Germany Poultry Feed Market Size, Share, By Animal Type (Layers, Broilers, Turkey, and Others), By Additives (Antibiotics, Vitamins, Antioxidants, Amino Acid, Feed Enzymes, Feed Acidifiers, and Others), Germany Poultry Feed Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesGermany Poultry Feed Market Size Insights Forecasts to 2035

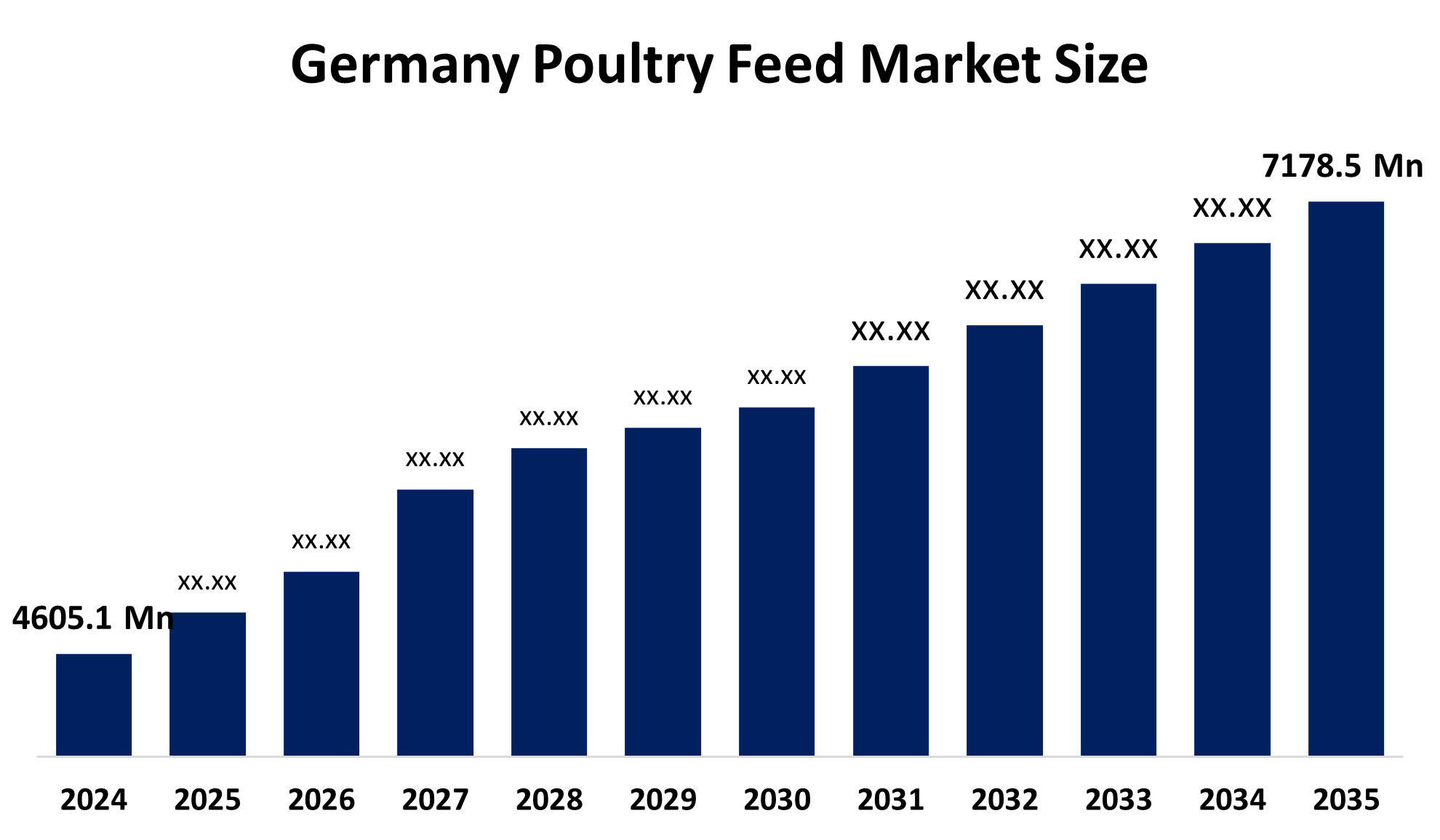

- Germany Poultry Feed Market Size 2024: USD 4605.1 Million

- Germany Poultry Feed Market Size 2035: USD 7178.5 Million

- Germany Poultry Feed Market CAGR 2024: 4.12%

- Germany Poultry Feed Market Segments: Animal Type and Additives

Get more details on this report -

The Germany Poultry Feed Market Size involves the production and distribution of nutritionally complete food substances specifically formulated for domestic birds such as chickens, turkeys, and ducks. It encompasses a wide array of specialized diets, including starter, grower, and finisher feeds that provide essential proteins, carbohydrates, vitamins, and minerals required for optimal growth and egg production. The market is characterized by a strong shift toward sustainable and organic feed options, a high demand for antibiotic-free formulations, and a growing emphasis on high-protein diets to meet the surging consumer appetite for premium poultry meat and eggs.

