Global N-Propyl Acetate Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial/Technical Grade (<99%) and Pharmaceutical/Food Grade (>99%)), By Application (Solvent, Flavoring Agent, and Others), By End-Use (Chemical, Pharmaceutical, Paint & Coatings, Printing Ink, Food & Beverages, and Agrochemical), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal N-Propyl Acetate Market Insights Forecasts To 2035

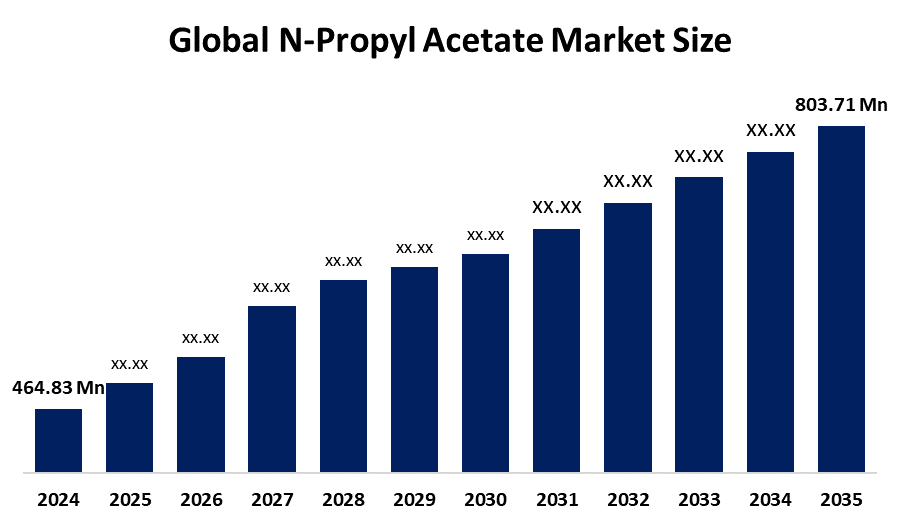

- The Global N-Propyl Acetate Market Size Was Estimated At USD 464.83 Million In 2024

- The Market Size Is Expected To Grow At A CAGR Of Around 5.1% From 2025 To 2035

- The Worldwide N-Propyl Acetate Market Size Is Expected To Reach USD 803.71 Million By 2035

- North America Is Expected To Grow The Fastest During The Forecast Period.

Get more details on this report -

According To A Research Report Published By Spherical Insights And Consulting, The Global N-Propyl Acetate Market Size Was Worth Around USD 464.83 Million In 2024 And Is Predicted To Grow To Around USD 803.71 Million By 2035 With A Compound Annual Growth Rate (CAGR) Of 5.1% From 2025 To 2035. The demand for N-propyl acetate in the market is increasing due to its application in the paints and coatings industry, printing ink industry, and pharmacy industry, among others, because of its property of being a non-toxic, fast-evaporating solvent, among others. The strict norms of the environment also contribute to its usage as an environmentally friendly solvent.

Market Overview

The World Market Size For N-Propyl Acetate Is Defined As The Production, Distribution, And Consumption Of The Colorless, Flammable Organic Liquid Known As N-Propyl Acetate. In Fact, This Liquid Has Numerous Applications Due To Its High Solubility, Low Evaporation Point, And High Ability To Function As A Solvent. Though the market is developing due to increasing industrialization, urbanization, and rising construction activity globally, especially within developing nations, the increasing application of low-VOC, environmentally friendly solvents is boosting the world market for N-propyl acetate.

The Market Size Has Ample Opportunities For Expansion In Pharmaceutical And Printing Ink Applications, And The Development Of Bio-Based And Greener Variants Of N-Propyl Acetate. Major players in the market, such as BASF, Eastman Chemical Company, LyondellBasell, Anhui Zhonghao, and Shandong Fangming Chemical, go for capacity expansions, R&D, and strategic partnerships to meet global demand and sustain competitiveness in the dynamically changing solvent market. The U.S. EPA issued SNURs for certain chemicals in July 2025, which came into effect on September 29, mandating notifications on new uses to evaluate their risks to human health and the environment. A follow-up in November extended SNUR requirements to many other substances, affecting manufacturers of n-propyl acetate and encouraging the handling of safer chemicals.

Report Coverage

This Research Report Categorizes The N-Propyl Acetate Market Size Based On Various Segments And Regions, Forecasts Revenue Growth, And Analyzes Trends In Each Submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the N-propyl acetate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the N-propyl acetate market.

Global N-Propyl Acetate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 464.83 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.1% |

| 2023 Value Projection: | 803.71 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Grade By Application |

| Companies covered:: | Eastman Chemical Company, BASF SE, LyondellBasell, Dow Chemical Company, Anhui Zhonghao, INEOS Group Holdings S.A., Celanese Corporation, SHOWA DENKO K.K., OQ Chemicals GmbH, SABIC, LG Chem Ltd., Solvay, Tokyo Chemical Industries, Shandong Fangming Chemical, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Global Market Size Share For N-Propyl Acetate Is Driven By The Rising Applications In The Paint And Coating Industry, Due To Its Extensive Use As A Solvent, Owing To Its Rapid Evaporation Properties And Its Ability To Dissolve. The use of N-propyl acetate as a solvent in printing inks, adhesives, and the pharmaceutical industries has increased, which has added pace to the growth of the market. The increased awareness regarding the use of low-VOC and eco-friendly solvents among the end-users has forced the industry players to switch to the use of N-propyl acetate. The rising urbanization and developments in emerging countries have encouraged the growth of the market.

