Germany Meat Market Size, Share, and COVID-19 Impact Analysis, By Type (Raw and Processed), By Product (Chicken, Beef, Pork, Mutton, and Others), and Germany Meat Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesGermany Meat Market Insights Forecasts to 2035

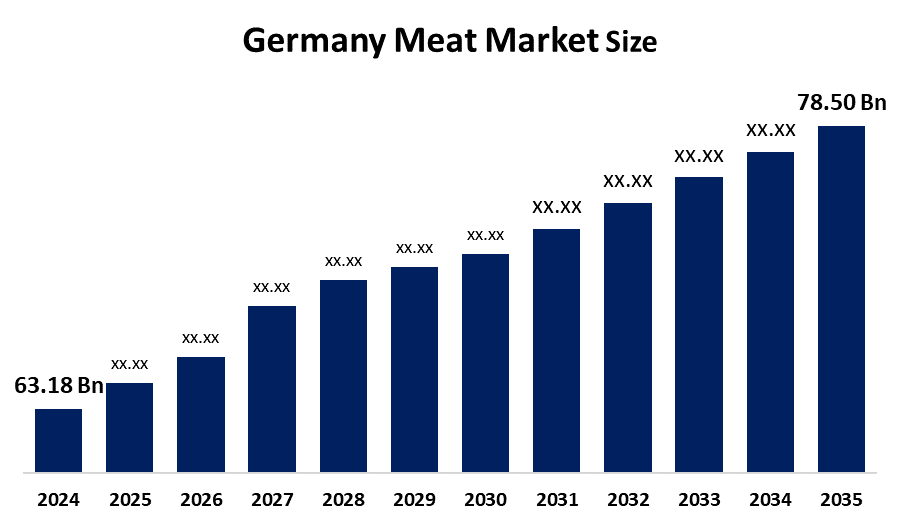

- The Germany Meat Market Size was estimated at USD 63.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.99% from 2025 to 2035

- The Germany Meat Market Size is Expected to Reach USD 78.50 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Germany Meat Market Size is Anticipated to reach USD 78.50 Billion by 2035, Growing at a CAGR of 1.99% from 2025 to 2035. The market is supported by rising consumer demand for ethically and sustainably produced goods, which is driving the trend toward local and organic meat. Efficiency, transparency, and food safety are being improved by advancements in meat processing technology, logistics, and traceability.

Market Overview

The meat sector in Germany covers the production, processing, distribution, and consumption of food products originating from animals throughout the country. This ranges from domestic animal farming, slaughter, and packaging, through to supply chains influenced by consumer preferences, regulation, and sustainable trends. Additionally, strong prospects are available in value-added segments of the German meat market. For quick meals, consumers favor portions that are marinated, ready to cook, and pre-seasoned. Retailers increase the variety of packaged goods that are simple to use. Consistent demand is driven by expanding urban populations with limited cooking time. Value-added products are used by foodservice channels to maximize preparation efficiency. To launch new cuts and flavors, producers invest in innovation. Retail expansion is supported by modern packaging, which prolongs shelf life. It diversifies revenue streams beyond conventional fresh categories and generates robust margins.

Report Coverage

This research report categorizes the market for the Germany meat market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Germany meat market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Germany meat market.

Germany Meat Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 63.18 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Type |

| Companies covered:: | Tonnies Holding GmbH PHW Group Westfleisch SCE Vion Food Group Muller Fleisch GmbH Heidemark GmbH and Other key players |

| Growth Drivers: | CAGR of 4.05% |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of e-commerce channels leads to growth in the German meat market. A greater selection of fresh and frozen meat is accessible through online platforms. Pre-portioned and carefully chosen boxes are delivered to homes by subscription services. Investments in cold-chain logistics guarantee freshness and safety while in transit. Premium cuts and local specialties are highlighted by niche platforms. Younger customers use digital platforms because they are more convenient and offer a wider range of products. Digital loyalty programs are integrated by retailers to improve customer engagement. It diversifies sales channels outside of traditional retail locations and expands distribution reach more quickly.

Restraining Factors

Growing environmental discussions about livestock production present difficulties for the German meat market. Due to emissions from large-scale production, consumers who care about the environment restrict their consumption of meat. Growth potential in conventional meat categories is diminished by plant-based diets. Through campaigns against intensive farming methods, NGOs put pressure on producers. Regulations pertaining to carbon taxes and emission reduction goals are being discussed more. Managing costs while adhering to sustainability regulations is difficult for producers. Changes in eating habits have a greater impact on younger populations than on older ones. It puts pressure on margins throughout supply chains and compels adaptation.

Market Segmentation

The Germany meat market share is classified into type and product.

- The processed segment dominated the market in 2024, approximately 55% and is projected to grow at a substantial CAGR during the forecast period

The Germany meat market is segmented by type into raw and processed. Among these, the processed segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to growing consumer demand for ready-to-eat options, extended shelf life, and convenience in retail and foodservice channels. Adoption has accelerated due to urbanization, hectic lifestyles, and the popularity of packaged foods high in protein. Expansion is further supported by technological developments in cold chain logistics, packaging, and preservation. Strong distribution networks and private-label expansion expand market reach and profitability, while product innovation in organic, low-fat, and plant-based processed meats is drawing in health-conscious consumers.

- The pork segment dominated the market in 2024, approximately 60.5% and is projected to grow at a substantial CAGR during the forecast period

The Germany meat market is segmented by product into chicken, beef, pork, mutton, and others. Among these, the pork segment dominated the market in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth due to a well-established domestic production infrastructure, high per capita consumption, and strong cultural preferences. The extensive use of pork in processed goods like sausages, cold cuts, and ready-to-eat meals, which satisfy consumer demand for convenience, contributes to growth. Furthermore, the segment's competitiveness and long-term growth prospects are improved by Germany's export capabilities, especially to EU and Asian markets, and continuous investments in animal welfare and traceability systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Germany meat market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tönnies Holding GmbH

- PHW Group

- Westfleisch SCE

- Vion Food Group

- Müller Fleisch GmbH

- Heidemark GmbH

- Others

Recent Developments:

- In April 2025, BASF and Werz had launched a closed-loop, sustainable meat packaging solution for the Horeca sector in Germany. Using BASF’s Ultramid Ccycled polyamide and SÜDPACK’s recyclable high-barrier film, the packaging met EU 2030 Packaging and Packaging Waste Regulation (PPWR) targets. Already in use at BASF sites, the solution integrated recycled materials into existing systems, showcasing chemical recycling as a viable path to circularity in food packaging for community catering and hospitality services.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Germany, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Germany Meat Market based on the below-mentioned segments:

Germany Meat Market, By Type

- Raw

- Processed

Germany Meat Market, By Product

- Chicken

- Beef

- Pork

- Mutton

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the Germany meat market size?Germany Meat Market is expected to grow from USD 63.18 billion in 2024 to USD 78.50 billion by 2035, growing at a CAGR of 1.99% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Rising protein consumption, the desire for ethically and organically sourced meat, improvements in processing technology, better logistics, and a growing inclination for traceable, locally produced meat products are some of the major factors driving the growth of the German meat market.

-

Q: What factors restrain the Germany meat market?A: Growing vegan and vegetarian trends, strict animal welfare laws, environmental concerns, volatile livestock feed prices, and growing consumer demand for transparency and sustainable sourcing methods are some of the main factors limiting the German meat market.

Need help to buy this report?