Global Lubricant Ester Market Size, Share, and COVID-19 Impact Analysis, Russia-Ukraine War Impact, Tariff Analysis, By Ester Type (Monoesters, Polyol Esters, Diesters, Trimellitate Esters, Aromatic Esters, and Other Ester Types), By Application (Engine Oil, Gear Oil, Industrial, Automotive, Turbine Lubricants, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsLubricant Ester Market Summary, Size & Emerging Trends

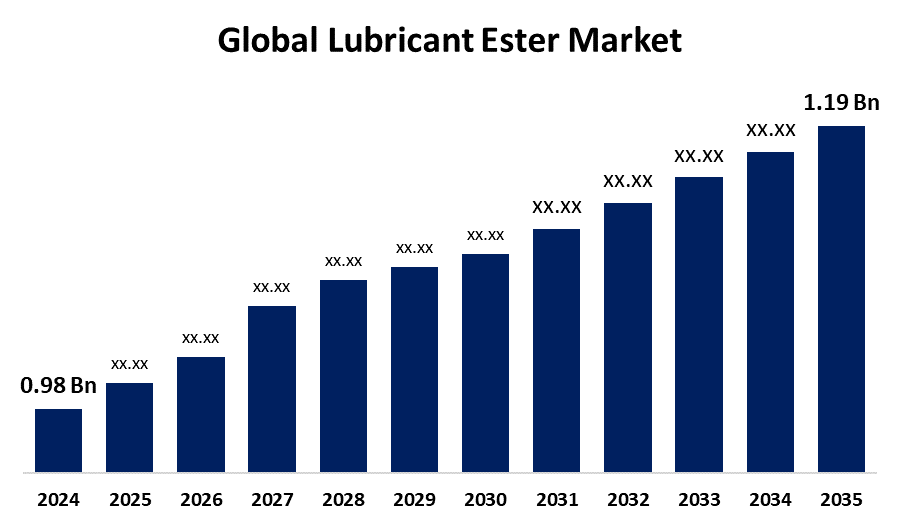

According to Spherical Insights, The Global Lubricant Ester Market Size is Expected to Grow from USD 0.98 Billion in 2024 to USD 1.19 Billion by 2035, at a CAGR of 1.78% during the forecast period 2025-2035. An increasing demand for high-performance and environmentally friendly lubricants is a key growth driver for the global lubricant ester market.

Get more details on this report -

Key Market Insights

- North America is expected to account for the largest share in the Lubricant Ester market during the forecast period.

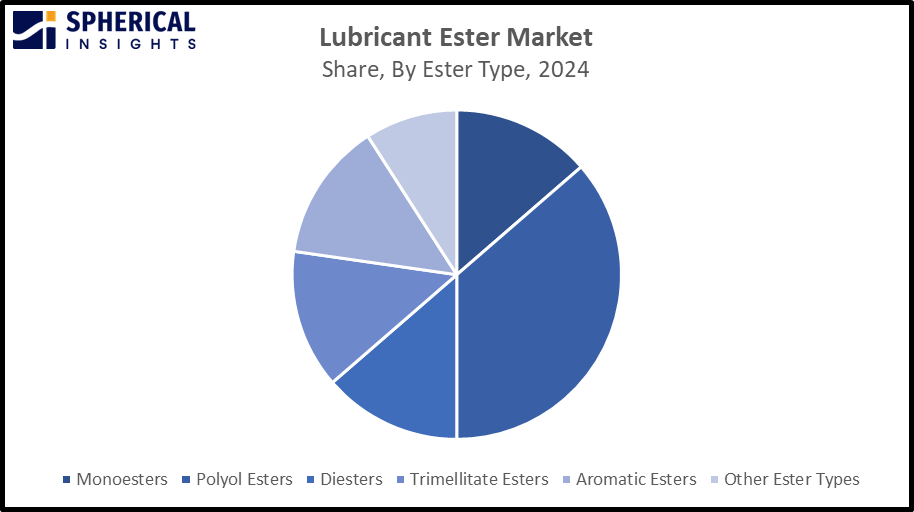

- In terms of ester type, the polyol esters segment captured the largest portion of the market

- In terms of application, the engine oil segment is projected to lead the lubricant ester market in terms of application throughout the forecast period

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 0.98 Billion

- 2035 Projected Market Size: USD 1.19 Billion

- CAGR (2025-2035): 1.78%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Lubricant Ester Market

The lubricant ester market refers to the industry encompassing the production, distribution, and application of lubricants made with synthetic ester base oils that offer superior high-temperature stability, lubricity, and biodegradability as compared to traditional petroleum-based lubricants. Lubricant ester is a synthetic or bio-derived fluid created from the chemical reaction of an alcohol and an acid. It is used in the manufacturing of high-quality engine oil. Further, blended with other additives like detergents, dispersants, and viscosity index improvers, aids in producing high-quality lubricants that are capable of withstanding increased temperatures and pressure in combustion engines. There is growing investment in research and development activities for improving ester formulations, along with an increasing emphasis on innovation, capacity expansion, and sustainable production practices in the lubricant ester market.

