Global Glass Flake Coatings Market Size, Share, and COVID-19 Impact, By Resin Type, By Substrate Type, By End-use, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032.

Industry: Chemicals & MaterialsGlobal Glass Flake Coatings Market Insights Forecasts to 2032.

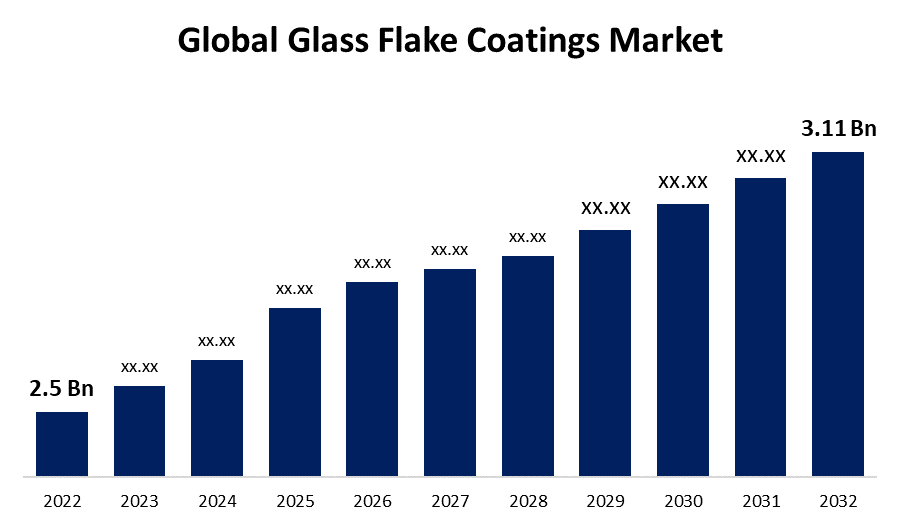

- The Glass Flake Coatings Market Size was valued at USD 2.5 Billion in 2022.

- The Market is Growing at a CAGR of 4.9% from 2022 to 2032.

- The Worldwide Glass Flake Coatings Market Size is expected to reach USD 3.11 Billion by 2032.

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Glass Flake Coatings Market Size is expected to reach USD 3.11 Billion by 2032, at a CAGR of 4.9% during the forecast period 2022 to 2032.

Glass flake coatings are one sort of protective coating that is applied to various objects to offer superior corrosion resistance and other protective qualities. Glass flakes, which are thin, flat pieces of glass, are incorporated into the coating material to create them. These glass flakes are frequently created from various glass kinds, such as borosilicate, soda-lime, or E-glass, which are resistant to chemical assault and have exceptional mechanical strength. Glass flake coatings are excellent at preventing corrosion brought on by chemicals, moisture, and exposure to the environment in substrates. They are therefore particularly helpful in situations where defense against hostile environments is crucial. Glass flake coatings are advantageous for outdoor applications because they can endure lengthy exposure to ultraviolet (UV) radiation without suffering considerable deterioration.

Impact of COVID 19 On Global Glass Flake Coatings Market

The raw materials and chemicals used in the coatings business come from many different vendors across the world. Transport delays, industrial stoppages, and border restrictions brought on by the pandemic may have had an effect on the supply chain, causing delays and shortages of vital materials needed to make glass flake coatings. Lockdowns and economic slowdowns caused by the epidemic had an impact on sectors like the automobile, aerospace, building, and manufacturing. Significant amounts of coatings, especially glass flake coatings, are consumed by these industries. The total market for coatings may have been impacted by decreased demand in certain industries. Many infrastructure and building projects were delayed or abandoned as a result of the pandemic, which may have had an impact on the demand for coatings used in those projects, particularly glass flake coatings used to prevent corrosion.

Key Market Drivers

The demand for glass flake coatings has increased as a result of the need for effective corrosion protection solutions in sectors like oil and gas, maritime, chemical processing, and infrastructure. These coatings provide high corrosion protection, extending the useful life of buildings, machinery, and other assets. The demand for protective coatings like glass flake coatings has increased as a result of expanding infrastructure developments, particularly in developing nations. Reliable corrosion protection is necessary for the construction of bridges, pipelines, water treatment facilities, and other structures. Glass flake coatings are renowned for their reduced permeability and chemical resistance, which can assist contain dangerous compounds and avoid environmental pollution. The use of protective coatings that reduce environmental impact is becoming more crucial as environmental rules tighten. As it requires strong corrosion protection in challenging onshore and offshore settings, the oil and gas industry consumes a substantial amount of glass flake coatings. The need for these coatings in this business is probably going to increase as long as energy demand keeps rising.

