Global Hypersonic Weapons Market Size By Type (Hypersonic Missiles, Hypersonic Glide Vehicles), By Domain (Land, Naval, Airborne), By Range (Short-range, Multi-Medium-range, Long-range), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Hypersonic Weapons Market Insights Forecasts to 2033

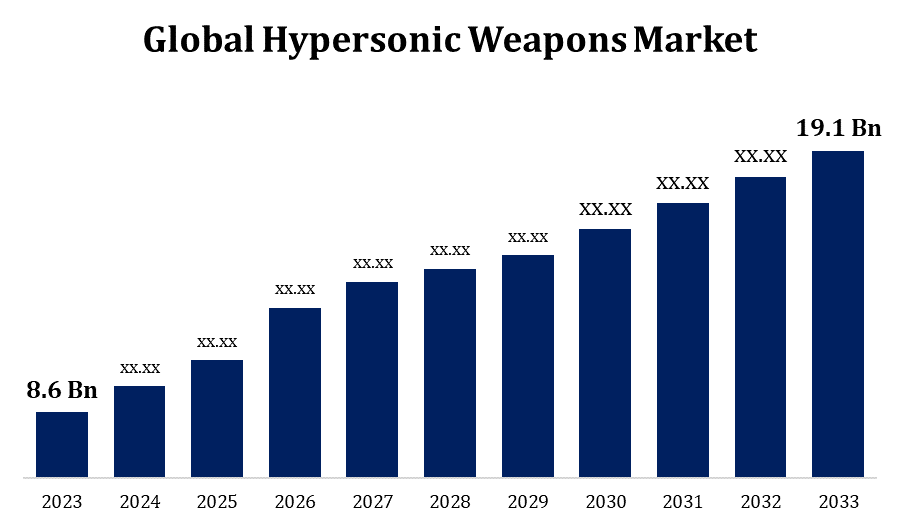

- The Global Hypersonic Weapons Market Size was valued at USD 8.6 Billion in 2023.

- The Market is Growing at a CAGR of 8.31% from 2023 to 2033

- The Worldwide Hypersonic Weapons Market Size is Expected to reach USD 19.1 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Hypersonic Weapons Market Size is Expected to reach USD 19.1 Billion by 2033, at a CAGR of 8.31% during the forecast period 2023 to 2033.

Due to growing investments in research and development by major military countries including the US, Russia, China, and others, the market for hypersonic weapons has been growing quickly. Furthermore, a number of other nations were actively pursuing or investigating hypersonic capabilities, either on their own or in collaboration with one another. Applications for hypersonic weapons include anti-ship combat, precision strikes, and anti-satellite operations. They are especially desirable for breaching heavily fortified targets and countering sophisticated air defence systems due to their agility and speed. Concerns regarding arms control and strategic stability have been raised by the development and use of hypersonic weapons. At numerous international forums, initiatives have been made to allay these worries and provide guidelines for the responsible application of hypersonic technology.

Hypersonic Weapons Market Value Chain Analysis

The hypersonic weapons market value chain represents the sequence of activities and stakeholders involved in the development, deployment, and sustainment of hypersonic weapon systems. It starts with research and development efforts led by government agencies, defense contractors, and academic institutions, focusing on areas like propulsion, materials, and guidance systems. Following successful R&D, components are manufactured by aerospace companies and specialized manufacturers, then integrated and assembled into complete weapon systems by defense contractors. These systems undergo rigorous testing and evaluation before deployment with military units, supported by ongoing maintenance and logistical support. Over time, upgrades and modernization efforts ensure the weapons remain effective against evolving threats. Eventually, at the end of their operational life, decommissioning and disposal activities are carried out, overseen by government agencies responsible for arms control and environmental protection. Throughout this process, collaboration among stakeholders is crucial to ensure the efficiency, reliability, and compliance of hypersonic weapon systems.