Restraining Factors

The N-Propyl Acetate Market Size Is Challenged By Volatility In Raw Material Costs And High Production Costs. Environmental regulations on volatile organic compounds are also a hindrance to the market. The lack of sustainable alternatives and supply chain issues also obstruct the N-propyl acetate market, especially when ecological regulations are stringent.

Market Segmentation

The N-propyl acetate market share is classified into grade, application, and end-use.

- The industrial/technical grade (<99%) segment dominated the market in 2024, approximately 62% and is projected to grow at a substantial CAGR during the forecast period.

Based On The Grade, The N-Propyl Acetate Market Size Is Divided Into Industrial/Technical Grade (<99%) And Pharmaceutical/Food Grade (>99%). Among these,the industrial/technical grade (<99%) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The industrial/technical grade (<99%) market showed prominent growth due to its wide application base in the paint industry, adhesives, coating formulations, inks, and cleaning compounds. Its properties, including high solvency power, moderate evaporation rate, ease of dissolving resins and pigments homogeneously, low toxicity levels, and environmental friendliness, have increased its demand.

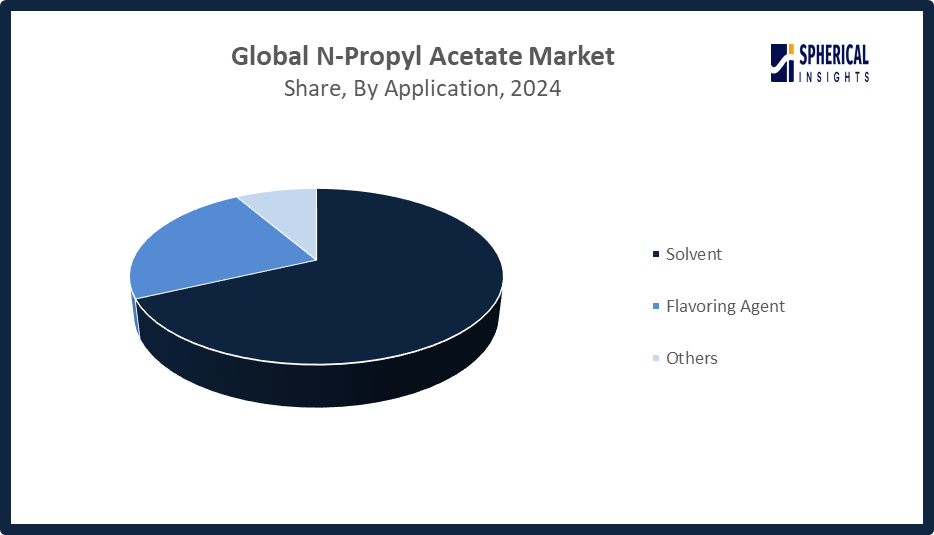

- The solvent segment accounted for the largest share in 2024, approximately 68% and is anticipated to grow at a significant CAGR during the forecast period.

Based On The Application, The N-Propyl Acetate Market Size Is Divided Into Solvent, Flavoring Agent, And Others. Among these, the solvent segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The solvent portion is leading in the N-propyl acetate industry due to its primacy in coating, adhesive, and chemical applications. The low surface tension and high solvency power of this portion make it preferred and essential for all sorts of industrial paints and varnishes, and even automotive painting. Increasing applications associated with environment-friendly and biodegradable formulations and advancements associated with solvent recovery also boost its usage.

Get more details on this report -

- The paint & coatings segment accounted for the highest market revenue in 2024, approximately 38% and is anticipated to grow at a significant CAGR during the forecast period.

Based On The End-Use, The N-Propyl Acetate Market Size Is Divided Into Chemical, Pharmaceutical, Paint & Coatings, Printing Ink, Food & Beverages, And Agrochemical. Among these, the paint & coatings segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. N-propyl acetate has numerous applications in the field of paints & coatings for fast drying, glossy, and hard films. The strong solvability, easy application, drying ability, and protective nature of N-propyl acetate make it suitable for automotive, wood, and protective coatings of various industries. The market for N-propyl acetate propels due to the rise of low VOC, water-based, and advanced formulations of coatings.

Regional Segment Analysis of the N-Propyl Acetate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the N-propyl acetate market over the predicted timeframe.

Asia Pacific Is Anticipated To Hold The Largest Share Of The N-Propyl Acetate Market Size Over The Predicted Timeframe. Asia Pacific is expected to have a 45% market share and dominate the global market for N-propyl acetate due to the rapid growth in the vehicle industry, construction, and infrastructure development that is occurring in China, India, Japan, and South Korea. A major application in the vehicle industry, paint industry, adhesive industry, and printing ink industry contributes to the growth. Low VOC solvents, growing manufacturing, and construction also boost the market. Increasing government support to develop environmentally-friendly chemical production methods, along with the enforcement of more stringent environmental regulations, will also positively support the market. In December 2025, the Indian government lifted several Quality Control Orders (QCOs), making BIS certification optional for various industrial chemicals.