The Federal Government provides subsidies for organic farming and has implemented stricter regulations under the EU Medical Device and feed safety frameworks to limit the use of antibiotics and hormones. Private sector players are actively collaborating through "Pacts Against Food Waste" and signing target-setting agreements to ensure that feed production aligns with environmental goals, while private investments in domestic production facilities aim to reduce the country’s reliance on imported soy and corn.

Technological advancement is a primary catalyst for efficiency in the German poultry feed sector. Modern production facilities are increasingly adopting automation and precision feeding technologies, such as AI-driven formulation software that optimizes nutrient ratios based on real-time flock data.

Market Dynamics of the Germany Poultry Feed Market:

The Germany Poultry Feed Market Size is driven by the escalating consumer demand for affordable, high-quality animal protein, particularly chicken and eggs, which are perceived as healthier alternatives to red meat. This surge in consumption necessitates high-performance feed to optimize bird growth and productivity. Furthermore, the industry is fuelled by a robust commitment to animal welfare and the widespread adoption of precision nutrition technologies.

The Germany Poultry Feed Market Size is restrained by the volatility of raw material prices for essential grains like corn and wheat, which are subject to climate change and geopolitical disruptions. Additionally, the high cost of premium additives and strict regulatory compliance regarding antibiotic-free production place financial pressure on small-scale producers.

Significant opportunities exist in the development of insect-based and non-GMO feed segments to meet the rising demand for sustainable and organic poultry products. Additionally, the integration of digital farm management tools and data analytics offers manufacturers a chance to provide customized feeding solutions that enhance operational efficiency for modern farmers.

Germany Poultry Feed Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4605.1 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.12% |

| 2035 Value Projection: | USD 7178.5 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Animal Type, By Additives |

| Companies covered:: | Deutsche Tiernahrung Cremer GmbH & Co. KG, AGRAVIS Raiffeisen AG, ForFarmers GmbH, HaGe Kiel, Rothkotter Mischfutterwerk, Broring Beteiligungs GmbH, GS agri eG, BayWa AG and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Germany poultry feed market share is classified into animal type and additives.

By Animal Type:

The Germany Poultry Feed Market Size is divided by animal type into layers, broilers, turkey, and others. Among these, the broilers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because broiler production concentrates on meat, which is always more in demand both domestically and internationally than eggs (layers) or turkey. Large-scale feed consumption is also fueled by intensive broiler farming, which supports a significant market share and is anticipated to experience strong growth.

By Additives:

The Germany Poultry Feed Market Size is divided by additives into antibiotics, vitamins, antioxidants, amino acids, feed enzymes, feed acidifiers, and others. Among these, the amino acid segment accounted for the largest share in 2024 and is projected to grow at a significant CAGR during the forecast period. They are a crucial component of commercial poultry feed formulations because of their vital role in boosting poultry growth, increasing feed efficiency, and promoting general health.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Germany Poultry Feed Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Germany Poultry Feed Market:

- Deutsche Tiernahrung Cremer GmbH & Co. KG

- AGRAVIS Raiffeisen AG

- ForFarmers GmbH

- HaGe Kiel

- Rothkötter Mischfutterwerk

- Bröring Beteiligungs GmbH

- GS agri eG

- BayWa AG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Poultry Feed Market Size based on the below-mentioned segments:

Germany Poultry Feed Market, By Animal Type

- Layers

- Broilers

- Turkey

- Others

Germany Poultry Feed Market, By Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Germany poultry feed market size?A: The Germany poultry feed market is expected to grow from USD 4,605.1 million in 2024 to USD 7,178.5 million by 2035, at a CAGR of 4.12% during 2025–2035.

-

Q: What factors are driving the growth of the Germany poultry feed market?A: Growth is driven by rising demand for poultry meat and eggs, expansion of commercial poultry farming, and increasing adoption of nutritionally balanced and performance-enhancing feed formulations.

-

Q: Which animal type dominates the Germany poultry feed market?A: The broilers segment dominates the market due to higher meat consumption, intensive farming practices, and consistently strong domestic and export demand.

-

Q: What are the major challenges faced by the market?A: Key challenges include volatility in raw material prices, high costs of premium additives, and compliance burdens that affect small-scale producers.

-

Q: What opportunities exist in the Germany poultry feed market?A: Opportunities include insect-based protein, non-GMO feed solutions, organic formulations, and digital precision-feeding technologies.

-

Q: Who are the key players in the Germany poultry feed market?A: Major players include Deutsche Tiernahrung Cremer, AGRAVIS Raiffeisen, ForFarmers GmbH, HaGe Kiel, Rothkötter Mischfutterwerk, BayWa AG, and others.

Need help to buy this report?