Hypersonic Weapons Market Opportunity Analysis

The hypersonic weapons market presents a compelling opportunity driven by several factors. Firstly, the increasing sophistication of global defense systems necessitates the development of advanced weaponry capable of evading and overpowering existing defenses, positioning hypersonic weapons as a critical solution. Additionally, geopolitical tensions and regional conflicts have fueled demand for military modernization, prompting governments worldwide to invest heavily in hypersonic technologies. This investment creates opportunities for defense contractors, research institutions, and technology firms to collaborate on innovative solutions and secure lucrative contracts. Moreover, the versatility of hypersonic weapons, which can be deployed for various missions including precision strikes, anti-ship warfare, and strategic deterrence, further expands market potential. Furthermore, the commercialization of hypersonic technology could extend beyond defense applications, opening avenues for collaboration with space agencies, commercial aerospace firms, and transportation companies.

Global Hypersonic Weapons Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 8.6 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 8.31% |

| 2033 Value Projection: | USD 19.1 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Domain, By Range, By Region. |

| Companies covered:: | Lockheed Martin Corporation, Brahmos Aerospace Pvt. Ltd., SAAB SA, General Dynamics Corporation, Dynetics Inc., Northrop Grumman Corporation, Raytheon Company, The Boeing Company, Thales Group, Aerojet Rocketdyne Holdings Inc, and other key vendors. |

| Growth Drivers: | Technological advancements is propelling the market growth |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Hypersonic Weapons Market Dynamics

Technological advancements is propelling the market growth

Propulsion technology advancements have produced more potent and efficient engines that can maintain hypersonic speeds. The performance and range of hypersonic weapons have been greatly enhanced by developments in hybrid propulsion systems and scramjet and ramjet engines. Thanks to advances in materials science, it is now possible to produce materials that are both strong and lightweight, and that can endure the high pressures and temperatures encountered during hypersonic flight. The durability and structural integrity of hypersonic weapon systems have been improved by the use of sophisticated alloys, heat-resistant composites, and thermal protective coatings. The precision, manoeuvrability, and autonomy of hypersonic weapons have improved with advancements in guidance and control systems.

Restraints & Challenges

Overcoming several technological obstacles, such as those related to propulsion, materials, thermal management, and guidance systems, is necessary to develop hypersonic weapons. Great engineering hurdles lie in reaching and maintaining hypersonic speeds while maintaining accuracy and dependability. Lack of appropriate testing infrastructure makes it difficult to conduct extensive testing under actual hypersonic flight circumstances. There aren't many hypersonic wind tunnels or flight test ranges that can replicate hypersonic speeds, which makes it challenging to validate designs and evaluate performance with precision. Although they are frequently hard to come by, materials that can endure the intense pressures and temperatures encountered during hypersonic flight are crucial. Hypersonic component production also presents obstacles since high quality standards must be met in order to guarantee performance and dependability.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Hypersonic Weapons Market from 2023 to 2033. North American defence companies are leaders in the development of hypersonic weapons because they have a wealth of experience in propulsion systems, materials science, guidance technology, and aeronautical engineering. Their capabilities make it possible to design, produce, and integrate cutting-edge hypersonic systems that are specifically suited to military needs. Defence contractors from North America compete worldwide for contracts related to the development and deployment of hypersonic weapons. These businesses want to address the changing demands of international partners and allies while preserving a competitive edge in the hypersonic weapons industry by utilising their vast industrial base and technological prowess.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. A growing number of nations in the Asia-Pacific region are investing in hypersonic weapons as a result of increased geopolitical rivalry and security issues. As countries look to improve their deterrent and defence capabilities, growing territorial disputes, modernization initiatives, and strategic rivalries all contribute to the desire for hypersonic technology. Asia-Pacific nations, especially China and Russia, have made great advancements in the development of hypersonic technologies. These developments, which have made it possible to develop hypersonic missiles, glide vehicles, and boost-glide vehicles domestically, include breakthroughs in propulsion systems, materials science, and guiding technology. The spread of hypersonic weapons throughout the Asia-Pacific area creates security issues and fuels the dynamics of an arms race. The intricacy of strategic calculations has increased due to the numerous countries' swift development and implementation of hypersonic systems.