Global Glass Flake Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 2.5 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 4.9% |

| 2032 Value Projection: | USD 3.11 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Resin Type, By Substrate Type, By End-use, by Region and COVID-19 Impact Analysis. |

| Companies covered:: | MICHELIN, The Goodyear Tire & Rubber Company, Continental AG, Nokian Tyres plc., Apollo Vredestein, Bridgestone India Private Ltd, Hankook Tire., Pirelli & C. S.p.A., CST, Sailun, LINGLONG TIRE, Kenda Tires., CRAIN COMMUNICATIONS, INC., Cooper Tire & Rubber Company, Yokohama Tire Corporation, Nexen, MRF, Petlas, Balkrishna Industries Limited (BKT), TOYO TIRE U.S.A. CORP and other key venders. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Challenges

In comparison to other kinds of protective coatings, glass flake coatings can be quite pricey. Their greater price tag is a result of the high cost of raw materials, notably premium glass flakes, and the involved manufacturing process. Their adoption may be constrained by this cost aspect, particularly in sectors where money is tight. Glass flake coatings must be applied correctly, which calls for trained experts and specialised tools. For them to work, uniform thickness and coverage are essential. Some users could be discouraged from using these coatings because of the potential for inadequate application to cause coating defects and lower protection. To guarantee effective adhesion to the substrate, glass flake coatings need to be prepared properly. The coating may not adhere properly without sufficient surface cleaning and preparation, which could result in delamination and reduced corrosion protection. Glass flake coatings have great mechanical strength and abrasion resistance, but they can be less flexible than some other coating types. The stiffness of glass flake coatings may provide a problem in situations where substrates may undergo significant thermal expansion or movement.

Market Segmentation

Resin Type Insights

Epoxy segment is dominating the market over the forecast period

On the basis of resin type, the global glass flakes coatings market is segmented into epoxy, vinyl ester, polyester. Among these, epoxy segment is dominating the market over the forecast period. The outstanding chemical resistance, adhesion, and mechanical qualities of epoxy-based glass flake coatings have led to their widespread use in a variety of industries, making them one of the most popular choices for corrosion protection and other protective applications. Epoxy-based glass flake coatings are ideal for challenging conditions where surfaces are prone to wear and tear because they have great mechanical strength, abrasion resistance, and impact resistance. Strict environmental and safety laws apply to many businesses. Epoxy-based glass flake coatings are a popular option for projects that necessitate adherence to exacting standards since they may be customised to satisfy specific regulatory requirements.

Substrate Type Insights

Steel substrate segment holds the highest market share over the forecast period

Based on the substrate type, the global glass flakes coatings market is segmented into steel and concrete. Among these, steel substrate segment holds the highest market share over the forecast period. In sectors like oil and gas, maritime, chemical processing, infrastructure, and transportation, steel is a key component. These industries frequently operate in difficult settings where corrosion protection is essential. As a result, these industries have seen an upsurge in the demand for glass flake coatings on steel substrates. Demand for protective coatings on steel substrates has expanded as a result of expanding infrastructure construction, particularly in developing nations. Steel components that need to be protected against corrosion are frequently used in new building projects in the transportation, water management, and energy sectors.

End Use Insights

Marine segment dominates the market over the forecast period

On the basis of end use, the global glass flakes coatings market is segmented into oil and gas, marine, chemical and petrochemical, others. Among these, marine segment dominates the market with the largest market share over the forecast period. Glass flake coatings are used in marine applications to assist address the problems caused by marine growth. These coatings produce a smooth, long-lasting surface that prevents marine creatures from adhering to it and growing on it. Glass flake coatings' ability to resist corrosion also shields the substrate from deterioration brought on by marine growth and exposure to saltwater. Due to rising demand from numerous industries, including maritime, oil and gas, chemical processing, and infrastructure, the market for glass flake coatings has been expanding. The market has grown as a result of the increase in offshore exploration and production operations as well as the requirement for corrosion prevention in marine and coastal constructions.

