Germany Oil & Gas Insulation Market Size, Share, and COVID-19 Impact Analysis, By Product (Stone Wool, Glass Wool, CMS Fiber, Calcium Silicate, and Cellular Glass), By Mode of Application (Cladding & Lagging Insulation and Spray Insulation), By Application (New Structures), By End-use (Onshore and Offshore), and Germany Oil & Gas Insulation Market Insights, Industry Trend, Forecasts to 2035.

Industry: Advanced MaterialsGermany Oil & Gas Insulation Market Insights Forecasts To 2035

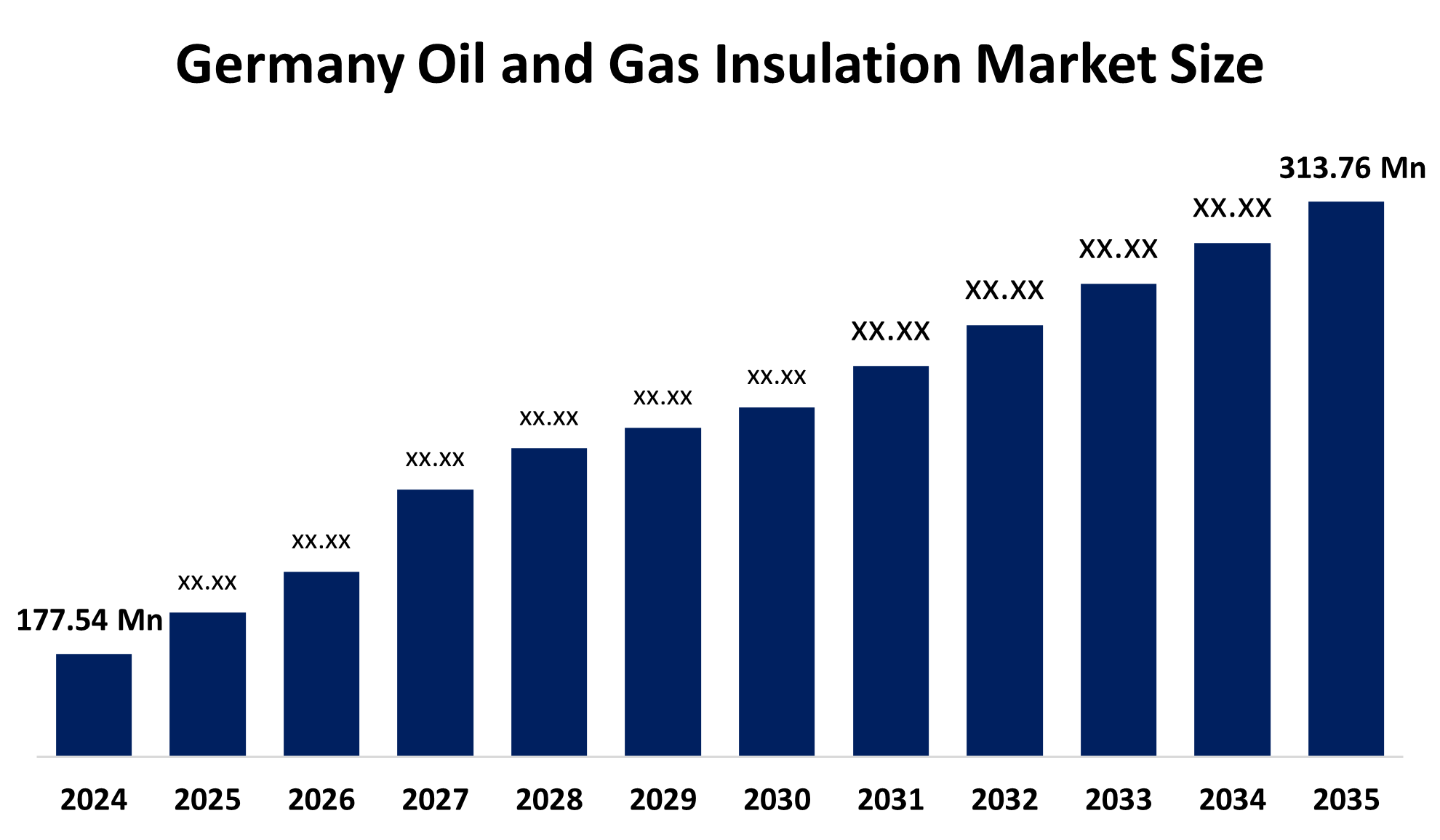

- The Germany Oil & Gas Insulation Market Size Was Estimated at USD 177.54 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.31% from 2025 to 2035