Lubricant Ester Market Trends

- Increasing demand for high-performance, biodegradable, and bio-based synthetic esters

- Technological advancements in ester synthesis for enhancing efficiency

- Digital integration, such as AI, aids in optimizing operations and supply chains

Lubricant Ester Market Dynamics

Global Lubricant Ester Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.98 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.78% |

| 2035 Value Projection: | USD 1.19 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Ester Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Avi-Oil India [P] Ltd., ABITEC, Afton Chemical Corporation (NewMarket Corporation), Avient Corporation, BASF SE, Beser Chemical Industry, Cremer Oleo GmbH & Co. KG, Croda International Plc, Emery Oleochemicals, Evonik AG, ExxonMobil Corporation, Kao Corporation, Lanxess, NYCO, Quality Group, SPAK Orgochem Pvt. Ltd., Zschimmer & Schwarz, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors:

Increasing demand for high-performance and environmentally friendly lubricants is driving growth in the lubricant ester market

The growth of the lubricant ester market is driven by the growing need for high-performance and environmentally friendly lubricants. Synthetic ester is used in the production of these lubricants, offering thermal stability, low-temperature performance, and lubricity as compared to traditional mineral oils. The growing adoption of environmentally friendly bioderived lubricants and biolubricants in the marine and agriculture sectors leads to the biodegradable and sustainable new formulations in which esters are used as the base fluid.

Restrain Factors:

The Lubricant Ester market faces challenges due to the lack of technical expertise and awareness about the long-term benefits of advanced lubricants

The limited adoption of ester-based solutions is due to a lack of user awareness about the advantages of advanced lubricants, such as extended equipment life, energy savings, and sustainability, which are restraining the lubricant ester market.

Opportunity:

Increasing demand for lubricant esters is creating new opportunities in the lubricant ester market

Lubricant esters are increasingly required in the oil & gas sector, as well as mining and heavy construction activities. This is due to the increasing demand for lubricant esters to withstand high operational temperatures and constant exposure to abrasive dust from equipment operating in harsh environmental conditions.

Challenges:

In the lubricant ester market, volatility in raw material prices

Despite its potential, the Lubricant Ester market struggles with several obstacles. The volatility and constraints in raw material prices, especially for bio-based esters, are a challenging factor. Further, a rigorous approval process for new formulations slows down the market growth.

Global Lubricant Ester Market Ecosystem Analysis

The Global Lubricant Ester Market ecosystem includes raw material suppliers who provide renewable or petrochemical-based feedstocks, ester manufacturers, and end users of automotive, aviation, and personal care. Investment in R&D is promoting innovations in ester formulations that are tailored for high-tech applications. Market growth is driven by increasing demand for high-performance and environmentally friendly lubricants, while the lack of technical expertise and awareness remains a challenge. Opportunities lie in emerging markets and demand for lubricant ester for the oil & gas sector, as well as mining and heavy construction activities.

Global Lubricant Ester Market, By Ester Type

The polyol esters segment led the lubricant ester market, generating the largest revenue share. This dominance can be attributed to its good thermal stability, low volatility, and superior lubrication under extreme conditions. Polyol esters are used to reduce friction between parts, preventing damage to the machine.

Get more details on this report -

The aromatic esters segment in the lubricant ester market is expected to grow at the fastest CAGR over the forecast period, as the esters are increasingly used in industrial and automotive gear oils. Aromatic esters are ideally used for applications such as compressor oils, oven chain oils, and gear oils due to their excellent high-temperature stability, low volatility, and resistance to oxidation and hydrolysis.

Global Lubricant Ester Market, By Application

The engine oils segment is dominating the lubricant ester market, due to the consistent need for esters in engine oil formulation, with an increasing number of vehicle purchases. Engine oil has an important role in keeping the vehicle running smoothly, not just reducing friction but also protecting, cooling, and ensuring that the engine stays efficient.

