Germany Virtual Cards Market Size, Share, and COVID-19 Impact Analysis, By Card Type (Debit Card and Credit Card), By Product Type (B2B Virtual Cards and B2C Remote Payment Virtual Cards), By Application (Business Use and Consumer Use), and Germany Virtual Cards Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyGermany Virtual Cards Market Insights Forecasts to 2035

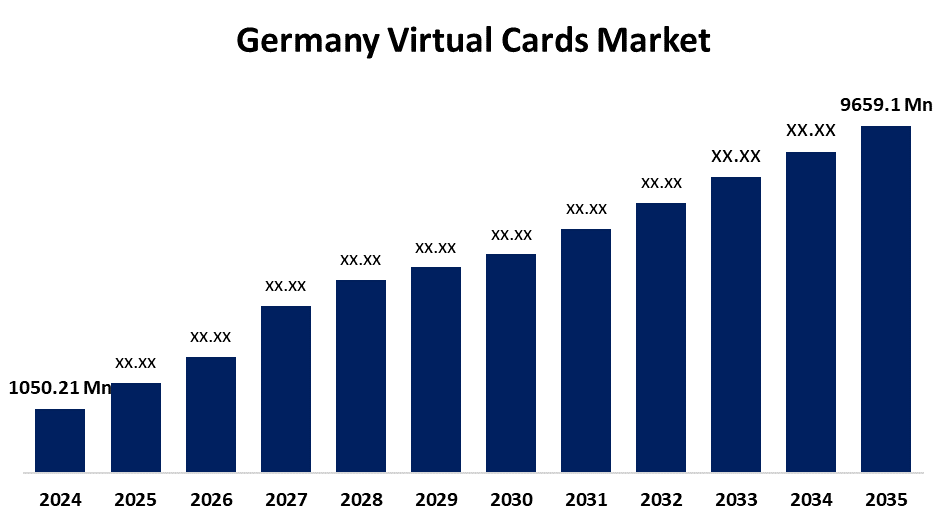

- The Germany Virtual Cards Market Size Was Estimated at USD 1050.21 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 22.35% from 2025 to 2035

- The Germany Virtual Cards Market Size is Expected to Reach USD 9659.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Virtual Cards Market Size is anticipated to reach USD 9659.1 Million by 2035, growing at a CAGR of 22.35% from 2025 to 2035. It is anticipated that the increasing volume of digital transactions worldwide would fuel demand for different kinds of virtual cards, which will support market expansion.

Market Overview

The virtual card market includes the financial ecosystem around digital payment solutions that are substitutes for using a physical credit or debit card. These cards are digital-only and are utilized for purchasing goods and services online, providing added convenience and security over traditional payment methods. This market includes revenues earned from issuing these digital cards and using them for e-commerce purchases, subscription-based services, and other business-to-business (B2B) transactions. In terms of security, virtual credit card solutions are even more secure than the actual physical card. Virtual credit card solutions are designed to generate unique card numbers to make transactions, usually with either a one-time use of the card number or a time limit for future transactions. Because the information made available through the card number becomes invalid following the time of purchase, the potential for fraud is substantially decreased. As virtual cards create different card numbers for each transaction, they not only provide better security against data breaches and fraud, they also protect the real card information.

Report Coverage

This research report categorizes the market for Germany virtual cards market based on various segments and regions forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany virtual cards market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany virtual cards market.

Germany Virtual Cards Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1050.21 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 22.35% |

| 2035 Value Projection: | USD 9659.1 Million |

| Historical Data for: | 2020 to 2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Card Type, By Product Type, By Application |

| Companies covered:: | Wirecard AG, Solarisbank AG, PPRO Group, N26, Raisin, FinTecSystems, figo, Fidor Bank AG, Mambu, Payone, Payworks, Penta, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The rise of e-commerce and digital payments is increasing demand for safe and streamlined online transactions. In addition, security enhancements, like one-time use numbers, tokenization, or spending limits, mitigate fraud and encourage adoption. The rapid growth of subscription-based services, ability to issue cards instantly, cost savings associated with eliminating physical cards, and integration with mobile wallets further simplify payments and drive the market.

Restraining Factors

The market for virtual cards is limited due to the limited acceptance by merchants especially in the physical world, due to infrastructure challenges, especially with legacy POS systems, as well as limited consumer understanding and awareness of virtual card use. It is also hampered by regulations and compliance requirements across jurisdictions, like AML, KYC, and data protection levels, which ultimately are more complicated and costly.

Market Segmentation

The Germany virtual cards market share is classified into card type, product type, and application.

- The debit card segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany virtual cards market is segmented by card type into debit card and credit card. Among these, the debit card segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The demand for virtual debit cards is anticipated to be fuelled by the increasing number of net banking customers.

- The B2B virtual cards segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany virtual cards market is segmented by product type into B2B virtual cards and B2C remote payment virtual cards. Among these, the B2B virtual cards segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for business-to-business (B2B) transactions has increased due to the growing imports and exports of products and services worldwide. This is anticipated to fuel the demand for B2B virtual cards. Instead of depending on outdated techniques like paper checks, businesses are incorporating virtual cards into their business-to-business (B2B) payment processes to enhance cash flow, boost security, and make Accounts Payable (AP) automation easier.

- The business use segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany virtual cards market is segmented by application into business use and consumer use. Among these, the business use segment dominated the share in 2024 and is expected to grow at a significant CAGR during the forecast period. Businesses pay suppliers and merchants online using virtual cards. Due to their inability to be lost or stolen, these cards offer a higher level of protection than conventional credit and debit cards. Additionally, the likelihood of fraud is decreased because these cards can only be used once or for a restricted number of transactions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany virtual cards market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wirecard AG

- Solarisbank AG

- PPRO Group

- N26

- Raisin

- FinTecSystems

- figo

- Fidor Bank AG

- Mambu

- Payone

- Payworks

- Penta

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany virtual cards market based on the below-mentioned segments:

Germany Virtual Cards Market, By Card Type

- Debit Card

- Credit Card

Germany Virtual Cards Market, By Product Type

- B2B Virtual Cards

- B2C Remote Payment Virtual cards

Germany Virtual Cards Market, By Application

- Business Use

- Consumer Use

Frequently Asked Questions (FAQ)

-

Q.1: What is the market size of the Germany Virtual Cards Market in 2024?A: The Germany Virtual Cards Market size was estimated USD 1050.21 Million in 2024.

-

Q.2: What is the forecasted CAGR of the Germany Virtual Cards Market from 2024 to 2035?A: The market is expected to grow at a CAGR of around 22.35% during the period 2024–2030.

-

Q.3: Who are the top 10 companies operating in the Germany Virtual Cards Market?A: Key players include Wirecard AG, Solarisbank AG, PPRO Group, N26, Raisin, FinTecSystems, figo, Fidor Bank AG, Mambu, Payone, Payworks, Penta, and Others.

-

Q.4: What are the main drivers of growth in the Germany Virtual Cards Market?A: The rise of e-commerce and digital payments is increasing demand for safe and streamlined online transactions.

-

Q.5: What is the main restraining of growth in the Germany Virtual Cards Market?A: The market for virtual cards is limited due to the limited acceptance by merchants especially in the physical world, due to infrastructure challenges, especially with legacy POS systems, as well as limited consumer understanding and awareness of virtual card use.

Need help to buy this report?