- The Germany Oil & Gas Insulation Market Size is Expected to Reach USD 313.76 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Oil & Gas Insulation Market Size is Anticipated To Reach USD 313.76 Million by 2035, Growing at a CAGR of 5.31% From 2025 to 2035. The need for high-performance insulating solutions is driven by the expansion of oil and gas infrastructure, including pipelines, LNG terminals, and offshore platforms. Insulation is expected to increase efficiency in upstream, midstream, and downstream operations as the energy needs grow and nations spend more on cleaner energy transitions.

Market Overview

The oil and gas insulation market is part of the industry engaged in developing and producing specific materials and solutions for temperature (thermal) management, energy conservation (via thermal), noise abatement and safety in various industrial applications, including oil and gas. It specifically pertains to insulating of buildings, structures, equipment, and piping within the oil and gas industry. Insulation helps to protect employees from hot and cold surfaces, thus decreasing the chance of burns and other risks. Insulation stops condensation, which can lead to structural damage and slip hazards. Insulation is protective of equipment and allows for a longer life cycle and reliability by protecting equipment from hot and cold extremes. Since the oil and gas industry is putting a greater emphasis on sustainability and energy efficiency, new insulation materials and solutions are now commonly requested. Due to increased infrastructure investment in some economies, especially with the expansion of energy facilities, manufacturers and service providers of insulation have the opportunity to provide insulation services, equipment and take advantage of government policies related to the improvement of oil refinery operations and energy conserving practices across industries; and, the development and use of biofuels like compressed biogas, ethanol and biodiesel.

Report Coverage

This research report categorizes the market for Germany oil & gas insulation market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany oil & gas insulation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment Germany oil & gas insulation market.

Germany Oil and Gas Insulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024 : | USD 177.54 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.31% |

| 2035 Value Projection: | USD 313.76 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Mode Of Application, By Application, By Application, By End-use |

| Companies covered:: | Armacell, BASF SE, ContiTech AG, DBW Advanced Fiber Technologies, Evonik Industries AG, GH Isolierung, Kaimann, Darmstadter, IIG Industrieisolierungen (IIG GmbH), Heidelmeier Isoliertechnik, Eugen Arnold, RIG Rohrisolationsgesellschaft, Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A growing need for energy with more exploration and production means the need for cost-effective insulation solutions both to keep temperatures at desired levels, retain energy before it's wasted and to protect against corrosion and fire hazards. New technologies in insulation materials like high-performance aerogels and cryogenic insulations are being used to improve operational efficiency and safety, especially in subsea and offshore insulation applications.

Restraining Factors

The up-front costs of high-performance insulation materials, combined with often complex installation process, can be an impediment to adoption especially for small and medium-sized enterprises (SMEs). Further, the fluctuating prices of raw materials, particularly for insulation materials based on crude oil), can contribute to price variability, affecting production costs and profitability.

Market Segmentation

The Germany oil & gas insulation market share is classified into product, mode of application, application, and end-use.

- The stone wool segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany oil & gas insulation market is segmented by product into stone wool, glass wool, CMS fiber, calcium silicate, and cellular glass. Among these, the stone wool segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. Thermal insulation, sound absorption, and fire resistance qualities. Stone wool, which is made from volcanic rock, is perfect for use in processing units, refineries, and pipelines where heat management and fire safety are crucial because it can tolerate high temperatures. It is appropriate for tough conditions, especially onshore and offshore installations, due to its resilience to dampness, chemicals, and pests. For dependable, long-lasting insulation solutions, the industry is increasingly turning to stone wool as efficiency and safety become major objectives.

