industries Company

- Phillips 66 Company

- Renelux Cyprus Ltd.

- Suncor Energy Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, PDVSA launched two export contracts with Latif Petrol and Reussi Trading for up to 1.6 million tons of petroleum coke, aiming to expand international distribution, boost sales, strengthen trade ties, and meet growing industrial fuel demand.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the petroleum coke market based on the below-mentioned segments:

Global Petroleum Coke Market, By Type

- Fuel Grade Coke

- Calcined Coke

Global Petroleum Coke Market, By Application

- Aluminum

- Cement

- Power

- Iron and Steel

- Storage

- Others

Global Petroleum Coke Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the petroleum coke market over the forecast period?The global petroleum coke market is projected to expand at a CAGR of 6.55% during the forecast period.

-

2. What is the market size of the petroleum coke market?The global petroleum coke market size is expected to grow from USD 29.65 billion in 2024 to USD 55.90 billion by 2035, at a CAGR of 6.55 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the petroleum coke market?Asia Pacific is anticipated to hold the largest share of the petroleum coke market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global petroleum coke market?Aminco Resources LLC, British Petroleum, Chevron Corporation, Graphite India Limited, Indian Oil Corporation Ltd, Marathon Petroleum Corporation, Nippon Coke & Engineering Co., Ltd., Oxbow Corporation, Petroleum Coke Industries Company, Phillips 66 Company, Renelux Cyprus Ltd., Suncor Energy Inc., and Others.

-

5. What factors are driving the growth of the petroleum coke market?The petroleum coke market growth is driven by rising industrial demand, expanding aluminum and steel production, increasing cement consumption, growing power generation needs, and cost-effective fuel availability in emerging economies.

-

6. What are the market trends in the petroleum coke market?Refinery expansions, the use of calcined petcoke in aluminum production, its use in the cement and power industries, and technological developments in energy and carbon efficiency are some of the major trends in the petroleum coke market.

-

7. What are the main challenges restricting the wider adoption of the petroleum coke market?Stricter environmental laws, excessive carbon emissions, worries about air pollution, a lack of acceptance of cleaner fuels, and a growing emphasis on low-emission and sustainable energy sources are all obstacles facing the industry.

Need help to buy this report?