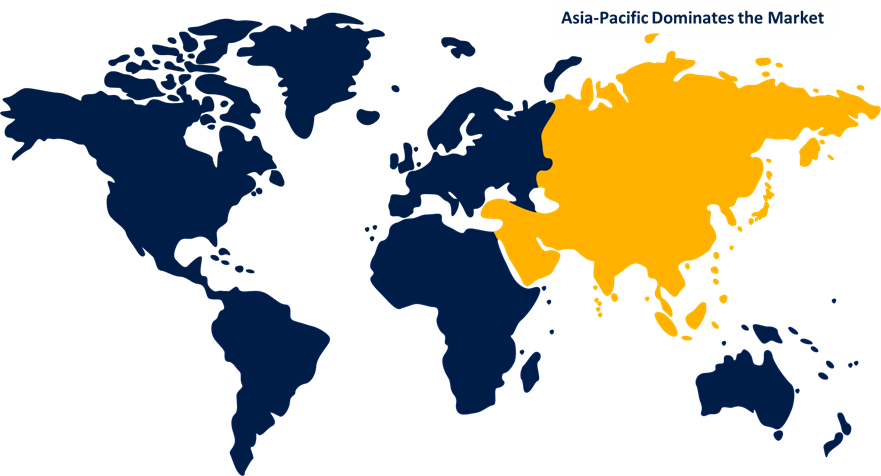

Regional Insights

Asia Pacific region holds the highest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with the highest market share over the forecast period. The demand for high-performance coatings that offer corrosion protection and chemical resistance has been fueled by the region's developing industrial and infrastructural sectors, which include shipbuilding, offshore oil and gas platforms, and chemical processing plants. Some of the busiest ports and marine commerce routes in the world are in the Asia Pacific area. Ship owners and operators are using glass flake coatings to shield their vessels against corrosion and marine growth, which also helps them save money on maintenance. Given the significant offshore oil and gas deposits in the area, exploration and development efforts have received more attention. To protect assets from corrosion and fouling, glass flake coatings are preferred in such hostile marine settings.

North America is witnessing the fastest market growth over the forecast period. Bridges, power plants, and chemical processing facilities are all part of North America's well-developed infrastructure. The need for glass flake coatings has been pushed by the necessity for high-tech protective coatings to preserve and prolong the life of these assets. Sustainability and energy efficiency are becoming more and more important to the North American coatings sector. With their durable protective qualities, glass flake coatings can help cut down on maintenance cycles, which in turn reduces waste and energy use.

Recent Market Developments

- In May 2019, in Santo André, Brazil, Akzo Nobel established a performance coatings manufacturing facility. With this development, the business will be better able to adapt to the demands of the regional market and local customers.

List of Key Companies

- MICHELIN

- The Goodyear Tire & Rubber Company

- Continental AG

- Nokian Tyres plc.

- Apollo Vredestein

- Bridgestone India Private Ltd

- Hankook Tire.

- Pirelli & C. S.p.A.

- CST

- Sailun

- LINGLONG TIRE

- Kenda Tires.

- CRAIN COMMUNICATIONS, INC.

- Cooper Tire & Rubber Company

- Yokohama Tire Corporation

- Nexen

- MRF

- Petlas

- Balkrishna Industries Limited (BKT)

- TOYO TIRE U.S.A. CORP

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2032. Spherical Insights has segmented the global Glass Flake Coatings Market based on the below-mentioned segments:

Glass Flake Coatings Market, Resin Type Analysis

- Epoxy

- Vinyl ester

- Polyester

Glass Flake Coatings Market, Substrate Type Analysis

- Steel

- Concrete

Glass Flake Coatings Market, End Use Analysis

- Oil and gas

- Marine

- Chemical and petrochemical

- Others

Glass Flake Coatings Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of Glass Flake Coatings Market?The global Glass Flake Coatings Market is expected to grow from USD 2.5 Billion in 2022 to USD 3.11 Billion by 2032, at a CAGR of 4.9% during the forecast period 2022-2032.

-

2. Who are the key market players of Glass Flake Coatings Market?Some of the key market players of MICHELIN, The Goodyear Tire & Rubber Company, Continental AG, Nokian Tyres plc., Apollo Vredestein, Bridgestone India Private Ltd, Hankook Tire., Pirelli & C. S.p.A., CST., Sailun, LINGLONG TIRE, Kenda Tires., CRAIN COMMUNICATIONS, INC., Cooper Tire & Rubber Company, Yokohama Tire Corporation, Nexen, MRF, Petlas, Balkrishna Industries Limited (BKT), and TOYO TIRE U.S.A. CORP.

-

3. Which segment hold the largest market share?Epoxy segment holds the largest market share is going to continue its dominance.

-

4. Which region is dominating the Glass Flake Coatings Market?Asia Pacific is dominating the Glass Flake Coatings Market with the highest market share.

Need help to buy this report?