The turbine lubricants segment in the lubricant ester market is projected to register the fastest CAGR, driven by the increasing use of wind energy infrastructure. Lubricants based on synthetic esters have been developed for modern aircraft to meet the temperature demand. They are also refined in terms of basestocks and additive packages to meet current specifications.

North America is expected to account for the largest share of the Lubricant Ester market during the forecast period,

Get more details on this report -

Driven by the adoption of eco-friendly bioderived lubricants and biolubricants across marine, agriculture, and forestry equipment sectors. Further, its increasing use for lubrication across various automotive parts and machines aids in propelling market demand.

The United States is experiencing steady growth in the lubricant ester market,

Fueled by the presence of large-scale manufacturing as well as strong automotive and aerospace sectors. Further, the use of ester products like fatty esters for lubricant products, especially in the automotive industry, is propelling the market.

Asia Pacific is expected to grow at the fastest CAGR in the lubricant ester market during the forecast period.

This rapid growth is driven by the presence of industrial sectors including manufacturing, mining, and energy. Further, the growing investment in high-performance lubricants is driving the demand for producing esters, thereby escalating the market growth. Premium quality lubricants for providing lubrication across various automotive parts and machines, as well as in aviation, industrial, marine, and food-grade lubricants, are propelling market growth.

China is rapidly expanding in the lubricant ester market,

Due to the presence of the textile and chemical industry requiring esters like Esterex esters. Further, the government initiatives for pushing the use of sustainable and environmentally friendly goods, driving the lubricant esters like polyol lubricant esters, are propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the lubricant ester market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

WORLDWIDE TOP KEY PLAYERS IN THE LUBRICANT ESTER MARKET INCLUDE

- Avi-Oil India [P] Ltd.

- ABITEC

- Afton Chemical Corporation (NewMarket Corporation)

- Avient Corporation

- BASF SE

- Beser Chemical Industry

- Cremer Oleo GmbH & Co. KG

- Croda International Plc

- Emery Oleochemicals

- Evonik AG

- ExxonMobil Corporation

- Kao Corporation

- Lanxess

- NYCO

- Quality Group

- SPAK Orgochem Pvt. Ltd.

- Zschimmer & Schwarz, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Product Launches in Lubricant Ester

- In June 2025, Perstop, a global leader in specialty chemicals and a wholly owned subsidiary of PETRONAS Chemicals Group Berhad (PCG), launched a new range of saturated synthetic polyol esters designed for high-performance lubricant applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the lubricant ester market based on the below-mentioned segments:

Global Lubricant Ester Market, By Ester Type

- Monoesters

- Polyol Esters

- Diesters

- Trimellitate Esters

- Aromatic Esters

- Other Ester Types

Global Lubricant Ester Market, By Application

- Engine Oil

- Gear Oil

- Industrial

- Automotive

- Turbine Lubricants

- Others

Global Lubricant Ester Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the lubricant ester market?The global lubricant ester market size is expected to grow from USD 0.98 Billion in 2024 to USD 1.19 Billion by 2035, at a CAGR of 1.78% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the Lubricant Ester market?North America is anticipated to hold the largest share of the Lubricant Ester market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Lubricant Ester Market from 2024 to 2035?The market is expected to grow at a CAGR of around 1.78% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Lubricant Ester Market?Key players include Avi-Oil India [P] Ltd., ABITEC, Afton Chemical Corporation (NewMarket Corporation), Avient Corporation, BASF SE, Beser Chemical Industry, Cremer Oleo GmbH & Co. KG, Croda International Plc, Emery Oleochemicals, and Evonik AG.

-

5. Can you provide company profiles for the leading Lubricant Ester manufacturers?Yes. For example, Avi-Oil India [P] Ltd. is a joint venture of Indian Oil Corporation Ltd., Balmer Lawrie and Co. Ltd. and Neden Holding B.V., Netherlands, aids in achieving self-reliance in the crucial area of synthetic lubricants for Defense services. ABITEC manufactures base fluids and performance enhancing additives for industrial/commercial lubricants and metalworking fluids.

-

6. What are the main drivers of growth in the lubricant ester market?An increasing demand for high-performance and environmentally friendly lubricants is a major market growth driver of the lubricant ester market.

-

7. What challenges are limiting the lubricant ester market?Lack of technical expertise and limited awareness about the benefits of using lubricants remain key restraints in the lubricant ester market.

Need help to buy this report?