Germany Mutual Fund Market Size, Share, By Fund Type (Equity Funds, Bond Funds, Money Market Funds, Hybrid Funds and Others), By Distribution Channel (Banks, Financial Advisors, Direct Sellers, and Others), Germany Mutual Fund Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialGermany Mutual Fund Market Insights Forecasts to 2035

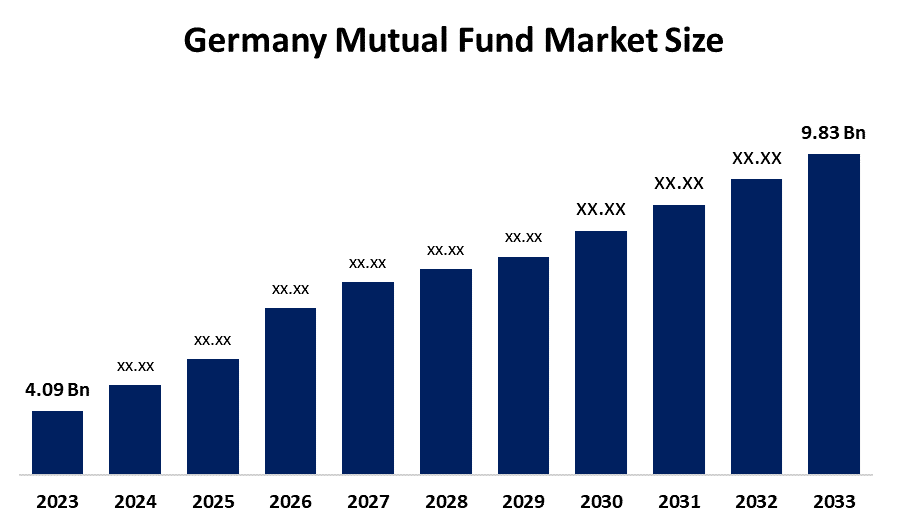

- Germany Mutual Fund Market Size 2024: USD 4.09 Bn

- Germany Mutual Fund Market Size 2035: USD 9.83 Bn

- Germany Mutual Fund Market CAGR 2024: 8.3%

- Germany Mutual Fund Market Segments: Fund Type and Distribution Channel

Get more details on this report -

The market for mutual funds is the place where the asset management firms offer the pooled investment schemes, allowing the investors to invest together in the shares, bonds, or any other securities. It allows individual investors to have the benefits of the diversified portfolios, professional management, and potential returns while risk is being shared.

The government of Germany has set in motion the Deutschlandfonds, an important program to attract private capital and reinforce investment in key areas like tech, energy transition, infrastructure, and innovation. The government has committed around €30 billion in public funds and guarantees as part of this initiative to lure private investors into the critical projects and companies with the aim of turning the total investment in the economy to approximately 130 billion over time.

Germany's government measures to the capital markets, such as foreigners and locals, will not only attract but also support mutual funds, ETFs, and eco-friendly finance investments. The more money makers take these areas into consideration, the wider range of long-term investments they will have available to choose from.

Market Dynamics of the Germany Mutual Fund Market:

The Germany mutual fund market is driven by the increasing savings of households, the increasing awareness of investors, and the strong demand for diverse and professionally managed investment products. The government support, the rise of the sustainable and ESG focused funds, the low cost ETFs, and the digital investment platforms are also factors that are driving the retail and institutional investors into the market and thus contributing to the overall market growth.

The Germany mutual fund market is restrained by facing various challenges, such as market volatility, rising interest rates, which directly affect returns of funds, costs incurred to comply with regulatory requirements, and prudent investor sentiment. Moreover, the competition from other types of investments and passive products has also been a factor that has limited the growth of active mutual funds.

The future of the Germany mutual fund market is growing at a slow but steady pace, with the main triggers being digital investment platforms, increasing ETF usage, and great demand for sustainable and ESG oriented funds, all of which will be supported by long term household savings and a stable regulatory environment.

Market Segmentation

The Germany Mutual Fund Market share is classified into fund type and service.

By Fund Type:

The Germany mutual fund market is divided by fund type into equity funds, bond funds, money market funds, hybrid funds and others. Among these, the equity fund segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The primary reason for the dominance of banks is their widespread customer approach and trust that has lasted for years among German investors. Moreover, they provide a package of different financial services as well as in person guidance at their branches, which in turn makes investing in mutual funds easier for the investors.

By Distribution Channel:

The Germany mutual fund market is divided by distribution channel into banks, financial advisors, direct sellers, and others. Among these, the bank segment accounted for the largest share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The German mutual fund market is mainly ruled by equity funds as a result of their greater long-term return potential and a steadily increasing number of investors opting for their product as the most suitable for wealth creation.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Germany mutual fund market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in:

- Linus Digital Finance Ag

- Tu Investment Club E.V.

- Fruitbox Africa Gmbh

- Lupus Alpha Asset Management Ag

- Deutsche Invest Capital Partners Gmbh

- Angermann & Co. Holding Gmbh

- Franz Haniel & Cie. Gmbh

- Conren Land Ag

- E1 Holding Gmbh

- Dwpt Deutsche Wertpapiertreuhand Gmbh

- Others

Recent Developments in Germany Mutual Fund Market:

In January 2023, The value of German government bonds on loan increased to EUR 111.1 billion (USD 121 billion) in 2023, the highest level since December 2015. Investors amassed the biggest bet against German government bonds since 2015, as the country issues large amounts of debt and the European Central Bank (ECB) talks tough on inflation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the Germany Mutual Fund market based on the below-mentioned segments:

Germany Mutual Fund Market, By Fund Type

- Equity Funds

- Bond Funds

- Money Market Funds

- Hybrid Funds

- Others

Germany Mutual Fund Market, By Service

- Banks

- Financial Advisors

- Direct Sellers

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Germany mutual fund market size?A: Germany Mutual Fund Market is expected to grow from USD 4.09 billion in 2024 to USD 9.83 billion by 2035, growing at a CAGR of 8.3% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing savings of households, the increasing awareness of investors, and the strong demand for diverse and professionally managed investment products. The government support, the rise of the sustainable and ESG focused funds, the low cost ETFs, and the digital investment platforms are also factors that are driving the retail and institutional investors into the market and thus contributing to the overall market growth.

-

Q: What factors restrain the Germany mutual fund market?A: Constraints include facing various challenges, such as market volatility, rising interest rates, which directly affect returns of funds, costs incurred to comply with regulatory requirements, and prudent investor sentiment.

-

Q: How is the market segmented by Fund type?A: The market is segmented into equity funds, bond funds, money market funds, hybrid funds and others.

-

Q: Who are the key players in the Germany mutual fund market?A: Key companies include Linus Digital Finance AG, TU Investment Club e.V., FruitBox Africa GmbH, Lupus alpha Asset Management AG, Deutsche Invest Capital Partners GmbH, Angermann & Co. Holding GmbH, Franz Haniel & Cie. GmbH, CONREN Land AG, E1 Holding GmbH, DWPT Deutsche Wertpapiertreuhand GmbH, others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?