Segmentation Analysis

Insights by Type

The hypersonic missiles segment accounted for the largest market share over the forecast period 2023 to 2033. In order to preserve their strategic advantage and resist new challenges, several nations are giving priority to modernising their armed forces. The growing number of hypersonic missiles in current military arsenals is attributed to their capacity to execute pinpoint strikes with unmatched speed and manoeuvrability. Applications for hypersonic missiles in the military are numerous and include penetration of missile defence systems, ground attack missions, anti-ship warfare, and strategic strike capabilities. They are highly sought-after assets for defence forces due to their versatility and efficacy across a range of operating circumstances, which fuels demand and growth. Growing defence budgets for the research, procurement, and deployment of hypersonic missile systems are a common feature of many nations' budgets, especially those of large military powers. The increasing awareness of hypersonic capabilities is reflected in this increased expenditure.

Insights by Domain

The land segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Many nations are making investments to modernise their land-based military assets in an effort to improve their combat effectiveness and defence posture. Growth in this market is fueled by the ability of land forces to hit high-value targets quickly and precisely with hypersonic weapons, such as missiles and glide vehicles. The integration of hypersonic missiles with current land-based strike systems, such as artillery vehicles, mobile launchers, and missile defence batteries, can improve their operational flexibility and variety. Growth in this market is further fueled by the capacity to launch hypersonic weapons from land-based systems, which increases the reach and range of surface forces. Interoperability and networking capabilities are improved when hypersonic weapons are integrated with more comprehensive land-based command and control systems. This facilitates the smooth coordination and synchronisation of operations across many domains.

Insights by Range

The multi-medium segment accounted for the largest market share over the forecast period 2023 to 2033. Weapons built for multi-medium operations that are hypersonic can move between land, air, and water conditions with ease. Because of their versatility, these weapons can be used in a variety of tactical theatres and against a wide range of targets, providing greater operational flexibility and adaptability. Integrated strike capabilities are made possible by multi-medium hypersonic weapons, which let armed forces attack targets in several domains at the same time or in succession. The operational reach of hypersonic missile systems is increased and mission effectiveness is improved by this integrated strategy. In order to improve networking and interoperability, multi-medium hypersonic weapons are frequently incorporated into larger military networks and command and control systems. Growth in the multi-medium market is fueled by this integration, which makes it possible for operations to be seamlessly coordinated and synchronised across the air, land, and marine domains.

Recent Market Developments

- In January 2023, the US Congressional Budget Office estimated that the cost of purchasing 300 intermediate ballistic missiles and maintaining them for 20 years would be USD 13.4 billion, compared to USD 17.9 billion for hypersonic missiles with a comparable range.

Competitive Landscape

Major players in the market

- Lockheed Martin Corporation

- Brahmos Aerospace Pvt. Ltd.

- SAAB SA

- General Dynamics Corporation

- Dynetics Inc.

- Northrop Grumman Corporation

- Raytheon Company

- The Boeing Company

- Thales Group

- Aerojet Rocketdyne Holdings Inc

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Hypersonic Weapons Market, Type Analysis

- Hypersonic Missiles

- Hypersonic Glide Vehicles

Hypersonic Weapons Market, Domain Analysis

- Land

- Naval

- Airborne

Hypersonic Weapons Market, Range Analysis

- Short-range

- Multi-Medium-range

- Long-range

Hypersonic Weapons Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Hypersonic Weapons Market?The global Hypersonic Weapons Market is expected to grow from USD 8.6 billion in 2023 to USD 19.1 billion by 2033, at a CAGR of 8.31% during the forecast period 2023-2033.

-

2. Who are the key market players of the Hypersonic Weapons Market?Some of the key market players of the market are Lockheed Martin Corporation, Brahmos Aerospace Pvt. Ltd., SAAB SA, General Dynamics Corporation, Dynetics Inc., Northrop Grumman Corporation, Raytheon Company, The Boeing Company, Thales Group, Aerojet Rocketdyne Holdings Inc.

-

3. Which segment holds the largest market share?The land segment holds the largest market share and is going to continue its dominance.

-

4. Which region is dominating the Hypersonic Weapons Market?North America is dominating the Hypersonic Weapons Market with the highest market share.

Need help to buy this report?