Germany Modern Oral Nicotine Products Market Size, Share, By Product (Nicotine Pouches, Nicotine Gums, Nicotine Lozenges, Nicotine Patches, and Others), By Distribution Channel (Online and Offline), Germany Modern Oral Nicotine Products Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareGermany Modern Oral Nicotine Products Market Size Insights Forecasts to 2035

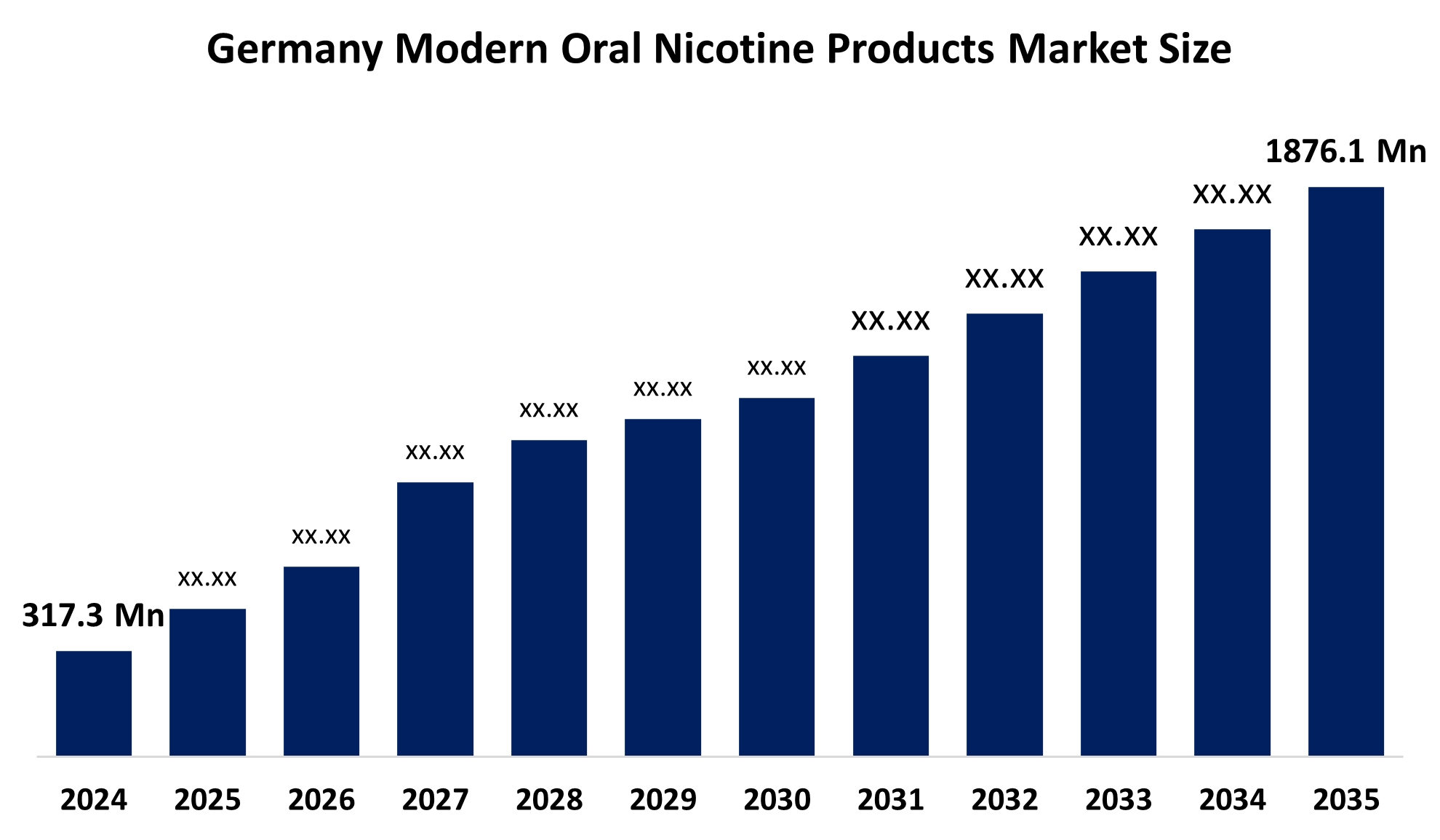

- Germany Modern Oral Nicotine Products Market Size 2024: USD 317.3 Million

- Germany Modern Oral Nicotine Products Market Size 2035: USD 1876.1 Million

- Germany Modern Oral Nicotine Products Market CAGR 2024: 17.53%

- Germany Modern Oral Nicotine Products Market Segments: Product and Distribution Channel.

Get more details on this report -

The Germany Modern Oral Nicotine Products Market Size refers to the industry encompassing tobacco-free, discreet delivery systems such as pouches, gums, and lozenges designed to provide nicotine through the oral mucosa without combustion. These products are characterized by their "spit-free" and "smoke-free" nature, making them socially acceptable alternatives to traditional cigarettes and heat-not-burn devices.