North America Is Expected To Grow At A Rapid CAGR In The N-Propyl Acetate Market Size During The Forecast Period. The North American market is anticipated to have a 25% market share of the N-propyl acetate market, largely due to the rising consumption in the United States and Canada. The growing use in the automotive, construction, and painting sectors to meet the low VOC demands for environmentally safe solvents is a key factor that fuels the market. The governmental policies for environmentally friendly production in the chemical industry have a positive influence on the market for N-propyl acetate in the North American region.

The Market Size For N-Propyl Acetate In The European Region Is Expanding Positively, Primarily Driven By The Prominent Countries Of Germany, France, And The UK, Due To The Demand For The Product In The Coatings, Printing Ink, Adhesives, And Specialty Chemical Sectors. The strict regulations imposed by the government regarding the environment, such as VOC regulations, promote the application of low-VOC, environmentally friendly solvents like N-propyl acetate in the market.

Competitive Analysis:

The Report Offers The Appropriate Analysis Of The Key Organizations/Companies Involved Within The N-Propyl Acetate Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Eastman Chemical Company

- BASF SE

- LyondellBasell

- Dow Chemical Company

- Anhui Zhonghao

- INEOS Group Holdings S.A.

- Celanese Corporation

- SHOWA DENKO K.K.

- OQ Chemicals GmbH

- SABIC

- LG Chem Ltd.

- Solvay

- Tokyo Chemical Industries

- Shandong Fangming Chemical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Eastman announced a strategic partnership with Huafon Chemical to establish a joint facility in China for producing cellulose acetate yarn. The plant will support localized manufacturing and innovation of Eastman’s Naia cellulose acetate filament yarns, strengthening supply capabilities and market presence in the region.

- In April 2020, Oxea announced a 100% sales control on n-Propanol and n-Propyl Acetate due to surging demand and COVID-19-related logistics challenges. Effective immediately for Q2 2020, allocations will be based on average monthly consumption over the past six months or existing contract terms.

- In June 2018, Celanese Corporation launched a new Regulated Product (RP) category for all acetate tow grades used in U.S. tobacco products. The company will invest in regulatory support, enhanced product testing, and improved raw material and product traceability to better serve customers amid complex regulations.

- In March 2018, Showa Denko completed the expansion of its n-propyl acetate (NPAC) production, a safer solvent for gravure printing inks on food packaging. Rising over 10% annually, NPAC demand grows due to stricter VOC emission regulations, replacing traditional solvents like toluene and MEK in the market.

Market Segment

This Study Forecasts Revenue At Global, Regional, And Country Levels From 2020 To 2035. Spherical Insights has segmented the N-propyl acetate market based on the below-mentioned segments:

Global N-Propyl Acetate Market, By Grade

- Industrial/Technical Grade (<99%)

- Pharmaceutical/Food Grade (>99%)

Global N-Propyl Acetate Market, By Application

- Solvent

- Flavoring Agent

- Others

Global N-Propyl Acetate Market, By End-Use

- Chemical

- Pharmaceutical

- Paint & Coatings

- Printing Ink

- Food & Beverages

- Agrochemical

Global N-Propyl Acetate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the N-propyl acetate market over the forecast period?The global N-propyl acetate market is projected to expand at a CAGR of 5.1% during the forecast period.

-

What is the N-propyl acetate market?The N-propyl acetate market involves the production and use of N-propyl acetate as a solvent in coatings, inks, adhesives, and industrial applications.

-

What is the market size of the N-propyl acetate market?The global N-propyl acetate market size is expected to grow from USD 464.83 million in 2024 to USD 803.71 million by 2035, at a CAGR of 5.1% during the forecast period 2025-2035.

-

Which region holds the largest share of the N-propyl acetate market?Asia Pacific is anticipated to hold the largest share of the N-propyl acetate market over the predicted timeframe.

-

Who are the top 10 companies operating in the global N-propyl acetate market?Eastman Chemical Company, BASF SE, LyondellBasell, Dow Chemical Company, Anhui Zhonghao, INEOS Group Holdings S.A., Celanese Corporation, SHOWA DENKO K.K., OQ Chemicals GmbH, SABIC, and Others.

-

What factors are driving the growth of the N-propyl acetate market?Growth of the N-propyl acetate market is driven by rising demand from paints, coatings, adhesives, and printing inks, increased industrialization, construction activity, and the shift toward low-VOC, eco-friendly solvent formulations.

-

What are the market trends in the N-propyl acetate market?Key trends include demand for low-VOC, eco-friendly solvents, growth in automotive and industrial coatings, and expansion of printing inks and adhesive applications

-

What are the main challenges restricting wider adoption of the N-propyl acetate market?The main challenges restricting the wider adoption of the N-propyl acetate market include stringent environmental regulations, volatility in raw material prices, and intense competition from alternative solvents.

Need help to buy this report?