- The cladding & lagging insulation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany oil & gas insulation market is segmented by mode of application into cladding & lagging insulation and spray insulation. Among these, the cladding & lagging insulation segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Insulating materials from weather exposure, mechanical wear, and environmental harm. These systems ensure the longevity and efficacy of the insulation underneath by serving as a protective outer layer, particularly in outdoor and offshore applications. The need for strong insulation application techniques like cladding and lagging is increasing due to expanding infrastructure investments and an emphasis on lowering energy loss. They improve operational efficiency and safety while also improving thermal performance.

- The new structure segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany oil & gas insulation market is segmented by application into new structure. Among these, the new structure segment dominated share in 2024 and is expected to grow at a significant CAGR during the forecast period. Higher demand for materials used for insulation. High-performance insulation solutions are needed for new structures in order to guarantee energy efficiency, process stability, and safety as the energy demand rises and nations spend on developing and updating their energy infrastructure. These projects usually use the newest insulation technologies, such as high-temperature and cryogenic solutions, that are designed to satisfy contemporary environmental and operational requirements.

- The onshore segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Germany oil & gas insulation market is segmented by end-use into onshore and offshore. Among these, the onshore segment held a majority share in 2024 and is expected to grow at a significant CAGR during the forecast period. Continuous advancements in transportation, processing, and drilling infrastructure. Onshore projects sometimes cover bigger areas and entail more extensive pipeline and storage networks than offshore projects, all of which necessitate effective thermal control. Additionally, operators are upgrading insulating systems in existing plants in response to regulatory constraints for energy conservation and environmental compliance. The demand for flexible and long-lasting insulating solutions is being driven by the fact that many onshore locations are situated in climatically varied areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany oil & gas insulation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the companies' current news and developments, including product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Armacell

- BASF SE

- ContiTech AG

- DBW Advanced Fiber Technologies

- Evonik Industries AG

- GH Isolierung

- Kaimann

- Darmstadter

- IIG Industrieisolierungen (IIG GmbH)

- Heidelmeier Isoliertechnik

- Eugen Arnold

- RIG Rohrisolationsgesellschaft

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany oil & gas insulation market based on the below-mentioned segments:

Germany Oil & Gas Insulation Market, By Product, By Mode Of Application

- Stone Wool

- Glass Wool

- CMS Fiber

- Calcium Silicate

- Cellular Glass

Germany Oil & Gas Insulation Market, By Mode Of Application

- Cladding & Lagging Insulation

- Spray Insulation

Germany Oil & Gas Insulation Market, By Application

- New Structure

Germany Oil & Gas Insulation Market, By End-use

- Onshore

- Offshore

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Germany Oil & Gas Insulation Market in 2024?The Germany Oil & Gas Insulation Market size was estimated USD 177.54 Million in 2024.

-

2. What is the forecasted CAGR of the Germany Oil & Gas Insulation Market from 2024 to 2035?The market is expected to grow at a CAGR of around 5.31% during the period 2024–2030.

-

3. Who are the top 10 companies operating in the Germany Oil & Gas Insulation Market?Key players include Armacell, BASF SE, ContiTech AG, DBW Advanced Fiber Technologies, Evonik Industries AG, GH Isolierung, Kaimann, Darmstadter, IIG Industrieisolierungen (IIG GmbH), Heidelmeier Isoliertechnik , Eugen Arnold, RIG Rohrisolationsgesellschaft , Others

-

4. What are the main drivers of growth in the Germany Oil & Gas Insulation Market?A growing need for energy with more exploration and production means the need for cost-effective insulation solutions both to keep temperatures at desired levels, retain energy before it's wasted and to protect against corrosion and fire hazards.

-

5. What is the main restraining of growth in the Germany Oil & Gas Insulation Market?The up-front costs of high-performance insulation materials, combined with often complex installation process, can be an impediment to adoption especially for small and medium-sized enterprises (SMEs).

Need help to buy this report?