Government and private initiatives have increasingly focused on tobacco harm reduction (THR), with some health organizations viewing modern oral products as viable smoking cessation aids. However, the market also faces scrutiny through initiatives aimed at youth protection, leading to stricter age-verification protocols and marketing restrictions. Private sector players are actively collaborating with regulatory bodies to establish clear safety standards, ensuring that these products are recognized as significantly lower-risk alternatives compared to combustible tobacco.

Technological advancement remains a cornerstone of the modern oral nicotine sector in Germany. Innovations include the development of advanced pH-buffering agents that optimize nicotine absorption rates and "Stingfree" pouch technologies designed to protect the oral mucosa from irritation. Furthermore, manufacturers are investing in synthetic nicotine production to ensure higher purity and the removal of tobacco-specific nitrosamines.

Market Dynamics of the Germany Modern Oral Nicotine Products Market:

The Germany Modern Oral Nicotine Products Market Size is primarily driven by the increasing consumer shift toward health-conscious and smoke-free lifestyles, which has led many traditional smokers to seek tobacco-free alternatives. Additionally, the broad availability of these products through well-established online retail platforms and convenience store networks significantly enhances market accessibility and consumer adoption across diverse age groups.

The Germany Modern Oral Nicotine Products Market Size is restrained by a complex and often inconsistent legal landscape, where nicotine pouches sometimes fall into a "grey area" regarding food safety and tobacco regulations. Additionally, the highly addictive nature of nicotine remains a significant public health concern, prompting strict marketing controls.

Significant opportunities exist in the expansion of the "premium" segment, focusing on high-purity synthetic nicotine and eco-friendly packaging. Furthermore, the rising trend of "pre-juvenation" and wellness-oriented products allows brands to innovate with functional ingredients, such as caffeine or vitamin-infused pouches, catering to a more health-centric German consumer base.

Germany Modern Oral Nicotine Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 317.3 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 17.53 % |

| 2035 Value Projection: | USD 1876.1 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | British American Tobacco (VELO), Philip Morris International (ZYN), Imperial Brands (Zone X), Poschl Tabak GmbH & Co. KG, Heinz Tröber GmbH & Co. KG and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The Germany modern oral nicotine products market share is classified into product and distribution channel.

By Product:

The Germany Modern Oral Nicotine Products Market Size is divided by product into nicotine pouches, nicotine gums, nicotine lozenges, nicotine patches, and others. Among these, the nicotine lozenges segment is projected to grow at the fastest CAGR during the forecast period. This is due to growing customer desire for controlled-dose, oral nicotine forms that aid in quitting smoking and gradually reducing dependence. They are appealing to consumers looking for a practical substitute that is appropriate for travel or work because of its discreet, chew-free, and simple design.

By Distribution Channel:

The Germany Modern Oral Nicotine Products Market Size is divided by distribution channel into online and offline. Among these, the offline segment held the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the ease of comparing products, instant availability, and the opportunity to ask in-store employees for advice, consumers continue to favor offline transactions.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Germany Modern Oral Nicotine Products Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in Germany Modern Oral Nicotine Products Market:

- British American Tobacco (VELO)

- Philip Morris International (ZYN)

- Imperial Brands (Zone X)

- Pöschl Tabak GmbH & Co. KG

- Heinz Tröber GmbH & Co. KG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Modern Oral Nicotine Products Market Size based on the below-mentioned segments:

Germany Modern Oral Nicotine Products Market, By Product

- Nicotine Pouches

- Nicotine Gums

- Nicotine Lozenges

- Nicotine Patches

- Others

Germany Modern Oral Nicotine Products Market, By Distribution Channel

- Online

- Offline

Frequently Asked Questions (FAQ)

-

Q: What is the market size and growth outlook of Germany’s modern oral nicotine products market?A: The market was valued at USD 317.3 million in 2024 and is projected to reach USD 1,876.1 million by 2035, growing at a CAGR of 17.53% during 2025–2035.

-

Q: Which product segment is expected to grow the fastest?A: Nicotine lozenges are expected to grow at the fastest CAGR due to their discreet, controlled-dose format and suitability for smoking cessation and gradual nicotine reduction.

-

Q: What are the key drivers of the Germany modern oral nicotine products market?A: Rising health consciousness, increasing preference for smoke-free alternatives, and wide availability through online platforms and offline retail stores are key growth drivers.

-

Q: What are the major restraints affecting market growth?A: Regulatory ambiguity, strict marketing restrictions, youth-protection policies, and public health concerns related to nicotine addiction restrain market expansion.

-

Q: Which distribution channel dominates the market?A: The offline distribution channel dominated the market in 2024 due to immediate product availability, in-store guidance, and consumer trust in physical retail outlets.

-

Q: Who are the key players in the Germany modern oral nicotine products market?A: Key players include British American Tobacco (VELO), Philip Morris International (ZYN), Imperial Brands (Zone X), Pöschl Tabak GmbH & Co. KG, and Heinz Tröber GmbH & Co. KG.

Need help to buy this report?